CubFinance launched around March 8th, or just above a month. It’s been a great months for the platform as it found some stability after the launch and a clear roadmap going forward. Also, a lot of lions have made nice yields in this month.

After the first couple of days, I have made post with some CUB data:

Time to revisit now and see how things stands and what have changed and look at some additional data as the supply.

We will be looking at:

- Total Value Locked [TVL]

- Individual pools liquidity

- Inflation

- Price

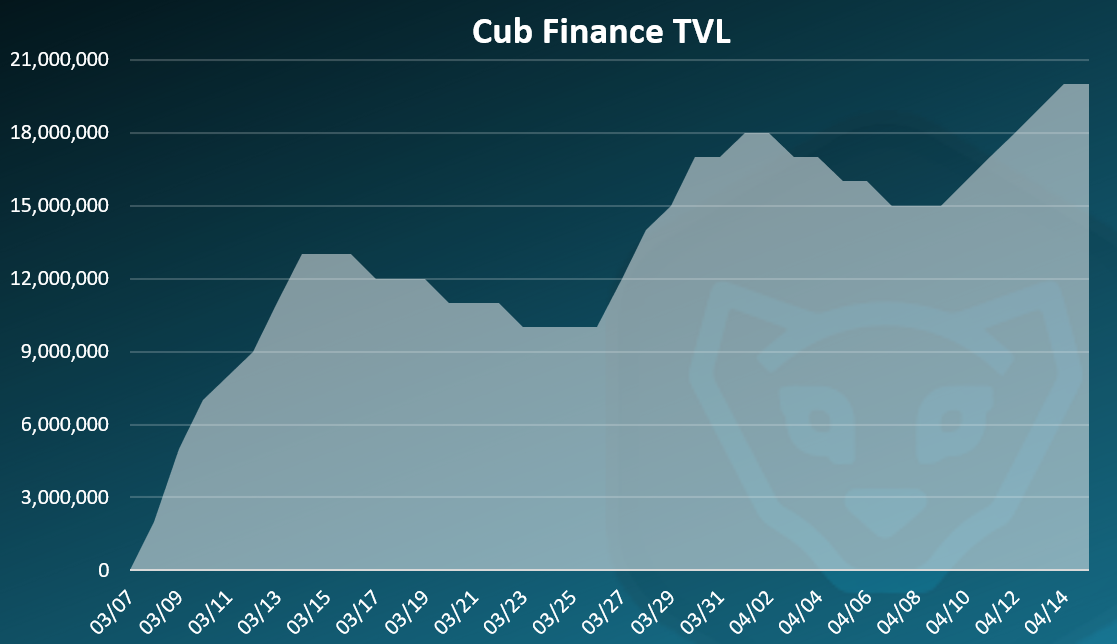

The total value locked TVL usually is one of the key metrics that is looked at about these platforms. Cub is not yet in some of the apps that are tracking this metric over time, but I have managed to gather some data and represent a rough chart on this.

Total Value Locked TVL

Here is the chart for TVL.

Note, as mentioned this is not an exact representation of the TVL, but a rough estimation.

As we can see CUB has an amazing start reaching more than 10M in TVL just in a few days after its launch. There was a period of small decline and then at the end of March, a sharp growth again, reaching 18M. There was a no fees day around that time, so this has most likely increased the TVL.

In the last days we have seen another growth reaching 20M in TVL.

Farms and Dens

CubFinance had some restructuring on the farms and dens after the initial launch. Some of the farms and dens with not a lot of liquidity were removed, and the BUSD-DEC farm was added.

Farms that got removed:

- BNB-BUSD

- DOT-BNB

- USDC-BUSD

- CAKE-BNB

- CAKE-BUSD

Dens that got removed:

- USDT

- BUSD

- USDC

- DAI

- BNB

- CAKE

From the dens, all stables were removed, since users have the stable to stable option in the farms.

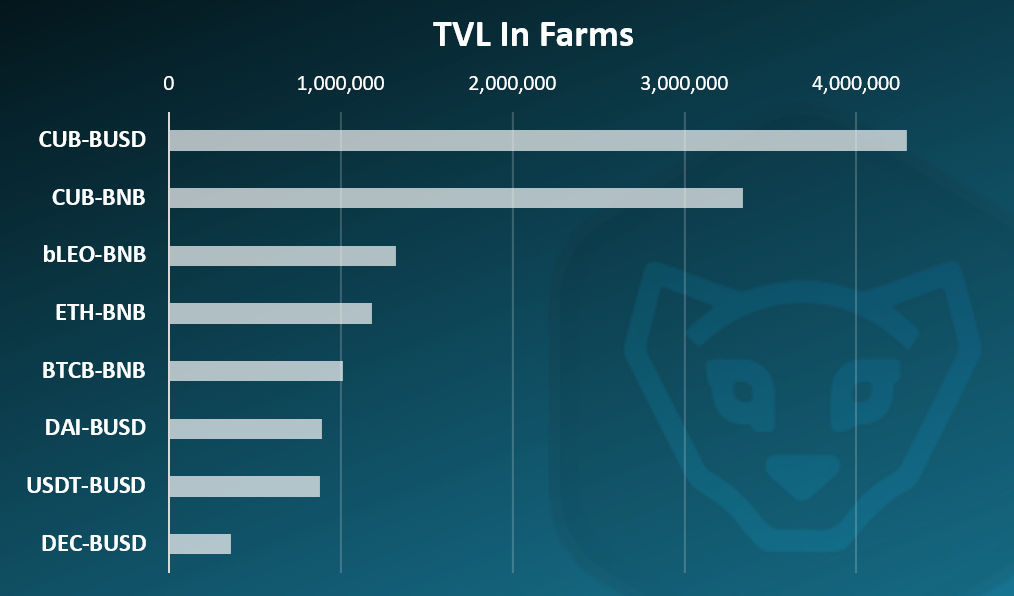

First the farms.

Note this numbers are at the moment of writing this, they can change fast.

There is a total of 8 farms now, down from the previous 12.

At the top are the two CUB farms, CUB-BUSD with almost 4.2M liquidity, then the CUB-BNB with more than 3.3M.

Combined from these two pools CUB now has around 7.5M in liquidity.

Outside of CUB pools, next is the bLEO-BNB pool, with 1.3M in liquidity. These three pools are the most incentivized so there is a good reason why they are on the top.

Next are the ETH-BNB and BTC-BNB pools. Obviously the top two coins, and then the stable coins pools.

A total of 13M in the farms.

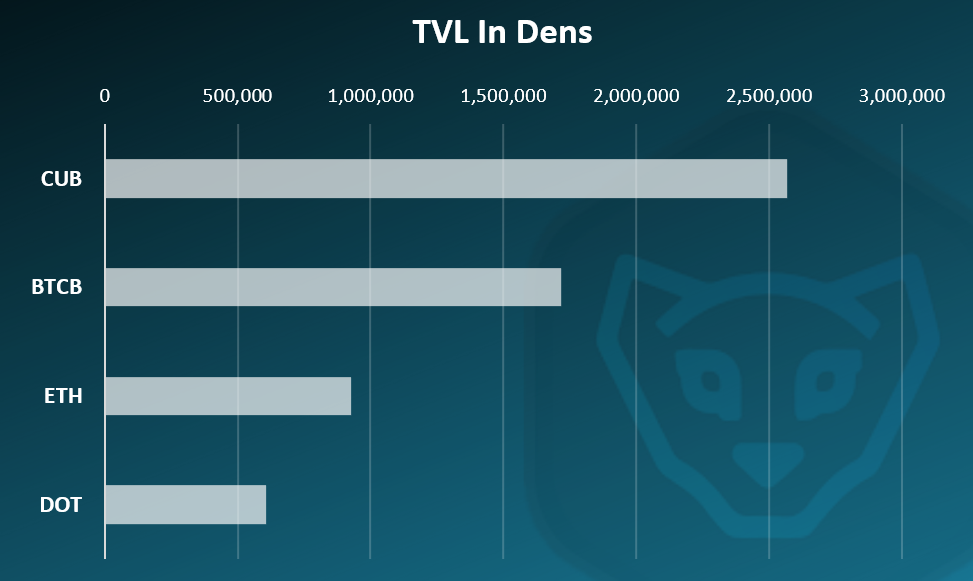

The Dens

Here is the chart for the dens.

A lot of dens were removed and now there is only four of them. CUB, BTC, ETH and DOT.

Dens are single assets pooling, if you want to avoid impairment loss. You stake your asset and earn CUB.

CUB is on the top here with 2.5M, basically stake CUB earn CUB.

BTC is next with 1.7M, followed by ETH and then DOT.

A total of 6M staked in the dens.

Inflation and Supply

CUB is starting with a low initial supply and high inflation and no presale.

What this means that going forward most of the token supply will be mined by liquidity providers.

As stated in the docs the inflation goes like this:

Emission Rate

Week 1: 3 tokens / block

Week 2: 2 tokens / block

Week 3: 1 tokens / block

At 3 tokens per block this is around 86.4k tokens per day, at 2 tokens per block, 57.6k and at 1 token per block 28.8k tokens per day and this will stay until the community decided otherwise. If the 28.8k tokens per day stays in the first year, there will be around 10M tokens minted.

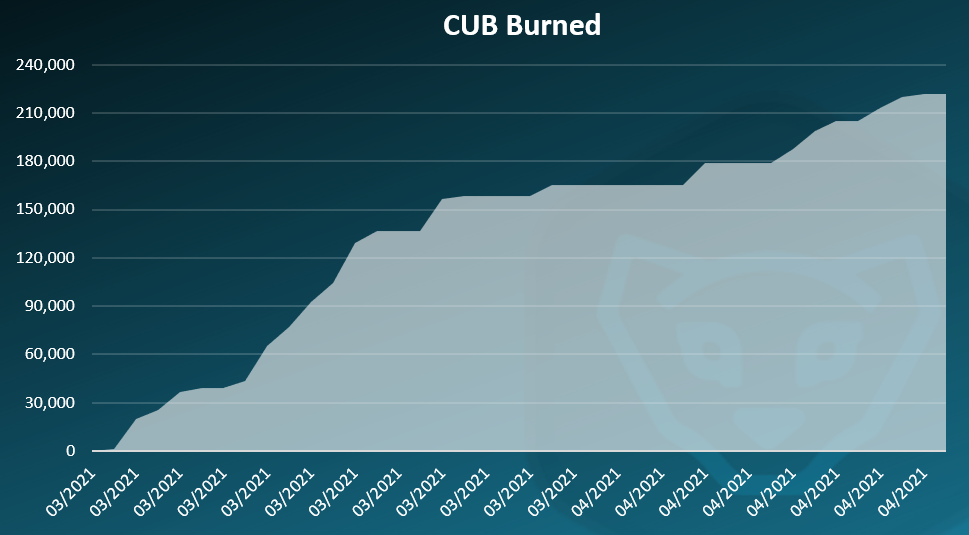

Burns

The fees that are earned from deposits are used to burn CUB. Here is the chart.

More than 200k tokens burned now.

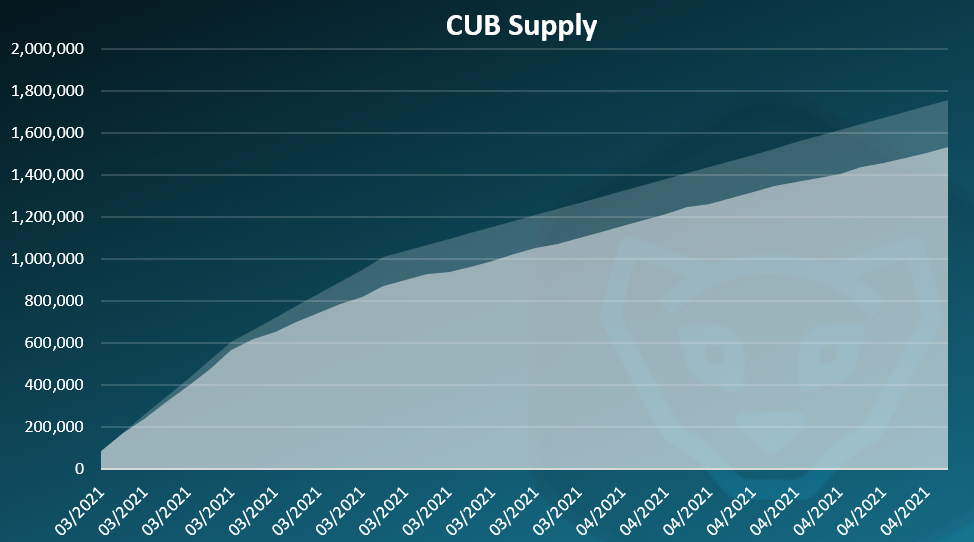

When included the burns the **supply looks like this:

We can see that in the first two weeks there is a sharp increase in the supply since the inflation per block was x3, then x2. Since then, we have a more gradual increase, and the burns are also reducing the supply. At the moment there is around 1.7M CUB minted and with the burns the supply is around 1.5M. More than 10% of the supply has been burned in the period.

Overall, the inflation is still high, with around 850k tokens per month, but as the base increases the relative inflation will drop. In a year time with 10M CUB in circulation and 840k tokens per month created the inflation will be less then 100%, then the next year it will drop to 50% etc 😊.

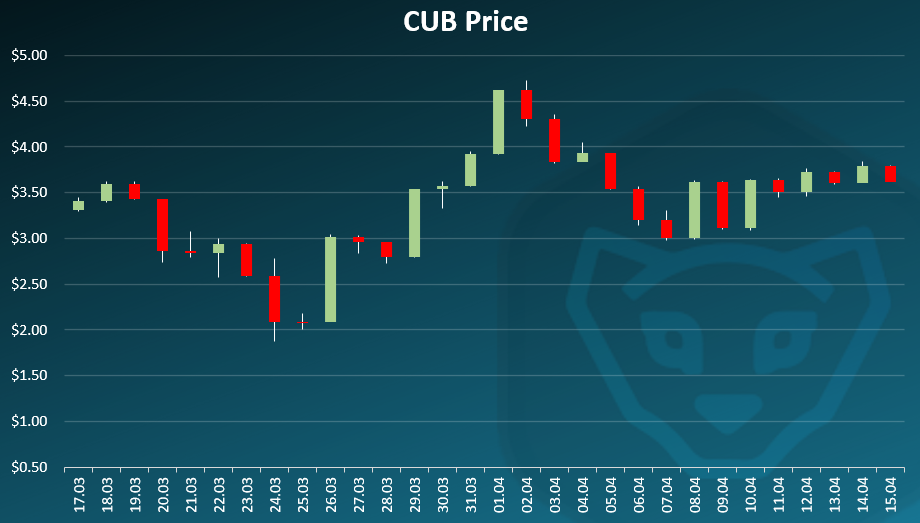

Price

At the end the price with data from coinmarketcap.

The first days are missing here, since CMC didn’t list CUB on day one, but we can see that in the last 30 days CUB has been trading in the range from 2$ to 5$, and quite stable in the last week just above the 3.5$ mark.

All the best

@dalz

Posted Using LeoFinance Beta

I'm still trying to get my head around this stuff and was wondering ...

The last time I looked the DEC-BUSD farm had a higher APR than the CUB-BNB and CUB-bLEO ones but now it is lower. Any idea what the reason is for this?

Posted Using LeoFinance Beta

The APR changes based on how much is in the pool. For example, if one of the farms was paying 300% APR and then some people decided to put more money into it, the APR would drop. That little number with the "x" next to it is the representation of how much of the newly minted Cub is going to pay the people in that pool. If more money goes into the pool, the amount of Cub being paid to that pool stays the same, but it gets divided among more people. Thus, the APR% goes down. If people leave the pool, it goes up.

Posted Using LeoFinance Beta

Thanks for the excellent explanation.

Does that mean if I add more liquidity to the pool the APR goes down but I get more of the newly minted CUB because my stake is larger?

!ENGAGE 30

Posted Using LeoFinance Beta

Correct. You get a percentage of what is mined/minted based on your percentage of the total pool. If you were the only person in the pool, then it wouldn't matter how much you had in there, you'd get it all. If you hold 10%, you get 10% of the rewards. If people leave the pool and your stake becomes 20% of what's in there, you would then start to get 20% of the rewards.

If the APR is currently 250% and the pool doubles in size, the APR would go down to 125%. If you were the one that doubled it, you'd only be getting 125% but you would be making more actual reward because your percentage of the pool would have grown substantially.

Posted Using LeoFinance Beta

ENGAGEtokens.DEC is a small cap token, low amount of TVL in the pool

Posted Using LeoFinance Beta

View or trade

BEER.Hey @dalz, here is a little bit of

BEERfrom @tcpaikano for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Nice stats, thanks.

Large amount of simply staking Cub.

What do you think are the pros and cons of the top two farms?

Why do you think the cake den didn’t do well?

Posted Using LeoFinance Beta

Thanks!

Well the pros are obviously the high APR, and the cons the risk if the CUB price goes down. The CUB-BUSD is more safe with high APR and a dollar hedge. The CUB-BNB is the more bullish option.

The CAKE den didn't do so well because the LEO community is not as deep in BSC and didn't hold much of it. BTC and ETH did quite well :)

Posted Using LeoFinance Beta

I like the graphical info graphics. As always, thank you for sharing your statistical data posts!

Posted Using LeoFinance Beta

Thanks Dan!

Posted Using LeoFinance Beta

Continuous developments and that's why I'm bullish on CUB

Posted Using LeoFinance Beta

Great information! I have been really happy with CUB so far. I just put some more funds into it yesterday. I am hoping to generate as much as I can!

Posted Using LeoFinance Beta

Thanks! Cub had an amazing month ... hoppe for even better one!

Posted Using LeoFinance Beta

Me too!

Awesome data summary my friend, appreciate it!

Posted Using LeoFinance Beta

If there is one token which I won't even plan to sell in near future - it is CUB :) Thanks for the data .

Is the BSC API free to use ?

Posted Using LeoFinance Beta

Thanks!

I haven't used any APY for the data :)

Posted Using LeoFinance Beta

I had joined CUB with Dens of USDT and after its removal, I moved to CUB>BUST pool. I have also purchased 120+ CUB at the price of 3.3 which is good and so far its going great. I expect that the CUB price will be approx $5 in the next few weeks looking at the interest of the people. Lets see how it goes.

Posted Using LeoFinance Beta

Happy to see DEC-BUSD on the chart. Let's go Splinterlands!

Posted Using LeoFinance Beta

Thanks for sharing this post. I still have a lot to learn about decentralized finance.

How come the Farm APR always changes?

APR always changes due to a lot of factors, TVL, price etc ...

Posted Using LeoFinance Beta

Happy to be in this project and hope to make some nice gains over time ;)

Posted Using LeoFinance Beta

Instead of “Total Value Locked” shouldn’t it be “Total Value Deposited” considering you can with draw whenever?

Posted Using LeoFinance Beta

Yea, but TVL is something that all the defi platforms are using, including Uniswap

Posted Using LeoFinance Beta

Congratulations

!BEER

Wery good ;))