Just a month or so ago, many people were feeling pretty optimistic about the economy. Inflation looked like it was on its way down. Interest rates weren't all that high and the financial system seemed to be holding up all right. However, in the past couple of weeks, everything has suddenly got quite a lot worse. At time of writing, four banks, SVB, Silvergate, Signature and Credit Suisse have collapsed, and it's likely that others will follow suit. So in this article, I thought we'd do our best to explain what's going on, why the current crisis presents central banks with a difficult dilemma and why things might be about to get worse.

To understand why banks are collapsing, you need to start with inflation, i.e. the rate at which prices are rising. Now, in most of the world, prices are usually rising. That's why Cheetos get more expensive over time, for example. And this is usually a good thing because rising prices incentivizes consumers to buy stuff sooner rather than later, which keeps the economy going. Politicians and central banks don't like it when inflation gets too high. However, for a variety of reasons, significantly higher prices are politically toxic because they eat away at living standards and induce the risk of so-called wage price spirals, which is when wages and prices enter a positive feedback loop. Essentially, workers demand higher wages to account for inflation, and these higher wages mean they spend more money on stuff, which means even higher prices, which makes workers demand even higher wages and so on and so on. In the worst case scenario, this wage price spiral can push inflation up so high that people don't want money anymore because it decreases in value too quickly. And this is really bad news for an economy because, well, economies sort of rely on money to work.

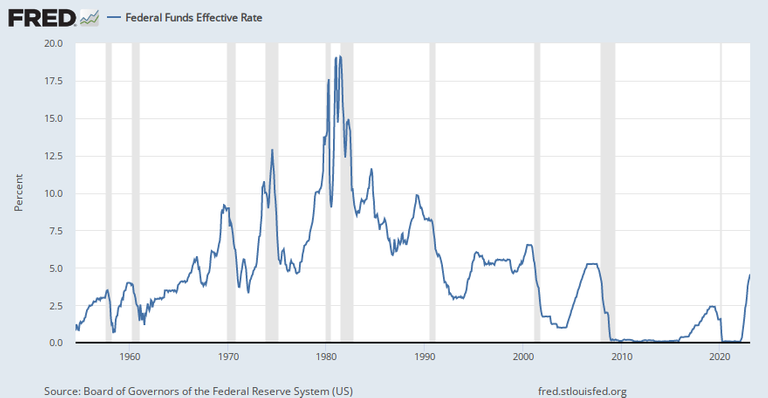

Anyway central banks usually try to bring down inflation by raising interest rates, which makes it more expensive for people to borrow money to reduce demand, which should put less pressure on prices. Now, in a simple world where banks just lend money to creditworthy customers, interest rates are good news for banks because it means they can make more interest from lending money. However, banking is no longer as simple as it once was. Banks today also use a whole load of complicated financial models and instruments to make as much money as possible. This has two implications. First, it means that high interest rates can actually be bad for banks because of the way that high interest rates interact with these instruments. And second, it means that today banking is too complicated for finance managers or central bankers to be able to fully anticipate the consequences of interest rate hikes, which leaves banks unprotected and therefore vulnerable to collapse.

Now, I'm not saying that central bankers didn't expect any stress in the financial system. Part of the point of raising interest rates is to weed out the least profitable businesses, including the least profitable banks. But they don't know exactly where or to what extent which left central bankers running around trying to find ad hoc solutions to unforeseen bank crises like financial Whack-A-Mole. And this high interest rates and an unpredictable financial system is fundamentally why so many banks are going bust. Obviously, in every individual case, there are other factors at play. Svb had particularly flighty investors. Signature had too much money in risky crypto assets, and Credit Suisse had, well, basically every problem you could imagine. But the background cause to all this chaos is rising interest rates and Finance's inability to accurately anticipate the consequences.

Anyway, this brewing bank crisis leaves central bankers across the world with a bit of a dilemma. The way to stop a bank crisis is to, well, bail out the banks by giving them enough money to stop gap their outflows and restore confidence. There are different ways of doing this. The Swiss Central bank, for example, gave UBS a massive loan when they bought Credit Suisse, when the Fed extended its guarantee for deposits to protect wealthy SVB depositors. But in practice, these are pretty similar. Central banks are either giving money or promising to give money to certain banks. However, the reason this is a dilemma for central bankers is because, at least according to the standard economic theory, if you pump more money into the economy, which is what you're doing when you bail out a bank, you'll create more inflation.

Now, this point can be overstated, but it at least makes central banks wary of further interest rate rises, because even if they want to hike rates to fight inflation, they know it will cause more unforeseen damage in the financial sector. Anyway you get the idea, Central banks are in a bit of a pickle because they can either hike rates to bring down inflation but risk another financial crisis or stop rate hikes to protect the financial system but risk further inflation. To make matters worse, whichever horn of the dilemma they choose, it's not even clear they're very good at solving either problem. Interest rate hikes around the world have proven remarkably ineffective at fighting inflation and central banks. Efforts to stem the brewing financial crisis have been moderately successful at best.

The Fed's decision to extend its deposit guarantee, for example, only applied to certain big banks, which has put pressure on. Smaller banks as their customers have desperately shifted their money to these better insured larger banks. Now, it's important not to get too pessimistic here. After all, SVB and Signature were pretty minor banks involved in very specific industries, and Credit Suisse has been Europe's financial basket case for the best part of a decade now. So they're not necessarily systemic risks. However, the fact that central bankers don't have many great options at this point and their apparent inability to stem either inflation or the brewing crisis really doesn't bode well.

As a final thing, how might we avoid this dangerous dilemma in the future? Well, there are broadly two things we could do. First, we could better protect the financial system. This could either be via more stringent regulation or full on nationalization. This might sound dramatic, but banking is arguably a public good and well. If the Fed is insuring basically everyone's deposits, that's a sort of de facto nationalization anyway. This would probably mean slightly less economic growth in the boom times and definitely less money for bankers. But it would reduce the risk of crisis in the downtimes. Alternatively, if you don't think the government would do a better job running the financial system, the other thing would be if central banks stopped only using interest rates to fight inflation.

Rate hikes make sense when inflation is caused by too much demand, but when inflation is caused by a lack of supply, like, say, when war limits the availability of oil, then more targeted measures aimed at loosening up the supply of oil might be both more effective and put less strain on the financial sector. Again, this might sound crazy, but, well, interest rates don't seem to be working all that well at the moment, so maybe it's time to try something else.