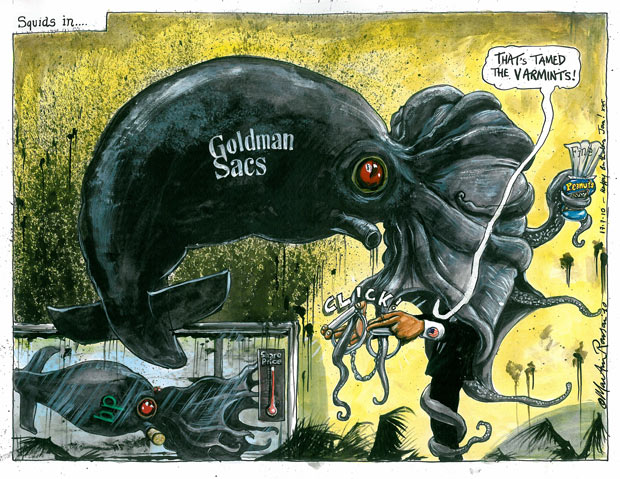

The Vampire Squid has done a full 180 degree turn on crypto

Rewind the clock several months ago and bitcoin put out a lengthy report to their clients where they specifically mentioned bitcoin and crypto.

Their final conclusion was that it wasn't an asset class and didn't recommend it to clients.

Rewind the clock a bit futher and they were just as dismissive of bitcoin and crypto.

Well, in news out today, they have hired someone to manage their blockchain/digital asset division and are contemplating creating their own coin...

Say what?

This reminds of the long standing quote that has been uttered by bitcoin investors basically since bitcoin was created.

It goes something like this:

- First they ignore you

- Then they laugh at you

- Then they fight you

- Then you win

(Source: https://satoshiwatch.com/fringe/lunatic-fringe/videos/fighting-off-great-vampire-squid-bitcoin/)

Some of the specifics...

Goldman has done a complete 180 from where they were just several months ago as it relates to crypto.

Some notable quotes from their recent head of blockchain digital assets:

"In the next five to 10 years, you could see a financial system where all assets and liabilities are native to a blockchain, with all transactions natively happening on chain. So what you're doing today in the physical world, you just do digitally, creating huge efficiencies. And that can be debt issuances, securitization, loan origination; essentially you'll have a digital financial markets ecosystem, the options are pretty vast."

"In securities finance and repo, if you look at those markets, they're ripe for standardization. There's a lot of legacy processes in the vast movement of collateral that makes them very cost inefficient, so by leveraging distributed ledger technology, you can standardize processes to manage collateral across the system, and you have a much more efficient settlement process given the real time settlement."

And the really interesting ones for crypto investors and users...

"We are exploring the commercial viability of creating our own fiat digital token, but it's early days as we continue to work through the potential use cases."

"We've definitely seen an uptick in interest across some of our institutional clients who are exploring how they can participate in this space. It definitely feels like there is a resurgence of interest in cryptocurrencies."

Goldman and JPMorgan are birds of a feather...

If you don't recall, JPM also did a 180 on crypto and eventually launched their own coin as well.

I imagine the move by JPM is what spurred GS to act, though the new head of digital assets did mention there has been a ton of interest from clients again as of late. Similar to what was seen back at the height of the craze in late 2017.

Either way, it's pretty funny how two of the largest banks in the world bashed bitcoin and crypto and now they are endorsing it and even creating their coins (potentially).

Funny how that works out.

Stay informed my friends.

Image Source:

https://news.bitcoin.com/goldman-sachs-bitcoin-cryptocurrency/

-Doc

Posted Using LeoFinance

Looks like COVID and the impending doom set upon the legacy economy may be kicking in soon. More and more companies that said they'd have nothing to do with crypto will be forced into it soon.

I assume JPM is showing cost savings by using their own coin as well, which I am sure is attractive to Goldman.

When corporations realize that crypto is giving them all the opportunity to become their own shadow-banking federal-reserve they'll jump on the opportunity. Soon enough one of these companies is going to create the code that allows any corporation to plug-and-play their own currency with ease. That's when things will get really interesting.

Lol, scrambling like little chicks. This is the one company that I want to see completely destroyed by crypto. Their level of corruption is unprecedented.

I think a lot in the crypto space share your same thoughts...

Ha, finally they see the light of day, eh? After all that trash talking, even fairly recently, they've gone and minted their own coin. Let's see how far they get with that, though I imagine it'll have a much easier time going through regulators that Bitcoin.

Posted using Dapplr

I think they have probably been keeping an eye on how JPM is doing with their coin as well. If they are seeing cost savings, Goldman will want in. Plus the renewed interest in crypto across the board is probably playing a role as well.

That's a good point. The resurgence of cryptocurrencies aren't something that any bank could change, so either Wall Street gets into the hype and make big bucks from it, or they get left out entirely.

Yep exactly. If there are clear rules surrounding what they can and cannot do, they will play ball as well.

I'm just waiting to see when Wall Street and big banks are going to start skirting those rules, just making huge bets with money they don't have. Imagine going through the same housing crisis of '08 again, but this time it involves crypto :-p

Can we crash the price as much as possible? Maybe link them up with the Venezuela coin and sink their bullshit to to bottom of the ocean? The anti-moon coin.

Lol, but squids can swim...

I see this move by Goldman Sacs as being one of two things, either they are seeing the growing influence is having and are doing their best to co-opt it, or they must be greedy SOBs and are just looking for a quick buck since crypto has of late has been seeing a rally.

It's probably mostly number 2. They are trying to make as much money as they possibly can within the the current legal framework, it's basically their responsibility to their shareholders.