The CPI data that has the most impact on FED interest rate hikes will be released tomorrow. If there is a permanent decline in consumer inflation, the Fed may slow down interest rate increases. The baseline scenario for November is a 0.75 points increase. An increase of 0.50 points is expected for December.

Interest rate increases affect risky assets more than others. Therefore, technology stocks and cryptocurrencies have lost the most value this year. In addition to the level of interest, the uncertainty on this issue also negatively affects the market. We do not know at what rate of interest inflation will fall permanently. Therefore, the CPI data to be announced tomorrow will be pretty critical.

Nasdaq 100

The Nasdaq 100 index does not show good signs technically. As seen in the graph, lower highs and lower lows have been seen in the index for a year. There is no sign that this situation is changing. The index is below the 50-day and 200-day averages. RSI is below 50. A typical downtrend situation.

The price has fallen below June 15 in the last few days. Tomorrow, if the CPI data does not come out better than expected, we can see that the downtrend continues for a long time.

Nasdaq 100 vs. Bitcoin

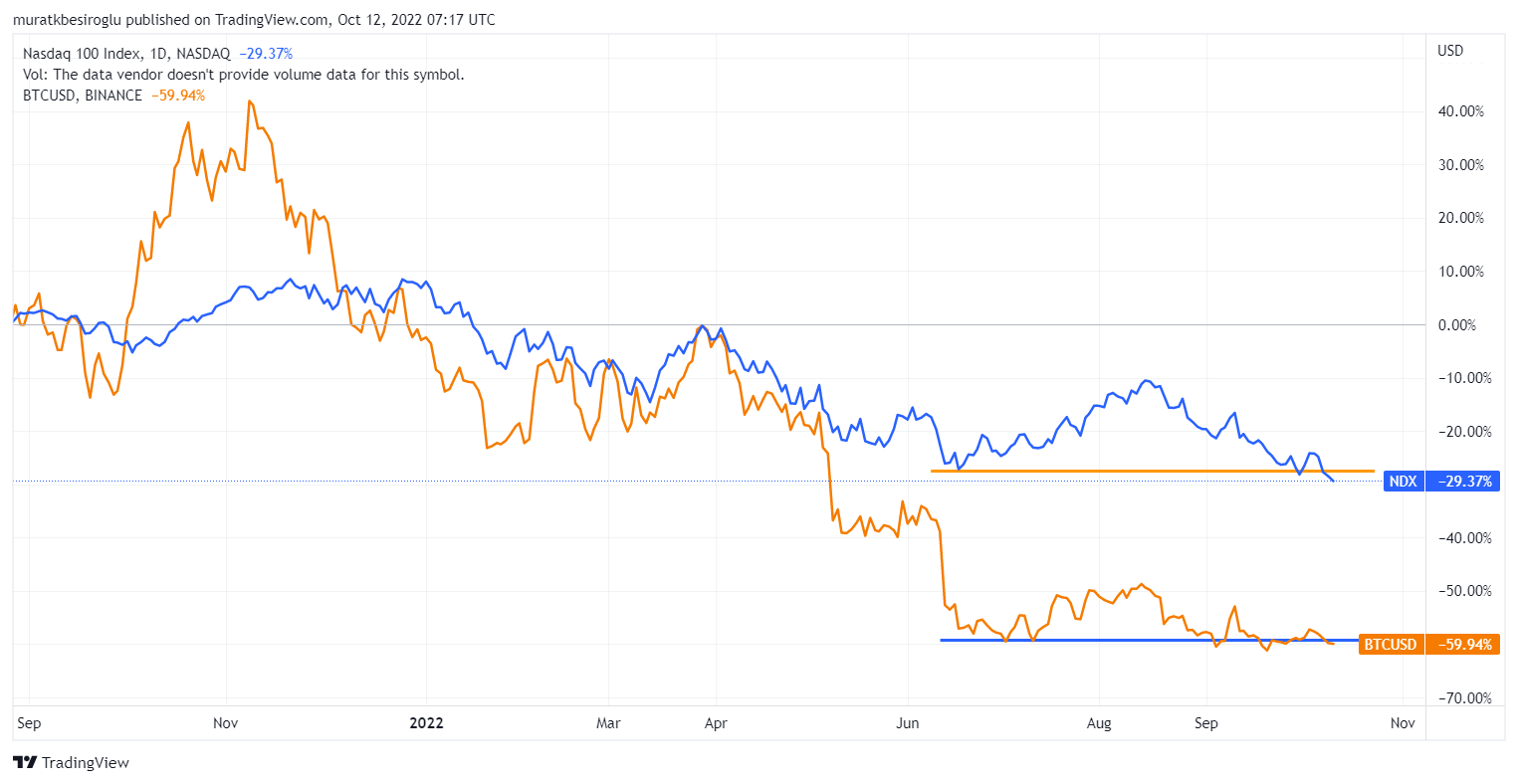

I wonder how the crypto market is performing compared to technology stocks. In the chart below, we see the Nasdaq 100 vs. Bitcoin comparison. The blue line shows the Nasdaq 100 index, and the orange line shows the Bitcoin price. Comparison is made through percentage changes.

From the beginning of 2022 until May, prices have progressed harmoniously. With the collapse of Terra Luna on May 7, the Bitcoin price declined. In June, the Celcius event occurred, and the liquidity crunch in the crypto market triggered price drops. Since then, there has been a sideways trend in Bitcoin price. The Nasdaq 100, on the other hand, tried to rise but fell even below the level where the movement started.

Bitcoin

We saw that things were not good on the Nasdaq 100 front. So what is the situation in Bitcoin?

There is strong resistance in the Bitcoin price at $18,600. The price is below the 200-day and 50-day averages. Daily and weekly RSI values are below 50. It means that the downtrend in Bitcoin continues. A similar scene is seen on the 4-hour chart. In terms of technical indicators, the situation is not encouraging. Technically, the only consolation for the bulls is that the 18,600 resistance has not been broken, even though it has been tried many times.

Hive

On the Hive front, we can say that things are going well. As a constantly evolving network, Hive is trying to resist the negatives in the market. The Hive/BTC chart below shows that Hive has steadily gained value against Bitcoin over the past two years.

So, what is the situation with Hive's dollar-based price?

The chart shows that the price has bounced back at the green 200-day average line several times. It was able to pass the 50-day average in June. Currently, Hive is borderline in terms of the 50-day average and RSI value. On the 4-hour chart, the price is below the critical averages.

Conclusion

The Fed's interest rate decisions are so influential on the markets that technical indicators only become effective when there is no significant news flow. The same is true for crypto, as it moves in correlation with stocks.

On the crypto side, strength accumulates to support an upward move as time goes on. Infrastructures and applications are constantly evolving. The FED will announce the next rate decision on November 1. There is also a Fed meeting in December.

My main scenario is that unless there is a black swan event, the 18,600 resistance in Bitcoin will not be broken. Because the resistances of 40k USD thousand and 30k USD were broken due to the Terra Luna and Celcius events.

The place where the members of a sect shelter, worship, and perform ceremonies is called a lodge. A Turkish proverb says, "who waits for the lodge drinks the soup." It emphasizes the importance of stability. We are waiting for the lodge :)

Thank you for reading.

Posted Using LeoFinance Beta

Yeah, I think has managed to resist the negatives in the market in comparison with steem, it was a total disaster. I think with the Inception of hive from 2020, no one has bought hive and lost from 2020.

I sold all my Steems and bought Hive in June 2021. It was a wise choice.

The problem with the CPI numbers is that nobody can "predict" them, and they are just making a "comparison" between the expected and "real" numbers... And then, markets react to that news, which is a bit stupid... Unfortunately, I'm not too optimistic regarding "stopping" the inflation, but I believe that BTC (and HIVE) will resist and HODL current values... Of course, in the long term...

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

https://app.truflation.com/ shows the U.S. inflation data near real-time, but it is inconsistent with CPI data.

thanks for the information by the way.