In this world, nothing is certain except death and taxes (Benjamin Franklin)

Hi Everyone,

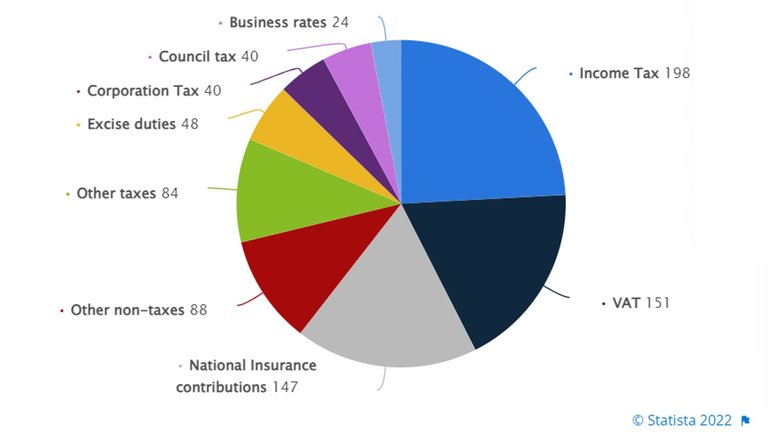

For many, paying taxes is considered an inevitable part of life. If tax was not collected, it is widely accepted that society could not function. For most countries, the value of the amount of tax collected is sizeable. For example, in 2022, the United Kingdom’s Government are expecting to receive £820 billion in revenue. Almost 90% of this revenue is generated by some form of tax. See figure below.

Expected public sector current receipts in the United Kingdom in 2021/22, by function (in billion GBP)

Source: Statista

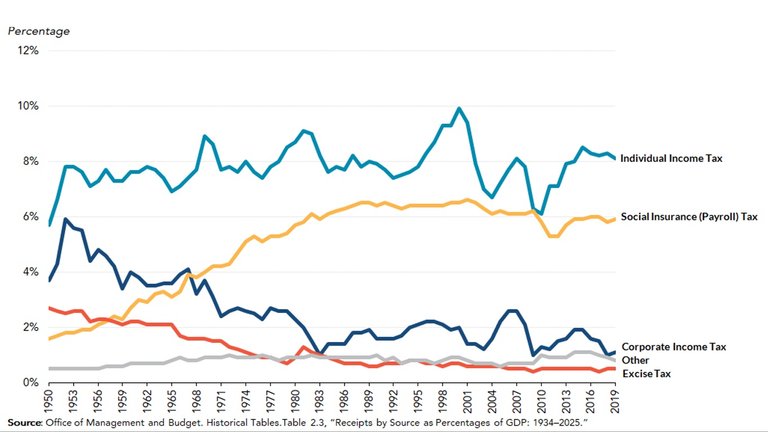

In the USA, Federal Government revenue (not including State or local revenue) is approximately 17.5% of GDP. It has remained consistently around this level since the 1950s. Sources of revenue have changed slightly over time. As a percentage of GDP, excise taxes and corporate taxes have fallen and social insurance tax has increased.

Sources of Federal Revenue as share of GDP (USA)

Source: Tax Policy Center

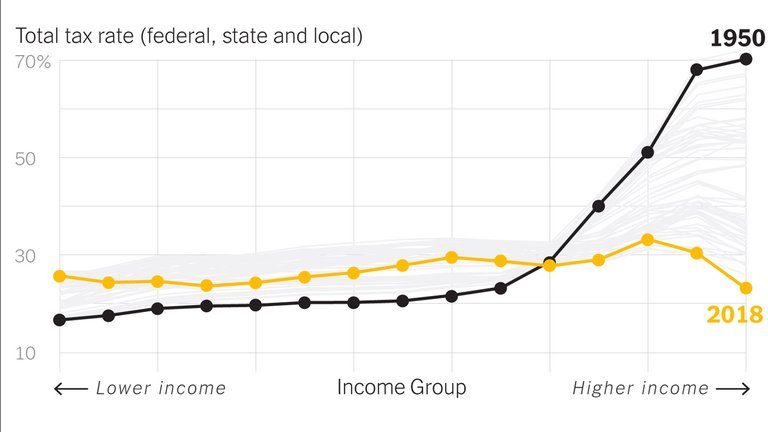

The shifts in sources of tax funds is most likely responsible for the tax burden shifting away from the highest income earners to the lower and middle-income earners.

Total Tax Rate (Federal, State and Local)

Source: New York Times

Tax money is used to finance Government expenditure on goods, services and infrastructure. Tax money funds critical services such as education, healthcare, law enforcement, social support, and national defence. Tax money funds critical infrastructures such as transport, energy, water and sanitation. We could not operate as a society without the services and infrastructure typically provided by Government expenditure, which is mostly funded by tax money. However, this does not mean that these services could not be provided nor the infrastructure could never be built, if they were not funded by tax money. The existing systems prevents alternative funding for these critical services and infrastructure. There is little desire for Governments to move away from existing systems as doing so reduces their power. From the perspective of the people, there is a fear of the unknown. Tax funded services and infrastructure offers a sense of security.

In my post, Oligopoly – The market structure that does not let the market decide, I discuss how the privatisation of Government run industries has often not improved efficiency or reduced costs. This is because privatisation often creates oligopoly market structures where large companies profit from market control and subsidies rather than improved efficiency or increased innovation. However, the failures of particular market structures (oligopoly or monopoly) is treated as a failure of private provision of services in general. Therefore, Government run services look better by comparison. This fuels the argument that Governments should offer services instead of the private sector.

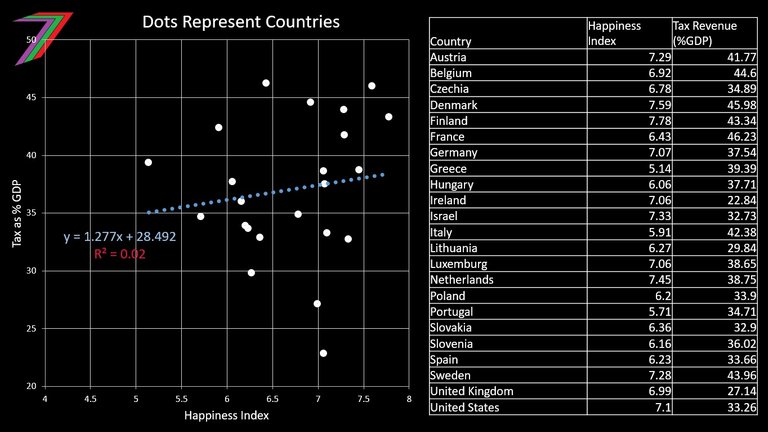

The Happiness Index is an indicator of subjective wellbeing. The happiness index could be compared with the tax rates (i.e. tax collected as percentage of GDP) of countries to determine if higher taxes increases or decreases quality of life. See figure below.

Relationship between tax as a percentage of GDP and Happiness Index for selected OECD countries (2017)

Source: Research Gate

Note: The above graph does not include the impact of other factors such as income. The very low R2 indicates more variables need to be considered as determinants of happiness before a regression analysis could yield relevant results.

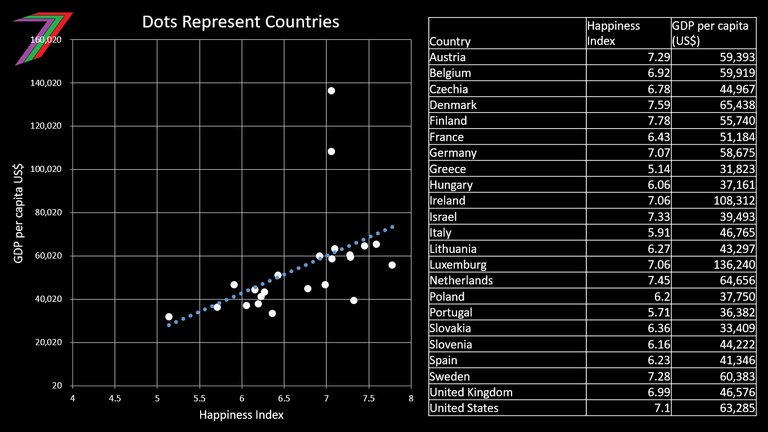

A moderately positive trend (linear) can be mapped in the figure. This perceived positive relationship between happiness and tax rate could be argued to suggest that paying more tax increases happiness (Live Science). However, the large variance in values as shown by the widely dispersed points is a much stronger indication of no correlation between happiness and tax rate. There is a considerably stronger relationship between GDP per capita and happiness. See Figure below.

Relationship between GDP per capita (US$) and Happiness Index for selected OECD countries (2021)

Source: Research Gate and Data OECD

There are several arguments that, at least on the surface, suggest Government expenditure improves quality of life and is in many cases superior to private funded alternatives. Therefore, we could argue that paying tax is not only necessary but also an obligation to achieve a greater good.

In this post, I want to explore tax funded Government expenditure from two different possible scenarios. In the first scenario, I consider Government/leadership as benevolent. They intend to spend tax money in a manner they perceive as in the best interests of the public. In the second scenario, I consider Government/leadership as self-serving. They intend to primarily use tax money to gain more power and wealth.

Benevolent Government/Leadership

Can benevolent Governments/leadership exist? This depends on how decision-makers are determined. In my post, Power, Money and Me Me Me, I discuss how existing “democratic” (representative) systems cannot produce benevolent leadership. It is possible that changes can be made to existing systems that could enable but not necessarily guarantee benevolent leadership. Such changes could include:

- Replacing political parties with independent candidates.

- Greatly increasing public involvement in decision-making (move towards direct democracy).

- Holding separate elections for legislative and executive branches.

- Changing voting systems (changing first-past-the-post systems to preference voting systems such as a Condorcet system or a Borda Count system or combination of the two).

- Removing media and campaigning bias (e.g. all legitimate candidates invited to debates and caps on campaigning budgets).

- Ensuring all major decisions are transparent and decision-makers can be held accountable at all times.

These changes should enable a wider range of candidates to gain opportunities to achieve positions of leadership as well as reduce party and media bias. Therefore, let us assume we live in a society that has benevolent government/leadership. Leaders genuinely want to act in the best interest of the people they represent. Tax money would be used to support services and build infrastructure the leaders believe to serve the best interest of the public. Leaders would engage with the public to obtain genuine input and feedback on decisions.

We could argue good intentions combined with responsible actions will lead to good outcomes; the type of outcomes that our tax money should be supporting. However, a relatively small number of people are responsible for the majority of decisions made in Government. The decisions are made based on perceptions of leaders. These perceptions could be informed based on public engagement but representation will be limited even under good circumstances. Therefore, some decisions will lead to outcomes that address the needs of the public while others will not and some may even do the opposite.

Even if Government/leadership have benevolent intentions and are able to make good decisions, the delivery of these decisions may fail to reach desired outcomes efficiently and effectively. The problems of large bureaucracies such as lack of motivation and innovation will remain regardless of the intentions of leadership. However, a benevolent Government/leadership will eventually realise the shortcomings of the predominantly centralised system they operate. This realisation will lead them to initiate change in an attempt to fix these shortcomings. The likely success of these attempted changes are difficult to predict but they will ultimately require the loss of power of their own Government. Hence, this could be a good indicator of the benevolence of a Government/leadership.

In my post, Blockchain Government – Part 2: Leadership from the Blockchain, I discuss decentralised governance using the blockchain and how decisions can be made without anyone holding any significant power. I would expect an informed benevolent leadership to utilise blockchain technology or something similar or equivalent to increase decentralisation of decision-making.

If we ever have a benevolent Government/leadership, paying tax can be justified. The biggest problem is identifying a truly benevolent Government/leadership. For one to be possible, our political systems needs to change radically. Even with radical change, we may not get a benevolent Government/leadership immediately. When we do get one, it could be brief. Once we have a benevolent Government/leadership, it could take some time to be confident that they are truly benevolent. A good indication that they could have benevolent intentions is their approach to change and willingness to decentralise power and control.

Self-serving Government/leadership (the more likely scenario)

The benevolent Government/leadership scenario is not going to occur on its own. People need to insist on change. The existing systems need a massive overhaul. Neither the incumbent Governments nor official opposition will be open to discussing any changes of such magnitude. The people will need to insist on it. The people can take control and insist on change because they have the numbers. I believe the biggest problems that the public have in being able to force changes are as follows:

- creating a sufficient amount of awareness amongst people to force change

- obtaining agreement about what changes are necessary

- coordinating an effort that will force change to occur

Until significant positive change happens, we are left with the existing systems that continue to push power and wealth into the hands of the few.

The two years of internationally coordinated Covid-19 oppression followed by the internationally coordinated response to Russia’s invasion of Ukraine, demonstrates Governments’ complete disregard for their own people.

Covid-19 was used to:

- implement draconian laws that increased the powers of Governments

- force people out of work so that they become dependent on Government handouts

- transfer wealth from small businesses to large businesses through the use of restrictions

- transfer tax payers money to pharmaceutical companies in exchange for dangerous ineffective experimental drugs

- coerce people into taking these drugs by threatening their freedom and livelihood

- censor any opinions that even question the effectiveness and safety of Covid-19 drugs (vaccines)

- restrict and ban protests opposing Government actions

- create health passes that are used to monitor people’s medical procedures and will likely be used to monitor other activities in the near future

- increase money supply by an excessive amount, which would inevitably lead to inflation in the medium and long run

So far, Russia’s war with Ukraine has been used to:

- freeze or steal people’s assets based on alleged links to the Russian Government

- restrict import of essential energy such as oil and gas, which has worsened supply chain problems and inflation

- attack another countries economy in a deliberate attempt to bring poverty and death to a nation of people because of the actions of their Government

- pressure other countries to adopt the same aggressive approach

- encourage hate towards others based on nationality

- arm and train military groups that openly support Nazi ideology (e.g. Avoz Battalon)

- spread pro-Ukrainian and pro-Western Government propaganda, and anti-Russian propaganda

- ban media that may present an alternative view regarding the war

The tax money we pay to Governments is being used to our detriment and to the detriment of others. It is being deliberately used in this manner and it has been done openly. Anyone who takes the time and effort to find out about what is really happening will encounter the same information I have. Below are several posts where I elaborate about the approach to Covid-19 and the Russia Ukraine war.

- My Concerns about the Covid-19 Vaccines

- A Peripheral look at the Great Reset and Fourth Industrial Revolution

- The fall of Australia plus my experience prior to the fall

- Covid-19 Assault: Have the Establishment made the Right Moves? (Part 1)

- Covid-19 Assault: Have the Establishment made the Right Moves? (Part 2)

- Covid-19 Assault: Have the Establishment made the Right Moves? (Part 3)

- Russia Invades Ukraine: What is going on?

- Russia-Ukraine War 2022: Winners and Losers (Part One: Losers)

- Russia-Ukraine War 2022: Winners and Losers (Part Two: Winners)

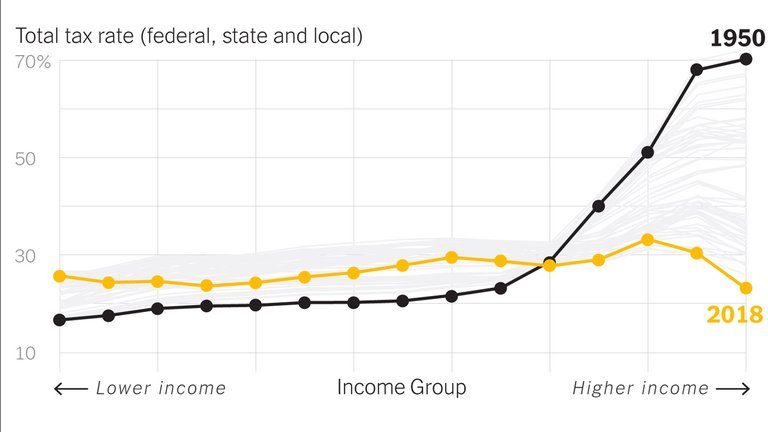

Most of the tax money that is used to fund Government tyranny comes from the working and middle classes, see the figure below for an example of the USA (figure also used earlier in this post).

Total Tax Rate (Federal, State and Local)

Source: New York Times

Responsibility for how tax money is being used does not just fall on the people in Government who spend this money; it also falls on the people who pay this money to their Government. If Governments are committing atrocities and the taxpayers are aware of these atrocities, the taxpayers should acknowledge that they share some of the responsibility for these atrocities. Continuing to pay tax under these circumstances could be considered as unethical.

In most countries, refusing to pay tax owed is illegal. Tax payments are often beyond the control of the taxpayer. For example, income tax is deducted before a person receives their income or a value added tax is included in the price of a good. Governments have made it difficult for people to avoid paying tax.

People could try to reduce their tax payments by homesteading. Becoming mostly self-sufficient on a plot of land in the middle of nowhere is a great way to reduce your tax burden legally. Another possible way of avoiding tax is through cryptocurrency. Holding cryptocurrency for over a year reduces tax burden from possible capital gains in some countries. Holding cryptocurrency indefinitely should enable people to avoid tax. Some countries are considering taxing unrealised capital gains (Bloomberg). However, taxing unrealised capital gains would be very difficult as value is held in assets and money (fiat) may not be available to pay the tax. Another way of reducing tax burden is donating money to charity. This enables a person to have more control over how his or her income is used. Earning income through cash-in-hand payments is a possible way of avoiding tax payments. Tradesmen often request payments in cash. This approach to tax avoidance is not legal but does not appear to be heavily policed.

My Opinion

Our existing systems must change. We are going down a path where Governments are becoming more authoritarian and power is becoming centralised at the top. The power is likely to continue shifting towards the few as global governance is growing. We have seen this unofficial shift to more global governance with the coordinated response to Covid-19 and now the coordinated response towards Russia. The World Economic Forum strongly backs global governance and want more decisions made on a global level. Below are two of my posts regarding the World Economics Forums plans for global governance.

- My summary and opinions regarding ‘The Great Reset’ – Part 6: Conclusion

- A Peripheral look at the Great Reset and Fourth Industrial Revolution

Global governance is and will be funded by tax. People will be giving more money to the few while having less say on how it will be used.

At an individual level, for most of us, not paying tax is currently not a viable solution. Tax is mostly taken from us without our consent. Not declaring income that should be taxed is a way of avoiding paying tax but it is risky as you could be caught and be required to pay the amount of tax owed plus interest and possibly fines.

At a collective level, not paying tax or paying less tax might be possible. Collectively, people can force Governments to change policies. They can force Governments to become smaller; therefore, requiring less tax. They can pressure Governments into not transferring huge sums of money to private companies that are working against public interest to make profit. They can pressure Governments into changing existing systems that centralise power in the hands of the few. They can force politicians who do not support the interests of the public out of office. If you are unhappy about how your tax money is being used, you should make yourself heard. You might be surprised by the number of other people who feel the same way.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

My CBA Udemy Course

The course contains over 10 hours of video, over 60 downloadable resources, over 40 multiple-choice questions, 2 sample case studies, 1 practice CBA, life time access and a certificate on completion. The course is priced at the Tier 1 price of £20. I believe it is frequently available at half-price.

Future of Social Media

Taxation is theft, but we pay it because the penalty for not paying is incarceration or worse. This is why it is our responsibility to minimize our tax liability as much as we can. While it's true that some billionaires pay less income tax than their secretaries or assistants, they also pay many other forms of taxes: property tax, licensing fees, permit fees, etc. For taxes both billionaire are secretray/assistant pay, the billionaire will pay magnitudes more: VAT or sales tax, health insurance tax, telecom tax, etc.

So if taxation is theft-- money taken by means of coercion-- what else can a government use as a source of money? Here are techniques used in the past:

While excise taxes are still being used, as a source of tax revenue they are minimal compared to what they had been in the past. We still pay fees for things we actually use, but we're also stuck paying fees for things some of us don't need.

All political forms of government rely on taxation, even democracies. While people will always need a way to govern themselves-- rules and boundaries to which all agree-- this does not necessarily mean that people need to use political forms of government. People can vote with their feet. People can vote with their wallets. People can also vote with their time. These are 3 ways in which people vote for what they want and get what they want all the time. Political forms of government rely on special interests to take from one group to pay for another group, and often people end up paying for things they don't want.

Governance does not mean government, yet government is what we end up with, and government is the greatest source of theft.

Posted Using LeoFinance Beta

Governments greatly contribute to creating a false reality. They try to create the idea that paying tax is an ethical duty. They want the illusion that our tax money is only being used for our benefit. People who avoid paying tax are treated as unethical, selfish, or greedy. Therefore, they deserve to be punished.

Society still seems willing to accept this fake reality even though Governments are constantly misusing tax money. It is going to be very difficult to break this way of thinking because it is built on tradition and not logic.

Then there is the complaint that some people "don't pay their fair share." Not including tax evasion (defined as a crime despite taxation itself being theft) , that's because they pay what the law legally permits them to pay.

Although both a billionaire and his secretary are obliged to pay a percentage of their income in taxes, the billionaire has more access to investment opportunities than the secretary. Investments are handled differently from wages, and this alone gives the billionaire opportunities to reduce what is legally required to be paid in taxes. Other discrepancies exist, but you see the point.

Government as a machinery of the state will be difficult to overhaul as some of the reasons you actually mentioned are very prevalent and one of the most prevalent is, can people actually form the numbers, come to agreement and overhaul the whole system? This is difficult. One of the things government do to people is to sow a seed of discord amongst them. Another thing is that since most system are under the illusion of practicing democracy it will be difficult for people to come to a certain consensus as to which government should stay and which should go.

In Nigeria for example the system of taxation is totally different. While the money gotten from taxation isn't used to fund terrorism, it is being constantly embezzled rather than used to improve the lives of people.

The government themselves can afford to run the state from the state and federal revenues gotten from different sectors in the country. Nigeria is rich in crude oil and so many other cash crops. The money being generated by the educational sector in Nigeria is enough to repair and take care of the other sectors. But it seems this morning are not enough simply because they are being embezzled in bulk.

However it is only when the system ceases to exist that you can have unfair taxation like the one we have in so many countries.

Again we are back to that loophole. Most governments try to make themselves indispensable. This automatically creates relevance for everything they are doing, including taxation. I feel change is imminent.

@tipu curate

Upvoted 👌 (Mana: 34/44) Liquid rewards.

In the West, democracy is treated as something sacred. Yet at the same time it is an illusion. Voting for party A or B every 3, 4, or 5 years is considered democracy. Debates amongst a few people with similar views is considered democracy. Media pushing ideology fed to them by political parties or big business is considered democracy. The people are almost never involved with any form of decision-making. However, the system is promoted as doing exactly that. Anyone who disagrees or attacks our fake form of democracy are labelled as opposing democracy. More people are becoming aware of our fake democracy but few are willing or able to do anything about it.

Well let's just say government in most states have lost the essense of what democracy is. Or it could be that they have politicalized it. In Africa democracy this is mostly common and this is because the electorate themselves lacks the basic understanding of what democracy is supposed to be like.

But then the most common aspects which people deem be democracy changing individuals every four or five years. However in situation where you have politicians ruling the country with constitutions with they wrote themselves, how does the ordinary people even compete or bring a change when they do not even have the power to do so? It's rather unfortunate.

Yeah, they don't even ask people how to use the money. There is no votes about that. There is no special funds from that helping people themselves when they are in a bad situation. Everything is done for their own benefit. Even the pension they think to stop giving it at all to people who worked for years. That's a rubbery. Plus, all those who pay are involved you can say in their crimes. Not only what they do with war, even what they have done with the virus and restrictions. They paid the mass media with our money to make us live in fear and to create a social distancing between us and to restrict us and take the rights left. How to pay after that. How to trust them. Anyway, now they even think to take a tax from our crypto earning, or maybe they are already taking it from some people. That's why we should avoid centralized exchanges, and use only decentralized one. We didn't move to crypto world to keep supporting the old dirty and sick system. We moved here to create a new better world with more transparency and privacy. We just should create a new world. We should reset the system. I think it's possible if more of us realize what's done with us during all the history. We were born free and we should die free !

I am becoming more frustrated with crypto exchanges. They are asking for more information and personal details. Most of the information is not necessary and does not help protect my account. One exchange even froze some of my coins until I showed them how I acquired them. They asked for screenshots from other exchanges (buying, selling, withdrawals, deposits, etc.). They are becoming just like banks. I have moved all my coins off exchanges now.

Me too. And I'm finding more and more decentralized exchages where they don't ask for any details. I'm sure most of crypto community willmove there and centralized exchages will have less power. I like some exchangers where monero, piratecain, dero and wave is listed. I think wax is good as well.

I believe the importance of tax is very important when been used to settle every important project needed in the society.

Congratulations @spectrumecons! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 49000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Governments always operate as a monopoly, and the nature of taxation (extortion) exacerbates the waste and abuse 9nherent in such a system. Governments cannot rationally allocate resources because they do not have the market price signals and competitive pressure required when gaining consent. Refusing to pay taxes to such a system may be dangerous, but is not immoral.