HBD has seen more changes and adoption in the last period. A 20% APR on HBD in the savings, a USDC-HBD pool on Polycub was created that now has more than 400k liquidity.

Meanwhile the DHF budget kept increasing and so does the funding for the @hbdatabilizer. For those who don’t know the @hbdstabilizer account is trying to maintain the peg of the HBD to the dollar. It receives HBD from the DAO/DHF and trade it on the internal market and then sent funds back to the @hive.fund.

Let’s take a look how is the @hbdstabilizer doing!

Since the last Hardfork and the ability to convert HBD to HIVE, the @hbdstabilizer works in both directions and it is buying or selling HBD on the internal market depending on the HBD peg at the moment. The bot is runed and operated by @smooth.

We have two scenarios/modes of the stabilizer operation.

- Selling HBD

- Buying HBD

HBD is paired on the internal market with HIVE so the trading is in the two native Hive currencies.

Selling HBD

If the price of HBD is above the dollar then the stabilizer is selling HBD to bring it back to $1.

When the stabilizer is selling HBD, it receives HBD from the DHF (DHF payments are in HBD only), sells it on the internal market for HIVE and sends back the HIVE to the DHF, where it is being instantly converted to HBD so it can be used from the DHF.

These instant conversions from HIVE to HBD in the DHF are a bit tricky since there is no virtual or any operation showing them, hence the exact price of conversions. @howo has already stated that he will be developing an operation that will show these conversions in the future.

Buying HBD

When HBD is below the peg then the stabilizer is buying HBD to bring the HBD value to $1. Since it receives HBD from the DHF, fist it is converting that HBD to HIVE, and then uses HIVE on the internal market to buy HBD. Buying HBD means selling HIVE.

From the description above we can conclude that the @hbdstabulizer is receiving funds in HBD only but it is returning funds in HBD and HIVE. When it sells HBD it is returning funds to the DHF in form of HIVE, and when it is buying HBD it is returning funds in form of HBD. To be able to compare the received vs returned funds we will need to convert the HIVE sent to the DHF in HBD.

The @hbdstabilizser started operating at the end of February 2021, and we will be looking at the data since then.

HBD Sold VS Bought

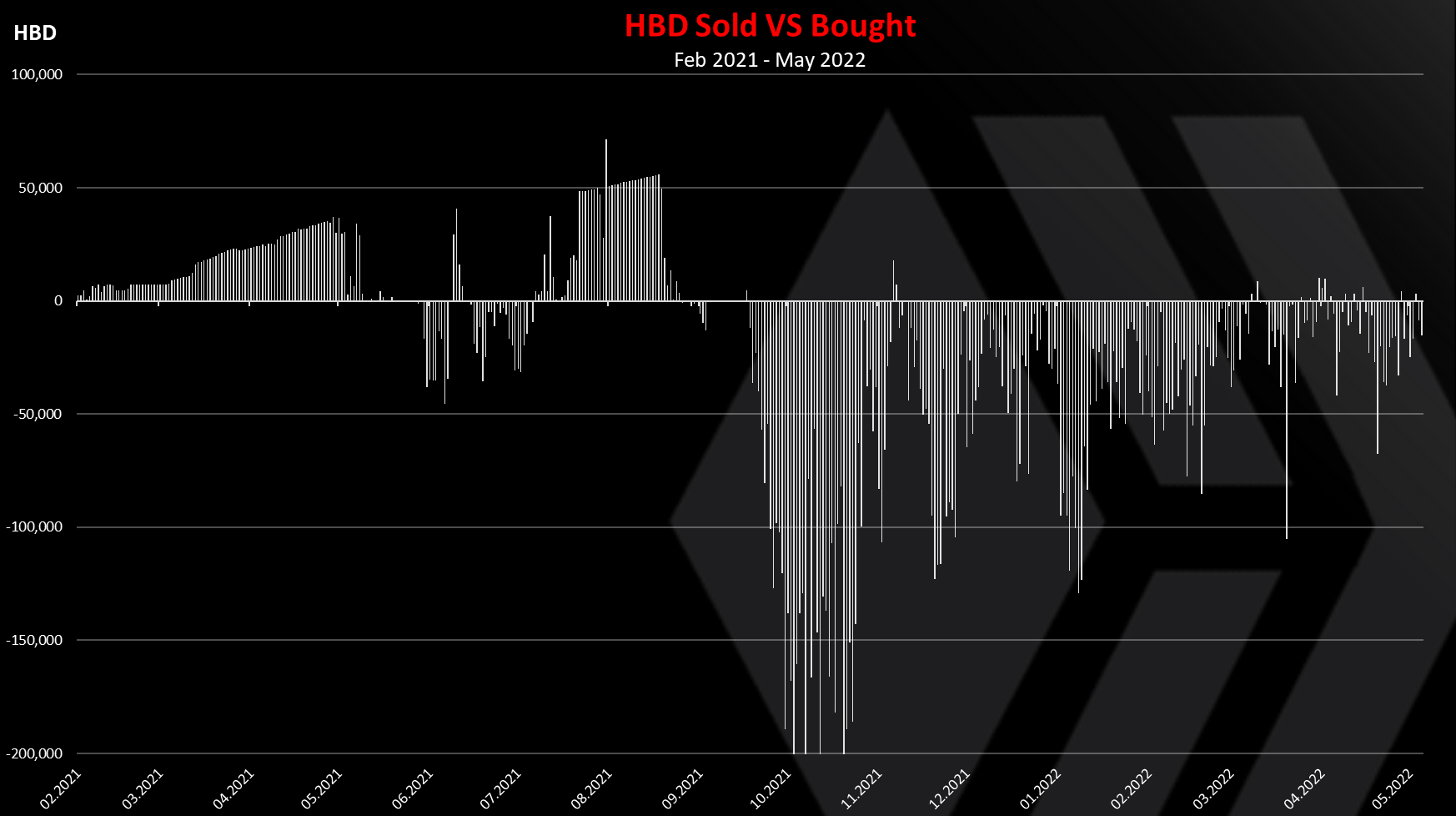

Now let’s take a look at the market activities and how much selling and buying the stabilizers has been doing.

Note that when the stabilizer is selling HBD it means HBD is above the peg, and when it is buying HBD is below the peg.

We can see that until August 2021 the numbers for the HBD sold mostly kept going up and reached 50k per day. The stabilizer had a small budget in that period and the market conditions allowed HBD to break the peg on the upside.

Because of this a lot of conversions from HIVE to HBD happened in September 2021, resulting in HBD expansion. Then in October the HBD price returned back to 1$ as the speculators stopped buying HBD, and then a lot of buying was made from the stabilizer.

Since October 2021, the stabilizer is buying more HBD then selling (supporting the price of HBD), although the amounts keep going down.

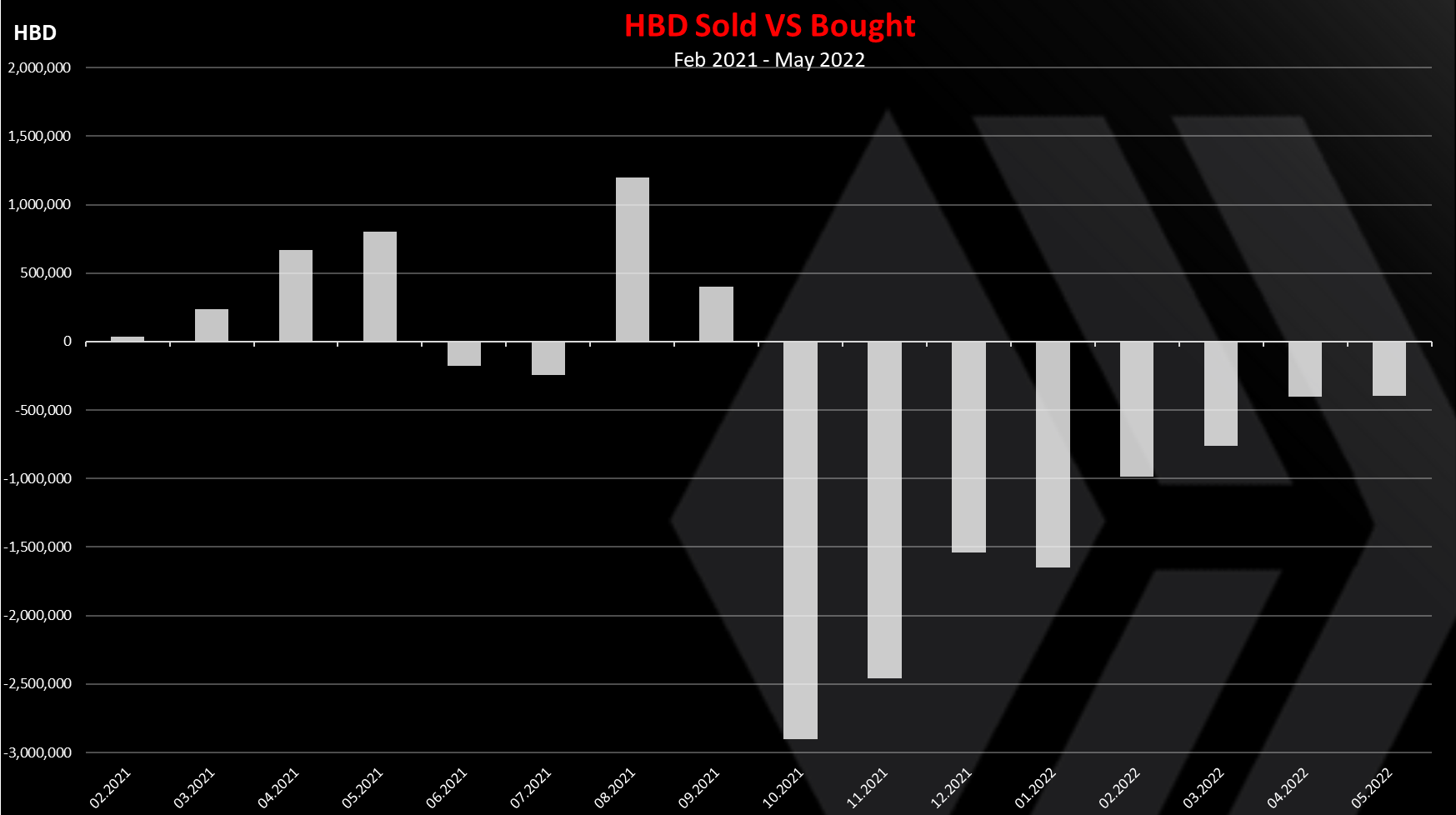

Here is the monthly chart.

We can see the trend from above here as well. Selling HBD at first in 2021, and a constant buying HBD since October 2021, giving HBD a support. In the last months there are around 400k HBD more bought then sold per month by the stabilizer. Back in October 2021 there was almost 3M net HBD bought by the stabilizer.

A total of 3.8M HBD was sold and 12M HBD was bought in a year and three months operation of the @hbdstabilizer. Note that a lot of these amount are circulated.

Funds Received

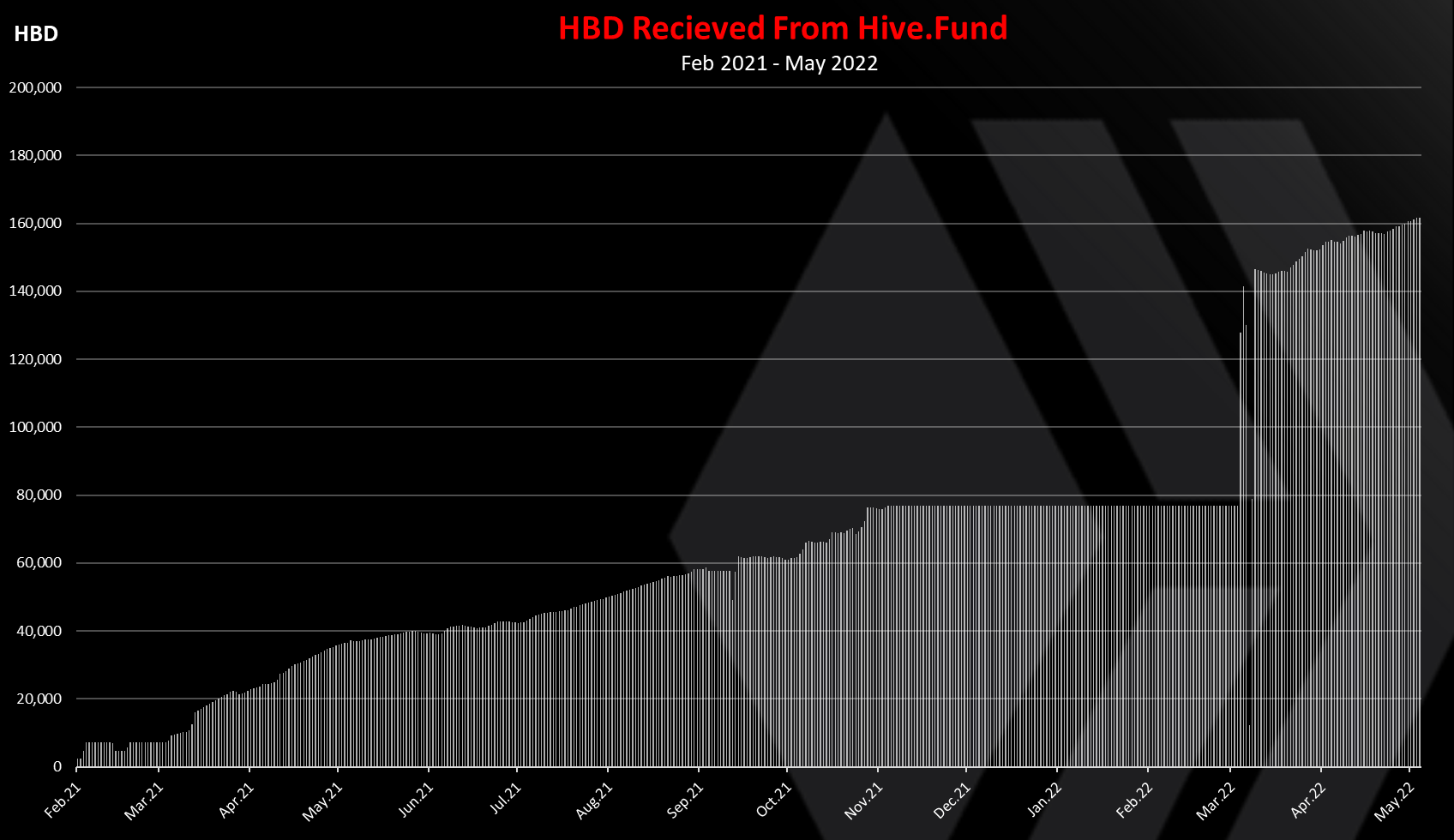

As already mentioned the DHF is paying funds only in HDB. Here is the chart for the HBD transferred to the stabilizers.

As mentioned, the @hbdstabilizer started receiving funds for the first time on February 20, 2021. At first it was only 2.3k per day. The thing is the DHF had a small amount of HBD back in February 2021 and could not transfer more funds. As the time progressed the funds in the DHF grew from 1M to more than 16M HBD now and the daily payouts increased.

The stabilizer now receives more than 160k HBD daily and growing. It is not using all these funds and a big sums is just sent back. Depending on the market condition it will use the funds as needed and provide liquidity in the direction that is needed at the moment.

Funds Sent To The Hive.Fund

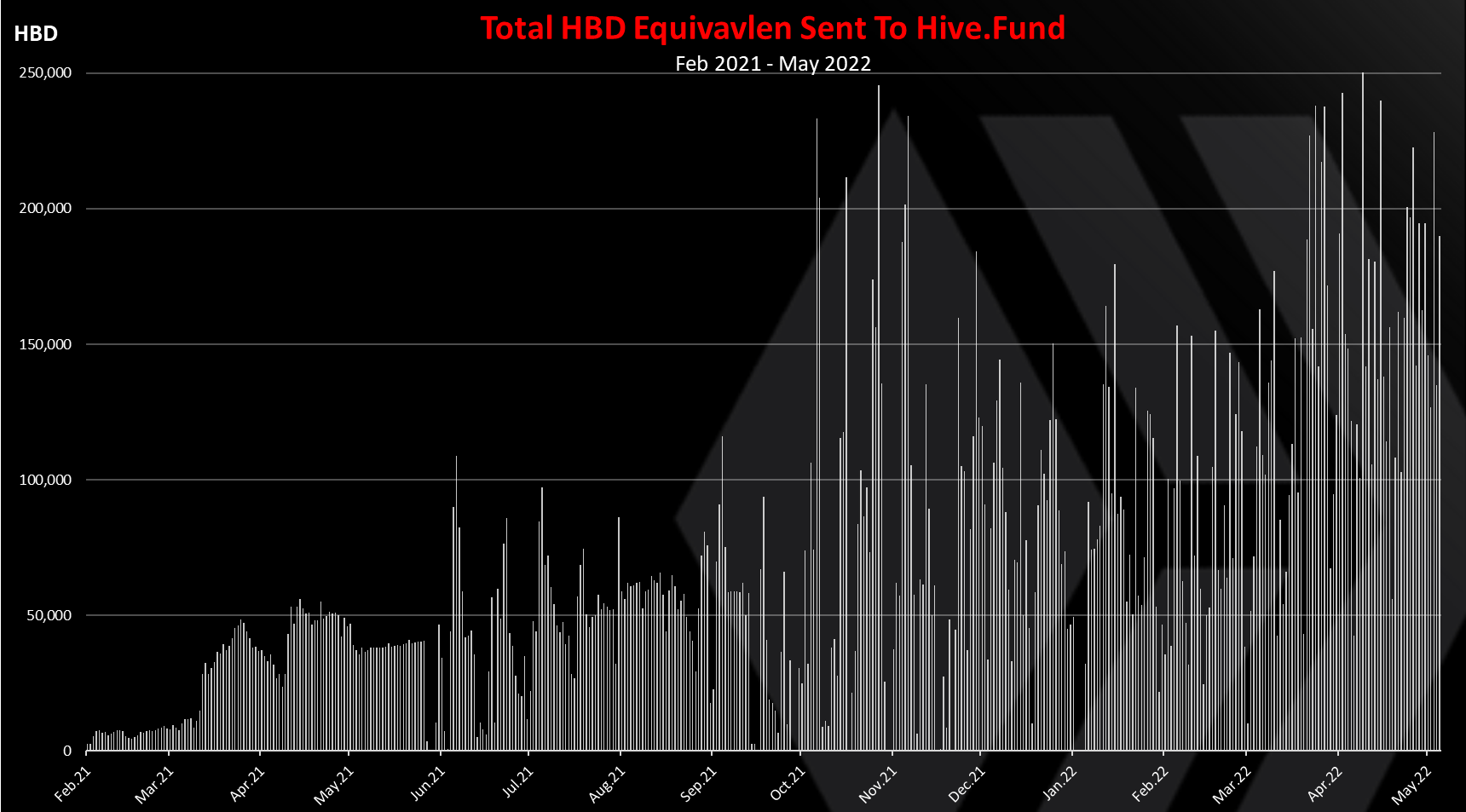

We have seen the funding of the @hbdstabilizer now let’s take a look at the funds that it has sent back to the fund.

Note that funds sent to the @hive.fund are in form of HIVE and HBD. I have converted the HIVE rewards to HBD, for easy representation and comparison. The numbers are approximate because of the conversions.

As mentioned the @hbdstabilizer sells HBD for HIVE on the internal market and then sent the HIVE to the @hive.fund where it is instantly converted to back to HBD. It is also buying HBD with HIVE when the price of HBD is bellow one dollar and sends that back the HBD as well.

On occasions there was more then 200k HBD sent to the DHF on a daily basis.

HBD Received VS Sent

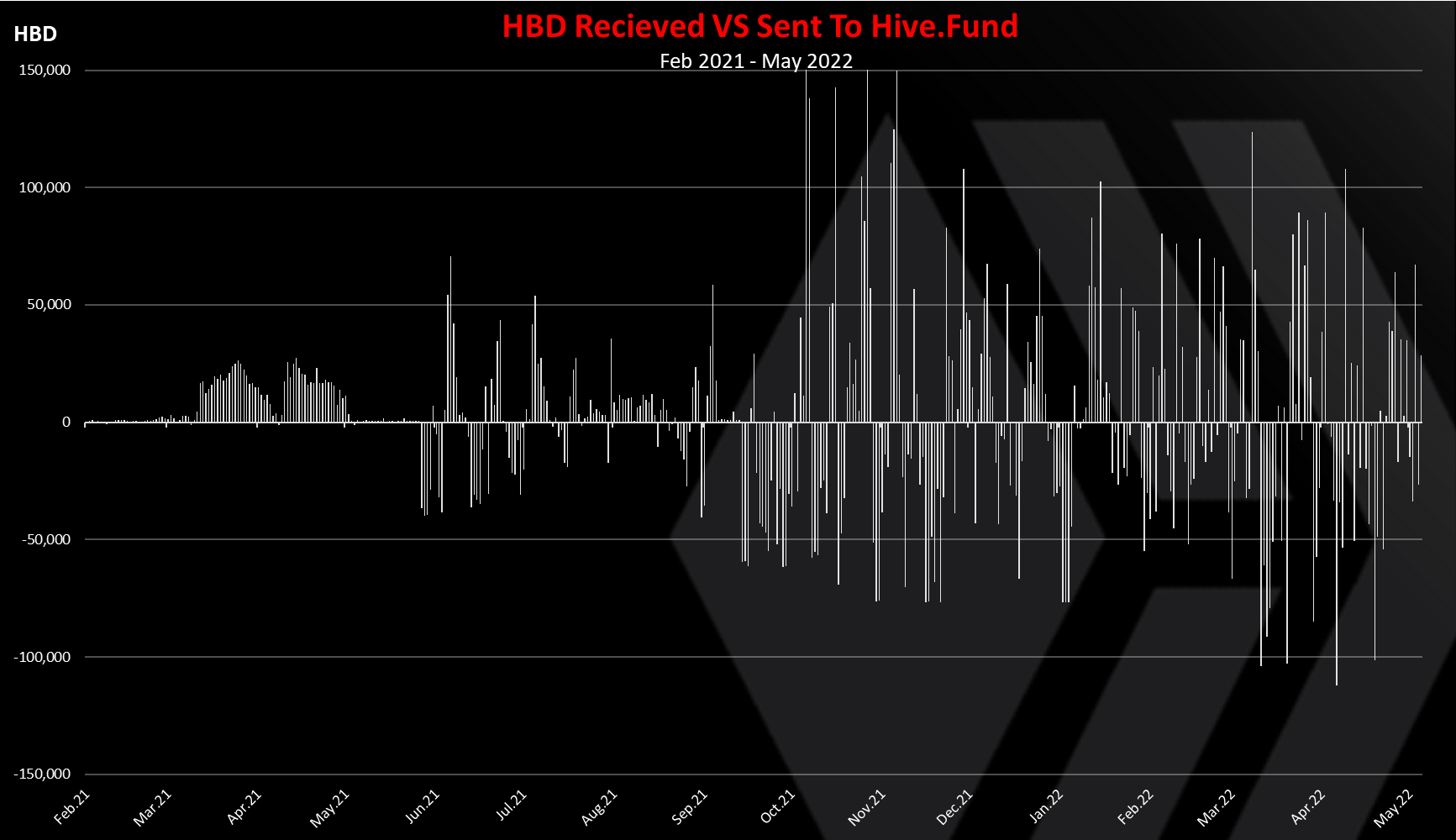

If we plot the amount of HBD received VS sent to the @hive.fund from the @hbdstabilizers we get this.

A positive bar means that the stabilizer has sent more funds to the DHF then received, a net profit, while a negative bar means that the stabilizer has received more funds then sent back, or a net loss.

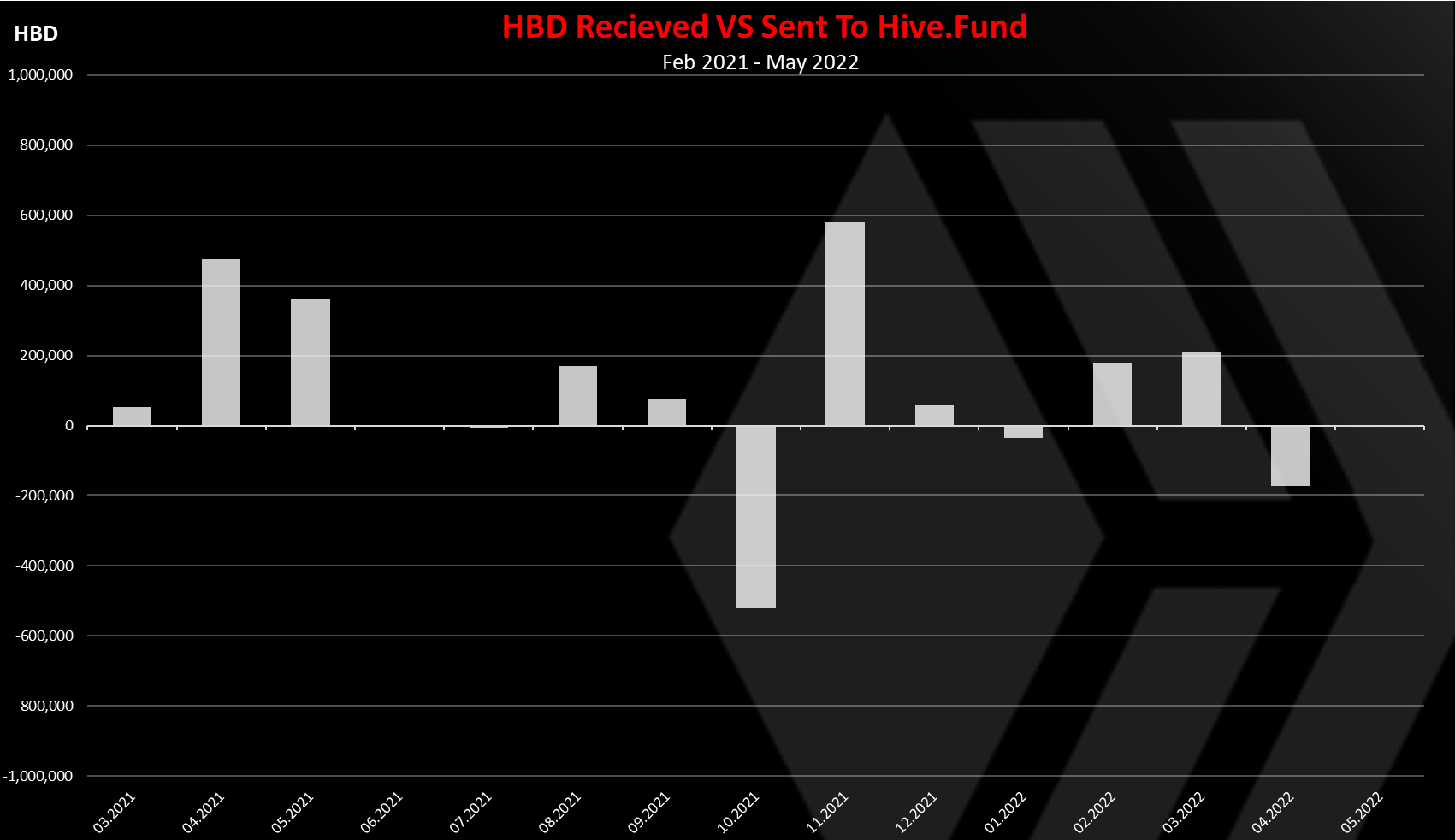

The monthly chart looks like this.

We can see that in most of the months of operations the stabilizer is in profit or neutral, with the exception of October 2021 and April 2022.

The hbdstabilizer profitability is a combination of the buying and selling it is making on the internal market and the conversions from HBD to HIVE.

As mentioned above the @hbdstabilizer is constantly making HBD to HIVE conversions in order to have HIVE and buy HBD if needed. The thing is these conversions take 3.5 days and have a market risk in them, and sometimes they can be market positive, while other times negative. Because the stabilizer is making a relative big amounts in conversions, those can add up.

November 2021 is a record month for the profit of the @hbdstabilizer. The HIVE price reached ATH high in that month and most likely this profit is coming from conversions.

In April 2022, the HIVE price went down, together with the overall crypto market, and we can see that the stabilizer is in negative, although in this month the 20% APR was introduced and there was demand for HBD and the stabilizer was selling HBD at a premium.

Overall, in the period of operation the stabilizer received a total of 29.7M HBD from the DHF and returned a 31.1M HBD, resulting in 1.4M profit.

A cumulative profit for the @hbdstabilizer of 1.4M HBD.

HBD Price

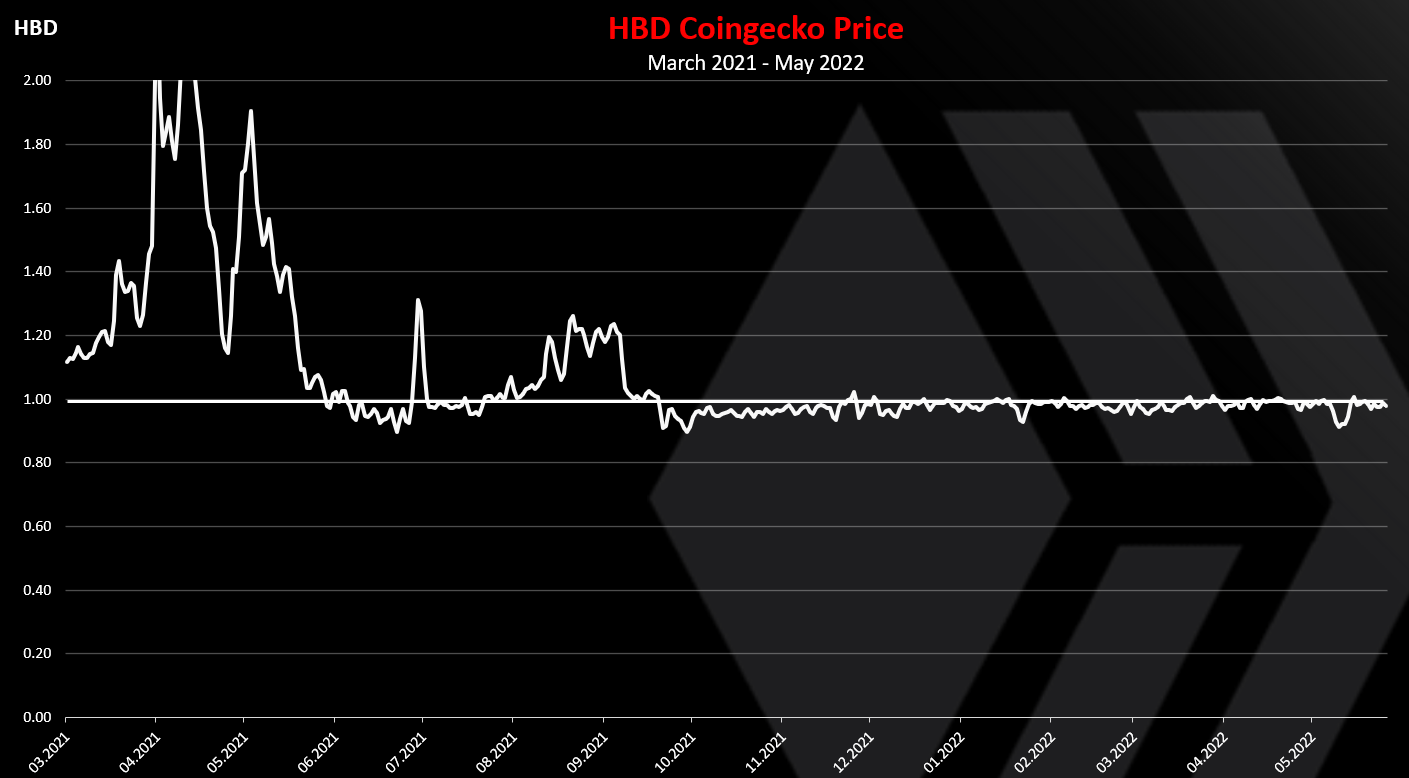

At the end the chart for the HBD price in the period.

Note that this price is mostly from Upbit, while the internal market and the pHBD on Polycub are not included. These pools have the dominant trading volume for HBD in the last months.

We can see that HBD was quite unstable in the first half of 2021 reaching price more then 2 USD. At that time the HIVE to HBD conversions were not possible, and the DHF funds were small. Since June 2021 the HBD has been more stable, with a spike up at the end of August to $1.2, but the conversions were live then and the DHF had more funds, so the peg was brought back quite fast.

Since September HBD is trading mostly in the range of 0.95 to $1. On the internal market and on Polycub the peg is holding better.

The net effect from the @hbdstabilizer still remains positive This profitability comes from the trading on the internal market but also from the HBD to HIVE conversions.

There was a lot more volatile in terms of positive and negative balance for the stabilizer in 2021, while 2022 has less oscillations.

The final goal is for the HBD to have a stable price, and that has been achieved with relative success in the last period.

The HBD concept is solid. It has a lot of elements now for it to work. It has an incentivized internal market where DHF funds are used through the @hbdstabilizer to maintain the peg. Any external markets and exchanges can use the internal market and arbitrage the price of HBD. The two-way conversions are also doing their job. HBD has a 20% interest now for the savings account, that is a competitive APR.

All the best

@dalz

Posted Using LeoFinance Beta

Seems that the implemented measures on HIVE are working pretty well, I'm happy to use the savings account to protect my capital

HBDStabilizer can only be so effective.

To truly protect your capital, we need to build out the utility of HBD. Providing resiliency to that coin is vital.

That is what will allow it to maintain its store of value.

Posted Using LeoFinance Beta

I agree.

I think DeFi is great to build liquidity, but real world utility would benefit the stables and overall market.

Todays market action makes me wonder if we are entering another bear market with Cub and Polycub both not recovering, and potentially going lower.

What do you think about Hive, Leo, Polyvub and Cub going lower?

Posted Using LeoFinance Beta

it would be interesting to see the total amount of HBD that was converted via the bridge thingy i.e. the amount of outside interest in HBD

You mean HBD on Polycub?

I only have a vague idea how HBD works on Polycub, in my mind you can buy HBD via the bridge and stake it in savings on Hive. I don't know if that it how it really works

You buy pHBD like you buy any other token on Polygon. So you take something like POLYCUB and swap it for pHBD.

Then you go to the bridge website, and put in your pHBD, which is sent to the bridge wallet, and you receive HBD (from their wallet) in your Hive wallet.

Then you can put it into savings.

Posted Using LeoFinance Beta

well I wasn't far of how it actually works then :) So my initial thought was: do we know how much HBD has entered the Hive ecosystem via the bridge as a sort of measurement of outside interest ?

I am not sure that can be construed. Someone could look at the transactions and see which went from pHBD to HBD by researching the data on the different chains.

But it is impossible to determine if that was someone from outside doing the swap or you/me. No way to tell without knowing the Polygon and Hive addys.

Posted Using LeoFinance Beta

Yes you can buy pHBD on Polycub, then bridge it to Hive

A great summary of what takes place. This is an excellent tutorial for how HBDStabilizer works along with what it has been doing.

The fact that it "generated" $1.2 million during that time period which went into the DHF is exceptional.

We need to fund more projects that actually pay back the DAO instead of keeping all the money.

Posted Using LeoFinance Beta

Its 1.4 acctualy :)

But yea, still profitable

i dont see a way how it could scale to be semi stable if MC increase 10x on avg.

Only if a on demand buffer transfer would be possible to balance out of a buffer pool ( every user can convert from it instant).

Ser ... what language are you speaking :D

Yup, the DHF works with HBD payments, so the funding will shrink compared to the power of the swings in case of a 10x bigger market cap HBD.

The big on-demand Buffer Pool should be a 3rd party application since the stabilizer is one anyway, people might be able to clone it and raise funding by themselves. It's just amazing to watch how little liquid HIVE is actually floating around and being actively traded. Unreal.

It is interesting to learn how the HBD stabilizer works, thank you for this :) And glad that HBD is doing well.

Posted Using LeoFinance Beta

It is very important that people understand the service that HBDStabilizer is offering the Hive community.

Obviously, we can see how it providing liquidity for the internal exchange. However, it is also a profit center that feeds into the DHF. This is actually having a bot that everyone on Hive effectively owns. The proceeds deepen the DHF.

Posted Using LeoFinance Beta

Yes, reading this post has enlightened me about how it works. I was amazed!

Posted Using LeoFinance Beta

The stabilizer is making good trading gains, impressive. Right now, it seems a bit overwhelmed :D

It is not overwhelmed at all.

You have to understand that the price shown on coingecko/coinmarketcap is not the "real" price, because they are ignoring the highest volume price source: the internal market.

If they correctly accounted for this, you would see that the peg is holding much tighter than they are currently reporting.

Instead they are incorrectly reporting the price on upbit, because by discounting the trading on the internal exchange, it appears to them to be the largest volume of trading. But upbitrestricts who can trade there (I think it's for Koreans only), so it is only to be expected that the price on upbit can stray from the overall market price. And if you can trade on both upbit and the internal market, you can make some small profits that way.

That is actually a big oversight error on my side. It's obvious to me why they do it, as a Coin Price website they want external data to echo. Might be interesting actually to try and get an Upbit account, since it's based as "Upbit Singapore Pte. Ltd." in Singapore and they have an English website as well.

At the swap pool on polygon pHBD/USDC is ~0.985c$ right now.

Btw. I'm shocked and honored that you answered my comment, the Hive OG Blocktrades.

The Polygon pool hasn't varied by more than a penny or so in the past 12 hours. That's pretty representative of reality, IMO, since anyone can trade against it with known liquidity at any time.

Pretty cool actually, those Pools are useful.

Can we somehow provide/build an api from the internal market for these aggregators to use?

I have a memory that some dev volunteered to do this, but can't remember who it was. My guess is they got busy with some other task.

We need to put a bounty on this :)

Is someone working on a public API for the HBD price history from the internal market?

I could do this.

Great work as always dalz.

Good to see the discussions pumping here in the comments section to!

Posted Using LeoFinance Beta

Tnx!

A lot of comments yes ... I guess it is an interesting topic :)

It is interesting to know this, HBD is doing well and more reason to put it in savings.

Where does the Decentralized Hive Fund liquidity or Treasury come from? Can users invest in that or does it have a token or how does that work? Or is there another way to invest in the HDBStabilizer?

Posted Using LeoFinance Beta

The DHF recive a share of the Hive inflation, plus it has old stake. The hbdstabilizer is adding more funds with its operation. The DHF is a dao account... it is not owned by anyone ... the only way funds get out of the dhf is when someone makes a proposal and the hive power stakehilders vote on that proposal to recieve funds.

Oh, ok, so the funds are controlled by the hive power stake holder votes on proposals? Is there a specific way the DHF receives a share of the Hive Inflation? How does that work?

Posted Using LeoFinance Beta

Every block some additional HIVE is converted to HBD and added, much like how the reward pool and HP staking rewards are funded. 10% of the inflation (around 8% per year currently) goes to DHF.

This is awesome, glad to see a project helping to keep the peg stable, though I do hope in the future it is no longer necessary due to the natural market increasing.

!PIZZA

I had the same thing in mind about the processes keep running behind the scene about HBD peg when I was reading an article by Edicted HBD Hysterics.

So these stabilizer task are done manually, it a very complex mechanism, but keep the peg stable is way too tricky, I know there needs to be lots of maths behinds it.

Well done bro.

Posted Using LeoFinance Beta

The tasks arent manual. It is automatic, all coded in.

HBDStabilizer is running 24/7.

Posted Using LeoFinance Beta

with a buffer mechanic ( that would be needed with scale) it could become more stable.

It would need a pool that works on demand.

like a 12h delay before sending back funds to DAO.

Hey @dalz, we need a detailed post from you on how HBD stabilizer works and why it is beneficial for the Hive Ecosystem.

I still don't understand it fully even after reading so many blogs about it.

Posted Using LeoFinance Beta

https://github.com/iamsmooth/hbdstabilizer/blob/main/hbdstabilizer.txt

Sorry Smooth!

I had a hard time comprehending plain text on how it works. Code will definitely not going to help a dumb person like me. 😂🙈 Thanks for sharing it though! Cheers.

Posted Using LeoFinance Beta

Probably one of the writers on the platform with some technical background could interpret it and provide a clear explanation if anyone is interested.

There might be some more details about how it works, but the general overview is here ... it recieve funds from the dhf on an hourly basis, checks what is the price of hbd on the internal market, makes buy or sell, and return the funds instantly ... next hour the same

It can also convert which takes 3.5 days, so not immediate.

Thanks for the info guys! So HBDStabilizer buys or sells depending upon the price of HBD. Under what condition(s) will it use the convert feature?

Posted Using LeoFinance Beta

If the price is below a dollar and it has received HBD, rather than sending it right back, it will convert it into HIVE. Depending on what happens 3.5 days later when the conversion finishes, it might be used to buy HBD, or that HIVE might just get sent back to DHF (which automatically converts it back to HBD). In the latter case it ends up being the same amount of HBD as before the conversion. In the former case it will depend on market conditions but should usually end up with more.

What are you not understanding? This post seemed to sum it up entirely.

Posted Using LeoFinance Beta

Yea I was hoping for that :)

Haha. I am sorry guys, was checking it on my phone and it didn't load properly. I thought some details were missing and that's why couldn't understand properly.

After reading this 2 times, I get it now :') At least most of it.

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 96000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

The rewards earned on this comment will go directly to the people(@taskmaster4450le) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This is really interesting and informative knowing more about the HBD. Keep up the good work.

This information is for last year.

I was hoping there would be some information on what's going on currently to bring HBD back to life🤔

No its up to date. .. May 2022...and hbd it at its peg

Ohhh Okay.. That's great.

I guess I missed that.

Thank you.

Pegging back needs a while obviously 🤔😁

(screenshot taken from the internal coingecko widget)

It is also interesting to see that the internal market has its own rules and works completely detached from what is happening at the exchanges. I love the thrill of sniping good deals there. 😀

The "deals" are on the relatively illiquid exchanges. For the most part, the price offered on the internal exchange is the "real" price, because it's backed with more liquidity. It's just that coingecko/coinmarketcap aren't tracking the internal exchange to know that.

I think there are some oddities in how they report too. If it is a HBD-BTC pair, the last trade was a while ago, and the price of BTC has since moved, I'm not sure they report that correctly (or if it is even clear what correct means in this case).

I don't have and don't want access to that exchanges. I'm totally fine with the Hive ecosystem and its internal market atm. Just looking out now and then for a few percent profit over a couple of days. Nothing breathtaking... 🙂

Congratulations @dalz! Your post has been a top performer on the Hive blockchain and you have been rewarded with the following badge:

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPPIZZA Holders sent $PIZZA tips in this post's comments:

@onewolfe(1/15) tipped @dalz (x1)

Join us in Discord!

.We see, with the HBD Stabilizer, how it is working to get HBD in people's hands.

Super nice to have some detailed analysis on this mechanism!

Posted using LeoFinance Mobile