Mirror Protocol is one of the more interesting Defi projects. Let's start out with a basic overview, and then we will dive into some advanced yield farming strategies. Finally we will review the governance module, with its own interesting yield implications for MIR, the governance token.

Overview

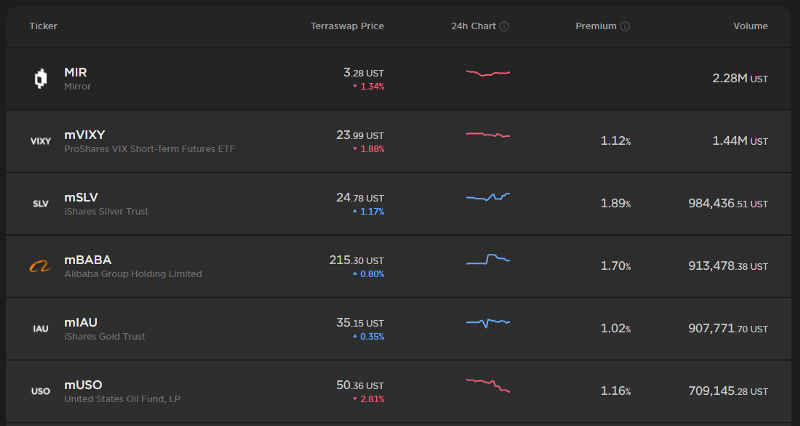

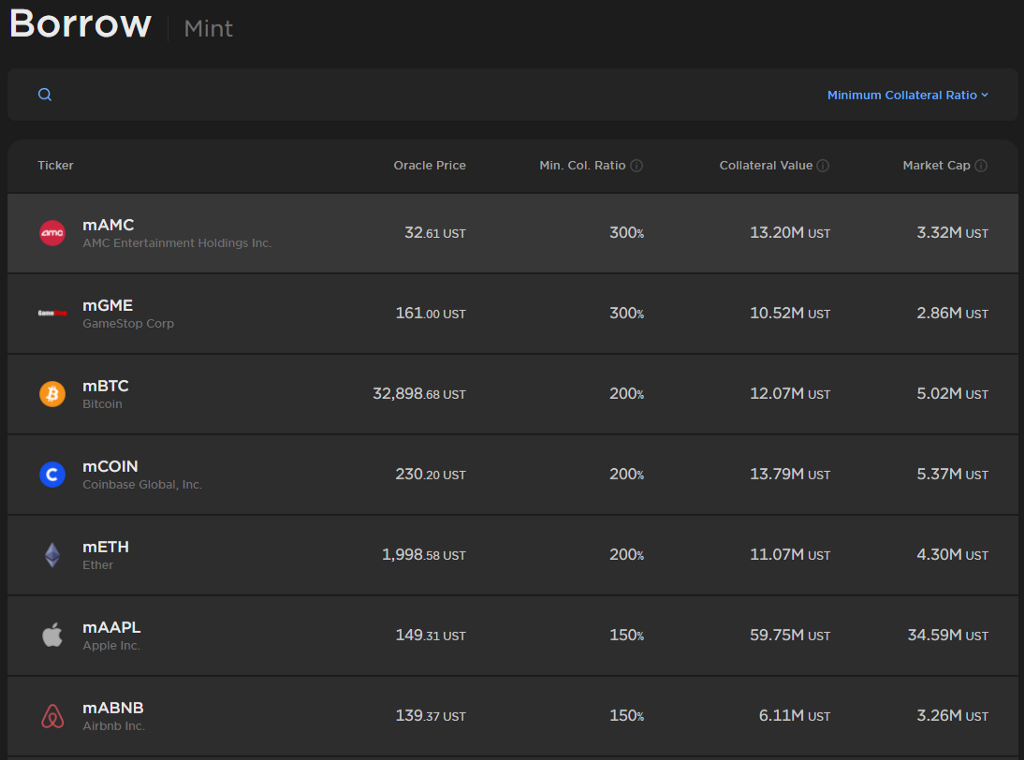

Mirror Protocol is built on the Terra blockchain, and facilitates the minting of 'synthetic' assets. A synthetic asset 'mirrors' the performance of an underlying asset, but is not actually backed by the underlying asset. Mirror calls its synthetic assets 'Mirrored Assets' or 'mAssets', and each token has a little m followed by an identifier that mimics the identifier of the underlying asset it mirrors (mBTC, for example, for synthetic bitcoin). Here are some examples:

Minting mAssets allows you to post collateral in one asset and take a loan in another asset. While this is similar to money market protocols, such as Compound, with Mirror Protocol the borrowed asset is created at the time it is borrowed! Its value is backed by the posted collateral, and the collateral requirements and liquidation processes ensure that the minted asset holds its value.

There are three key reasons why you might mint an asset on Mirror Protocol.

- The primary reason is to enter staking pools (either long or short). There is not always adequate liquidity to take a sizable position for yield farming, so large positions may require minting the asset first, and then adding it to the liquidity pool for yield farming rewards.

- The second reason is to take a short position (Borrow and sell the stock, then buy back later, hopefully at a lower price, to repay the borrow). Some assets on Mirror Protocol may be more cost effective to short than they are using Traditional Finance (TradFi) brokers.

- The third reason is price arbitrage. Mirrored assets trade on the Terraswap Dex, which uses an x*y=k model like Uniswap, but minting mAssets (and collateral requirements) are governed by price Oracles that are provided by Band Protocol. (Later these will also be provided by Link, but the Link integration on Terra blockchain is still a work in progress.) mAssets frequently trade at price premiums to the oracle price, so traders may mint mAssets to capture the price premium, while hedging their position using Traditional Finance (TradFi) brokers.

Version 2 of Mirror Protocol introduced a unique yield farming concept, short LP (sLP) that provides yield farmers additional incentives to mint assets when there is a price premium. This helps keep premiums within a narrow range, and is beneficial to traders because it helps mAssets to mirror the prices of the underlying assets more closely.

When trading and minting mAssets, one should always be mindful of the fees!

Mirror Protocol uses Terraswap for their trading engine which charges 0.30% per trade.

Mirror Protocol charges 1.50% of the minted value (taken out of the collateral) when a mint is closed (borrow is repaid).

You need at least an 0.6% move to break even on a long position, and a 2.1% move to break even on a short position. This may not be ideal for short-term traders with good access to TradFi brokers. For longer-term traders, especially traders without TradFi access, utilizing yield farms over the duration of the trade can create yield, with some risk of "Impermanent Loss."

On a 50% price move, Impermanent Loss from the yield pool is about 4%, so use the pools judiciously, based on whether you think the yields will compensate for that over the time period you expect the price move to take.

Delta Neutral Strategies

For yield farmers, the fees create time-frames over which a pool needs to be held to create income in excess of fees. Since yield farmers might not have a directional view, many opt for the 'delta neutral' strategy.

A 'delta neutral' strategy involves holding a short position against a similarly sized long position, to earn yield from both the long and short farms available on Mirror.

The precise calculations for delta neutral positioning depend on the asset, since some mAssets have different collateral requirements. The simplest examples are mAssets with 200% requirements, because you split your position evenly between long and short.

For our example we will use mGME, because it has a higher collateral requirement and will help us to demonstrate formulas that apply across all mAssets.

Imagine we want to take $100 long position in mGME, and offset it with $100 short position. Since Terraswap liquidity pools require depositing both assets in equal proportion, you will need UST in the same value as your core position (another $100).

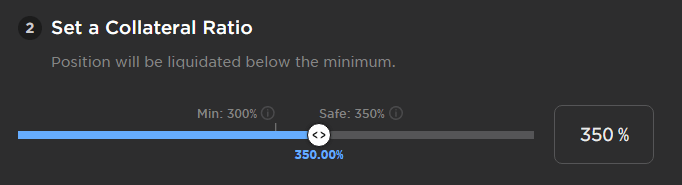

For the short position you will need 'Safe' collateral of $350, or you could give yourself more safety by over-collateralizing. I personally think the narrow range between 300% required and 350% 'Safe' actually makes it riskier for the borrower (safe for the protocol though!) and would set my collateral much wider unless I want to watch it regularly.

Starting out (at 'Safe' level) will require a total of $550 to enter a $200 'delta neutral' position in mGME!

Long LP: 100 UST + $100 worth of mGME

Short LP: 350 UST (or other collateral valued at $350)

To enter larger positions, divide the requirement for each piece by the total required!

350 / 550 = 63.64% allotted to sLP collateral

100 / 550 = 18.18% each allotted to to UST and mGME for long LP.

Things to Consider…

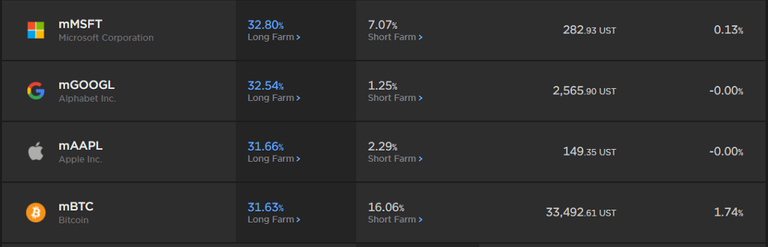

The long yield is calculated using the entire value (40.40% APR on $200 at the screenshot rates gets you 80.80) but the short yield is calculated only on the borrowed mGME value (29.69% on $100 of mGME sold short gets you 29.69). Taken against the entire capital requirement, that 80.80 + 29.69 = 110.49 represents a blended yield of only 20.09%

The high collateral requirement makes the blended yield for high volatility farms less attractive than the yields for some lower volatility farms. This is the impact of capital efficiency - rates shown are not based on the full capital required to capture them, so effective APR may be much lower.

An additional caveat is that APR changes every hour, based on the assets in each pool, along with the premium at which the asset trades, relative to the oracle price.

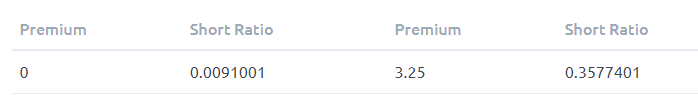

In this snippet (click the link for the full table), Premium represents the % price premium relative to oracle, and 'Short Ratio' is the proportion of MIR rewards for that mAsset that go to sLP providers versus long LP providers. At parity (no premium), the sLP providers get only 0.91% of the rewards, but at 3.25% premium that shoots up to 35.77% of the rewards. That's a 40x swing! That means that when you see short yields of 80% at 3.25% premium, they could swing as low as 2% on the next hour if the premium reduces to 0. This is another reason traders opt out of yield-chasing and let delta-neutral farmers take both sides.

Governance Strategies

Mirror Protocol is governed by a DAO, and stakeholders can stake MIR into the governance module to participate in governance processes. The DAO determines the whitelisting of new assets and manages their collateral requirements, along with disbursement of funds from the governance treasury or 'Community Pool'.

For more information on the mechanics of governance, see the official documentation: https://docs.mirror.finance/protocol/governance

The DAO stakeholders receive irregular MIR earnings from the mint closing fees, as well as from failed proposals. Fees are received irregularly (as proposals fail or as mints are closed) so the DAO earnings can swing substantially.

The APR shown is based on the fees from the previous 15 days, and should not be considered representative of actual earning potential!

In Mirror Protocol v1, it was rare for proposals to reach the 10% quorum required to succeed, so v2 introduced voting incentives - the fees rewarded to governance are split in half:

- Half of the fees are paid to all stakeholders, and compounded automatically.

- The other half is split into separate pools for each of the active governance polls, and pay out to active voters in proportion to the stake that is voted.

This means that if you are active in Mirror governance, you can receive additional earnings that are subsidized by non-voters!

We can think of non-voters as getting half the 'base rate' and voters as getting the whole 'base rate' plus a pro rata share of the half that non-voters are giving up…

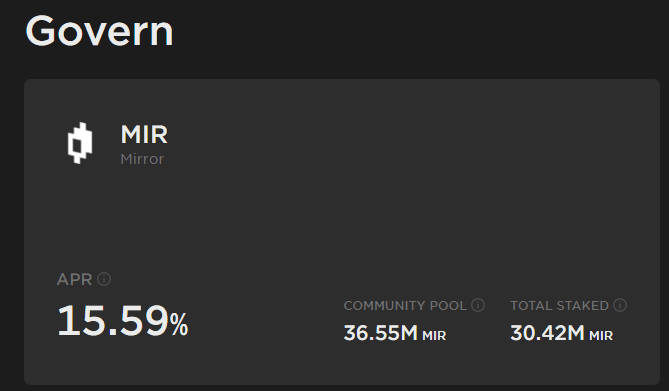

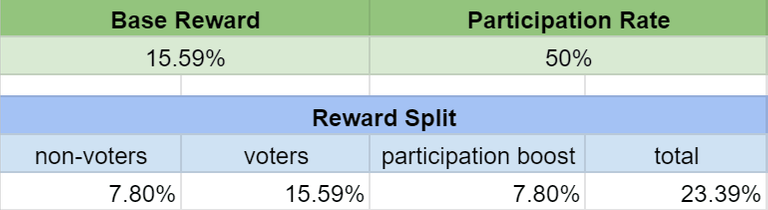

For a quick example, let's assume a base reward of 15.59% as shown in the graphic below, with 50% participation… the non-voters would get roughly 7.8%, the voters would get 15.59%, plus share the other 7.8% that the non-voters are giving up, for a total of 23.39%.

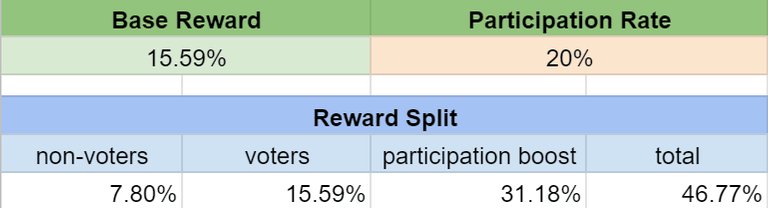

Actual voter participation rate has recently been only 15–20%. With the same base rate of 15.59% and only 20% governance participation, the governance participants are earning 46.77% APR!!

Conclusion

There are as many reasons to experiment with DeFi as there are people experimenting in DeFi. I have shown some reasons Mirror Protocol is interesting, given an overview of how it works, and provided a walk-through of some of the more interesting strategies that have come out of v2.

If you found this interesting, check out Mirror Protocol, learn more about the Terra blockchain, and follow my newsletter!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Savage Corner writers hold crypto assets and actively trade in certain markets.

Cross-posted from Savage Corner; subscribe for free to never miss a post!

Posted Using LeoFinance Beta

Such an educating post on Mirror protocol, from what I’ve read, the concepts seems interesting, it takes DeFi up a notch with the inclusion of collaterizing assets. Personally, I stay away from worlds like collaterization and liquidation especially when they are used in the same sentence, but maybe it’s time I get my feet wet into these things afterall. Thanks for sharing.

Posted Using LeoFinance Beta

My writing focus is on finance education, so that people can safely use things like that while still managing their risks appropriately. At the very least, I want to help people make the right decision about whether a tool is a good fit for their needs or not.

Please don't jump into a protocol just because I write about it. Take the time to understand the concepts and determine whether it fits into your financial picture.

Way over my head but im going to send this @dynamicrypto and I's buddy who is all about this stuff.

I was trying to score a bounty award from the Terra team (which I did not win), so I dived into some material that's a bit more advanced. The next few posts after this one are more introductory.

Our friend has been bragging about his cardano and various other staking pools with a defi exchange That is making him 80% apr a month on staking to rewards pools and something about mirrors. He is even making an extra $50 a month from his tether even. It is wild

"Something about mirrors" could be mirror protocol, so if he's active in their discord I might know him.

There is defi on most major blockchains now though. 80% APR implies annual, not monthly (80% monthly is more like 960% APR. I see yields like that sometimes, but they rarely last long and always come with substantial capital risk.

Yes annual not monthly but because he is restaking profits it is higher monthly he said

Compound interest is a powerful beast!

Yeah, I talked briefly with him a few days ago. If I recall right he got defi tokens or something on the cheap last year