If I had to pick the top five buzz words of 2020, one that would certainly be up there with "Karen" and "Rona" is DeFi. It has been all the rage lately and although it is a definite paradigm shift, it is also the natural progression of decentralized currencies.

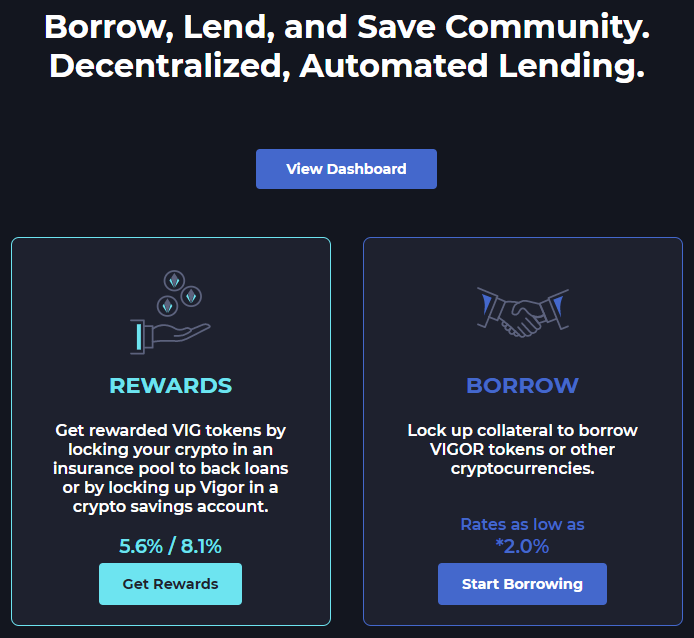

What is the point of having a blockchain based currency if you still need to visit a bank to perform the common transactions that take place with currency. Borrowing/Lending/Saving are now right at your fingertips with the advent of DeFi.

I was tipped off to the Vigor project by @lovejoy and I soon began investigating it.

Built on the EOS network, Vigor takes advantage of some of the things those of us who use Hive have come to know and love. Fast transactions on the blockchain at zero to low cost. Given the headaches people have been having with gas fees over on ETH lately, that is a huge deal. I understand brand loyalty, but it really is time that people started giving EOS a second look.

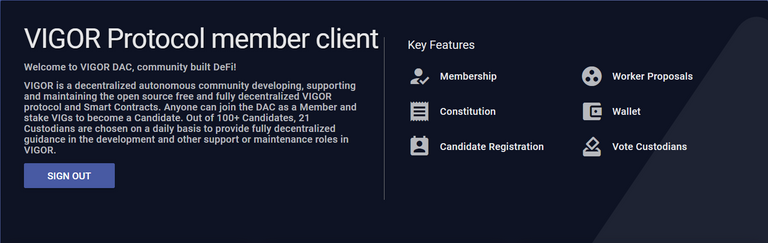

Vigor was officially launched about a week ago, but I was able to take part in an early version of it by registering to be a candidate. Similar to witnesses on Hive or block-producers on EOS, Vigor has a cabinet of 21 custodians who guide the direction and development of the project.

To become a custodian, you first have to register to be a candidate. It used to take an upvote from one of the custodians to be approved as a candidate, but now anyone can simply by staking 10,000 VIG tokens.

Remember, anyone can use the platform now. All of those hoops I went through are absolutely unnecessary.

If you want to be involved in the project rather than just using it, the custodian/candidate piece is built on a DAC. There is a constitution you need to sign and you also need to create a robust profile so the people who are voting can get an idea of who you are.

If you are lucky enough to get some custodian votes or better yet make it into the custodian pool, you earn rewards for contributing to the community (paid in VIG).

I have to admit, Vigor is one of the most active projects that I have ever seen. They have several Telegram Channels for the different aspects of the service as well as bi-weekly committee meetings that many of the custodians participate in.

I will admit I was an absolute moron to throw my hat into the candidate ring at the end of the summer. With school starting and a massive reliance on technology due to the increase in distance learning, I have not had the time I thought I would to dedicate to Vigor. I am hoping that can change once things die down.

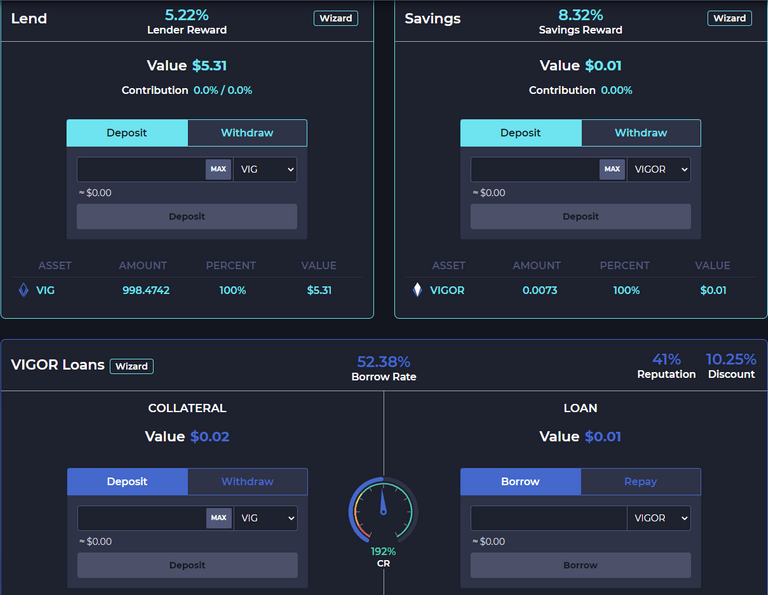

Without getting into the in depth specifics, Vigor can be as in depth or easy as you want it to be to get started. The biggest thing to realize when you first look at the dashboard is that those percentages you see are not fixed. They will move and adjust as funds are moved in and out of the platform.

There have been countless messages on the Telegram channels from people confused that they didn't get the percentage yield they expected. The best advice I can give is to play around with it and figure out the averages yourself.

Another important thing to understand is that there are actually two different tokens on the Vigor network. One is the VIG token and the other is the VIGOR token which is more of a "low volatility token". Additionally, you can deposit funds into the pool with EOS and USDT which gives you a small variety of options for investing.

Running on the EOS blockchain, Vigor uses Scatter or Anchor to authenticate/perform the transactions.

If you don't yet have an EOS account, the Wombat wallet is a great way to get one created. I really do feel that EOS is going to be one of the chains to watch when the next bull run finally gets around to gracing us with it's presence.

One more thing, this should not be construed as financial advice. I am not an expert even though I may pretend to be sometimes

The advice I can give you is to play around with it and see how it feels to perform fast/"free" borrowing and lending. No gas required!

All screenshots taken by me from my Vigor Dashboard

Sports Talk Social - @bozz.sports

Yeah DeFi is definitely a buzz word. I’m sad I missed out on that uni drop.

Ditto!

Cool @bozz! Will check Vigor out soon (:

Posted Using LeoFinance

Cool! There is definitely a lot to learn, so you will want to test it out with small amounts before you go all in!

Well, I'm glad to see Karen errrr DeFi move to EOS. I've had it with ETH and the freaking gas fees.

I still have 13 Crypto Kitties that I'd sell pretty cheap :)

Posted Using LeoFinance

Haha, I never got into the Cryto Kitties thing.

I choose games about like I generally invest. Poorly. You want to buy a Drug Wars account?

I can't keep up with all the development on the blockchain :) But this seems pretty neith...

It has definitely gotten my attention. I just sat in on one of the meetings this morning with the community building team before I had to run because of work.

Congratulations @bozz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: