Well some go in the direction right away, and some take a bit of time. Seems like the Home Depot trade is going to take a bit of time. But I am liking where I am at.

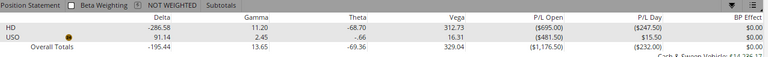

I am short after a 50 point run up, and have been averaging down. So that means I have 7 21MAY21 300 puts now, and am down about 625 dollars in the trade so far.

I have a negative delta of 286 meaning for every dollar it falls my position should go up 286 dollars. So I need a 2 dollar move to break even.

Should be able to at least get that.

Posted Using LeoFinance Beta

It could correct to the .38 Fibonacci which is located at exactly $110:

Best regards!

Posted Using LeoFinance Beta

ya I am hoping for a lower price

We have new products rumored to be coming in April. The WWDC event in June and the annual iPhone launch sometime in September. What's that old saying? " Buy on the rumor, sell on the news!"

Posted Using LeoFinance Beta

I personally would not be going long Apple right now. The QQQ is not looking so hot and I think the market makers are just going to let Apple hover in a range. The reason why I don't think QQQ is going to go up by that much is because it is under the 50 day moving average while SPY is fairly close to the all time high. If they can push financials and the other sectors, they can keep tech suppressed and buy it up when retail is tired of holding Apple.

Posted Using LeoFinance Beta

ya, but if it dips you can buy and sell calls

Yes but selling calls doesn't mean you won't lose money. You only limit your losses and will be stuck bag holding. Depending on the strike price you are willing to let go, the premium might not be worth it as you could spend that on a better opportunity in the stock market.

Posted Using LeoFinance Beta