The Funding Rates haven't spiked much at all while bitcoin has been climbing the past few days

There is one metric that many traders like to watch when decided how healthy a price move is, and that metric is funding rates.

In layman's terms, when funding rates rise it means there are more traders using leverage which can exacerbate price moves in both directions.

The current rally in bitcoin isn't being accompanied by a spike in funding rates, which means the move up is being driven by demand for the underlying on spot markets.

In fact, as bitcoin goes over $58k, we are actually seeing a slight drop in funding rates currently:

Why does this matter?

In the short term it means that a "rug pull" type of move is less likely.

When you get a move fueled by leverage, a slight dip can turn into a decent sized dip as they are forced out of their positions due to margin calls etc.

This can have a cascading event where stop losses are triggered and weak hands get scared and dump as well, causing a rather large correction that originally started with just a few stop losses on margin getting liquidated.

This also probably means that the rally is not anywhere close to being over in the short term.

Let the leveraged players pile on after the spot driven rally starts to stall, and they can be used as fuel for the next leg of the rally.

Things looking very good still...

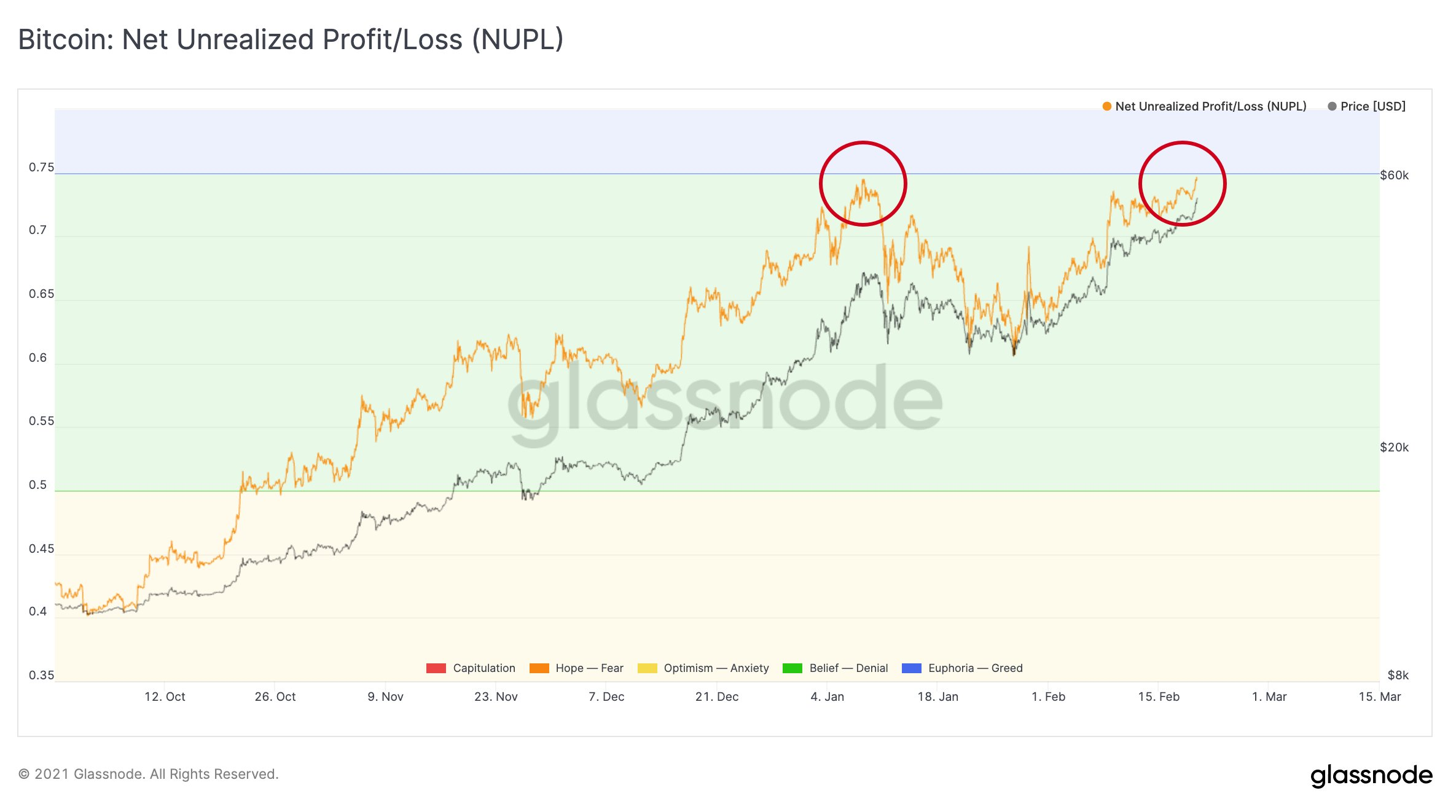

Another neat metric relating to the current rally is the fact that NUPL is just now getting to where it was back around $41k.

Check it out:

(Source: https://studio.glassnode.com/metrics?a=BTC&m=indicators.NetUnrealizedProfitLoss&resolution=1h)

The technical reset on that recent dip and have plenty of room to run now.

The current NUPL is around .74 with a top in a trend usually not occurring until the NUPL goes above .8 or so.

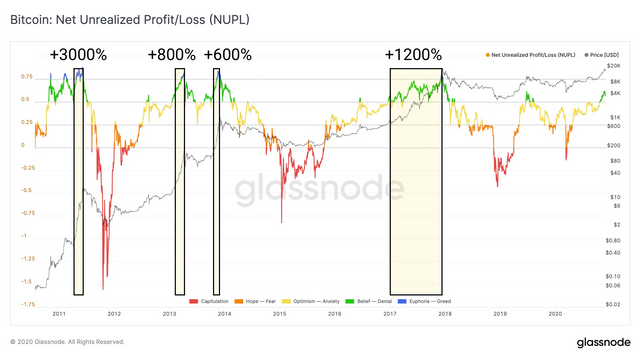

Here's some historical precedent:

(Source: https://studio.glassnode.com/metrics?a=BTC&m=indicators.NetUnrealizedProfitLoss)

This implies we have some more room left on this current rally both in the short and medium term before we need to start worrying about a pullback.

I've been looking at a price between $60k-$70k for our next local top for a while now, but we will see if that ends up being the case or not.

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Looks like we just got hit with a bit of a correction this morning. I am sure our feeds are going to be flooded with that most of the day!

Posted Using LeoFinance Beta

Yep, that was a bit surprising given the low funding rates. Though it probably means that was the lows already. On another note, wWe were due for a 30% correction anytime between $58k to about $70k, I was just hoping it would go over $60k before it started. We will see if this is the beginning of that or if it's already done.

There still seems to be a bit of uncertainty, so we could definitely head back down I guess. If this was the 30% correction the majority of it seems to have passed fairly quickly!

Posted Using LeoFinance Beta

Well, it's only been about 18% from peak to trough, so if it is the 30% correction, it's not over yet. Personally I don't think it is (a 30% correction), I think that $48k touch was the low, but it's possible it wasn't.

Good Point!

Posted Using LeoFinance Beta

Not much of correction in a psychological terms. BTC is more or less on the same level it was before the weekend (when nothing was supposed to happen).

Posted Using LeoFinance Beta

Yeah, for sure. I don't really feel as bad about the movement today as I thought I was going to.

Posted Using LeoFinance Beta

You are going to be waiting for quite a long time...

Where will you buy it?

A pullback is not a bubble popping. There's still another stimulus plan on the way and the FED isn't going anywhere. This thing is going to inflate a lot more than this before it's all said and done.