I have been short IWM for a while, but closed out those positions for a small small profit. But If I would have held them it would have been a nice day. But I rolled them over to some SPY puts.

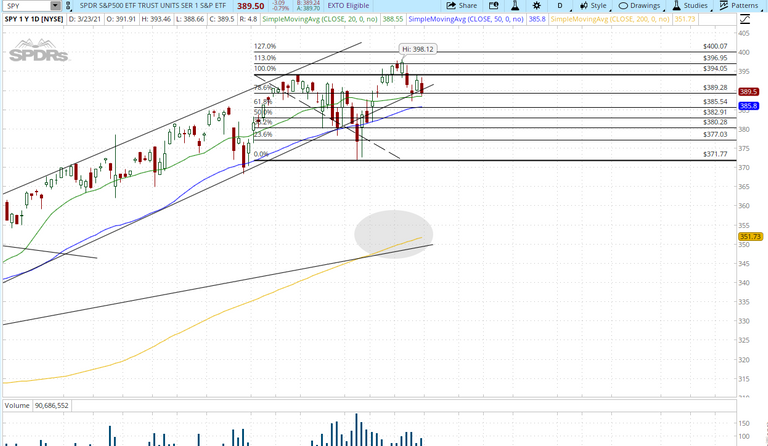

Looking at the chart it looks like we have a possible 113 double top, with the market right on the moving averages. I don't think it will break down, as the government is now throwing out 3 trillion dollars around. But, this is what we have a crap show in washington. Technically it looks as if we are heading lower, and you can see today was a red candle, and I went long the puts yesterday. As the market began to sell off, it was a perfect time to get in and play the down side. I made 600 in a 24hr period.

I have been holding straight puts and not selling a calendar spread as much. Riskier, but more reward. I have been using the average down strategy, and it has seemed to work so far. But the more consistent move is to sell volatility.

Posted Using LeoFinance Beta