High-Yield is Relative

Let's face it, what passes for yield these days in traditional markets is an absolute joke. People have no incentive to save, and that's by design, because our Keynesian overlords believe we can spend our way into prosperity. For my own purposes, I decided to start tracking the available yield for cryptos I hold, so I thought why not share my findings. But first, let's have a laugh...

High-Yield Interest FIAT Style

'Savings' Accounts

Sure, if your definition of savings is lagging inflation by multiples of your yield.

Src: https://citi.com

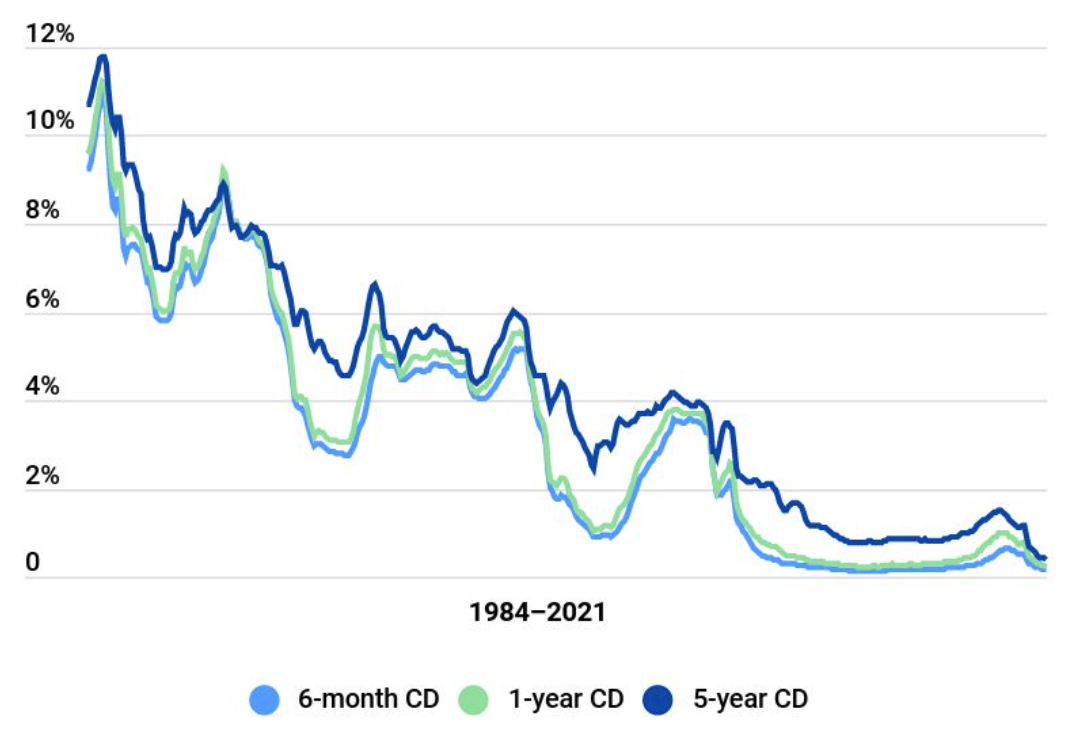

CDs Nuts

Remember when CDs used to be a great place to park some cash? Does anyone remember CD laddering? That's when you stagger your CD maturities so you periodically have cash coming available. Who does that now? Take a look at this for a good laugh:

Src: https://www.bankrate.com/banking/cds/historical-cd-interest-rates/

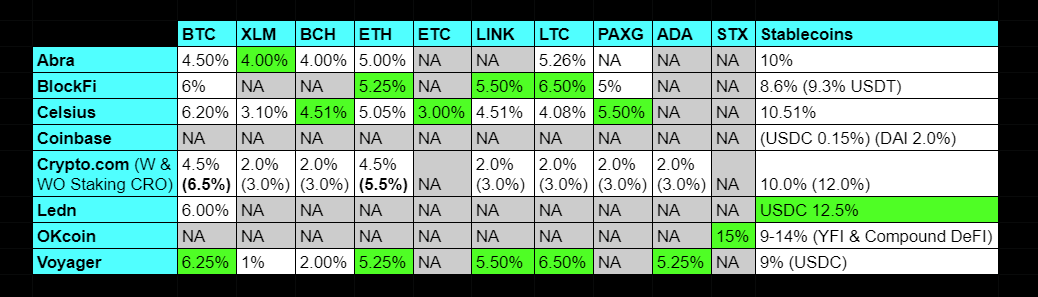

High-Yield Interest Crypto Style

Wow, look what happens when we introduce competition without some central bank dictating rates. We get offered yield! I'm not talking about running a node or doing complicated farming. I'm talking about passive yield, where you just make a deposit and leave it alone. Without further ado, here are the rates:

Let me just add that of these sites, BlockFi is my favorite, because I can receive all my of interest in the form of BTC, without incurring a tax penalty for trading into BTC. BlockFi is also nice for holding liquid cash in stable coins, because you can transfer them right back to your traditional bank account. That being said, I'm not an advocate of putting all my eggs into one basket, so I have accounts on all of these other sites as well. The good news with that is I can chase higher yields as I find them and move my funds around. Crypto.com is my least favorite for that, as getting higher yields requires a lock up period similar to a CD. Crypto.com does support some more obscure holdings though, and also lets me top off my debit card for every day expenses directly using crypto.

Links (Most are referral links)

I'm donating rewards on this post to the Hive Fund, so feel free to use any of the referral links below if this post helped you find a rate for a crypto that you like.

| Site | Link | Referral Program |

|---|---|---|

| Abra | https://www.abra.com | None |

| BlockFI | https://blockfi.com/?ref=4c83ac5f | ($10 with $100 Deposit) |

| Celsius | https://celsiusnetwork.app.link/145846cae2 | ($30 with $200 Deposit) |

| Coinbase | https://www.coinbase.com/join/burman_pq | ($10 with $100 Deposit) |

| Crypto.com | https://crypto.com/app/zfvuhwrsrp | ($25 Staking 5k CRO) |

| Ledn | https://platform.ledn.io/join/ef591ec7737b148ac88f9d96b092ded5 | ($25 with loan) |

| OKCoin | https://www.okcoin.com/join?channelId=600012941 | ($10 with $100 Trade) |

| Voyager | https://voyager.onelink.me/WNly/referral?af_sub5=JOSBA9 | ($25 with $100 Trade) |

Suggestions

Do you have any other good suggestions for passive yield? Please let me know in the comments.

Posted Using LeoFinance Beta

A good summary of options.

For BTC at call BlockFi is the best but I don't mind locking up for 1 - 3 months to get higher rates. I also get an extra 2% on top of the above rates from my CRO staking and I'm earning 12% on that stake too and getting 5% cashback on credit card purchases.

If you split up your deposits so they mature at different times you can make sure you always have money maturing within a week for unexpected expenses.

That's a solid approach! Appreciate your comments.

Hey, go easy on those banks. They increased my interest rate to an eye watering 0.4.... I can't finish that sentence.

Stablecoins and 10.5% interest in Celsius sounds glorious to me! The interest rate for BTC is 4.06% at the moment I think but depends on how much CEL you have.

🤣

I have no CEL, and it's 6.2% for me!

Ah it might be different for you if you're in the US then. Us non-US folk get 4.06% atm. It was 4.74% but I think it's down to regulatory matters...

I gave up on passive yield and have put my coins to good use swing-trading. While I won't disclose what I do, it's a far better yield than leaving them with the methods you use. DeFi I am keeping well away from.

I do that as well, but I'm not really down with swing trading my entire portfolio. I only actively trade 20% at most, the rest is buy and hold, and seek yield on some percentage of that remainder.

Like ADA, XTZ, and ALGO?

ADA is up there. The other two I moved to staking directly, so I didn't think to add them. I will later though.

Would the Dens on CUB Finance count as passive yield?

Posted Using LeoFinance Beta

I would classify that as well as platforms like Uniswap and Cakeswap differently.

I notice you've left out Nexo. Any reason for this?

I only posted about the platforms I've tried. My intent was not to be all-inclusive.