Square, the payments company with Jack Dorsey as Chief Executive has announced its intentions to acquire Afterpay, the Australian based "Buy Now, Pay Later" industry leader in a deal worth $29 billion US ($39 Billion AUD). The deal (if approved), is the largest corporate takeover ever in Australia.

The Board of Afterpay have unanimously recommended shareholders accept the offer, which will see Square stock gain a secondary listing on the ASX. Afterpay's founders Nick Molnar and Anthony Eisner intend to stay on with the firm, as it gets integrated into Square's Cash App and Seller ecosystems. The deal would see The pair end up with around $2.6 billion worth of Square stock each, and cap a remarkable rise from a start-up in 2014.

My Afterpay adventures.

In December last year I posted about Afterpay, and described it as my best ever investment so far, and I'm delighted to report that the small holding I retained in Afterpay is still sitting happily in my Retirement fund. You can see that post here.

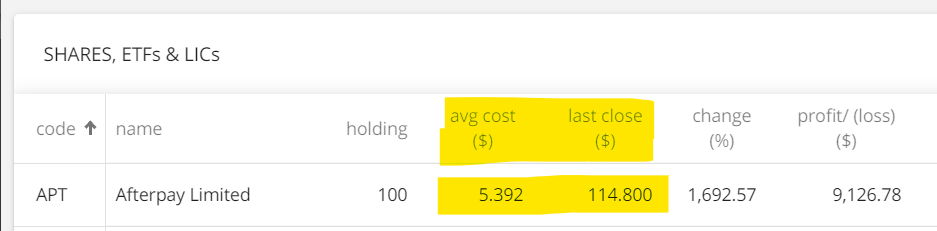

I did hold a lot more, but steadily sold of as the stock rose from my $5.392 average entry price to its highs, to be left with just 100 units currently. Still, those 100 shares will translate to 37.5 shares in Square once the acquisition happens, expected to be finalized early next year.

The news:

The deal has been well received in Australia, with the rise of the founders and their incredible success story being a common theme. This AFR article is a fascinating look at how the deal was done, and gives a good insight into how the two companies came together:

The two companies kept crossing paths for the next three years. Afterpay was signing up merchants and customers, while Square built its payment terminals network and Cash App, which now has more than 70 million active customers.

More and more, Square’s merchant customers were asking for Afterpay integration on their payment terminals. They liked the Aussie start-up’s pay-in-four offering, and saw it as a way to grow sales.

Here is a couple of other Australian news stories reporting the takeover.

Will Cash App be available in Australia?

Cash app is the flagship consumer product from Square, with a large user base and lots of functionality, including crypto options. The announcements talk about integrating Afterpay into Cash App, and the benefits this will offer. But what is missing is any news on when Cash App will become available to Australians. Once the takeover is completed, Square will have a registry that is around 20% Australian holders of the stock. While it is not explicitly mentioned, surely the partial "Australianisation" of Square would include prioritizing the role out of Cash App to the Australian market.

Australia has shown a propensity to quickly adopt new platforms, as seen by the rapid growth of Afterpay itself. Surely it makes sense for Square to fast track a launch of Cash App in Australia.

Two Disrupters unite.

Afterpay has been a Traditional Finance disruptor since it burst on the scenes. It's simple model allowing consumers to buy an item, and then pay for it over four fortnightly instalments with no interest or fees grew rapidly in the Australian market, where Layby was a commonly used facility and Credit cards carry huge fees. The big Banks didn't see Afterpay coming, and they quickly captured a generation, with Millennials turning their backs on the banks predatory credit card charges and embracing Afterpay with enthusiasm.

In fact, in the early days, it was a common occurrence to see many Australian retailers Facebook pages bombarded by consumers demanding they sign up for Afterpay, and the brand loyalty the service received was remarkable for a start-up. I think the day I decided to buy Afterpay shares was the day I saw thousands of people calling for a major Australian retailer to be boycotted until they offered Afterpay a a payment option. That did it for me, there was something unique about Afterpay, and any company with that fanatical user base in such a short time had to be on to a good thing.

Hopefully, with Square becoming a nearly 20% Australian company (by virtue of all the APT holders who will end up with SQ stock) we finally get the Cash App here in Australia. I'm not as familiar with Square, but it seems to be another TradFi disruptor. I'm just hoping this deal will end up making it possible for me to pay for the wife's Afterpay spending with Crypto.

Imagine being able to buy Bitcoin in four instalments... Hmmmm.... I wonder if Jack will let us Afterpay our future Cash App crypto buys?

Thanks for reading,

JK.

Posted Using LeoFinance Beta

I did not know Afterpay has this much royalty...you indeed picked up a promising stock!!

I don't know how they get revenue, do customers pay back with interest or something?

The Square deal id big and it will benefit stock holders of Afterpay who are getting some square stocks...

I am trying a bit to find other avenues to invest - I really would like to invest on square with Jack Dorsey being so upfront on Bitcoin and doing business related to bitcoin and expanding on it.

He is making the crypto space balanced after the poison involvement of that Elon Musk...

There is too much gossip entertainment in crypto...what a field to follow.

BTW has that gravity dex launched, I read its integrating with some platform and then it will have cross chain defi capabilities.

I am afraid, it looks like that would compete with Osmosis. I don't understand why a stable coin swap stuff and pool combination is not there in Osmosis.

It may lose out with Gravity Dex having all DEFI capabilities.

Anyway...

I think lazy pay is similar to this after pay... don't know if its there in other country I brought something with a loan on lazy pay and paid back a day later without interest.

Afterpay is cool. My wife loves it and uses it a fair bit, and I have some shares in my retirement fund, so it's going to be interesting to own Square stock.

Afterpay gets its revenue from charging the merchant a fee. It does also get some late fees from customers, but its mostly merchant fees for its revenue. No interest at all and no fees for customers at all if you pay on time.

As far as Gravity Dex goes, it's a bit of a disappointing launch. The protocol is live, but there is no front-end for it yet. Emeris (being built by Tendermint) will be launching a front end some time soon. So technically Gravity is live, but not really for most of us yet.

I think it will have a role, but Gravity and Osmosis will have different focuses, and I don't really see Gravity hurting Osmosis much. Could be wrong, but I'm quite happy to be building my Osmosis (and Sifchain) positions. Will look at Gravity once it's live (properly) but think I'm likely to stick with Osmosis and Sifchain.

Posted Using LeoFinance Beta

Sifchain is another DEFI on COsmos is it?

Yup, well very soon it will be, enabling IBC likely this week.

Check my last post for more info:

https://leofinance.io/@jk6276/sifchain-s-transformation-is-underway

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

If this purchase is made, will afterpay be extended to everyone? it would be interesting to see something like this and if it could also have crypto options, it would be even better.

Posted Using LeoFinance Beta

I think that Afterpay would be added pretty quickly into the Cash App for its customers, and as a payment option at Square POS merchants. BNPL is a booming industry, with Paypal and soon Apple Pay moving in and Square are buying the market leader instead of building their own.

Not sure about crypto options, there was not anything in the announcements specifically mentioned about crypto. But we can hope.

Posted Using LeoFinance Beta

So just confirming, this will mean that Cash App becomes available to Australians?

Posted Using LeoFinance Beta

Can't confirm unfortunately there is no mention in the announcements to that effect. The focus is on integrating afterpay into cash app, no mention of bringing cash app to Aus.

But, I'd like to think that if 20% of Square ends up being Australian owned, it'd become a priority at some point.

Posted Using LeoFinance Beta

Yeah, I couldn't find anything saying Aussies will be able to use Cash App after the Square deal.

It's definitely a question that people will be asking and an SEO play that hasn't yet been filled by any of the big boys ;)

Posted Using LeoFinance Beta

Should add some more thoughts into this post about that... 😉

Posted Using LeoFinance Beta

That's the dream JK. ❤️🚀

Posted Using LeoFinance Beta