.png)

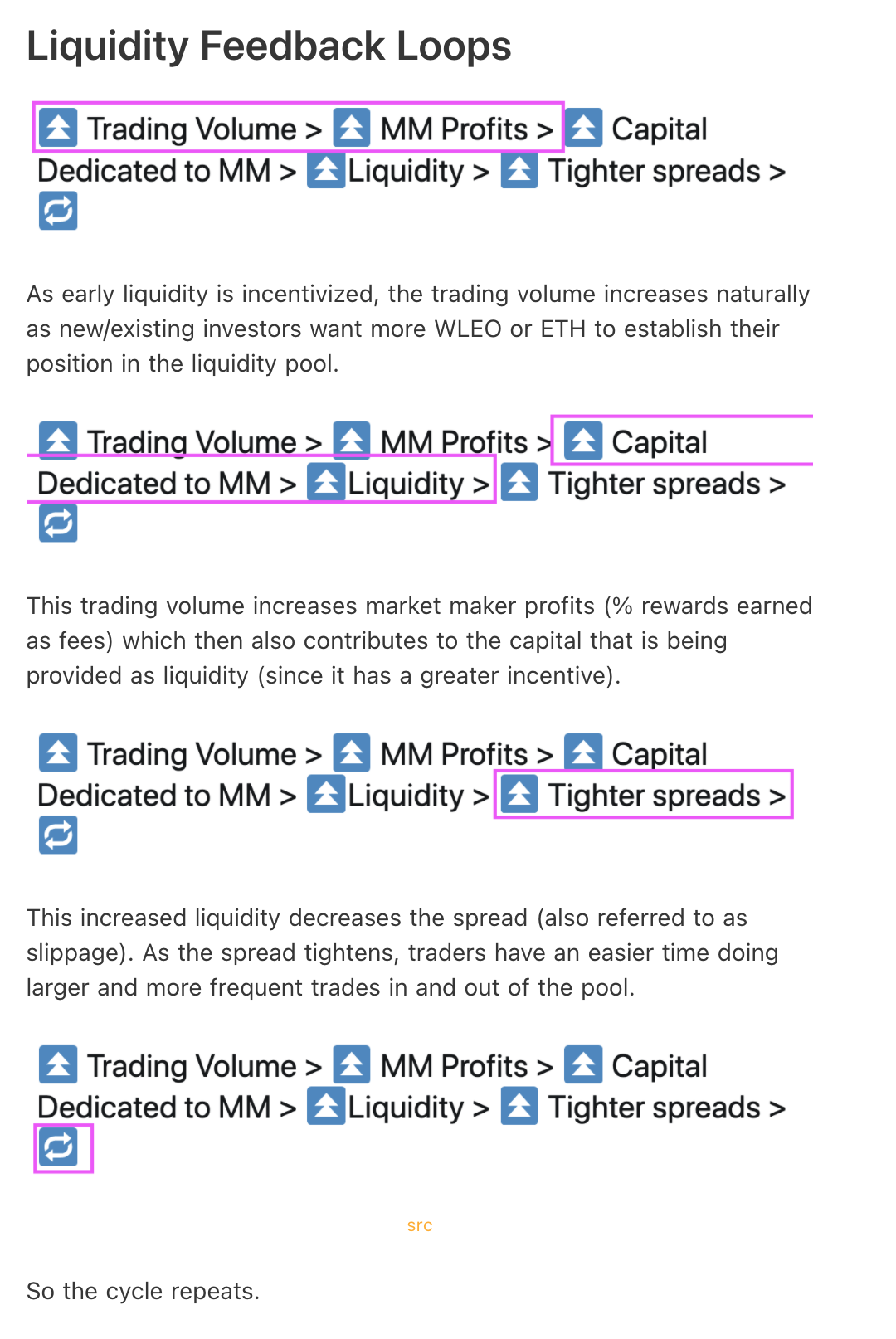

Back in November 2020 I wrote about a concept being discussed in the Thorchain community called "Liquidity Black Hole Theory". The theory itself is quite simple:

In the Thorchain context, liquidity incentives kick off a number of feedback loops to generate more trading volume, more profit for LPs, more liquidity depth and so on and so forth. Back in that post, we had recently launched WLEO on Uniswap (crazy how time flies) and so I related that information to LeoFinance's own liquidity programs.

As part of the LeoAlpha initiative, we're diving into a number of exciting projects in the space. Naturally, Thorchain is at the top of the list.

Protocol Owned Liquidity, DeFi 2.0 and Thorchain Accelerating It's Liquidity Black Hole Model

The launch and success of OHM and the Olympus DAO have sparked a new conversation that is feeling quite similar to Liquidity Black Hole Theory. Many are calling this DeFi 2.0 as we see the emergence of Protocol Owned Liquidity.

Protocol Owned Liquidity in a basic sense refers to liquidity owned by the protocol. A DAO or a series of smart contracts or even an org entity controls value that is captured by the underlying DeFi application.

That value is then deployed as liquidity for various use cases and end goals. The Olympus DAO created a backed token (not pegged) out of their POL and this has led to enormous value capture for their ecosystem.

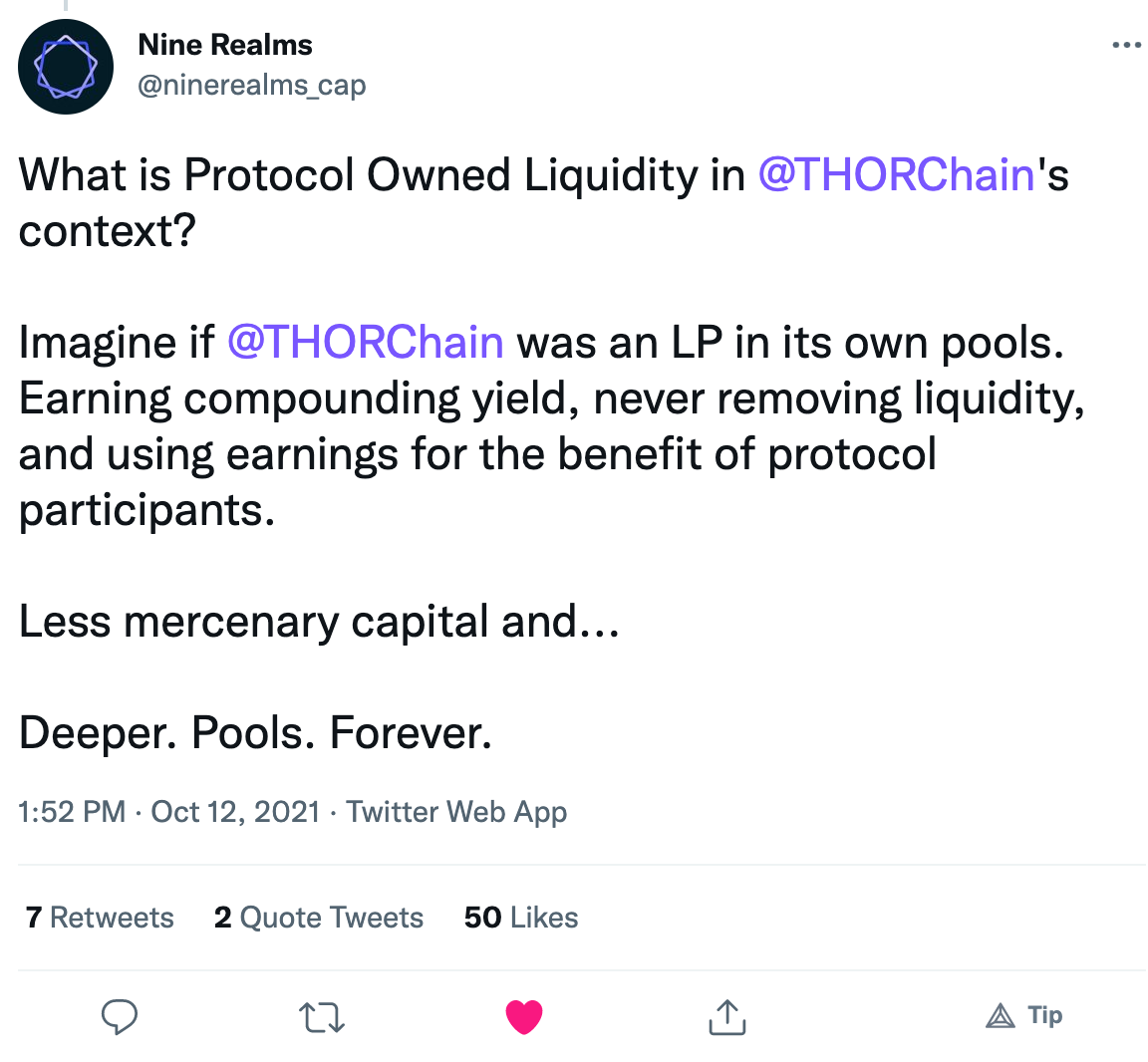

Some in the Thorchain community are now talking about accelerating the liquidity black hole thesis by deploying a version of Protocol Owned Liquidity.

Permanent and Compounding Liquidity

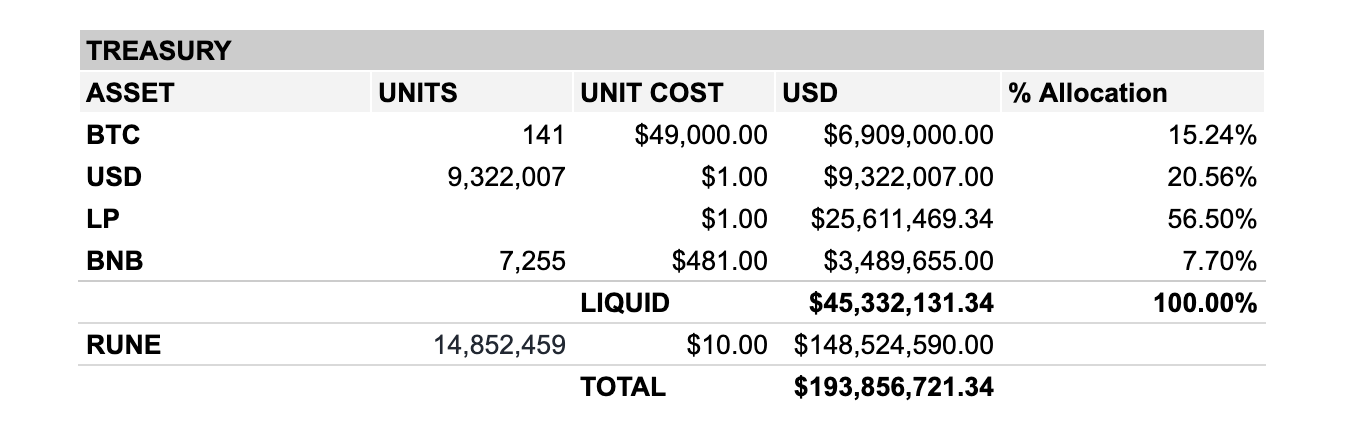

Thorchain has a large treasury of assets. Currently valued around $200m+ according to their latest treasury report:

One form of Protocol Owned Liquidity in the Thorchain context would be for Thorchain to deploy these treasury assets into their own Liquidity Pools on the network.

As the tweet above suggests: the treasury would earn compounding yield. It would never remove liquidity and it could use some of the earnings on POL to benefit protocol participants (i.e. bounties, development funding, insurance, etc.).. Deeper pools forever!

Why do deeper pools matter for Thorchain?

- Deeper pools = greater potential trading volume

- Greater trading volume = greater APY

- Greater APY = deeper pools

- 🔄

What other effects could this have?

- Endless treasury reserves (yield being used to fund protocol development, etc. instead of chipping away at principal reserves)

- Endlessly growing liquidity pool depth on Thorchain

- LP Insurance

- ...

Thorchain on the Bleeding Edge of Crypto

I almost titled this final section "Thorchain on the Bleeding Edge of DeFi" but that doesn't seem ambitious enough to describe Throchain. They're on the bleeding edge of the entire industry.

Thorchain aims to solve the largest problems in the entire space. The #1 issue being transferring crypto assets amongst various blockchains in their native forms.

As it stands, Binance is being heavily regulated.. Coinbase is fighting off an attack on their latest venture to provide yield to their customers..

Regulation is coming but it is not something to be feared. It's something to outbuidl. Bitcoin and the entire industry is about creating unstoppable code that provides freedom and access to the entire world.

Regulation is a good thing: it allows for major participants to join the space (mutual funds, large-cap hedge funds, etc.) and it also forces and reinforces the development of unstoppable protocols like Thorchain.

Thorchain is undoubtedly one of the most well-designed economic protocols in the crypto space. Adding this feature of Protocol Owned Liquidity further deepens that narrative.

p.s. Protocol Owned Liquidity is an important concept moving forward in DeFi. In fact, it's built-in to the PolyCUB Platform being developed by @leofinance. DeFi 2.0 is upon us 🦁

LeoFinance is a blockchain-based social media community that builds innovative applications on the Hive, BSC and ETH blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| DeFi Platform | Tokenized Blogging | Track Hive Data |

|---|---|---|

| Cub Finance | LeoFinance Beta | Hivestats |

|  |  |

| Native DEX | Wrapped LEO (ETH) | Hive Node |

|---|---|---|

| LeoDex | wLEO On Uniswap | Witness Vote |

|  |  |

Posted Using LeoFinance Beta

With the utility that Thorchain offers to the space... Checking for information to see if I can invest...

Because investing in project with use case and utility seem to being a long time strategy to earning good returns from the space

you are right about this exchanges, The idea of Thorchain looks very good but it's a huge project that might take time and needs a lot of factors. I trust the Leo Team anyway.

The world is waiting....

Posted Using LeoFinance Beta

Been observing your post and you have been mentioning thorchain a lot and from what you say about it, I think it’s a good project. I’m about to do my own research right now to see if it’s something worth investing. Thanks a lot for this post.

Nice article! I was going to write about DeFi 2.0 and Olympus. Beat me to it!

I like the concept that they purchase the liquidity using (locked-up, discounted) sales of their native token, rather than renting it through high APY.

It seems a potential solution to "toxic liquidity" (a.k.a. mercenary capital in your quote). Just a better alignment of incentives. Although I wasn't sure it would work for a new protocol, since usually there isn't much market cap to sell until you get the TVL off the ground.

Yeah Olympus is super interesting! You should definitely do some write-ups about it, I enjoy your technical perspective you share in your content

This concept is going to make massive waves in the space. We’re implementing it on Polygon CUB and I believe you’ll start to see it in most DeFi going forqard

Posted using LeoFinance Mobile

Wen LEO pool on THORChain?

WLEO will make an appearance there in the very near future. Currently waiting on ETH router deployment

Posted using LeoFinance Mobile

nice, ETH should restart soon :)

My favorite part of this post. I can’t wait to see the effects this will have on LPs.

Another fascinating realization is the LP insurance part. Like whaaat!

This is great to see

It’s going to have an incredible impact on the sustainability of Polygon CUB.. I can’t wait to see the potential of it!

Posted using LeoFinance Mobile

Me and you 🤝same

Very nice post!

!PIZZA

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@eirik(1/20) tipped @khaleelkazi (x1)

Learn more at https://hive.pizza.

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Hi Khal. At your last AMA a question arose about the LUV token (

at 25:00 minutes). You were right, it's an H-E token. It's a tipping or an appreciation token with this simple goal: to spread love around the Hive blockchain. It has gained daily traction since inception. I just gave you 10 LUV. You can now share the LUV freely in Hive comments using!LUV. Info at https://peakd.com/@luvshares/about. :)<><

@khaleelkazi, you've been given LUV from @crrdlx.

Check the LUV in your H-E wallet. (1/5)

<><

@khaleelkazi, this comment has been manually curated with LUV.

Check the LUV in your H-E wallet.

Is this how we expect the PoL of PolyCUB DeFi to function like?

Posted Using LeoFinance Beta

Yes!

Posted using LeoFinance Mobile