Economics 101: as with any fixed supply currency such as Bitcoin, any change in demand for the currency affects the value (price) of the currency. Therefore, the volatile nature of demand based on real world forces and economic conditions cause wide swings in the value of any fixed supply asset. So, any sudden crisis could adversely reduce demand for the currency thereby tumbling the system the currency supports. As demand fades away, the fixed supply currency's value fades away as well causing loss of value to the system. For the little guy ordinary investor (such as myself) this means a loss to my pocketbook.

While the big investors can manage this risk of loss what is the little guy to do? This led me to start researching this question and lo and behold - enter Ampleforth. First off, what is Ampleforth. Ampleforth is an Ethereum software that attempts to maintain itself with a value equal to the US Dollar while providing benefits to its holders by supply manipulation. It is not a Stablecoin per se in that Ampleforth has no collateral backing. Instead, the algorithm reaches a balance by accounting both price and supply in the system. The balance reached does not change the price of the token but rather changes the investor's supply of the token. This is done daily by a process known as rebase.

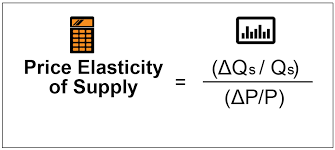

What does this mean? Daily, the algorithm governing Ampleforth looks at the price of the token. If the price of the token is over 5% of the target price, the supply of the token is increased and distributed to the holders of the token. If the price of the token is below 5% of the target price, supply of the token contracts. Thus, a stable price environment is created by virtue of the supply elasticity of the token.

But just how stable is the price of Ampleforth? A look at the six month price chart will give us this answer:

And our answer is, well, not very. Some relative stability does exist for the period October 2020 through date, but said stability is not within the price percentage goals set by Ampleforth.

As a result of the daily rebasing, the little guy ordinary investor's investment is somewhat protected if the investment is held in a long position. Risk is diminished by the supply elasticity if time is not of the essence, and in fact, it is possible to realize profit in this token during periods of price decline.

CONCLUSION

In this writer's opinion, algorithmic stablecoins just have not reached their potential - yet. With further development, it is my belief that the stability necessary for an algorithmic stablecoin to be a vehicle for exchange and valuation (and a replacement for fiat) is in our future. Many tweeks are needed to the algorithms to achieve this goal. But with patience and perseverance this goal is possible. Note, this is one man's opinion and should not be deemed investment advice of any nature.

I am merely an ordinary small investor who likes to share what I've learned through research into the Crypto World. I am not in any way a financial advisor and as such, do your own research before investing. If you enjoyed this article please like it, comment and/or tip. Feedback is always welcome here.

Posted Using LeoFinance Beta

Your post was promoted by @taskmaster4450le

Congratulations @kevinnag58! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 200 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!