Despite its recent struggles, Coinbase has been a very successful company and has made billions of dollars for its founders, initial backers and investors. But the investors who bought its stocks after it went public last year haven't anything but losses. Like many crypto exchanges, companies, and projects Coinbase was inspired by bitcoin and Satoshi's vision. Not only it is evident from its brand name, but also multiple public speeches by its co-founder Brian Armstrong. In reality though, the practice of the company have not represented the bitcoin vision in its entirety, but rather focused on a tiny part - making money.

Among the latest news about Coinbase is that Coinbase was caught in on going practice of inside trading by their employee/employees. Three people responsible for this action were arrested. One of them is an employee of the Coinbase who had inside knowledge of coins planned to be listed on the platform and used this knowledge to front-run the trades of these coins. This employee also shared this information with friends and family who also participated in these trades.

Brian Armstrong and Coinbase condemned these actions, made public announcements in an attempt to explain what happened and how that is not the case for the entire company. But that fact of the matter is, these suspicions were raised even before by the public, and nobody paid attention. Now that somebody was actually caught, based on some blockchain evidence shared on twitter, Coinbase is speaking about it as if they had anti-fraud measures in place all along. Again, the fact that these actions were revealed by forensic blockchain analysis of certain wallets by random people of the internet and not by Coinbase shows they probably haven't paid serious attention to this or maybe even never cared to.

This was just one incident that amounted on a million plus dollars in profits over about a year time. In a grand scheme of thing this is not a lot of money in crypto. There has been much bigger fraudulent activities in crypto world. However, just because this is has happened, and suspicious of such activities were present all along, it makes me wonder how many of such front-running trades and market manipulations Coinbase got away with. Maybe they never did. But the question remains that they didn't have proper measures in place to prevent them either.

I have a friend who strongly believes that Coinbase manipulates markets and sells more bitcoins than they actually have. I argue that it is not possible, or at the very least it would be a very bad idea for Coinbase to do anything like this. Because they are a US based company and may face harsh legal consequences if they did anything like that. Moreover, such actions of creating bitcoins out of thin air would make them vulnerable to market conditions and cause them go bankrupt in no time. After seeing the inside trading news, I am not sure what to believe any more. Anything is possible.

On another news, SEC announced a probe on Coinbase and its crypto listing practices. SEC seems to believe Coinbase may have violated laws by listing crypto assets that may be classified as securities. I am sure Coinbase will have their lawyers fighting these allegations. At this point nothing is clear and predicting the outcome is same as flipping the coin. Big Short investor Michael Burry seems to be of an opinion that SEC doesn't have proper resources or IQ to investigate crypto listing on Coinbase correctly. On one hand, I doubt SEC would take these steps unless they have done their research and have some solid leads to follow. On the other, SEC doesn't have good reputation of properly assessing crypto matters. It is known fact that they have limited resources. But they can dedicate them all to certain cases to achieve whatever they are trying to accomplish.

Ever since Coinbase went public, its stock has been on a downtrend, even before crypto bear market. The highest $COIN price has been is during its first couple days after IPO. It went as high as $430. But then kept dropping down, and never went back to these highs. Many analysts shared thoughts that its price at around $200-$250 was a good buy. In a short term their prediction was accurate. Because the price recovered to about $350 in short period of time. But since then it just kept going down and down. Cathie Wood's ARK Invest is known for brilliant bets on technology and innovation in the past and who made decent returns on Tesla investment. They also are big believers in bitcoin and crypto. I think for this reason, they bet on Coinbase as well. But in the latest news, ARK Invest announced they are selling their Coinbase shares because of the inside trading news.

Yes, Coinbase's stock price has been dropping for a while now. It may even drop more. But this is the case for many crypto related stocks. It is also the case for many tech companies and companies in other industries. It has just been a bear market. When bitcoin prices recover to previous all time high, it is very much possible that $COIN prices will go back up as well. But I wouldn't invest in $COIN anyway for different reasons.

Coinbase is the exchange where I bought my first bitcoin and I am forever grateful to Coinbase for that. But this is not a company that I would be a loyal customer of. At the time when first signed up for a Coinbase account, it was a necessity. There weren't any other options for me to buy bitcoins. The good thing about Coinbase is that they were indeed pioneers in building a platform and getting proper licenses that allowed them to provide services of selling bitcoin for fiat. They have served as a bridge between crypto and fiat worlds.

Not only they allowed buying and selling bitcoins for fiat, they also allowed use of crypto wallets which allowed users to transfer coins to and from the Coinbase platform. In my case I would buy the bitcoin on Coinbase and then transfer to Bittrex, where I would buy other coins. What I wasn't happy about Coinbase and the reason I didn't consider trading on their platform was their crazy fees. Taking advantage of the monopoly they have in bitcoin/fiat and fiat/bitcoin conversions in certain jurisdictions, they would offer these services with high fees. I wouldn't mind paying these fees either for buying bitcoins. At least there was an option to do so.

They also provided an easy to use platform. Both their web and native apps worked great, and it was not difficult to figure out how to buy bitcoins and how to use the wallets. The problem is, they thought this easy to use platform justified charging higher fees. They had a separate platform, which is called Coinbase Pro now and used to be named GDAX. Moving coins between these two didn't require fees and was fast and easy. However, ordinary Coinbase users didn't know about this other platform. Coinbase Pro was meant for frequent trading and its fees were/are a lot lower than Coinbase itself. I found out about it when someone suggested to try when I decide to sell, and when I compared the fees, the difference was significant.

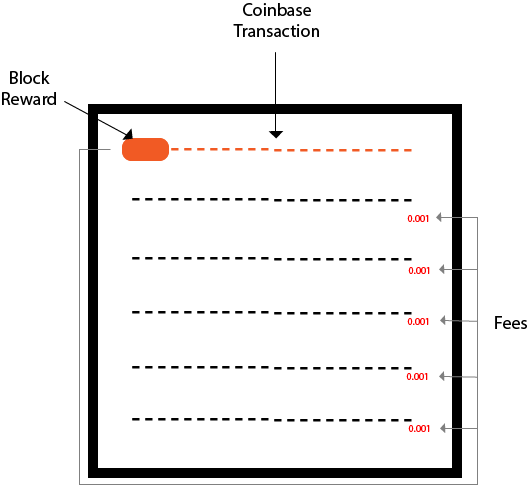

We can't really blame Coinbase for that. This free market. This is their business model. So be it. In fact, it is very appropriate business model for their branding. The name Coinbase is not original to the company. They took the word "coinbase" from bitcoin protocol. In bitcoin there is such thing called "coinbase transaction", it represents the rewards and fees miners receive.

A coinbase transaction is the first transaction in a block. It is a unique type of bitcoin transaction that can be created by a miner. The miners use it to collect the block reward for their work and any other transaction fees collected by the miner are also sent in this transaction.

source

This can explain that the only thing Coinbase really cares about in bitcoin is rewards and fees. Or in other words making money. Everything else about bitcoin is either irrelevant or secondary to them. However, Brian Armstrong keeps repeating that bitcoin and Satoshi's vision for decentralized systems is what he really cares about. In reality and practice, I don't really see this.

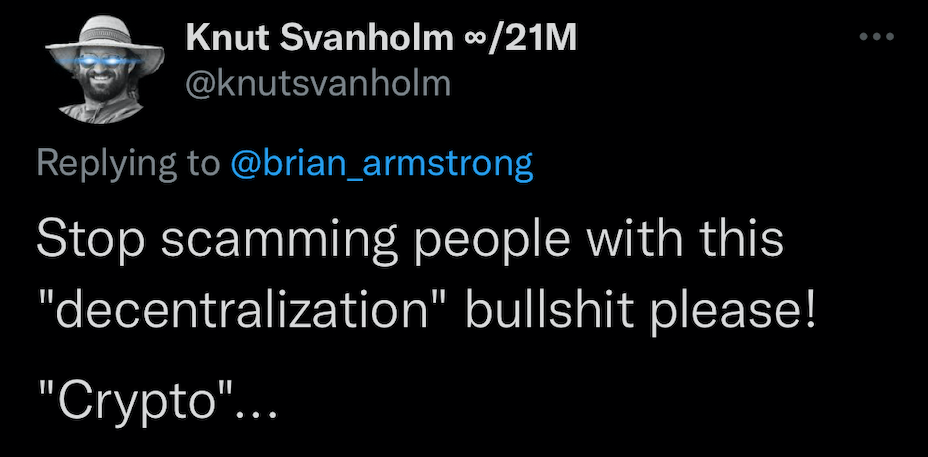

I may be biased against Coinbase, just because they haven't even considered listing Hive, one of the most decentralized network that exist. But comparing to things they have listed, it is not just bias, it is kinda an objective observation. I really doubt that Coinbase has a system to research and asses the decentralization levels of projects and coins in listing. I tend to think they are more inclined to charge fees for listing, getting partnerships with founder teams of projects. lol. Just last year Brian Armstrong tweeted this.

That time I did express my thoughts and frustrations. How is it possible a CEO and founder of a company whose job is to know all thing that is happening in crypto world, has no clue whatsoever about Hive. Impossible!

I don't even remember what my response was. But I was so happy to see someone on Twitter, who actually wrote a book about bitcoin, and left the following response to Armstrong's tweet.

That describes well what Brian Armstrong and Coinbase is sort has been doing. They don't care about decentralization. They care about money. The hypocrisy of Armstrong and Coinbase became very clear to me during an announcement event for EOS based social platform Voice. Dan Larimer was sill part of EOS, and was trying to reinvent social networking again. They went a great length to make this Voice project a success. They paid $30 million just for the domain name, and bought it from Michael Saylor, even before Saylor went all in into bitcoin. So, anyway, I think Voice was delayed for a long time, then failed. I don't know if it still works or not.

But the thing is, they really wanted to make this become something. To compensate for what is lacking they just kept throwing money at it, hoping that would do the trick. One of the big things they did was, a special unveiling event of Voice. They tried to copy Apple product unveiling events with design of the event, and how the entire thing was done. So, Coinbase was among some of the partner companies that was invited to the event. I don't remember who, but one of the highest ranking executives of Coinbase participated in the event and made the speech of how excited they are about this whole thing, etc. They were invited there by Block One. Another company, just like Coinbase. Not a decentralized entity. Would Coinbase come to a decentralized event. How about HiveFest? Don't even need an invitation. Just buy the tickets and show up.

My point is, if Coinbase really cared about decentralization and decentralized system, they would make efforts and would have framework in place how be involved in these efforts and how to push this idea forward. Instead, they do the opposite. The keep going towards more centralization. The example of this can be their acquisition of BRD wallet.

BRD wallet was known to be one of the best bitcoin wallets. It was one of the wallets I used. Coinbase ended up buying them. BRD had a nice and easy to use app that provided self custody of coins. Its reviews were great and it was trusted wallet by many. Coinbase also created a self custody wallet. But they have trust issues. So, what do they do? They acquire the competition, and don't have compete anymore. If they truly believed in decentralization, I doubt they would do this. They would instead encourage more competition. A little time after the acquisition, BRD wallet app became unusable. It redirected users of the app to a Coinbase wallet to retrieve the assets.

Now Coinbase planning another structural changes to their platforms. They will be discontinuing Coinbase Pro, and merge its activities to Coinbase platforms. I am not sure if the transfer of funds will be automatic or not. But before this happens, those who have assets in Coinbase Pro, may want to do some research and maybe even transfer them to Coinbase in advance to avoid confusion in the future. I don't think assets will be lost. They will probably redirect users to Coinbase platform once Coinbase Pro is discontinued. It seems like finally, they will start offers same low fees for regular Coinbase users as well. Not sure how exactly it will work, but that seems to be the goal.

There was a time when they enjoyed monopoly and could charge whatever fees they like. But now Coinbase will be facing new challenges, because more and more competition is emerging. And they won't be able to just acquire them. For example, Robinhood has been busy integrating crypto wallets to their platform, while they continue offering zero fee trades. Before Robinhood didn't have real crypto wallets. Those who traded crypto on Robinhood wouldn't be able to transfer coins elsewhere. Now users of Robinhood can transfer coins to and from Robinhood wallets and continue buying and selling them for zero fees. I know, Robinhood doesn't have the greatest reputation either. But when it comes to money, people will still consider cheaper options.

I haven't used myself, but I heard Binance has been offering zero fee for bitcoin trades for bitcoin/stable-coin pairs. That is another interesting development that will create competition for Coinbase. So, they will have to reevaluate their business model and fees. It is great to have competition in the space. Fair competition creates better trading and investing environment and options for ordinary people. These are just my thoughts. They may or may not be accurate and they are obviously not financial advice. Let me know your thoughts in the comments.

Posted Using LeoFinance Beta

Some for me for ETH. Saw this new coin popping up at $ 15. Good days!

Ha, didn't know that. There's always something new to learn!

👆

That smells like the good old Microsoft

Ya, got screwed during the gamestop case. Not a fan either..

Let's just hope that the insider trading news together with a rejection of the 30K level towards lower resistance levels does not put them legs up like Voyager and Celsius. It would send BTC down to 10k 😵

I wouldn't mind seeing btc at 10k.

Coinbase is a disappointment.

They have made a tremendous amount of money, and accumulated a lot of clout. They could use the infrastructure and marketing apparatus for good at this point, because you only need one mansion, and it’s practically impossible to spend a billion dollars in one lifetime on your daily needs, even if your extravagant. But some become obsessed with amassing wealth by any means possible, and they attract workers who are the same. They will die a slow death evoking irrelevant if they keep buying and destroying innovative platforms, while creating none of their own. They can coast on their laurels, but they will be consigned to the trash in of forgotten historical figures unless they change their ways.

Posted Using LeoFinance Beta

Greed is a strange thing. More you feed, bigger it gets.

Yep, reminds me of the American Indian proverb, ...we all have two wolves inside, and the one that you feed is the one you will become.

Posted Using LeoFinance Beta

Coinbase started as great potential. But its disappointed lots of users. I no doubt that the CEO has made a lot of money at the shareholders expense !

I strongly suspect that if they are doing this, should they encounter any "runs on the bank" they'll just throw up a technical difficulties message.

Recently I sent some ltc to a friend's Coinbase account. 8 hours later I asked if he got it. He hadn't, but it showed up seconds after he entered the help chat, which was also having issues.

This post has been upvoted by the VYB Curation Project

wow, 8 hours is way too long for ltc.

Yes, and what a coincidence that it arrived soon after it was being looked for... Made me wonder if it ever would have been added otherwise.

The insider trading was quite bad because the CEO went on air saying that they weren't going to let insider trading happen again. Of course, this was a fail as the greedy people still continued to insider trade. I think they tend to follow the approach of doing nothing until they are forced to.

Posted Using LeoFinance Beta

I think those happen in the stock markets as well. I have a Coinbase account and I did KYC years ago. However, I have never traded there and some months ago they sent an e-mail saying I had to do KYC again. I found it suspicious anyeay.

Because coinbase was the pioneer for bitcoin/fiat conversion so they made the most of it by charging high fees.

Many organisations start with good intentions and words but then they do not lead by example.

If coinbase took actions against the employ only after scrutiny by someone in the public, it simply means that they want to protect their reputation and not necessarily providing the crystal clear system to the customers

I'm not use long time for coinbase.

honesty is difficult to find in the crypto space

Some ppl are so dirty.. do anything for money! :(

The rewards earned on this comment will go directly to the people( @geekgirl ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.