The SPS airdrop ended last month and you can now earn SPS by providing liquidity to specific pools in Splinterlands. It took me some time before I finally decided to go through with this but I believe it's a good way to go forward. There are some risks to doing so but I have decided to go through with things as I believe in Splinterlands.

Liquidity pools

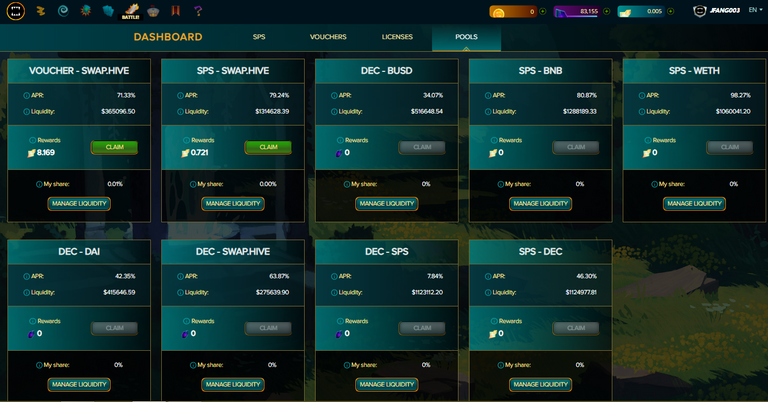

Above is the list of pools that you can on the SPS management page. It shows the current in-game rewards for doing so and the current in-game APR for providing liquidity. I just decided to do the simple way of converting some of my own SPS and VOUCHERs in-game into their respective SWAP.HIVE pools. This means that I converted half of my tokens into SWAP.HIVE before providing liquidity into the pools. You can find a tutorial to do this here.

Other advantages of providing liquidity to diesel pools

While there are ways to provide liquidity to the pools outside of Hive, I prefer the ones on Hive because there are some extra rewards for doing so. This includes (1) Existing Diesel pool rewards and (2) Fees generated from providing liquidity. Not all pools have diesel pool rewards because of the VOUCHER/SWAP.HIVE pool that I am in doesn't have any but the SPS/SWAP.HIVE pool does. However, all of them generate fees, and you are rewarded for putting your liquidity there and if people do decide to use the pool.

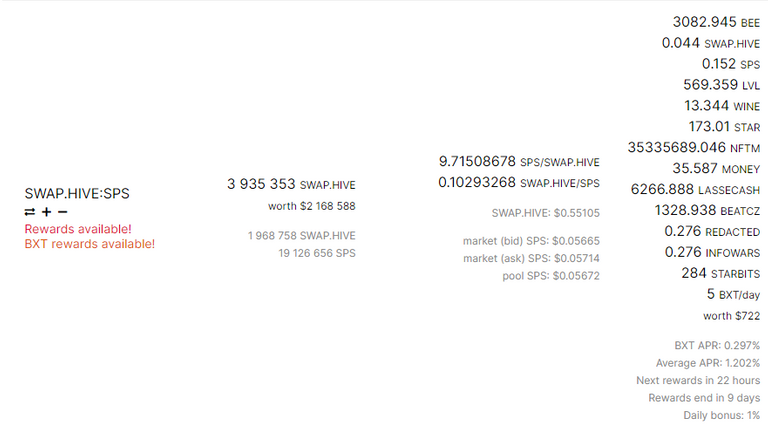

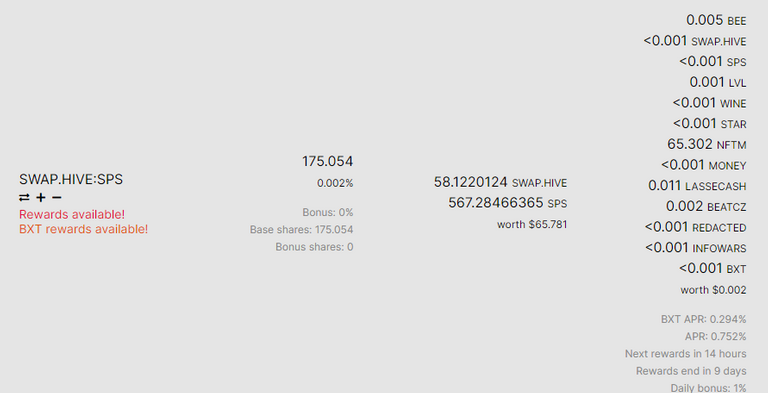

You can use either BeeSwap or TribalDex to see your positions and what the pools currently generate.

As you can see above, the SPS pool gives an extra 1.262% APR and you can also earn some BXT as well. It looks like the rewards will only be around for 9 days and I am not sure if these rewards will refresh again after this is done and there is an extra daily bonus of 1% right now. This means that you will earn 1% more shares in the pool in regards to the rewards being sent out.

You can also see what I will be getting each day as the image earlier was about what the entire pool was returning. Those rewards are rewarded based on your contribution to the pool versus the entire amount in the pool.

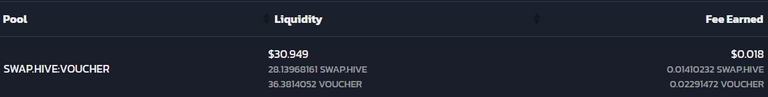

The last bonus reward you get is the liquidity provider fee for anyone using the diesel pool. When a user uses the pool, they no longer have to rely on the order book and they tend to get a better middle price. It also happens in an instant so there is an extra 0.25% charge for anyone in a rush. This amount is proportionally split between the users providing liquidity (based on their contribution versus total contribution). You can find out how much you have earned off fees on tribaldex diesel pool positions.

Conclusion

I like the decently high APRs and I will be taking advantage of it with part of my own holdings from the game. I am not sure how things will play out but I will watch and see how things unfold. I am not sure if I will take the SPS and compound it or take some profit from it though. After all, I don't know how bad the impermanent loss will be.

Are you in any of the Splinterlands liquidity pools?

Feel free to leave a comment if you read my post. If you have any questions, feel free to ask and I will do my best to answer.

Posted Using LeoFinance Beta

I am not in these pools, and I didn't know they existed. but I will check them out now.

Thanks

Posted Using LeoFinance Beta

Feel free to look into it. It's one of the other ways to get SPS after the airdrop ended.

Posted Using LeoFinance Beta

I'm glad you wrote this. I've been deciding whether to do these.

Posted Using LeoFinance Beta

I hope it helped and I decided to throw a little bit into this. At least I think it will pay off over time.

Posted Using LeoFinance Beta

Nice! Somehow I missed this announcement, and it was a nice surprise to find a new claim of ~15k DEC

Were you in the DEC pools? I only get SPS from VOUCHER and SPS pools.

Posted Using LeoFinance Beta

Yes. From the old times of Airdrop, I had a share in the DEC-HIVE liquidity pool.

I am in the Diesel pool, yet to go in on Splinterlands pools but will surely be getting in waiting to see how the SPS from ranked battles will be so I can plan accordingly.

Posted Using LeoFinance Beta

I have a feeling that the SPS price will go down accordingly but I think it should be offset by the trading fees that I get in that pool.

Posted Using LeoFinance Beta

One strategy is to get into the pool you think is the most stable on both sides.

Or as Jongo says, get into pools where your impermanent loss doesn't matter because you're stacking both tokens!

Posted Using LeoFinance Beta

That is one way to do things but I split the VOUCHER or SPS into SWAP.HIVE so I don't think I will suffer as much as someone who funded both sides from their own pocket.

Posted Using LeoFinance Beta

The APRs on these are pretty good and it feels like they will hold a pretty good value for a while. I'm curious if the next step is to introduce a swap page right into splinterlands UI and then the fees collected are divided out to liquidity providers. I have a feeling that would get a ton of action and value.

Posted Using LeoFinance Beta

Yea a swap page next to the pools would be nice or a way of converting SPS/DEC/VOUCHER into the pool directly. This means it will sell half, then add liquidity.

Posted Using LeoFinance Beta

I was in these pools from early on in the airdrop because of the double airdrop points. I sold out of the DEC:SPS pool entirely yesterday though. That impermanent loss was killing me.

Posted Using LeoFinance Beta

I didn't want to touch that pool due to the new changes on the reward chests giving SPS. This means SPS price should drop and DEC price should go up.

Posted Using LeoFinance Beta

After the weeks before being SPS going up and DEC going down, that switch made me whole again. That's why I jumped out before it for crazy again.

!WINE

Congratulations, @imno You Successfully Shared 0.200 WINEX With @jfang003.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/3 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.171

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

So glad you let us know about these pools. I was definitely missing out.

Posted Using LeoFinance Beta

It's been out for a while now but I decided to jump into it now because the APR is still high.

Posted Using LeoFinance Beta

I just moved some SPS over from POLYCUB. from 15% APR to 80% APR

Posted Using LeoFinance Beta

It is nice that more user are exploring the pool.

I am preparing my sheet to understand , how much I am losing orgaining in them.

Posted Using LeoFinance Beta

I just think that the APR there compared to staking is higher in the pools right now and it's worth it for my liquid SPS.

Posted Using LeoFinance Beta

i think this is worth checking out. thanks for the info man.

Posted Using LeoFinance Beta

It's worth checking out if you are interested. The APR isn't bad if you already have some liquid assets.

Posted Using LeoFinance Beta

It surprises me how many people still don't use the diesel pools or know about the ones where Splinterlands provides additional rewards. It's a great idea that you described your experience and what you learned in the process.

Posted Using LeoFinance Beta

I knew about most of it in the progress but I thought that letting everyone know about it was the better decision. After all, it lets people make an informed decision.

Posted Using LeoFinance Beta

Awesome J. I am going to hoard more DEC, SWAP.HIVE & SPS in these pools for sometime and see what happens. It's going to be fun. :')

Posted Using LeoFinance Beta

I prefer to swap half into the asset so I am not taking as big of a risk. At least that is the way I am looking at things.

Posted Using LeoFinance Beta

Pancakeswap SPS-BNB liquidity pool is an alternative.

As it is on the BNB chain, we must use the Metmask wallet.

Posted Using LeoFinance Beta

Yea but I don't like dealing with that over in CUB when I can do it feelessly on Hive.

Posted Using LeoFinance Beta

Awesome post! This seems to be a common topic these days, at least for me, so I'm happy to share and compare ideas.

I have 5k SPS staked in-game. During the airdrop that has brought in some SPS rewards, (and even ow I'm getting around 20 SPS in a week) but now the liquidity pools seem more enticing, so I am about to unstake some, maybe all of it.

So far I have put my DEC and VOUCHERs in the DEC-SWAP.HIVE and the VOUCHER-SWAP.HIVE pools respectively, and I agree: staying on the Hive blockchain is a huge benefit, setting my mind at ease. My positions of 42 VOUCHERs to 33 SWAP.HIVE brought me 8.5 SPS over the last seven days, and my 125k DEC with 157 SWAP.HIVE a reward of 3 DEC, plus the whole list of other rewards listed on BeeSwap.

The other pool I have been in for a while is SPS:SPT, simply because I wanted to use my SPT for something. There I have paired 763 SPS with 57k SPT, giving me about 2,760 SPT last week. This is where it gets interesting, as I need to think about how / if I want to reorganize it.

One option is to get out of the SPS:SPT pool entirely, and convert those funds to SWAP.HIVE to pair with the SPS. Or I could just leave it, letting it generate more SPT. On the other hand, it will certainly take some time to gradually unstake my 5k SPS, so it may be a good option to have something else to convert into SWAP.HIVE.

At the moment I am very certain that I want to unstake my SPS, so I'll do it right away. And I may as well unstake it all, since I can always re-stake it immediately if I want to. This way the increments will also be bigger. The 78.73% APR sound really nice, but by the time I unstake my SPS this may have changed.

Anyway, just wanted to share my thoughts, and would love to hear your thoughts about it.

Posted Using LeoFinance Beta

I think the APR between SPS staking and liquidity pools will become close eventually. So I think it's better to put the liquid assets and take advantage of the APRs right now as they will drop over time. It's hard to decide which pool is better but ideally, you want the exchange ratio to stay the same and also for it to have a lot of trading volume.

Posted Using LeoFinance Beta

It's a balancing act for sure. And diversifying is always good. For now I have put my SPS:SPT funds all into the SPS:HIVE.SWAP pool, and unstaked my in-game SPS. Let's see how things look in a week (not to mention in four weeks, when all of it gets unstaked).

Thanks for sharing! - @alokkumar121

I am not not sure I understand this entry:

Please explain.

Thanks

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta