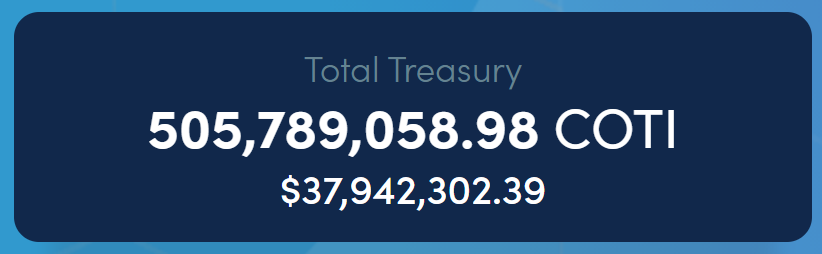

44% of all circulating COTI is now staked in the COTI Treasury

Over in the COTI community we have had a lot of announcements lately which is great news if you have stake. Ever since February last year when the COTI Treasury launched the APR has been on a gradual decline which was expected with the stake rising forcing the overall APR on offer down.

Still this is all positive as the growth is happening whilst growing with the project and use cases will slowly roll out. Where else can you receive 6.8% in the real world with little or no risk? We are fortunate to have found the various projects we have invested into as this is what is going to make the difference long term being successful.

This is the APR that is on offer being 6.8% today and is about the lowest it has been for the last 13 months. The difference now is the stake has grown sufficiently to offset the decline in the APR.

The good news id we have had these announcements which will change things and will increase the APR that is on offer. When COTI launched DJED on Cardano the fees that filter back in to the COTI Treasury tend to only affect the APR for around 3 days only. This has varied between a boost of 3-4% but then disappears again waiting for the next payout.

According to the team they have had to change the rollout for this year and now we will have a stable coin on BSC and on the Ethereum network along with the Enterprise token which is also being launched shortly. This will bring the total to 4 revenue generating tokens. The beauty about his part is even if the revenue boost increases the APR for 3-4 days each time it would be raising the average APR for about half the month.

The 4 different projects will generate fees which will then buy back COTI from the market reducing the liquidity which should over time slowly increase the price depending how successful the projects are. Obviously the more the demand along with increased minting and burning will only increase the service fees being generated. I am expecting a decent boost over the next 7 days as the latest DJED fees are due again.

The GCOTI is being launched in 2 weeks which is the governance token which boosts the APR as they are staked together so I se no reason why the APR wont be in double figures once these are launched. The great thing about this is that this is all organic growth due to the projects use case and is all sustainable.

I do expect once things settle down and the use cases grow with more partnerships the APR to reach a steady 12-15% which is virtually double where we are today. The growth along with the compounding being achieved will definitely start to speed up as the price should start to move upwards as there will be far more being staked by the investors.

The GCOTI airdrop will see most of the COTI being held tied up for a minimum of 6-12 months (180 - 270 days and 360 days).

The only downside about this is the US investors who are still excluded from partaking in the Treasury due to regulation issues. The US investors are being asked to hold on a CEX which is not ideal and hopefully this can be resolved as it does seem a little unfair. I think the US has been hampered by their governments decisions and maybe this won't be resolved as quickly as we had all hoped.

Posted Using LeoFinance Beta

I saw the other day on the one DeFi platform that I am invested in that ADA/DJED is one of the top five pools that they have right now. I am in the ADA/SHEN pool over there. I think I am probably paying more in gas fees to collect than what I actually make on the platform!

I saw that from another user and until the numbers climb it is not a great investment. Wait until DJED is on BSC as it is coming shortly then the numbers will make more sense. Possibly other staking options will become more obvious as well. The real money is going to be made in the value of SHEN when the ADA price rises.

Posted Using LeoFinance Beta

It's no big deal, I just moved a small bag over there.

I have done a lot of research about this project myself and the way you share it is very good and valuable detail. When these people stake up too much like we're seeing people have a lot of trust in it and they're buying it and holding it, the APR is going down. It's a very good project so people are holding it for Long term and waiting for the bull market. He also has a lot of money in his treasury and the team will use it at the right time.

It's really a good news for those who are holding Coti and have future plan with coti, 44 % in stake is a big ammount and because of this, it will retain the confidence of the community and attract more users.

Do you remember when Tezos had that massive run a few years ago? It was largely due to more than 90% being staked. Imagine if COTI's staked percentage of supply increased dramatically?

Posted Using LeoFinance Beta