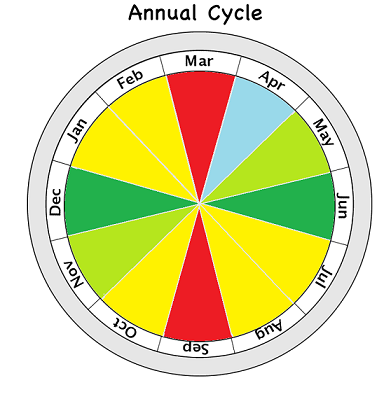

As predicted, Bitcoin is continuing to bottom out near the $55k level. Early April is always very boring. That's one of the reasons why it's the absolute best time to buy out of the entire year. It's almost a sure thing that this market will do nothing but ascend during the entire month of May. Like everyone else out there, I grow impatient and greedy.

There are so many weird variables this time around. COVID is obviously the biggest one. Millions of people are getting their vaccines right now and this summer will be the first time in over a year that many will feel that they have permission to take a vacation and travel around.

There's an extreme level of emotional pressure world-wide that's been building up for over a year. People are stircrazy. June has always been a good month for Bitcoin, and with all these other variables at play we are approaching a time period of EXTREME emotional and irrational money velocity. People are being given the greenlight to go nuts, and that's exactly what they are going to do.

On the other side of that coin is the rational money spending. Those who capitalize on other people's emotions are going to put that capital where it serves them best. Sharks gonna shark. In many cases this value is going to pour directly into Bitcoin by the billions.

Grease the wheels.

The results are in: corporations are on a mad dash to acquire as much Bitcoin as possible. Sports teams are taking their salaries in Bitcoin. Corporate adoption has never been higher and primed to accelerate. The FOMO hasn't even started yet. $60k Bitcoin is still a fair price.

Oakland A’s sell MLB’s first crypto-purchased ticket, a suite for 1 Bitcoin.

Elon Musk says people can now buy a Tesla with bitcoin

Corporations want your Bitcoin now, and they want it bad. They want it so bad they are building systems that allow you to send them Bitcoin directly, and there is no evidence to suggest they are going to sell the Bitcoin. A corporate blackhole has opened up, and the Bitcoin that gets sucked in is never coming out. They will simply use their new magical unicorn asset as leverage to get whatever they want.

This is just the beginning.

By the end of the year there will be dozens more companies who buy into Bitcoin and allow direct transactions. There will probably be several ETFs as well. Even Grayscale is trying to modify their fund to a direct exchange traded fund to secure the peg and build more trust.

Sup with Hive?

As always, Hive continues to trend down after a big pump. It's been just over a week since we spiked to higher than $1, and already we've almost crashed back to 50 cents as users who started their powerdown a week ago sell the unlocked funds.

Over the next couple weeks will likely be a good time to stack some more Hive as the price continues to crash. However, we have no idea when another pump will come. Wait too long and you could miss out, buy in now and it could still crash to 40 cents.

Hive is a completely unpredictable animal, that's why I was so aggressively accumulating in the obvious 10-15 cent range. Now I don't have to worry about acquiring more, and my blog payouts are dwarfing my day-job income. Like ya do. Everything is looking up.

Sup with LEO & CUB?

I just had a LEO powerdown unlock. I've to ported it to bLEO to provide liquidity in the bLEO/BNB pool. It's been stated multiple times that bLEO needs more liquidity for the incoming bridge, and the ROI return on the bLEO LP is still magnitudes greater than upvotes on the core blogging site. Users like @yabapmatt are doing the same, which is where I got the idea.

Sellers beware

Their are many problems with powering down my LEO. My primary concern is losing voting power. My voting power is my reputation. It's essentially free advertising and free networking on the Hive ecosystem. It boosts my brand identity and gets more eyeballs looking my way, whereas money in an LP gets none of those advantages.

Entering the bLEO/BNB pool carries the same risks as any LP pool: your LEO is for sale in the LP and can suffer impermanent loss and quite possibly forever lose the LEO. If LEO vastly outperforms BNB (which it easily could) my LEO will be sold to the buyers on BSC, and getting it back could be extremely difficult in the event that LEO does something crazy like go x100.

The reason to keep LEO on the main chain is the same reason users stack CUB in the den: those coins are not for sale. Even if the ROI return is theoretically lower, you'll make more money in the event these these micro-caps moon. During a mega-bubble year is when micro-caps moon, so the LPs are incredibly risky when we hit the peak of the mega-bubble. It's all but guaranteed that I will exit these LP pools during the beginning of Q4 to avoid massive impermanent loss. Micro-caps get pumped to the moon during mega-bubble peaks. I'm talking x100-x1000. It's going to be insane.

Matching BNB

I've wrapped 9562 LEO to bLEO, and I'm not looking to sell any. On the contrary, I'd like to get my 70k powered up stack back ASAP on the main chain.

So what I've done is removed 22.22 BNB from the CUB/BNB LP pool in order to match my LEO powerdown. That's just enough to enter the LP with bLEO/BNB. Using the extra CUB, I'm shoving 2800 CUB into the den because I don't want to sell that either. CUB has fallen sub $3 and we are bottoming out pretty hard. I'm thinking we hit rock bottom somewhere in the $2.50-$2.80 range. Once that happens I'll shove even more coins into the den, as my BNB stack is already larger than I want it to be.

It's interesting that I was able to pull all these LP moves off without having to sell a single asset.

DeFi Stronk

That being said I think BNB will get to at least $1000 by the end of Q2. Easy money. Hopefully BNB will continue to outperform CUB and LEO so I can continue to stack more of my favorite coins in the LP while still farming a ton of CUB.

Added bonus

The BSC network has cut fees in half today from 10 GWEI to 5 GWEI. We see that the BSC network will continue to dominate ETH fees in this regard because the POS network can likely reduce the fees to the minimum of 1 GWEI as BNB spikes during the mega bubble.

Meanwhile, don't be surprised when a single Ethereum operation costs $1000 or more (same goes with BTC). A flood of users will rage-quit ETH and hop over to BSC. There is a zero percent chance that ETH 2.0 will come into play by the time the mega-bubble hits. They will not be able to scale up in time. Hopefully the LEO bridge gets some action and notoriety during that time.

Also be ready for Litecoin to make huge moves.

This darkhorse is going to take a lot of people by surprise. Security on Litecoin is high. It's the second oldest crypto in history. Everyone who understands Bitcoin also understands Litecoin, and the fees are x1000 times cheaper. LTC will moon for the same reason BNB and BSC network is going to moon. People hate fees and love scaling. Yet another reason to own more Hive as well.

Conclusion

Early April is last call for everyone looking to fill up their bags cheaply.

This is it: piss or get off the pot.

You've been warned: don't FOMO in during a June peak.

Posted Using LeoFinance Beta

Thanks for the very detailed analysis here. I'm happy that I hold most of the coins you've listed here. It will be interesting to see how things play out in the coming few months. Cheers

Posted Using LeoFinance Beta

If corporations want BTC, can they just buy it from the open market? How come they're desperately trying to get customers to pay them in BTC? That doesn't seem like the best way to invest.

It's a marketing ploy.

Users with Bitcoin are more likely to support a company that accepts Bitcoin directly, whether it be with Bitcoin or fiat. There are also tons of bandwagon jumpers. Any corporation who even says the word "Bitcoin" gets a bump in the stock market.

One interesting variable to throw in is that HBD is back up to $1.7 (what dip lol); so the HBD stabilizer fund is going to be buying a fk load of Hive at these prices in the dip and taking them off the exchanges (34k USD worth at $1.7 HBD so that's 68k Hive at day at $0.5) . This has inflation running negative on Hive at the moment. Next Hive pump could be sooner and harder than people think; particularly with the associated airdrop fomo when the 3Speak white paper is released.

If you are looking for a way to earn some extra income every week. Look no more! Here is a great opportunity for everyone to make $82/per hour by working in your free time on your computer from home. I've been doing this for 6 months now and last month I’ve earned my first five-figure paycheck ever! Learn more about it on following LINK.......>>>>>>>>>>>>>> https://www.Nifty2.com

TL;DR Julyin' is for Buyin'

Kidding, kidding. There's lots to be really excited about over the next few months (and then maybe again in 4 years, I don't really understand bull and bear cycles).

I'm now moving some fundage that'll hit next week. I was going to get BTC and BNB, but I think I'll get some LTC and Hive as well. Hive is such a darkhorse but I had never thought of stake as a brand before... but I think you're right... it makes a huge difference in interaction. I noticed that BNB gas fee drop today and didn't know what was going on... I don't think I've ever had that kind of pleasant surprise on ETH ever. Agree that BNB:CUB is where a lot of the magic is... thanks for being so transparent with everything, there is so much complexity in this space, it's kind of impossible to keep on top of everything.

Posted Using LeoFinance Beta

Gee ya think?

Posted Using LeoFinance Beta

I'm feeling CUB:BNB is an each-way bet. I don't see a bump in BNB leaving CUB behind, and if CUB moons, then I have a CUB factory churning out more.

shhh be quiet don't tell them all meh secrets.

Fuck me, and I think it would be a good idea to sell my precious 3 LTC today, to buy ETh or Hive or CUB, but with what you have said I am seriously thinking better to leave it as is, and continue earning 0.50 Cub per day what to My little portfolio is a great fortune for something that is there, with these crazy markets I think the best thing is to hold until 4 years from now as Taskmaster says and to continue striving so that growth does not stop even if it is little and little by little.

Oh, this reading only financial things makes one start to think like a great investor with the few pennies that one has, greetings man.

Best regard.

Posted Using LeoFinance Beta

LTC is a safer bet than Hive/LEO/CUB.

Less potential upside, but also less potential downside.

At the end of the day it's all about what community you want to support most.

Thanks i Will consider the market movement.

Posted Using LeoFinance Beta

That's what i'm thinking about from some time.

Btc and Eth dominate but cause to high fee people move to other cryptos with low fees.

But one day even the now-low-fee cryptos will became expensive

So in the end, people will move to fee-less cryptos as Hive.

We have to be ready for that day... we need more nodes, more witness, and an efficient system to avoid what happened last year.

CRYPTO ON!!

Ha, yes... until RCs become expensive as well :D

RCs have a value... it's just that we currently round that value to zero and call it feeless

You'll see how crazy it gets by the end of the year: mark my words.

well it is kinda free because even if you will need to invest 200$ to transact you don't spend it, you can always sell it.

That is a great point... but I think what's going to happen is that eventually Hive will become so prohibitively expensive that users will start buying RCs directly without even owning any Hive Power. Anyone with HP will be able to farm on-chain bandwidth and sell it to the peasants directly. Hive is the original DeFi network and we aren't slowing down anytime soon. Anyone here today is in the top 1% of the top 1% in this respect.

The numbers don't really add up any other way. First it costs $2 to transact, then $20, then $200, then $2000, then $20k. At a certain point buying HP directly will be too expensive even with only a couple million daily users.

not sure, we did not have RC system in 2017-2018? So we kinda did not test it on a heavy load. and we are not really sure what a heavy load is.

i can just say that i hope you are right :D and not that i am going somewhere so will probably be here to see it

Next peak could be nine months out so... I mean imagine blog posts making thousands of dollars... that kind of money gets attention real fast. This time around instead of it taking 2 weeks to create an account users trying to enter the ecosystem gonna get in instantly just like they should have 3 years ago. This next run should be entirely different from last time.

Do you have an in-depth post on RCs on your blog? If not I think it would be an interesting to cover in depth.

There are some things that aren't so clear to me like the relationship between the hive blocksize and changing the RC costs of operations. For instance, can we make posting cost less RCs without changing blocksize? If so, wouldn't the blockchain just get bloated even though the RC system still shows that people can use the blockchain?

https://peakd.com/hive-167922/@taskmaster4450/hive-a-resource-credit-crunch-in-2021-2022

https://peakd.com/hive-167922/@edicted/hive-scaling-rc-burnout-open-letter-to-taskmaster4450

https://peakd.com/gaming/@edicted/creating-digital-assets-with-steem-s-resource-credits

The entire point of RCs is for the cost of operations to spike when the blocks start filling up. When RCs were launched, perhaps you remember how everyone had negative RCs and no one could do anything, we had to make RCs cheaper by x10 just so people could use the blockchain.

When blocks start filling up we are going to return to those x10 cost levels... perhaps even higher. This is going to prevent lots of users with low RCs from doing anything on Hive because it's so bloated. We need RC pools to avoid this: but that will push the cost of operations even higher.

Increasing the block size of Hive allows us to reduce RC costs, but again there is a huge cost to doing so: every node in the network becomes more expensive to run. That means many low level witnesses and new projects will drop out and go elsewhere. It's a balancing act of bandwidth and priorities.

Thanks, I needed to refresh my memory with all that info.

Long term, vertical scaling is needed. If I understand correctly what's been happening recently, modular hivemind is the first step into allowing devs to easily run their own sidechain where everything is cheaper and less secure.

Yeah that's true. We'll see.

You make the whole crypto world sound so reasonable. lol Everything just fits together perfectly. It's really a great read. I just hope you're right.

Just out of curiosity, why is that? I've kinda reached my goal for staking Leo short term and have some liquid. I've already got some LP in that farm but I could add a little more. Like I said, I'd like to know WHY I should do that other than the obvious Cub benefits....?

Posted Using LeoFinance Beta

A lot of people will tell you that LIQUIDITY is Bitcoin's killer dapp.

The more liquidity a network has, the more money that network will attract.

Takes money to make money.

By adding liquidity to LEO we attract outside capital to the platform.

This is why LP pools are so heavily incentivized in the farm.

We need deep deep liquidity to get more people involved.

In terms of the bridge, having more liquidity will cause less slippage, which will make the bridge more viable and cheaper to use.

Ok, thank you for the answer. I don't have a ton, like I said. I think I'm going to let the markets figure themselves out a little here first before I decide what to do. Truthfully I'd rather just buy more Cub but we'll see. I'm only talking about a couple grand either way so I'm not going to be making or breaking any banks, but I get it, it all adds up.

Posted Using LeoFinance Beta

Yeah you need to make whatever decision makes sense for you.

Bending over backwards for a few drops of liquidity isn't worth it.

I'd say $3 CUB for the den is a damn good deal.

If you believe in CUB: go long on CUB.

No LP required.

Hahaha! and sacrifice those precious APRs XD

Posted Using LeoFinance Beta

Donut 🍩 fomo in June.

Aka -don’t even think about selling now.

I’m not ready to make some gambles, but I sure am ready to HODL.

I have cub, I have tiny LP’s. I’m gonna build my LEO and HIVE stakes.

Stakes for future steaks.

Yeah, I can just not justify powering down. Maybe sell some liquid here and there, sure. But for both Hive and LEO, when I stake, it’s for the long haul.

Posted Using LeoFinance Beta

100% agree on litecoin! Funny how you often mention in posts the general thoughts I've been having recently. I sold some coins to buy more LTC. I've also been powering down my leo to stake on CUB.

However, I think hive bottomed out. This correction already went further then I expected.

True, we lost 100% of the gains from the pump on March 27th.

Now is a very safe time to buy in.

I was a bit shocked the other day to see BNB go over $400. I mean I knew it was coming, but still actually seeing it happen makes it more real you know.

Posted Using LeoFinance Beta

yeah just wait till summer it's gonna be super weird seeing it over $1000

Considering the last time I really wanted to stack up was $12.

подождем,время покажет

Posted Using LeoFinance Beta

Great call on the BTC dip. Also I agree it’s time to load the boat for a big bullish push. The action today it’s a bit odd which makes me feel like the big boys are accumulating for take off.

Litecoin does great performance but do not forget to dash . It is widely accepted by merchants becaus the low fee and enables microtrabsaction

Posted Using LeoFinance Beta

I was a bit shocked the other day to see BNB go over $400. I mean I knew it was coming, but still actually seeing it happen makes it more real you know. I need to move some more money over to Cub. I don't think I have been taking advantage of that like I should be.

Posted Using LeoFinance Beta

As all the states open up we should really begin to see some economic fireworks. It would be a perfect time to pump Bitcoin....

Posted Using LeoFinance Beta

just dont give up @edicted , continue doing interesting post like this one and see you in the moon :)

I start to get involded and I join to the pool of pair busd - cub and I have a loss like 20%, I see many people buy pump when cub was on $15 and I bought cub in $4.

I think the same, maybe it could go down until $2.5 or $2 and it will go up so fast.

It definitely will be interesting as I am focused on powering up my LEO or converting it into LBI. I also want to start putting some more CUB in the den but I may wait until Project Blank comes out (looking more and more grim).

I hope you plan of entering the bLEO/BNB pool goes well and you are won't lose the LEO you put in.

Posted Using LeoFinance Beta

You make some good points. Thanks for your time to put them out there.

Posted Using LeoFinance Beta

Good post !!

https://leofinance.io/@aggregator/bitcoin-waste-energy

Posted Using LeoFinance Beta

It all spins like a Swiss clock. I have a strong feeling 2021 will be more than similar with 2017. Nothing will moon in a straight shot though. A bit of galaxy explore until setting down the flag.

Posted Using LeoFinance Beta

June and December are best months for btc, curve seems to be down all those years between August to November.

I've just recently stumbled upon your account, and already love your content, I've also written you a DM on Discord, I would really appreciate if you could take a look!!

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 17000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

You know, I think you have become something of an inspiration for me. When the cub BUSD pool was on par with the BNB one, I switched from 2 thirds BUSD towards a heavier BNB commitment, I agree that this may be a mega bubble. Just now, I learned that BNB has slashed the GWEI which is so utterly bullish in my mind, to see that they act in real time like this. I had not thought about Litecoin that way and actually sold all of mine to get into DeFi, maybe my free riding plan could prioritize paying that one back ASAP and then some. It makes sense; however suprising. My victory is how Swamp has given me BTC exposure, which is not the same as pure holding but it'll doo kangaroo.

I would love to accumulate a million CAD of crypto wealth by end of June but that will have to wait until the next bull market. My best case scenario would be to have 100K in staples by fall. I don't consider Hive a staple but I never trade mine so I am very much commited. I would be fine to see it go back down to 15 cents knowing that one day, it will conquer the entire planet. It's not about Hive's day in the light, it's about the fact that there will be one.

Wouldn't it be nice if crypto hit ATH, slight correction and the trades sideways for a few years? This is not what is going to happen so lets take advantage and strategize accordingly.

Posted Using LeoFinance Beta

Still early days yet and i'm doing more promo for Cub by the day in the hopes it stands out in a crowded DeFi field.

Also, these are good prices to get more cub and with the difference between the farm and dens being lower than usual, sticking them in the den waiting for price to appreciate.

Posted Using LeoFinance Beta

Hi @edicted

Great post as usual. I thought of selling at 60 k and buying the dip, but there was that fake out news of 100k, so I hung in there and hodled...

I didn’t know Greyscale was changing their game. I am invested in them in my IRA, and wondered if they were going to try the ETF again... I hear there are four now Greyscale, Gemini, Fidelity and one more run by the Guy who was Trumps Chief of Staff for one day or something like that Scaramuchi ...

Cub is hovering around 3.00 I was going to wait to see if it went lower, but decided to pull the trigger at 3 as that is a discount over its recent 3.90 plus price :)

Take Care,Thanks for the insights.

@shortsegments

Posted Using LeoFinance Beta

I started off largely in the BUSD/CUB pool, but I gradually moving incoming CUB to the CUB den, as well as topping that up from outside. I completely agree that the value of CUB is close to bottoming out, and I personally wonder whether it will even drop much below $3 for a prolonged period.

I also have my eyes on XRP later on which I suspect, despite the small boom in the last few days, may well boom later than the other coins. I prefer it over LTC, because the ongoing SEC case means that (in my personal opinion) it has more upside. Also, a later peak would be favourable in terms of trading of course :).

Posted Using LeoFinance Beta

Love to vision out there. I sense a very disciplined investor here.

Posted Using LeoFinance Beta

your text in short.

Moon soon. Hive good. LTC good. already know :)

This post is very interesting. Here in Italy many people know Bitcoin, but it is true that all the rest of the cryptocurrencies are still almost unknown. In Italy there are still many who use Facebook and don't know HIVE. Litecoin in Italy is an unknown. The cryptocurrency market will grow further.

Sangat bermakna