The flppening! As its know in crypto, is when ETH surpases BTC in makretcap and take the first spot on the ranking lists.

Will this happen in the next bull run?

Ethereum has historically outperformed Bitcoin in the bull runs. It is also a smart contract chain so new products are built on top of it. This provides a possibility for innovation to happen, rather than just the basic function of a digital money.

Here we will be looking at the data for historical market cap for both Bitcoin and Ethereum. A ration between them and when was Ethereum the closest to flip Bitcoin. From there on we can have some idea is this flippening possible or not in the future.

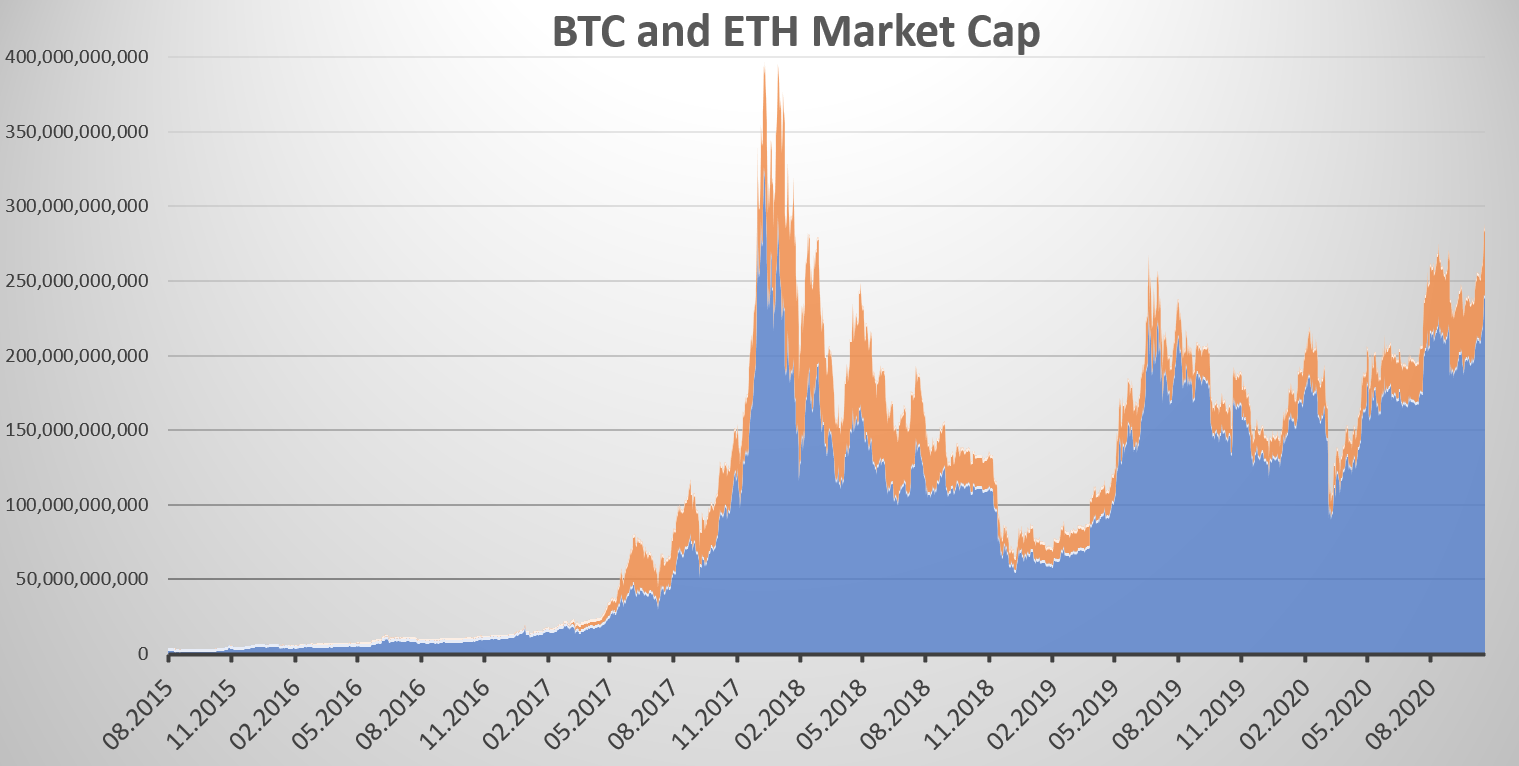

Bitcoin and Ethereum market cap

Fist lets take a look at the market cap of the top 2 coins.

This chart pretty much resembles the price chart. Although we can see the market cap and the axis.

The record high market cap for these two tokens happened at the end of 2017 and the begging at 2018. Combined this two had a market cap of $400 billion. Now days the market cap of both of them is around $250 billion.

At first from the chart above we can clearly notice that Bitcoin is dominating, and there is almost no chance Ethereum ever got close to it.

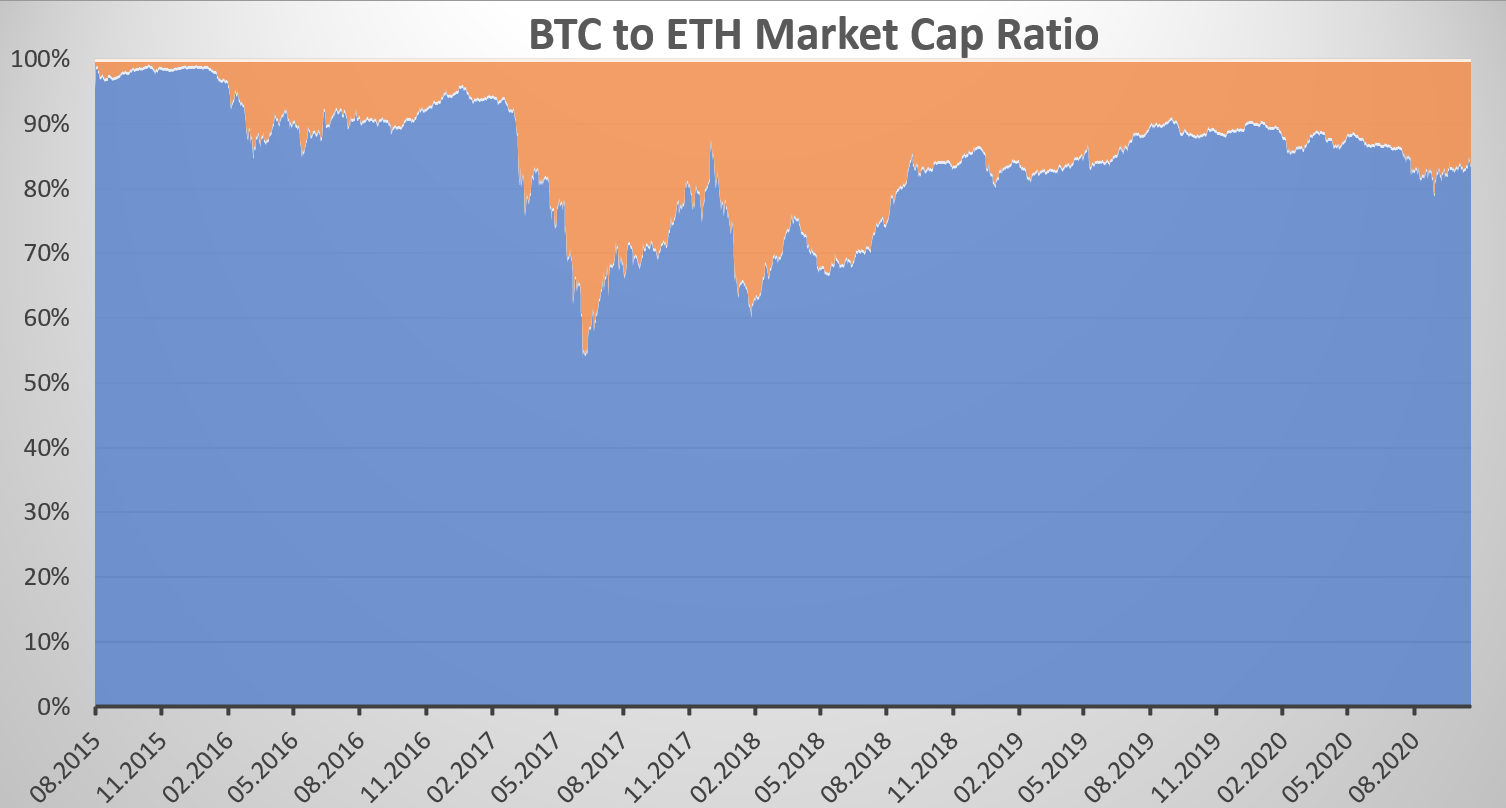

Let’s look at the ratio between the two.

This chart shows a bit different story.

We can see that on few short occasions Ethereum has come close to Bitcoin.

Starting from 2016, Ethereum is on average at around 16% from the combined market cap of the two. In 2020 up to this date the ratio is 13.7%. Lower than the average.

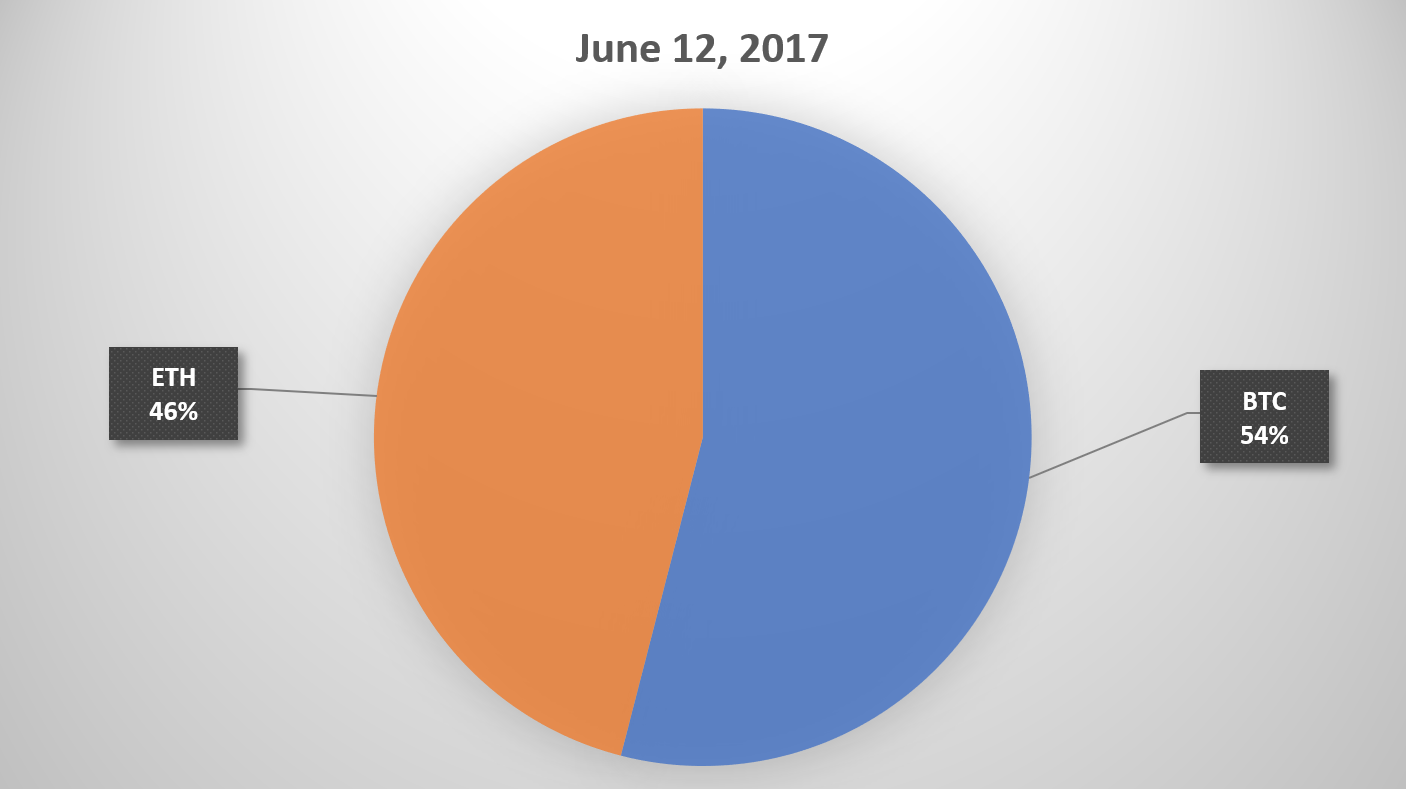

Ethereum came closest to Bitcoin on June 12, 2017

On this date Bitcoin had a market cap of 43 billion and Ethereum 37 billion. This is before the major bull run that happened late in 2017.

The chart for the share in market cap on this date looks like this.

The closest that Ethereum came to Bitcoin.

This is pretty close. A 43 to 37! A 6 billion more ant Ethereum would have flipped bitcoin. Looks like the flippening is not impossible 😊. A 54% to 46% ratio.

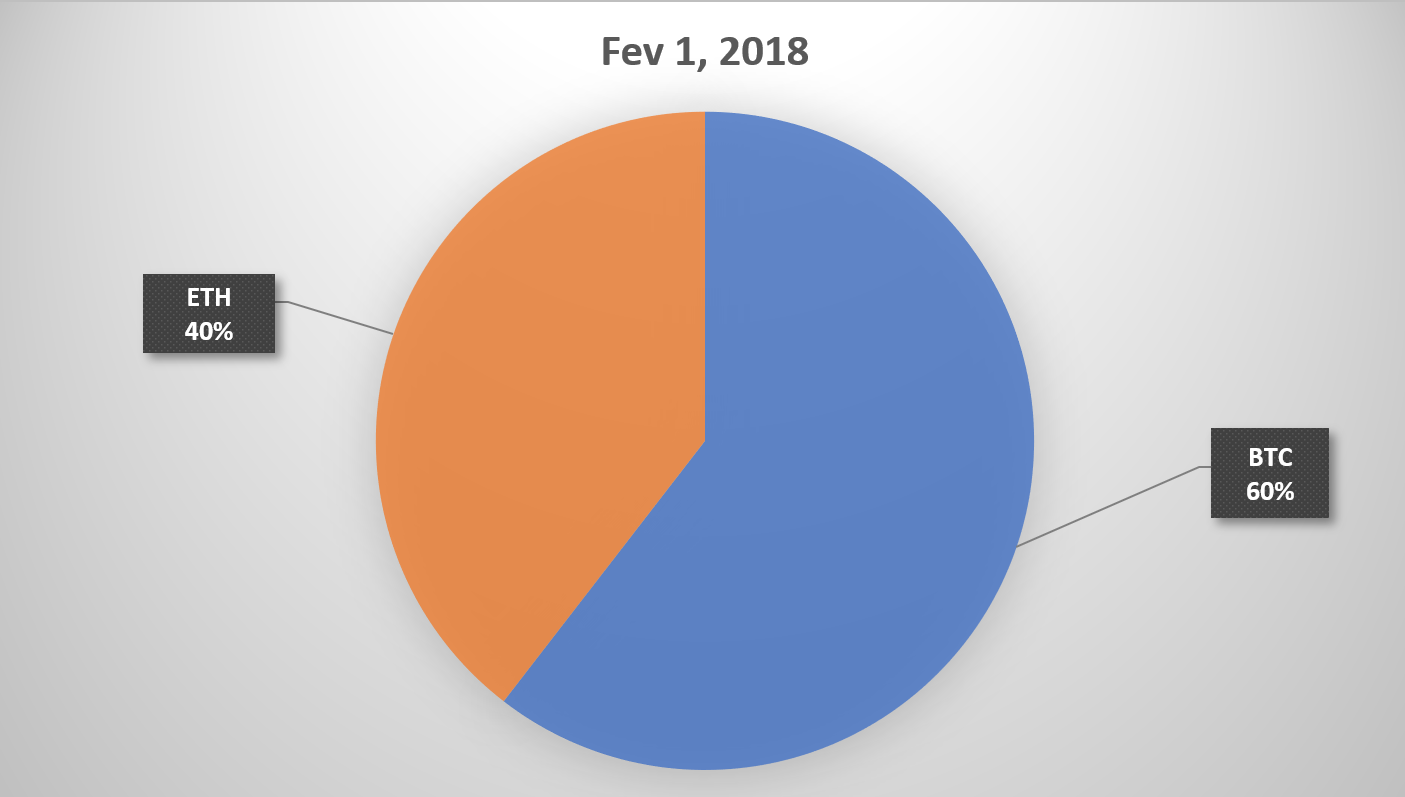

The second closest that Ethereum came to Bitcoin is February 1, 2018.

After the major bull run in December 2017 and January 2018, things started to go down in February. Just before the end of the bull run Ethereum came close to Bitcoin again.

The marketcaps were higher this time. Bitcoin at 154 billions and Ethereum to 100 billion. A 60% to 40% ratio in the cumulative marketcap of both.

After the bull run ended, Ethereum got hit harder than Bitcoin. Bitcoin consolidated its no.1 position.

Now in the last few months we can see that Ethereum has gained a bigger marketcap and its growing again.

It is important to note here that Ethereum has been around from 2015. The only bull run that Ethereum has went through is in 2017. Ethereum has not been there for the previous bull runs that come in crypto a year after Bitcoin halving.

The next bull run will be only a second one for Ethereum. Should be interesting to see what happens. As we have seen Ethereum came very close to Bitcoin in the previous one. A 54% to 46% ration. It only needs to go over that 50% 😊.

Personally, I would like to see both of this two perform well. Also, it looks like they are taking different roles in the industry. Bitcoin seems to become more of a digital gold and a corporation hedge. Ethereum on the other side is the place where development and innovation happen. New apps and use cases. More and more blockchains and projects are linking to Ethereum. There is a few that want to be a competitor to Ethereum, but till this day they are way behind. This said, competition is always a good thing!

All the best

@dalz

Posted Using LeoFinance Beta

Originally I was thinking it was pretty much impossible to do it this time around but in 2025 there'd be a really good chance. Now I'm not so sure. ETH already made it half way there. I won't be surprised if it happens or gets very close.

However, there is also the issue of where a lot of this value is coming from. The narrative for the next bull run is clearly Corporate Reserve Balance sheets. We may even see banks themselves starting to acquire Bitcoin. Given this narrative, it's pretty hard to imagine a scenario where ETH somehow overtakes that wave of "institutional" money that is essentially locked in to Bitcoin only.

This could also be interpreted as a bearish scenario. If ETH overtakes BTC that would imply many of the original Bitcoin bulls jumped ship to ETH, leaving all the BTC in the hands of corporations and other potential bad actors. I don't like the sound of that.

Flip flopping AGAIN... I think the market fundamentals are in ETH's favor in certain aspects. Bitcoin's #1 job is censorship resistance and immutable value storage. In essence, Bitcoin should perform very well when crypto is under extreme attack from outside forces. Ethereum should perform very well when crypto is not under attack and many people are more interested in development and progressing forward.

It's gonna be super interesting no matter what happens honestly.

Posted Using LeoFinance Beta

Yea Bitcoin function is simple and yet so valuable. A world reserve currency.

Having the potential to bring in "old" money in, and keeps its tron.

What is an interesting question is the following:

Can crypto create value from within? How much "old" money do it needs?

Can you imagine new value being created within that dwarf todays giant like Amazon, Google, Facebook etc. This is the case for Ethereum (or more of them) and even Hive.

Innovation that dwarf the current system.

I still think Hive is a great and unique innovation. We just need to push the right buttons somehow.

Posted Using LeoFinance Beta

Creating new money from within will likely be the narrative of the potential bull run in 2025. The key is being to able earn crypto via job listings, while at the same time bolstering network value with said work (rather than lining the bigwigs pockets). Easier said than done. I'd say we're four or five years away from that at least.

Everyone can say what they want.

I am Bitcoin maximalist.

Period.

And I'll remain so.

Posted Using LeoFinance Beta

But a special kind :)

With a lot of other coins in the bag.

Posted Using LeoFinance Beta

Well noted.

Those bags keep inflating during years

If You could see my Masternode's corner.... 😃

That's what happens once you become crypto addicted.

Posted Using LeoFinance Beta

They're both going to rally during the next bull run, but I'm not convinced a flipping is on the cards.

As Bitcoin is more of a store of value, it can get away with being inefficient tech. But as a decentralised platform for dApps, Ethereum needs to be fast and scalable for people to truly be able to use it.

Which as we have experienced first hand here with wLEO, it most certainly is not.

Posted Using LeoFinance Beta

ETH has updates coming that should make it faster and more scalable.

This being said, this updates are taking a lot of time to implement. I think they are already postponed two years.

Almost like SMTs on HIVE :)

Nice analysis of the different roles - I feel happier with the majority of my crypto in BTC, which it now is in $ terms thanks to a certain shitcoin you may have heard of called Hive absolutely tanking in value.

I've got a bit less in ETH, but I'm looking to accumulate some more - handily enough there's a certain platform that now lets you claim your LEO rewards in ETH!

I get the feeling ETH is going to pump hard with the next rise, so the flippening could well happen, especially when ETH 2.0 finally arrives, atm ETH is a freaking joke - I get tense every time I make a transaction not knowing whether it's going to take 3 minutes or 30 days.

Still, as you say, innovation, that's the key to it rising in value!

You've got a typo in the first sentence btw.

Posted Using LeoFinance Beta

Funny enough I feel Hive is more secure than ETH.

ETH without a hard wallet is crazy. All you ETH (liquid) in a metamask waiting for the right guy to come around.

These days ETH is with smaller fees. Also if you set the fast route (or in adjust the gwei higher), transactions will go immediately.

ETH set the trend with ICOs in 2017 and now is setting another one with DeFi.

All the other chains are following.

Funny enough Hive with its social blockchain in my opinion is still one of the most unique and innovative blockchains. We just need to strike the right chord somehow.

Posted Using LeoFinance Beta

'ETH' waiting to be stolen! Fair point!

I know what you mean about Hive, I'm not so much gutted about my stake, just not having waited until now to buy it!

One can't predict these things though!

Striking the right chord is a tough one! Even at these prices I still think it's worth writing and earning!

Posted Using LeoFinance Beta

I rebuke your claim. I see Hive as a basic blogging chain only. Definitely not social if communications are on discord. That's a major flaw and one that people don't realise is a major reason why normies DON'T switch and migrate from their 'i-got-all-that-i-need' mainstream networks.

By design this chain limits content which MUST BE original (flaw). By design again this chain is moving towards CURATOR rewards over creator rewards (flaw against attracting creators and flaw against retaining attention).

This chain/those in control are happy to slow burn rather than really put in the work to develop a robust product. One that can 'out-of-the-box' satisfy social users (mass) and business entities (money).

The "strike the right chord"?:

Finish the product (somehow).

The rest is network effect.

Very interesting post! I wonder how the wBTC amount is calculated into that? As far as i understood these are existing BTC frozen in an ETH contract and turned into wBTC on the ETH chain. So these BTC are out of circulation as long as the corresponding wBTC are existing, but the coins will not be substracted from the circulating BTC I suppose. Otherwise, the wBTC and the amount of money they resemble will not be added to ETH, but actually existing on the ETH blockchain. The quesiton is therefore, if from a valuation perspective ETH has already outnumbered BTC by bounding it through wBTC to the ETH chain - or is this just a wrong view of mine?

Posted Using LeoFinance Beta

I own enough of both so when this happens I'll be more worried about which vacation house to purchase.

Ether is more useful than BTC, but then again a pencil is more useful than a bar of gold.

What kind of bitcoin skeptic are you?

ETH is not a pencil :)

Not a very good one, but in hindsight, that's worked out well.

Glad I told myself this earlier in the year (maybe it was last year?) when it dipped under 100$.

Tweet:

Posted Using LeoFinance Beta

I doubt ETH will ever flip BTC. I know that Ethereum has way more use cases than BTC ever had, but in the mind of investors BTC is and will probably ever be the no.1 crypto. Most of the news about large investors entering crypto are about them purchasing BTC not ETH. It's definitely not impossible, but my take is that BTC will for sure remain no.1 for many years.

I know that almost everyone think BTC will remain the king. The probability for this is big. But I would like the keep an open mind and not exclude the possibility for flippening. Also I like to think in probabilities not deterministic. So thought is BTC will most likely stay at top but ETH might take the lead on short occasions.

Posted Using LeoFinance Beta

Bitcoin is the gold of cryptocurrency and unfortunately even if Ethereum brings more value and use cases in the world, I am afraid that will never happen. Some people are just betting on a symbol and its scarcity instead of its utility.

Posted Using LeoFinance Beta

Some like the comparison gold to copper. Copper has a lot more use cases, but still gold is the no.1 :)

Posted Using LeoFinance Beta

To me the #1 question remains open:

what is the ETH's total outstanding supply ?

Posted Using LeoFinance Beta

The current one around 113M :)

About the total one, from what I have read it was imagined a fixed supply of coins to be issued yearly. So in terms of percent% it should go down every year. The last few years, somewhere around 5 to 6M ETH has been issued on a yearly basis.

Posted Using LeoFinance Beta

very interesting post as reflections on the two coins, I think if there will ever be a flip between btc and eth, there could be when eth2.0 is launched ??

Posted Using LeoFinance Beta

Thanks!

Not sure will it happen just because eth 2.0 , but lets see how it goes.

Eth win with smart contract features so that demand of eth seem stable. Recently, new defi projects are on eth network that triggers the rise of eth marketcap.

Posted Using LeoFinance Beta