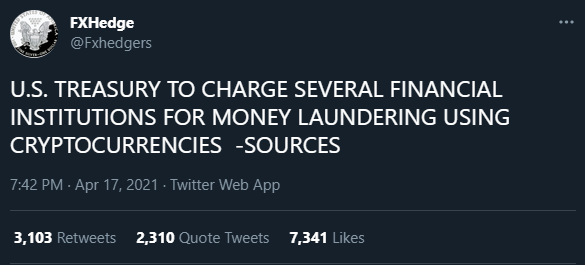

https://dailyhodl.com/2021/04/17/bitcoin-and-crypto-markets-plummet-as-u-s-treasury-rumor-spreads/

So perhaps not Dogecoin whiners!

But still just as comical. I promise I was looking for this news last night and couldn't find it. Guess I need to follow this @fxhedgers guy.

The important thing to note here is XRP.

The XRP lawsuit was way way way more devastating than some random threat against unnamed financial institutions. What happened then? The weak hands dumped immediately and the price of XRP proceeded to moon. The exact same thing will play out here.

Weak hands don't understand timelines.

They panic in the moment on the day of a bearish announcement. By the time they realize the market is going up still they buy back in and take the loss. This happens over and over again. This is essentially the opposite of buy the rumor and sell the news: sell the panic (news) and take the loss. Day to day price action means very little at a time like this.

Lawsuits can take years.

This dump happened in 30 minutes. Not only that, it doesn't even target Bitcoin or even crypto directly, only the centralized agents at the fingertips. This recent crash was nothing more than fluff that will be completely reversed next month.

It's also important to note that they always say "money laundering". You notice that? They never EVER say "tax evasion". If the problem was indeed "money laundering" that means taxes were paid and it's hard to imagine how multiple financial institutions got caught. As long as the government gets theirs they don't usually give a shit where the money came from. Tax evasion itself gets a lot more attention.

Not even what I wanted to talk about!

Just wanted to clear up my last post.

Begin new post.

So I've been thinking a lot about DeFi and CDP smart contracts. At this point I think it's pretty obvious that every DeFi token will actually have its own algorithmic stable coin. Why? Because these stable coins allow users to give themselves loans and provide anyone in the network access to on-chain atomic-swap stability while also supporting the parent collateral token.

Wow that's a lot of stable coins!

Sure is!

And when there are hundreds of stable coins I can see it now:

This is inefficient.

This is not crypto.

This is an abomination.

That's because most people don't get it yet.

The irony in calling crypto inefficient is palpable.

That's the entire point.

We are sacrificing efficiency for robust redundancy and trust.

It's easy to see why stable coins pegged to USD in a bank are a bad idea. There are a lot of points of failure there and the token itself (be it USDC, USDT, TUSD, BUSD, etc) is simply an extension of fiat worming its way into this new financial system. Many idealists see this as extremely counter productive, but it's not. This is all part of the process.

We see algorithmic stable coins like DAI and assume the same thing. It's pegged to the dollar so it must be bad. This is 100% incorrect. Dai is pegged to whatever value the network pegs it to. Right now that value is a dollar. This is a gigantic distinction from stable coins pegged to banknotes.

If USD started hyperinflating as many out there seem to fear, a network like MakerDAO could just decide to raise the peg of DAI to a higher level to account for this hyperinflation. It really is that simple: they can just do it, while dollars in a bank can't. Eventually algorithmic stable coins will become more stable then fiat itself. That's when the entire game changes and the value proposition of fiat goes right out the window.

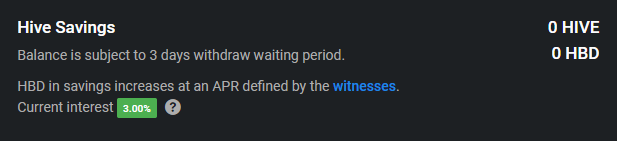

Hive's HBD

Hive has a stable-coin, and we are even making multiple upgrades to it on the next Hardfork 25. However, we do not have CDP smart-contracts yet. Eventually we'll be able to mint HBD directly with collateral in the savings accounts: at least that's the future I've been imagining. I think there's a strong chance that both CUB and LEO also have their own stable coins using this same system of smart-contracts. It's even possible that both liquidity pools get combined so that either LEO or CUB (all LEOfinance tokens) collateral could be staked to mint the same stable-coin.

Long

Many users (including myself) use MakerDAO and DAI stable-coin as a way to long the price of Ethereum or another crypto. Users can lock ETH in the contract and mint DAI from the collateral. That DAI can then be spent on another crypto.

Essentially this is the same as trading on margin. You give yourself a loan permissionlessly and gamble that loan on another volatile asset. Certainly there are other things you can do with the loan like pay bills or buy property but for the most part I feel like users currently utilize these contracts to gamble. If the market crashes the ETH collateral can get liquidated to pay off the loan you took out, so you have to watch the markets carefully to make sure that doesn't happen (13% liquidation penalty fee).

Short

Something I just realized yesterday: we can also reverse these contracts. This was actually the entire reason for writing this post. I haven't seen this done yet and it could be pretty revolutionary.

So instead of locking up ETH to create DAI, we reverse the process to lock DAI up to create ETH. On the ETH ecosystem, this is impossible because the mainnet would not allow ETH to be minted (they'd have to print Maker instead). This would allow users to buy stable coin DAI, lock it, mint a volatile asset, and then sell that volatile asset for more DAI. This is exactly how shorting the market works, but in a permissionless way.

With Hive, we have none of these constraints. The savings accounts can hold both HBD and Hive at the same time by design. A CDP smart-contract system would just add both of these collaterals together automatically to determine how much money could be printed.

By allowing the contract to print HBD from collateral, we allow users to long the market and buy more Hive. However, as I said, I just realized these same contracts could be used to print Hive itself, which would allow users to sell the Hive and effectively short the token price in a fully permissionless and decentralized way.

Honestly I'm curious what other people think about this. Clearly adding the ability to long and short the market is a huge DEFI utility that adds value to the network, but do we really want to allow users to SHORT our own network DIRECTLY ON CHAIN? Personally I think the value gained by allowing users to short the market is higher than the risk of the shorts themselves. Like a lot more, but I am curious what others think.

Remember, when Hive spikes up fast, smart-contracts in place like this would allow users to print Hive immediately with their collateral and dump it on the market. It could be a great way to stabilize the market and provide liquidity in the face of heavy buying pressure... something that we see all the time. When Hive goes x5 in an hour suddenly users would have the tools to mint Hive and dump it on the market, knowing there's a high chance they can buy that Hive back cheaper in a few days.

Conclusion

At the end of the day I see all these developments as inevitable. So many people are thinking short term on the day to day roller coaster that they can't see the forest from the trees.

Hive is a DeFi platform. All DeFi platforms will allow users to long and short the main token with stable-coin CDP smart-contracts. In ten years this will be the standard for all DeFi tokens.

Most importantly, algorithmic stable coins are not pegged to the dollar by force. They are pegged to whatever value the network decides they are pegged to. This fact is definitely going to come into play over the next few years and blow some minds. MakerDAO has already proved that we don't need USD to host a stable asset. We can simply use USD or another fiat currency as a reference point and set the price with governance votes from there. This is the future.

Posted Using LeoFinance Beta

Its a different way to look at shorts. I tend to prefer not to short since I dislike using leverage as I don't like blowing up accounts. But if you take the proper steps and plan out your trade, then shorts are fine. If someone blows up their account and loses more than what they own, what does the chain do? I think this kind of needs to be addressed before we attempt it.

Posted Using LeoFinance Beta

Basically impossible (or at least highly unlikely). The network sets a liquidation collateral percent, and if someone's collateral falls below what they've borrowed it gets liquidated to pay off the debt. MakerDAO sets a liquidation percent of 150%, so if you borrowed $1000 worth of assets and your collateral falls below $1500 a liquidation will be triggered. Most of the $1500 get sold and the user gets returned whatever is leftover.

Ok so its like a collateral account. You borrow based on what you have and unlike the traditional market, you don't have gaps (24 hour market). So its highly unlikely and will only happen when the liquidity on the market is too small on the ask side.

Thanks for the clarification.

Posted Using LeoFinance Beta

I'm curious, since you wrote about stablecoins, have you heard of RAI, what's your take on that?

Posted Using LeoFinance Beta

I have not. Been slacking on research of new tokens.

In a shorter version of your post, for the last 12 months this has been my plan to get to 100k hive. Not quite the yet.

... and if it keeps mooning, those shorting let us buy cheap Hive while cleaning themselves out. Fascinating.