By the estimation of many top crypto analysts, we are far from reaching the pinnacle of the bull market. If the 2017 bull market could be seen as a novella, then this year's bull cycle can be seen as a fine sequel. While being in a bull market, to a very large extent, guarantees profit, investors must be very strategic in order to avoid certain mistakes that can either slash profits or outrightly result to losses. In this short article, this writer looks at some of the mistakes that should be avoided in a bull market.

NewsBTC

1. The Mistake Of Not Having A Playbook

A playbook is probably one of the most essential ingredients in a bull market. It should have a list of specific cryptocurrencies, the entry prices, and the various points at which profits can be taken. While it might be a bit difficult to strictly follow the game plans in the playbook, not having one can be very catastrophic.

The real dangers lies in the fact that the investor is very likely to be driven by impulses than he is likely to be driven by reason and sound judgement. We could have a scenario where the investor will be lured into buying shitcoins that could end in colossal losses. If you want to avoid this, then develop your own playbook.

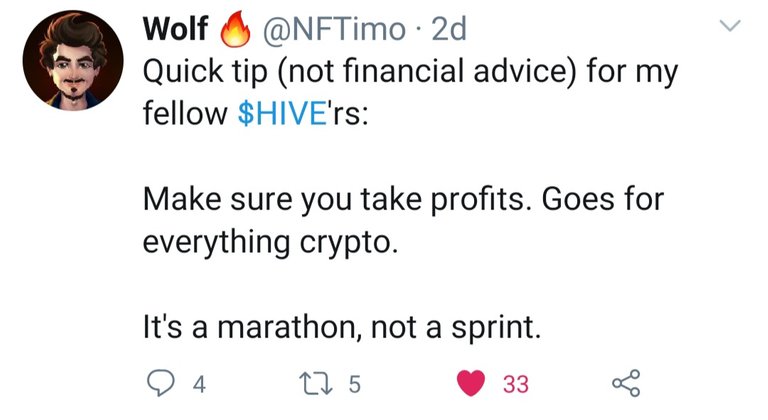

2. The Mistake Of Not Taking Profit

It is nothing but an illusion to think or imagine that the bull market will last forever. Winter is sure to come after the summer. A lot of investors, newbies especially, have the tendency to think that their crypto holdings will continue to appreciate. Unfortunately, many will be caught unawares. Below is a recent tweet from @therealwolf wherein he admonished his followers to pay attention to profit taking.

Profit taking protects the investor from the surprises that the market has to offer, sometimes. If you do not take profit, losses will likely take you.

3. The Bitcoin Delusion

No doubt, since its inception till date, Bitcoin has remained the undisputed king of cryptocurrencies. But, if anything, Bitcoin is not always the king of the bull market. There are hundreds coins that will by far outperform Bitcoin in terms of returns on investment. It is therefore delusional to assume that Bitcoin is best investment in a bull cycle. Should your portfolio have Bitcoin? Yes. Should your portfolio have only Bitcoin? No.

4. The Mistake Of Not Having A Hodler's Mindset

Because the market is on an upward trend, it is only natural that one is tempted to sell off one's assets as soon as some seemingly nice profits are made. This approach is not inherently bad because some money will be made but the bad side of it is that the potential profit will be missed which, in introspect, can be very painful.

Consequently, you have to always bear in mind that the bull market is a holder's game and only a true and vigilant hodler can make the best of it.

Posted Using LeoFinance Beta

i think the bitcoin-is-king narrative is quite silly because many who have been in the game and are honest will tell you that during a bull-run the gains are usually in the alts. the real challenge is sporting good projects.

holding is another key thing you mention. this is my greatest flaw--hodling. i am trying my best to train these weak hands of mine and it is working quite surprisingly.

Posted Using LeoFinance Beta

Buena publicacion, es muy instructiva, saludos.