Price

Efficient market hypothesis (EMH) says price of a product is always right in a free market. Meaning the price reflects all possible information at any given time. If that is true (this is only a theory), it means that it is impossible to beat the market (in long run). This is a simple statement but quite deep. The EMH theory can be proven within most markets with ‘high’ volume. Why? Because more the volume, more difficult it is to manipulate. The entire mutual fund industry is based on the EMH. The firm Vanguard in the 70s and 80s popularized the index mutual fund. They sold it to the public very well. Please do not get me wrong, although my tone perhaps suggests that I am not a big fan of EMH, but the fact is I am. Why? Because it is true. What Vanguard popularized that it is impossible to beat to market, so why don’t we match it. Make a financial product that buys every single constituent entity in the same proportion. For example, in case of S & P 500 index, a fund can buy all 500 stocks of the index in exactly same proportion and own it forever (if it is part of that index). Viola! You have matched the market!

If you think about it, it is a simple but profound concept. Perhaps all profound concepts must be simple. What Vanguard started became viral with the advent of cheap/free online trading/brokerages and a whole new industry is born in the 90s and 2000s; the ETF (exchange traded funds) industry. Today, every single financial element you can think of probably have an (or thousands!) ETFs associated with it. After High Frequency Trading (HFT) ETFs (and index mutual funds together) constitute the most volume of global financial markets.

Is the price always right?

No!

WTF?! You mean EMH is wrong?! Nah, not really. Read the definition again. Keyword “free market”. Lots of markets are not free markets. Even the best of the markets can be inefficient during a different (read smaller) time scale. If you understand that, and it is not an easy concept to understand, you have achieved financial nirvana! Well, not quite, but you are along the correct path 😊

Here comes crypto with a curveball. Crypto markets are easily inefficient. Why?

- Outside BTC, ETH and few other major crypto, volume is thin

- They are news driven, and easy to have a news ahead of time, compared to the masses

- Insider trading is allowed, happens all the time

- There is no governing body, like SEC, hey we like it that way!

- We are ‘decentralized’ (LOL!)

- Outside majors, a small group of individuals controls majority of the volume, so they can manipulate price

How can a common citizen handle it

Yes. It is possible to be successful even in the wild west of crypto. And it is not terribly hard. It is happening all around you every day. May be not consistently and all the time, but it is certainly common.

- Slow down. Most inefficiencies are short term. EMH says, over long term it is not possible to beat the market. Better believe it. House always wins…. So bet on the house if you can..

- Keep your antennas up! Listen to the chatter, but apply a broad range filter

- Watch the volume. Volume moves prices, and people can’t hide volume

- Know the people. Honest people are out there, and they won’t take your money

- Follow the tech. Better tech, newer tech, … more interest.. more momentum.. higher price

- Only put money you can afford to loose

- Have your keys!

- Buy BTC and never sell 😊

None of these are meant to me financial advice and meant to be a fun discussion. These are mostly my opinion. I am NOT a certified financial professional.

I have always maintained that the (smaller) crypto markets are much more like a commodity than a stock. They are driven by scarcity and volume and any given number can be stated as either condition. Incredibly news driven and particularly trader rumors they are easily manipulated in the short term.

I can't believe the reaction to DAILY charts. What a useless instrument. And a fraction of people are convinced every day that the moon is next or the crash is upon us. From a 24 hour trend. It just amazes me every day.

Thanks for a really good and rational post. I just wish more people would read it.

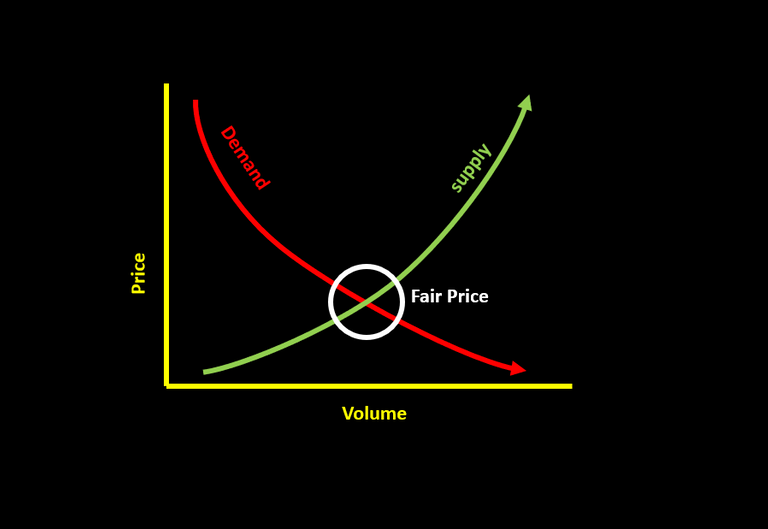

Supply - Demand in the intermediate to long term. That generally works. Certain financial concepts are simple to say; even communicate but incredibly hard to implement. That’s where trading/investing psychology comes into play.

Nice post. It is possible to have an idea of cryptocurrency. I have no experience, so I always read such publications. thank you

I've got close to zero knowledge of crypto currency but posts like yours have made a huge deposit into my knowledge bank of it.

Quite a nice post!