Today I want to talk about portfolio management and show you a portfolio that I totally live up to and that I suggest everybody to take a closer look at. This portfolio would perhaps, as I talked about in my earlier post (https://peakd.com/hive-167922/@olebulls/how-you-can-prepare-for-global-recessions) be a part of your economic shelter against the next global recession.

I totally believe that this portfolio, no matter what we are up against in the future, whether it is economic turmoil, bankruptcy, pandemics, or natural catastrophe or even an alien attack (lolz), this allocation will keep you somewhat safe. The only thing you need to do, after allocations of course, is to watch it from time to time an do some rebalancing whenever necessary, I will get back to that!

As I learned at my master’s degree before making any portfolio, we need to create some assumptions.

For those of you that want to build a portfolio it is good to map your horizon of investment and “risk attitude”. Risk attitude being the exchange ratio between risk and return. Thereafter you decide how the capital is to be distributed to the most important asset classes of your choice – I will show you my assets!

Note that this post will not be of any financial advice, I am just showing you what I would do to sleep better at night when I have invested all my money. Imagine having all your money invested and at the same time sleep well at night. Everybody slept well at night back in the 80s, especially in Norway where people had up to 15% savings rate in ye hehe, a bank! Now that is what I call lucrative times. What do we have now? 0.05% on my accounts, stupid, and with inflation of 2% you basically lose 1.95% of your money each year – a good reason to invest your money in a awesome portfolio!

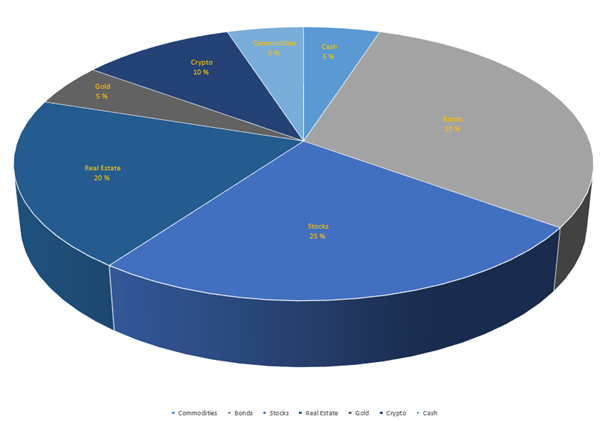

This is how I allocate my assets!

As I wrote in the beginning of this post this portfolio is designed to shelter you from recessions. This is how I allocate my money in time of writing. I got my first inspiration on this portfolio through the finance guru Ray Dalio in 2011. However, for your information I have made a lot of adjustments since then (I do not get the time to give you my whole analysis on how I came to these decisions, but I will give you some points).

This portfolio is designed to withstand almost anything. Based on the performance on similar portfolios thus far, it is quit outstanding how this has performed. According to Dalio a similar portfolio In the last 10 years, obtained a 7.15% compound annual return, with a 5.94% standard deviation. That is quit good for those of you who understand the relationship between risk and reward.

Here is my asset allocation in percentages: (I will not announce every instrument that I have invested in, I leave that to a future article).

• 30 % bonds (long-term bonds and intermediate-term bonds)

• 25 % stocks

• 20 % real estate

• 5 % gold

• 10 % Crypto

• 5 % commodities

• 5 % cash.

There is some interesting truth to this portfolio and that is the relatively low number of stocks. A financial advisor in any country, would probably put every single penny in a high volatile stock. In my portfolio it is only 25% due to the high volatility of stocks (If you want even lower risk, then lower the percentage of the stock you are holding).

Bonds make up the biggest piece of this portfolio. In short words this will work as a counter for “the stock volatility”.

I put a lot of my money in real estate (20%!) and that is because in the long term it is really minimalizing risk for me. For now I have one apartment that gives me passive income as well as price increase to my portfolio.

I have 20 % in crypto, commodities and gold. Dalio's portfolio suggest 15 % in only commodities and gold but the rise of crypto have really forced me to do some adjustments (Would you not do the same?). With these highly volatile assets, they do well in environments where there is inflation and that’s the main reason why I choose them (there are also many other reasons why I have crypto, but it will go too far to discuss that in this article).

I have 5% in cash, and this is just for monitor purposes. If some of my assets where to fall- or rise dramatically I will use my cash to adjust the portfolio. I will also make sure that this post is ALWAYS 5%. Tip of the day: Always have some money ready to be invested in your portfolio, based on experience you will need it from time to time.

I have to conclude that this portfolio makes me sleep better at night. Whether it is bull season or bear season this portfolio will give you a stable ROI (Return on Investment) that eventually will get you wealthy, if that was your goal. It is worth mention that this portfolio is also incredibly fun to monitor – look at it as a game keep your assets balanced!

So, let’s talk a bit about rebalancing this portfolio before I end my article for today. It is suggested that once every month you would do a rebalancing of the portfolio so that you can maintain original asset allocation. Let us quickly recap what I mean about that; it is the process of modifying your asset allocation as the amount of money in each investment fluctuates with the changing market. You will need to work with asset allocation – how fun!? 😊

The first thing you want to do is to find your target allocation. When you have decided how many percentages you want in each asset, stick to it, and play the game. After that you just need to ask yourself questions like “how has your portfolio changed since last time? Which stock went upstairs, and which stock went downstairs? That easy!

Case: BTC (Bitcoin) went through the roof in early 2021, how do I rebalance in order to get back to my target allocation? Hint: You will definitely buy or sell to get your target allocation. You actually have two enormously different choices;

- Buy more of the other assets (the expensive one) in order to rebalance.

- Sell BTC and reallocate to the other asset groups (the cheap one).

Whatever suits you! Once you have reverted to your target asset allocation, Voilà! You have successfully rebalanced your portfolio and you win the game!

Portfolio management has been the subject of major changes over the past decade. Hopefully, this article threw some new perspective to what you might do today!?

Have a great evening and weekend people!

Ceep calm and show me your assets!

Cheers

-Olebulls

Posted Using LeoFinance Beta

At least you can count on gold to help maintain stability when other assets increase rapidly!

Jokes aside, I think this approach is what most people should aim for. Especially in a time when "everything is in a bubble". Some are yelling for a housing crisis, others that the stock market is way overpriced and due for a correction, plenty think the cryptocurrency bull run must eventually see a correction while cash is like toxic to one's wealth at this point...

In this case, I think the balance you describe is the best option: Decent returns while also being protected against harsh falls in one or two of the asset classes.

Myself, I'm probably way more risk tolerant and happy to have all of my wealth in equity/index funds, crypto and single stocks 😂. Although it does seem to add more wrinkles.

Hahah totally @fredrikaa ! Thank you for supporting my opinion of a balanced portfolio in these uncertain times. You make some great points her Fredrik. So if you are in doubt in where you are putting your money for the future, reallocate to this "setup" and I beleive you will do just fine! Aswell as staking HIVE here your good my man haha!

Very interesting, my repartition is more something reckless like 95% crypto 5% stocks. I need to balance everything one of these days.

@howo In these times it is a good allocation! hahah! Now you have the chance to do some great allocations :)

Hahahaha high risk high reward is my motto. I guess I can afford to do these kinds of things because I'm young and without kids, if it all goes to 0, well I'll still have a job and just lost a few years of saving which is not the end of the world

Exactly, we are still young! It is now we can fail and not when we are 60 hehe :)

Wise words @zdigital222 :)