Be like water, friend.

Much like Bruce Lee's fighting styles, money too also flows like water. It's called liquidity for a very good reason, for when we think of money like water and all the metaphors and analogies that go along with it, we can much better understand the true scope of money.

Humans like to simplify things down so they are more easily understood. However, this makes oversimplification a huge problem. People think "money go brrrr" and they have the FEDeral reserve all figured out. Yeah, that's not how it works.

How does it work?!

Well, first of all: nobody knows how it works. This is what we must all admit to ourselves. How many times have you heard a professional economist blabbering on about something that's never going to happen? We must accept that the economy has game-theory (pure & predictable), and the economy always deviates from that theory in practice (complete chaos) for some reason or another.

Reverse engineering chaos is extremely difficult.

Economies are so complicated no one can fully understand them. There are way too many variables involved. Just like 10 doctors could come up with 10 different diagnoses to the symptoms, so too could 10 economists comes to 10 differing opinions on the symptoms of the economy and how they came about. Scaled up macro-economics are just as complicated as the human body itself. Just think about how little we know about the brain and even genetics itself. The same is true for the economy: there are many stones that go left unturned simply because they are too far off the path.

I actually learned a lot of what I know of the FED from @taskmaster4450's posts.

And now I've come to the understanding that no, money does not go 'brrrr'. When the FED 'prints money' that money doesn't just magically appear in people's bank accounts (not even rich and powerful people). When we actually do a deep dive on central banking there are so many weeds to navigate it's mindblowing. Rather than do any of the work everyone just says "yeah yeah yeah money go brrrr I got it I got it."

Yeah, you don't got it though.

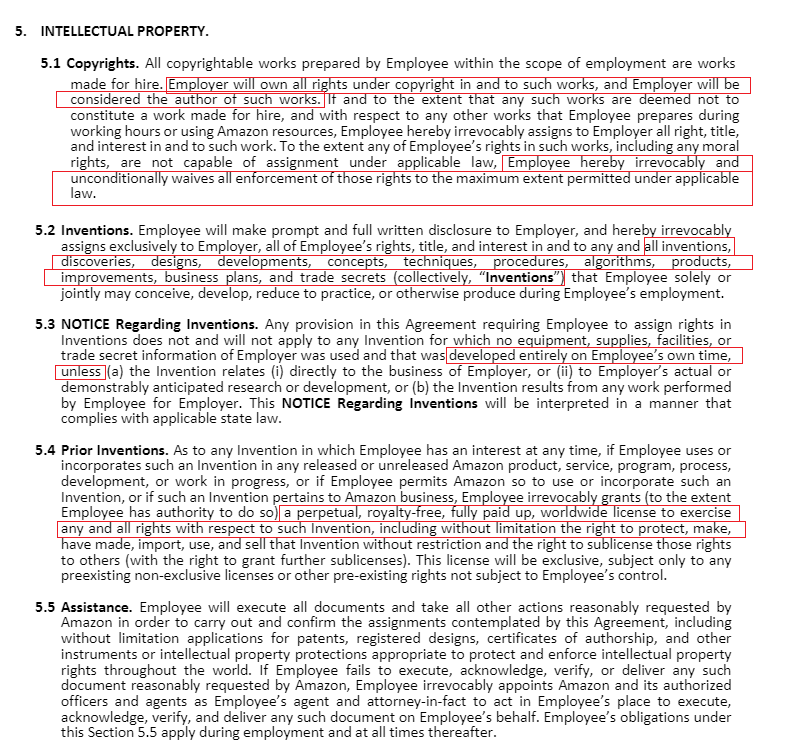

Because the only way for money to actually enter the economy is if a second-tier consumer bank will loan it to you or someone else. The money that the FED prints is loaned to the banks with interest, and in turn those banks will loan that money (in theory) to us with an even worse interest rate. Therefore, we can think of this system as a pyramid scheme of debt-slavery. At the top of the pyramid are the central banks (or rather the people that control the central banks), then comes commercial/consumer/retail bank that then loans money to the bottom tier: you. And even this explanation is grossly oversimplified.

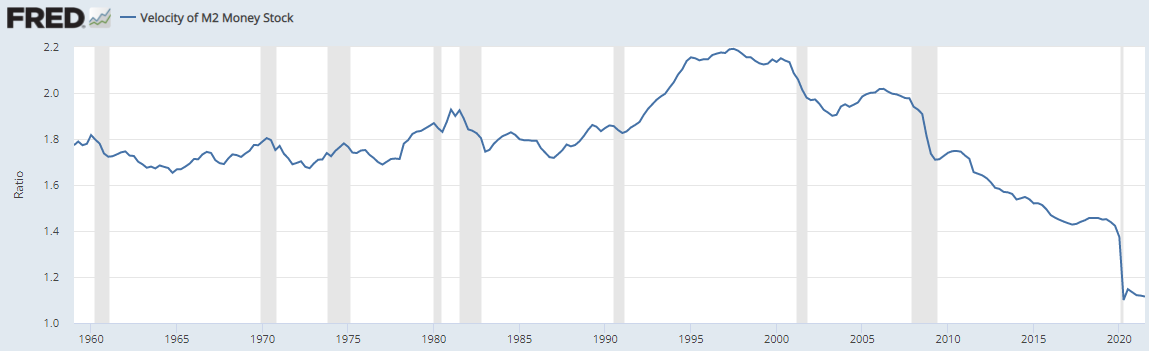

So what happens when the FED prints money and lowers interest rates, but the retail banks still refuse to give out loans because it's too risky? Well, I mean... looking at the velocity of money, that's exactly what's happening right now, so you tell me. The economy is not doing good right now.

At the end of the day in a system of capitalism everyone is expected to act in their own best interest. If it is not in the best interest of a bank to loan out money, then they aren't going to do it. They don't care that if collectively this tanks the economy. This is not a collective: this is a system fueled by greed and debt. As bad as that may sound this was actually the 100% absolute best way to scale up this economy as big as we have so far: imperialism and slavery. However, times are changing and the old way of doing things is facing headwinds of massive diminishing returns. We live in the age of exponents.

You don't know what inflation is!

Another subject that @taskmaster4450 harps on CONSTANTLY, but nobody listens (I'm slowly getting there). When the prices of goods and services goes up, people call it inflation. In reality, the vast majority of the time, what is happening is not inflation, but nobody gives a shit. When the purchasing power of the dollar goes down everyone will blindly call that inflation and there's nothing that can really be done to speak sense into the mob. They don't give a shit: gas is too expensive; let's go Brandon!

The honest truth is that actual inflation is subtle and can not be detected so easily as everyone likes to pretend (unless it devolves into hyperinflation, which is basically impossible for USD at the moment). It happens gradually over time. The live frog boils slowly and never notices the temperature change.

The actual reality of this topic is that inflation can't be happening, because retail banks aren't actually printing any money and loaning it out to people more than they were before. The money supply is not increasing. It doesn't matter that the FED is buying up liabilities and filling up the bank's vaults, because those vaults are not being opened to the public.

This truly is a weird clusterfuck of a system that makes very little sense. The SWIFT banking network was invented in the 70's and upgrades too it have been far and few between. These are technological dinosaurs that captured the world and never gave it back and never had to compete: all they do is stomp out the competition and secure their own legacies for as long as possible.

So if no money is being released into the wild, why are prices going up?

There are so many variables at play here. The core concept of "inflation" is that prices went up because money supply went up. That's provably not happening right now. Therefore, we must look at other factors at play.

The most egregious example:

When the cost of lumber went x3 everyone called that inflation, and the FED, rather than try to argue with the idiotic mob, said "this inflation is transitory", which was simultaneously was the truth and also misinformation all at once (half lies are the establishment's best friend). If lumber had really gone up due to inflation, everything would have gone up x3 in price, and it would have stayed that way forever and the economy would have almost certainly collapsed. That isn't what happened, is it?

The simple fact of the matter was that there was no inflation at play here at all. Prices of lumber went up because supply of lumber plummeted from the supply shock logistics of COVID. Again: nobody gives a shit. Number went up; must be inflation. I'm smart. I understand economy now.

Like... no.

Prices aren't going up because money is flooding the economy. If money was flooding the economy the velocity of money would be off the fucking chain. Instead we see constant lows.

Gee boss I dun know looks like inflation to me because the price of milk went up.

LoL c'mon, give me a break. Ask yourself truly: how is it possible that money is flooding the economy, which lowers the purchasing power of the dollar, but at the same time no one is actually spending the money? Correct: it's not possible. The thing you are calling inflation is not actually inflation. Perhaps this is a simple misunderstanding as to the definition of inflation, or perhaps the entire notion of inflation is rooted in shear ignorance. I opt for the latter.

This caveman approach to the economy is not a smart one. Crying wolf every time prices go up and calling it inflation is a gross misrepresentation of what is actually going down. Has anyone stopped to consider that USD can lose value WITHOUT printing money? What a novel concept. No, nobody thinks like that because they are brainwashed into believing that fiat has magical powers that stop it from losing value unless you print more. We tell ourselves these fairy tales because again, adding that extra variable to the equation makes it exponentially more difficult to solve.

Has anyone stopped to consider that USD can appear to lose value as resources become more scarce? Again, no. Must be inflation's fault. Let's go Brandon. Has anyone stopped to consider that the abundance that technology creates actually makes it appear like USD is gaining value? If you took your phone back in time 30 years the CIA would literally murder you instantly for it. Why? Because your phone would be worth more than a small country.

Have you seen how cheap eggs are? I can buy a dozen for $1.50. Guess what? I used to own 5 chickens, and I did the math and each egg was costing me x4 at 50 cents (I fed them a lot they were greedy little fatties). Did the power of my dollar get stronger? No, the resources required to make products is going down. The deflationary headwinds caused by technology are messing with the economy something fierce. This is yet another thing that @taskmaster4450 speaks on constantly but again, no one seems to understand the full gravity of the situation.

Supply, meet demand.

Almost everyone who says the word "inflation" doesn't know what they are talking about.

"Inflation" only refers to the supply of money going up.

It ignores the demand of money going down.

It ignores supply shock of goods and services.

It ignores supply abundance of goods and services.

Therefore it becomes clear that people who think "money go brrr" are only looking at 25% of the picture... and more like 10% or less because I'm also greatly oversimplifying what's happening here, especially considering that "money go brrr" people don't realize that the FED doesn't print money that goes into citizen's pockets.

How can the "demand for money" go down...?

Sounds weird, doesn't it? Demand for money can't go down! Everyone wants money, right? Oh, but how quickly we forget what money is. Because the way that we personally get money is completely disconnected from the system (which is worth further exploration).

So how do we get money? Vampiric time-slavery. Wow! What a mindfuck. So we go to our job and the employer pays us money without actually giving us ownership of any of the things we do. The company owns everything, and in turn they own us.

Under this system that we all know and love, we go to our job, and the job pays us money. The funny thing about all of this is that we own that money. In effect, we own the national debt. We work in exchange for debt that is owned back to the federal reserve. What the actual fuck?!?

So the next time someone expresses concern over the national debt: be sure to remind them that there is no problem with the debt going up. Why? Because the citizens of the country are the collateral. The government isn't in trouble when the debt goes up. Because guess who's footing the bill? Everyone holding USD. If you hold USD you are holding the bag of debt, so only the people holding USD need to be worried about the national debt, and let's be honest: your friend is probably poor and barely has any money in the bank so it probably doesn't matter.

DOES... NOT... MATTER!

Like, at all. Think about the macro scale of this insane situation we find ourselves in. The national debt is going up, and that's bad! That's terrible! LOL! WHY?! ALL THE MONEY IS OWED BACK TO THE FEDERAL RESERVE BY DESIGN! The federal reserve created an unsustainable model on purpose just to keep everyone enslaved to their debt.

So what happens when banks can't pay back the loans they took from the FED? Literally whatever the FED wants: happens. Because they fucking own us... man the more I think about this the more hilarious it is that people are worried about all the wrong things. Welcome to the children's table of politics.

Okay so let's assume that the national debt, is a problem. That means we must also assume that the Federal Reserve is going to go bankrupt if we don't pay them back. Immediately the entire logic of this situation falls to into tatters. If the banks default on their loans and the corporations default on all their loans and the people default on all their loans... what happens?

I'll tell you what happens.

The FED bails out the banks and the corporations and lets the people eat shit. Once again, we see that the national debt is not a concern of governments, the FED, or corporations, just as long as the FED decides you are "too big to fail". Crony capitalism at its finest. The citizens themselves are the cattle within this system. Always have been since the advent of central banking.

Spoiler alert: the FED can't go bankrupt.

This is one of the few concepts that "money go brrr" people do fully understand. The FED can't go bankrupt, because literally all the USD in the world (and more with interest) is owed back to them. Therefore, when shit hits the fan economically, the FED simply prints out money and bails out the most powerful organizations to make sure the system stays up and running.

Why do they do this? Because if the system collapses they might own everything on paper, but what good is owning an empire of dirt? Much like crypto prints value out of thin air, so to is it a smart idea for the FED to print value out of thin air and allocate it to the places that serve their bests interests. The People of this country need not apply (unless not helping the people will collapse the entire system).

What many intellectuals and theory-crafters fail to understand is that if the economy collapses, EVERYONE LOSES. Everyone. The people, the corporations, the government, the FED: everyone. It is the FED's job to keep this party rolling, and the last thing they are gonna do is actually give people money directly: because that actually would increase the money supply and create dreaded inflation. It's best to keep the people as poor and in debt as possible so they have to constantly struggle just to maintain the status quo. Busy citizens don't have time to revolt. As long as they can afford Netflix: they good. Entertainment and political division are key factors in distracting the masses.

Gold standard?

If we were still on the gold standard they absolutely could go bankrupt, because you can't print gold, can you? Many seem to think we should return to the gold standard: this is also a huge mistake. The gold standard sucked ass. Gold is a terrible and archaic form of currency and no successful economy will ever use it ever again to act as the role of money.

As bad as central banking seems like it is, it is still superior to the gold standard in pretty much every way. Being able to print out money on demand is an epic tool that has prevented many a Great Depression. Anyone who knows anything about economic history knows that the Great Depression was not caused by inflation, but rather by a deflationary supercycle. Using precious metals as currency creates these deflationary supercycles and can decimate an economy for an entire decade.

So while inflation is annoying: deflation is absolutely deadly. The key to a healthy economy is generating heavy inflation and allocating it to all the right places in order to counter-balances all the deflationary money sinks that exist in an economy.

This is why I constantly talk about how hyperinflation is the future of crypto.

Because the FED is a crumbling institution with very few tools in the toolkit. How does the FED allocate inflation? By issuing debt to retail banks and manipulating interest rates. That is such an archaic and dumb way to do things, but it made a lot more sense 100 years ago before the Internet.

The FED can only allocate capital to retail banks, and this is the crux of their ultimate failure. CBDC may actually help them quite a bit in this context, as they could not only allocate inflation where ever they wanted, but also track all the data and figure out what works best (in addition to selling the data to Big Tech and where ever else).

However, not only is cryptocurrency not debt, but it also has infinitely more maneuverability in its ability to generate and allocate capital in any way it sees fit programmatically. Even more importantly, this entire process is permissionless and does not require bureaucratic consent. These emergent communities can just do whatever they want instantly and boom: it's done. This is something that the legacy economy will never be able to achieve.

Grossly off-topic.

Well, I was supposed to be talking about supply and demand that whole time but fell down the rabbit hole. What was the original question again? Ah yes:

- "Inflation" only refers to the supply of money going up.

- It ignores the demand of money going down.

- It ignores supply shock of goods and services.

- It ignores supply abundance of goods and services.

- It ignores the demand of goods and services going up or down.

How can demand for money go down?

Again, normal citizens do not understand this concept, because normal citizens are the slaves of corporate vampires. We get our money in exchange for time, and then we receive that money with "no strings attached". Once the money is transferred to us we "own" it. In affect, we own the national debt. In the same way that the FED is owed all the money back at interest, when we hold USD in our wallet we now hold that same debt in our pocket, and that value is owed back to us.

So how does that work?

Well, think about it. You hold USD physically in a wallet or digitally in a bank. But all money is owed back to the FED at interest. However, before it goes to the FED it is actually owed back to retail banks, adding an extra degree of separation. Therefore the USD in your pocket has demand. Anyone who took out a loan needs your USD to pay back the loan.

Are we realizing how fucking insane this system is yet?

So not only does Average Joe with a home/car loan need your USD to pay back their loan, but also the bank that gave Average Joe the loan in the first place needs your USD to pay back their loan to the FED. The problem? LOL, the interest charged on all of these loans DOESN'T FUCKING EXIST. All the interest that the FED charged the retail banks: doesn't exist. All the interest that the retail banks charged Average Joe? You guessed it: DOES NOT EXIST.

So guess where that money comes from to pay off the old interest? Ah I bet you guessed right! You literally have to take out another new loan somewhere along the chain with even more debt just to pay back the old interest! Haha! What a joke!

So the FED gives the bank another loan, and the retail bank gives Average Jill another loan for another car/house. Then the money that Average Jill pays back on that loan is used to pay the interest on the Average Joe's loan and the interest on the loan the retail bank took out at the FED.

Fucking insanity.

The meat grinder of debt-slavery works this way ON PURPOSE.

It is unsustainable by design because then the FED has all the power. A new loan must be taken out just to pay back interest on the old loans, and so on and so forth and before you know it the national debt is in the trillions and everyone thinks "hm, that doesn't sound right... that sounds... bad and unsustainable. Oh no we are doomed!"

But it actually isn't unsustainable at all, because the FED owns everything so they don't actually give a shit if anyone can or can't pay them back. This isn't about money. Money is an illusion. This is about power, and the FED has the most power and delegates that power out to the banks and corporations: that in turn keep the FED in power. The cycle continues.

So again, back to this seemingly unanswerable question of "How can demand for money go down?"

Our personal concept of what money is, is flawed because we are the debt-slaves of the money masters. We do not think of the money we earn as debt, but rather pure value with no strings attached. Therefore, when I say the demand for money can decrease, I do not mean that the demand for pure value can decrease, because it can not. Greed is infinite. We always want more pure value because there is no downside to having more.

Rather, the demand for money decreasing implies that the demand for DEBT is decreasing. Now this is a concept Average Joe can wrap his head around. Being in debt sucks ass. Nobody wants to take on more debt.

Oh, if only that were true!

Debt is a badass financial tool. How awesome is it that I can walk into a bank and buy a house or a car straight up with only my identity up for collateral? (And the house/car of course; beware the repo man!) The truth of the matter is that we choose to go into debt all the time on purpose because we always get something of value out of it. Instant gratification is a very powerful tool, even if it gets abused constantly by the elite.

The sad truth of the matter is that it's easy to blame poor people and everyone else at the bottom of the pyramid for how bad things get. That's a classic move from the Republican playbook. Why do they make such bad decisions? Why are people so bad with money?

The fact of the situation is that this is a meat grinder and we are grading on the curve. A certain percentage of the class is going to fail no matter how hard they try. If everyone tries harder and saves money and employs proper financial responsibility: it doesn't matter. The meat grinder grinds meat. More money is owed back to the fed and retail banking than actually exists, meaning that no matter how good society gets at managing money we will have the exact same number of people defaulting on their loans on average. Either that or we have to double down, take out more debt to pay off the old debt, and then wait for it to all go to shit at a later time. We live on borrowed time.

When looking at things at a macro level we have to ask: what do the banks want? If the banks think citizens are going to default on their loans, leaving the bank with the bill, they aren't going to want to give out that loan (which would have in turn increased the money supply and the velocity of money and therefore increased inflation). Only when we understand these concepts can we begin to wrap our mind around how the "demand for money" could go down.

Money is debt.

If the demand for money goes down, what happens? Even Average "money go brrr" Joe knows the basic rules of supply and demand. When the demand of something goes down, it loses value. That is what is happening here. Stop calling it "inflation". That is silly. Calling it "inflation" is extremely embarrassingly ignorant of how the financial system works.

I'm willing to give a free pass though because we can not expect everyone to know everything, that would also be a foolish expectation. What society needs: is trust. That is what we are lacking and why cryptocurrecy is so valuable. Crypto monetizes trust on a core fundamental level using blockchain tech. But I digress.

I guess the real question is: why can't we trust the banks to tell us how the system actually works? Because if people knew how it actually worked they would revolt immediately. Why does the FED say "inflation is transitory" when inflation isn't even happening? Because if the FED gave everyone a lesson on why inflation isn't happening they'd realize the problem is a thousand times worse than gas prices rising. That's right dummy: you're literally a financial slave who's either whining about pronouns or second amendment rights. Don't worry about these silly little numbers floating around: math is hard, you no like maths. Go back to the fucking kids table and talk about how Kim Kardashian and Pete Davidson are fucking in order to divert attention away from the Astroworld deaths.

Pete Davidson has a huge dick and everyone jokes about it. Haha!

Finally answered one question: on to the rest.

While it takes thousands of words to explain how demand for money can decrease, the other variables are much more easily explained. Supply shock of goods and services isn't too difficult to navigate (most of the time). If a factory gets shut down from COVID and the entire system was based on the "Just In Time" model, supply runs out quite quickly. If a natural disaster wrecks Japan and that's where we were building a ton of computer chips, it takes over a year to rebuild those high-tech fabrication facilities. Simple enough.

In addition to production is also logistics. We produce plenty of food to feed the entire world, but actually shipping the food before it spoils to where it needs to be (while also turning a profit) can be an impossibility for capitalism to achieve. This is why people starve to death in the modern age of extreme abundance paired with artificial scarcity and profit seeking capitalism.

- It ignores supply abundance of goods and services.

- It ignores the demand of goods and services going up or down.

It's also fairly easy to see how technology creates abundance and makes it appear as though the value of a dollar is going up. Of course this is something that most people ignore. No one pays attention to the exponentially decreasing cost of technology. They don't feel as though the value of the dollar went up, but rather that they got a good deal or that they were owed. The entitlement is limitless in this regard.

It used to cost hundreds of dollars just to get a few kilobytes of RAM. Now you can get 16 GIGABYTES for under $100. That's insane. Once again: people take it for granted and will only complain when prices go up, never questioning when they go down. The selective memory is real.

If we boot up sustainable abundant sources of energy production in a certain area, energy prices in that area will go down. The dollar hasn't gained value: rather the price of energy has gone down.

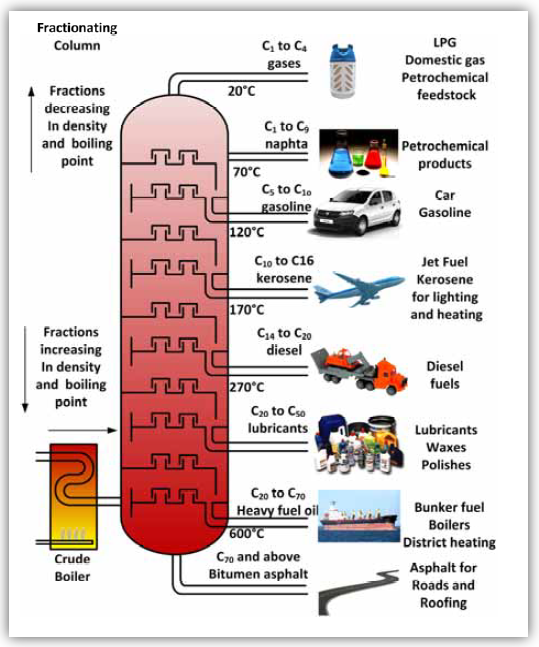

Speaking of energy.

Energy is the core of the entire economy. It costs energy to do everything. Want to distil crude oil? That costs energy. Want to plant crops? That costs energy. Want to turn on a computer? Energy? Heating/cooling? Energy. And the crazy thing here is that all energy on Earth is powered by the Sun in one way or another. Energy is infinite and free, but our ability to harness that infinite and free energy isn't good enough yet to make it infinite and free. One day it will be: and the entire world will change.

Even batteries are a form of energy.

The ability to store energy is just as important as the ability to harness it. There are plenty of sustainable energy sources that go to waste constantly. That's why Bitcoin is so important. Never before has it been possible to transfer energy on site and convert it into a digital borderless currency that lives on the Internet. Trust me: it's kind of a big deal that solved an impossible to solve networking problem posed in the 70's.

It is in this way that we can sort of think of Bitcoin as a battery for energy. But instead of the energy being saved, it is rather converted directly into pure value that has no debt associated with it and is impossible to counterfeit (another literal miracle).

But I digress (again)

We also have to consider the demand for goods and services themselves. What happens if people just collectively decide the cut back their spending, get scrappy, and save all that money for a rainy day? Ironically this sounds like a good thing but the economy would collapse instantly. This consumerist economy DEPENDS on we sheep to keep living paycheck to paycheck and buy all the things on credit.

The second we stop living beyond our means the businesses will make less money. If the businesses make less money they can't afford to pay back their loans or their employees. If they can't pay their employees they have to downsize or possibly go bankrupt. If unemployment increases then citizens now have even less money to spend, which will cause them to tighten their spending habits. The retail banks will in turn tighten their loaning habits because they aren't getting paid back, and less money will enter the economy. Less money in the economy incentivizes everyone to further hold on to what they have.

What I have just described above is the beginning of a devastating deflationary supercycle that would annihilate the economy. Again, it's not inflation we have to be worried about, and every economist knows this.

We can think of the legacy economy as a crack addict. The crack in this case, is money. The economy needs more money, but the way it gets the money is constantly unsustainable, so it needs more money. Even if it gets more money, the money that it just got requires even more money later, so the entire system is guaranteed to implode at some point or another.

The entire platform is built on a surprisingly flimsy house of cards that honestly stays upright for much longer than you'd think. The players propping up this house of cards are experts and know exactly what they are doing, even though they look completely incompetent to the outside world. The reason they appear incompetent is because, just as politicians do, they pretend to serve the people while serving the elite. Trust me on this: they are the masters of the maze. But their time is coming to an end. We figured another way out.

Conclusion

Believe it or not this whole post was supposed to be about currency and the strong analogy created when paired to liquidity. It was supposed to be about how fiat currency is is like a lake or a river and how cryptocurrency is a tidal wave. Looks like I got a bit sidetracked. Guess I'll have to create a part 2.

Apparently this instead is a post about inflation and the horrors of central banking. I guess the main point to nail home here is that inflation is not happening, unless you define inflation as "number of goods and services went up". This seems to be a common thing for those who whine about inflation: they assume it must be happening whenever the price of anything goes up, ignoring a dozen other relevant variables in the process. Real inflation is slow and largely imperceptible.

The economy is a complex beast that even professional economists do not understand. Therefore it would be foolish and arrogant to just assume we were going to nail it without even putting in any of the work required to reverse engineer this impossible chaos equation.

Instead of trying to explain the what's happening here: I instead focused on the variables at play rather than how they interact with each other in this clusterfuck we call the world economy. The variables are easier to identify than their roll in the outcomes:

- Supply of money. (The one everyone focuses on.)

- Demand of money. (The one very few understand.)

- Supply of goods and services. (Technology)

- Demand of goods and services. (Prosperity)

- Logistics/regulations of all of the above.

- Debt/loans and the central banking system of fractional reserves.

- People as products.

These seven variables alone can coalesce into a web of economic chaos that can not be deciphered by even the most talented professionals. And surely there are more variables than these and sub-variables underneath all of them that also come into play. All I can say for certain is this: "printer go brrrr" mentality is giving everyone a false sense of security about what is going on here. Money is the universal language we use to convey value to one another. To assume we understand this language based on one or two tidbits of information is a huge mistake that may lead to very foolish ideologies down the road. Just look at what Bitcoin maximalists are saying: they don't understand what is going on here at all. All they know is BTC/USD number go up so therefore they must be right.

This is a Laughable oversimplification that will inevitably lead to a great number of wrong-actions going forward. Deflation has never been a good idea: count on it. Luckily the future is permissionless and every door will be opened. Let the free market discover what's best the hard way. This is the way.

Posted Using LeoFinance Beta

It is fucked up by design. Just like the governments. Especially in Hungary.

Theoretically there is a thing called minimum wage. But actually it does not exists. Many people do not receive it. Me neither. I live with multiple disabilities. I receive a low, pension-like income, which is approximately $250 USD per month, and nowadays I also work as a packager in a four hours per day part time job, but my total income is only approximately $470 USD per month, while the local minimum wage is approximately $550 USD per month.

So nowadays I live in financial discrimination.

Shame on the Hungarian government. And on every other government, which practicing the financial discrimination against its citizens. Especially against pensioner and disabled people.

Das könnte lustig werden

@stehaller @eisenbart @mundharmonika @lauch3d

Hell of an article man ! Thank you for taking the time seriously !

I'm worried of the time when the FED will "buy" you and task to change your guidance ;)

Posted Using LeoFinance Beta

They can pay me in Hive.

Enough to jack up the price x2

😁

Man, that was a hell of a post. I might just go to sleep now. Although not living in the US you made some things clear to me, especially regarding inflation. I got a question that's been bothering me for a while: who owns the FED?

Posted Using LeoFinance Beta

Wow. You and @taskmaster4450 have given me a lot to think about. And I will need to evaluate where I want to put my hard earned USD.

Our modern day financial system is composed of stacks and stacks of spiderweb layers that entangle at so many points, I really do think it is complex by design to keep us in the dark of really understanding what "they" are doing. Fractional Reserve Banking is completely atrocious and generates most of the money in circulation, or at least that is how I understand it.

My only disagreement is your lumber theory. I can only speak from what I saw and from other discussions I've had, which is that the lumber supply at stores never really ran out. All the stores I went to had their normal stocks of lumber. And there are multiple accounts of this. So if the supply wasn't there, why were the stores stocked as usual?

Bookmarking this post!

Because people like you and me aren't buying lumber in bulk.

The developers buying lumber in bulk buy it all out and the retail sellers can no longer buy lumber in bulk without paying 3x the price. That price jacking gets passed on to the customer.

Chickens...they just never get tired of eating, do they?...lol

This was a great article, Might have reduced the number of articles am going to read today but am glad I stumbled on it first.

The change from Gold to fiat was necessary, and crypto is simply and more evidently the next step in that evolution of money.

Thanks for highlighting the abundance concept, I think I'll talk about it in my next piece. We really fail to factor in so many things when we postulate economic theorems

Saying that money printer goes BRR is an oversimplification, I agree, but the fact that more money is printed and injected to the economy no matter how they do it, affects the economy.

This was an interesting read and I actually learned some things from it, more posts like this one man, we need more thoroughly written posts about economic education like this one. Wish I had more HP to give the vote it deserves.

This was a long read, I couldn't complete it but I did grab something and now I feel like a total dumb ass.

So what I've known to be inflation since Secondary School is total crap? And it makes sense that inflation means the high supply of money where there's limited demand.

A crypto trader friend of mine recently said "all traders have the same charts but see different things".

Posted Using LeoFinance Beta

LoL yeah this one took me forever to write and I'm pretty annoyed about how long winded it is.

It's crazy long & watery! Lol Like a windy river. With some pretty wide and deep spots too. But, overall i feel the ocean. And, vast gentle soft rolling waves. #crypto ❄

Posted Using LeoFinance Beta

I am glad you understand the issue. The supply chain problems will probably stay with us for the next few years. The entire bonds/treasuries being locked into the Fed really throws people off and everything about money being debt is true. Even the government has to sell bonds/treasuries to print more dollars into the system.

Posted Using LeoFinance Beta

Many of whom are somewhere other than the U.S. Which sets the stage for some seriously counterproductive foreign policy.

Money is just energy. Let it flow.

Posted Using LeoFinance Beta

You presented FED as a sort of a all-powerful overlord. Task usually says FED "manages expectations", because it can't do much (almost anything) to intervene in the economy. While the two are not mutually exclusive, I like how different they sound, at first impression. If someone looks into it at a deeper level, you both are saying the same thing, just focusing on different aspects.

Did I though?

I said inflation isn't happening because the banks aren't doing what the FED wants them to do.

I said the FED is an archaic institution with very few tools in the chest. (interest rates and QE)

The FED is an all-powerful overlord in the same way that a Lion is king of the jungle.

And I said

:)

I meant all-powerful overlord in a way that when everything crashes, FED can pick and choose who to save and who to let die (or worse, to hold the bags). Maybe "all-powerful" was a bit too much, lol. But it has a sort of life and death "right" over its "subjects", when the time comes.

Yeah I can see why you said it.

Saying that everyone is literally enslaved by the FED puts off a certain vibe.

🖤. Numbers go up. There's nothing average about what is becoming. Nice to travel this way with men like you and Task. And, many others.

Posted Using LeoFinance Beta

You are right that we can't predict about the future economical status and this is difficult to describe, how it really works. You have points and all points are valid. Very wise discussion, thanks for letting us realize it once again.

Posted Using LeoFinance Beta

I realize I don't fully understand all elements of the financial system, not even after reading taskmaster or this post.

Here is what I do know..

If johnny makes $5oo a week, and suddenly his gas bill, his grocery bill, and his electric bill, his rent, and insurance prices all go up.

Johnny has less expendable income.

Posted Using LeoFinance Beta

Sounds like Johnny is not happy about this development.

Cathie Wood of ARK Invest predicts that deflation from technological advances is a far more realistic problem than inflation... and everyone else seems to mock ARK for it.

The USD is incredibly stable since so many countries use it for trade. I'm sure China would love to replace the USD with the Yuan for international trades... but I'm 100% they've got way bigger things to worry about with their real estate markets right now.

Now I have better understanding on the whole economy saga cos I use to believe that prices of commidities going up is actually inflation but its different now. Thanks for the enlightenment

So if money is debt(true with the exception of stimulus money) and the demand for money/debt can go down.

But since all the debt comes with interest, there is always a floor demand for money, or just as much to cover the interest for the previous loans.

Are you sure that this money isn't debt?

Positive that the government doesn't owe that money back to the FED?

I never checked.

Not a 100%, it was just how I thought it is... but it might be a gov debt ... or just bonds

Thanks @edicted,

Now I need a whole Boy Scout troop to pick up the pieces of my brain, because my head just exploded!

🤯

Good post.👍

Life is complicated.

Finances are complicated.

People are complicated.

But people want everything to be understandable, so they simplify it into “binary” concepts, so they don’t have to deal with the truth, which is it’s multifactorial. Which is why your posts are always so long.

You start out explaining “A”, which leads to an explanation of “B”, then “C”, then “D”, and when your explaining “F” you wonder how you got to “F” from “A” … because life is complicated.

Like inflation is bad, or inflation is good, or number go up because … insert favorite binary concept here…

Even binary computer code isn’t truly binary, it’s if, then so, which attempts to provide solutions, which are not really solutions, but really options or choices, for the anticipated or foreseeable situations, and they don’t work when the unforeseeable happens, which ultimately the true nature of life, probability and math, that you can’t foresee all possibilities… You just make your best guess what can happen, design a system to deal with the most common occurrences and accept that failure will occur when the least probable events happen, then you add a fix for that and turn the system back on, and wait for the next low probability or unforeseen event and repeat the process. It is the nature of things and systems to fail.

Which squeezes our noodles so much we need Togo get a drink, a smoke or whatever we do when we can’t figure something out and feel stressed by it.

Thanks…

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This. post. is. amazing.

Thx, edicted.

Posted Using LeoFinance Beta