Few days ago, I wrote a post oriented about how LeoBridge is barely going to make a dent on CUB's price, if any, in face of the rampant inflation, futilely remedied by very little, ineffectual burning measures in place. Today, I'm going to talk about what's really going to be a tight bottleneck on what's perhaps going to be the most eventful week for CUB as of the time of writing.

If executed well, what partnerships, and the resultant aggressive marketing it brings to a brand of DeFi, is undeniably powerful in the value it brings to both the price of that DeFi's native token price, and the many projects and collaborations it brings forth to the users of the platform.

The biggest paragon of this practice is ApeSwap, and the numbers speak for themselves. In the short, short span of two and a half weeks, they were able to overshoot the moon from a TVL of $60 million, to a whopping $600 million at the apex of the rally, stabilizing to $450 million at the time of writing. Needless to say, exposure of CUB in the bull market we are in is going to bring nothing but good going forward, and it reflects in the price of the token as well.

There is a saying in the cryptocurrency sphere that Bitcoin, and the coins it exerts its dominance on, takes the stairs upward, but jumps on the elevator downwards in terms of price. This is not the case ApeSwap's BANANA, which took the stairs both ways owing to the fact that , due to its intertwined network of collaborations and connection, it has multiple, very strong and beefy, support levels at every step of the stair. It'd have to be a really bad day for crypto overall if you wanted to see a long red candle across BANANA's price. Nonetheless, it has 10x'd it's price in record time, and is slowly cooling off back to where it was.

Clearly, such massive marketing is in order for CUB, ideally after all the roadmaps achieved and checked off. ApeSwap, in comparison to CUB, does not provide anything of unique value to the table, and has depite that skyrocketed due to heavy speculation. CUB, as I'm sure you know, has inherent value behind it. LeoBridge is a testament to this, Kingdoms is a testament to this, and everything else on the way will be a testament to this.

If ApeSwap was able to pull it off, why wouldn't CUB quadruple that? Turns out, the obscurity of CUB was the anchor behind it all, and marketing is the solution.

Earnings Report

Well, this is the first time I do something like this, go easy on me and my small capital :P

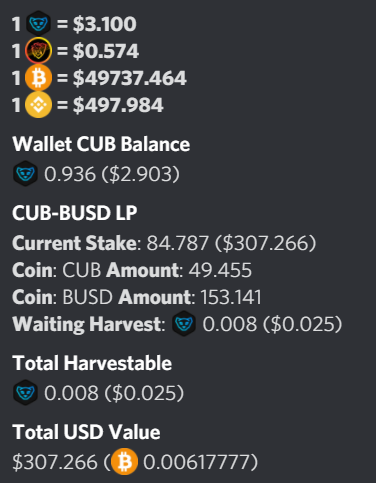

After ditching Publish0x looking for a more rewarding blogging experience, I stumbled upon LeoFinance not too long after CUB was freshly launched. I've since funneled about $307.2 dollars at an entry point of $3.10, as it was ascending toward it's ATH, into the CUB-BUSD farm.

...Which dropped off to about $264.3 at the time of writing and of CUB's current price. My share in the CUB-BUSD pool is currently comfortably churning out 0.87 CUBs ($1.99) daily at the moment. Ever since then, I've accrued $62.1 dollars in CUBs, enough to break even with the impermanent loss involved, which went straight into the pool again.

Now, I know this might not sound all that glamorous, but this really means a lot to me. Especially considering my humble beginnings of incessantly clicking faucets in FaucetHub.io back in 2018 when Bitcoin was trading at $4K, and then moving on to completing surveys on Cointiply for half a dollar a pop. All of which do not even come close to how lucrative CUB is to me, and in comparison to how menial it is clicking a faucet and completing a survey is. In staking your funds inside a farm, you do not have to do anything. Ever since then, I've been an iron-clad CUB investor.

This is amazing, and it's going to be even moreso when CUB finally reverses it's descent in price. I believe we are holding something that's on it's way to become a gem as Khal picks up the pace.

Thanks for reading!

Posted Using LeoFinance Beta

I love Cub and Cub Finance and while I'll always maintain some position here I've been thinking about selling some off recently which is something I hadn't really considered doing when I got in. I don't see this platform growing or gaining attention how I would expect it to or how I hoped which is actually quite surprising because of all the benefits ie the team behind it, user friendliness and the coming bridge and kingdoms. I had hoped the bridge and kingdoms would give us a boost. I'm a little turned off that price and APR are falling it used to seem like when price went up APR fell which at least there was some gain but that no longer seems to be the case. Heck it even seems like Pancake Swap is losing a little steam although its been on a tear lately.

Can you explain the bridge to me? I see we still pay full ether fees so whats the point or whats the benefit?

Posted Using LeoFinance Beta

I understand, man. Thoughts of pulling out and dumping it all into PancakeSwap's recently launched auto-compounding CAKE vault have crossed my mind recently, but the hopium gas is what's keeping my fingers off the sell button. My earnings thus far outpace the decline in price, so that's good. But if CUB reaches $1.5 or below, then I'm pulling myself out of the game.

Regarding the bridge, the benefit it posits to the table is an alternative to Binance's centralized ERC20-BEP20 bridge, which is, to my knowledge, closed off to the entirety of the U.S. users database. LeoBridge provides a solution to this by being a permissionless, anonymous and decentralized in nature. The ETH fee is just to get the funds from MetaMask, or whatever wallet you use, to the bridge bots to handle the bridging. It's just like how they tax you a fee when you buy an asset to convert to another on BSC, like buying CUB with BUSD.

Posted Using LeoFinance Beta

Our journeys seem very similar, I also started this whole thing by claiming free faucets. I still use them but I was able to use those free earnings to invest in a lot of other project that grew massively, and now I'm putting all my earnings from faucets into CUB.

Gotta give a big shout out to Freebitco.in, man. They are probably the most robust, lucrative faucet out there which pays out a nice %4 annual interest rate, I've transferred all my faucet and survey completion earnings to them and kept it there for 2-3 years until i withdrew all of it over to CUB. But nowadays, I've ditched it along with Cointiply once i discovered tokenized blogging, and I've made quite some money in a short span of time compared to completing surveys, which took a lot of time to get qualified for one given i live in a disadvantaged country.

Posted Using LeoFinance Beta