Another Downturn Another Lesson

Day 10 in NovemBlog

We're seeing another very public meltdown from a central exchange. As it turns out having an exchange coin is still a bad idea. Leaving funds on an exchange is still a bad idea. Trusting anybody with your crypto is still a bad idea. "Fool me once, shame on you; fool me twice, shame on me." It's unfortunate that the regulating bodies such as the SEC worked with these bad actors... who basically do the exact same things as banks. They use capital "efficiently" but dangerously.

Listing a token on an centralized exchange is quite a process... a shameful one. Listing fees, liquidity, centralized wallets and attack vectors. @starkerz gave me quite the compliment in a recent conversation: ~"I'm glad you don't trust anybody."

Alternatives

There are alternatives to centralized exchanges, decentralized exchanges. Listing fees are generally paid in an exchange tokens as well, to prevent spam. The public nature of most of these exchange tokens make it hard to hide the kind of fraud going on in opaque markets. They do have their disadvantages though, and we've seen DeFi hit with a tremendous amount of hacks and exploits while this technology is in it's infancy. Algorithmic stable coins and automated market makers have shown their weaknesses.

Here on HIVE we have an internal market and an algorithmic, soft-pegged, stablish coin. The stablish nature of HBD really set's it apart. With the haircut rule and some time locked exchange contracts it currently seems impossible to have a coin-wrecking hyper-inflationary spiral. One could argue we have seen it as bad as it can get when HBD was traded under a dollar for a prolonged time. With it's current 20% savings APR as long as HBD crosses the $1 line inside of 30 days it's as stable as it needs to be... and it's been far more stable than that since HF25. Kudo's @dan @blocktrades and @smooth for these brilliant improvements.

HoneyComb (dlux at the time) was the first token I'm aware of that built it's own DEX outside of the ecosystem it's based on. 0x and swap protocols on ETH made it possible to swap different assets in ETH contracts but... HoneyComb is built as a layer 2 to Hive, which lacks a smart contract platform. As such it went through 2 iterations. The first was an atomic swap protocol... which to my knowledge suffered exactly 0 losses or hacks, and the current autonomously managed multi-sig paradigm, which allows partial fill orders.

Cons

DEXs and staking in general suffer from the possibility of impermanent loss. When the staked tokens fall in value relative to other currencies. Most people on Hive will understand this, as their staked Hive Power is worth ~30% less than it was a few days ago before FTX blew up. Until you actually trade the token away this loss doesn't exist. 100 Hive power will still grant you 100 Hive Power worth of resource credits, and still allocated the same percentage of the reward pool thru voting. One thing Hive DeFi doesn't have to deal with is front running; where seeing a trade in the MemPool allows somebody to place the same trade with a higher fee to nullify or lessen the first trade.

Front running attacks are possible on Hive, but it would have to be executed by the witness actively signing blocks... which would probably have to be a top 20 witness, and therefore only subject to happen in 5% of the blocks... until they get voted out of the top 20 as you would be able to see these attacks in the block/ subsequent blocks. But hopefully there are enough incentives to stay in the top 20 where witnesses wouldn't be trying to engage in this behavior. Once again, the incentive structure of DPoS really shines through.

Pros

Saving the best for last. HoneyComb is enabling a new kind of growth paradigm. When the SPK network started their airdrop they asked the community to run some HoneyComb nodes. The Airdrop wasn't a portion of a premine... Hive was the "Premine." THE DHF paying for the developement. Additionally, users had to interact with the system over the course of a year to draw their full token potential. The developers didn't get a larger share, the founders didn't get a larger share... no centralized exchange had to purchase or be given a wad of token liquidity, no listing fees had to be paid, no single person had to be trusted with moving a ledger from ETH-20 to a native coin. Outside of bitcoin this might be the "purest" from of decentralized launch yet. The node operators might have claimed enough to be relevant, might have purchased enough to be relevant, or might have dropped off after understanding the economics of the system. The running cost of a node for a month was less than any operation on ETH; a failed trade on SushiSwap would likely have cost more than a year of running a SPK-CC node.

HoneyComb safely accomplishes this by maintaining it's order book smaller than the market value of it's collective collateral. Not having to worry about outside exchanges, much like the internal market place on Hive, allows it to precisely know which value to trust. If somebody wants to swing the market value for one of two reasons, colluding to steal multi-sig funds or get preferential prices, neither will be economically feasible.

Loss?

I personally see abundance in our future... but abundance also means a loss for some people. For instance nobody charges you for breathing the air because of it's abundance. If we create a shortage of something like clean water then some people have a vector to fleece you for what should have been yours. Digitally speaking we are creating an abundance of collective memory and story telling. The price of storage will hopefully be a race to the bottom where it's as close to real cost as possible. If you are interested in cat videos, IPFS will allow you to host those cat videos and participate in a network that makes distribution and storage as free as possible(owning the equipment that let's you access it), the same goes for any content you like to consume. In the long run I hope our endeavors benefit humanity... but playing with the bleeding edge of technology means some cuts along the way.

None of this is financial advice of course, just explaining systems and hoping that there are fewer cuts in the future.

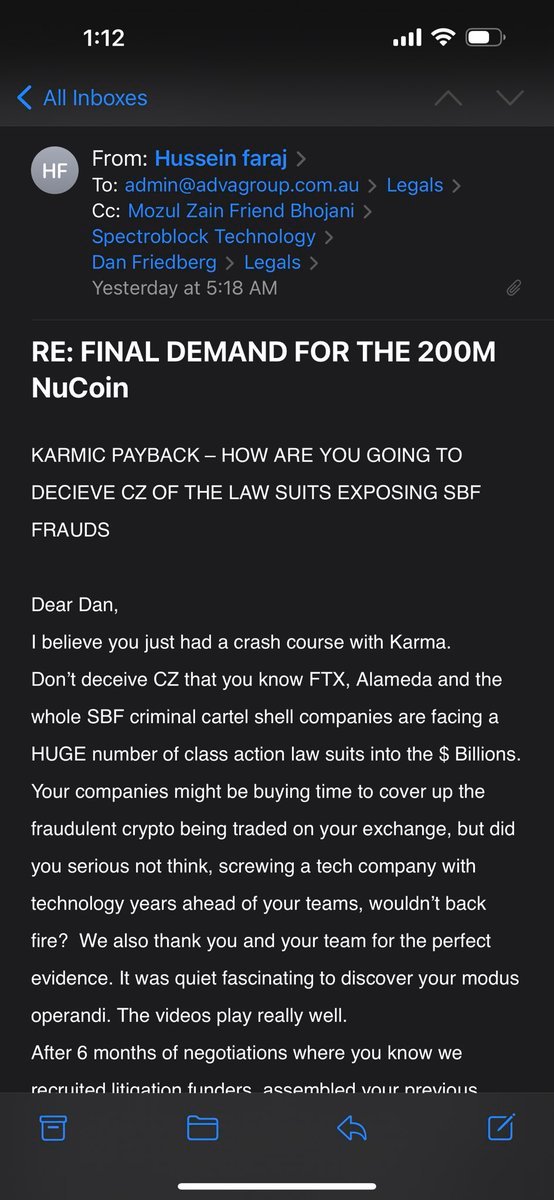

~~~ embed:1590751239847186434 twitter metadata:OTA1ODY2OTcxMTU3MjE3MjgwfHxodHRwczovL3R3aXR0ZXIuY29tLzkwNTg2Njk3MTE1NzIxNzI4MC9zdGF0dXMvMTU5MDc1MTIzOTg0NzE4NjQzNHw= ~~~

The rewards earned on this comment will go directly to the people( @taskmaster4450le, @mcoinz79 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I keep thinking there's only one way to go now and that's up, but crypto and these exchanges keep finding a new way to go down

I keep thinking there's only one way to go now and that's up, but crypto and these exchanges keep finding a new way to go down

Yeah! Fck Cexes! Dex is the future!

Something is amiss.

I made some changes to the processor to get it up to speed. Should be coming around now.

Thank you.