*Note: the article is based on my personal opinion, it is not considered an investment recommendation *

Bitcoin first surpassed a market capitalization of $ 1 trillion on February 2. What Bitcoin has achieved has attracted a lot of attention, with the king of digital money reaching a market cap of over 2021 trillion dollars in just 1 year, long before many other famous names. For example, it took Microsoft 12 years, Apple 44 years, Amazon 42 years, and Google 24 years ... to reach 21 trillion dollars.

Specifically, Bitcoin did this without any support from private investment banks or the government.

Bitcoin enjoys a lot of strong support from people. Indeed, Bitcoin is first and foremost everyone's money, supported by everyone. More than 100 million people currently own Bitcoin. This number seems ridiculously small because in the next few years more than a billion people will join and regain their monetary power with Bitcoin.

Many people wonder if Bitcoin's capitalization is too high or not

As I write this, the market capitalization of Bitcoin has even surpassed the $ 1.1 trillion mark. The question many ask is: Is Bitcoin (BTC) too big to fail now?

I don't know everything, but I will try to explain my thoughts to you.

First of all, you should notice that I specified Bitcoin as BTC in the title of my post, because sometimes someone told me that Bitcoin is not really BTC. They told me about Bitcoin Cash (BCH) or even worse, Bitcoin SV (BSV).

In this article, I only talk about real Bitcoin, the BTC code.

Bitcoin is the biggest giant of many giants

With a market cap of over $ 1.1 trillion, Bitcoin is now higher than the market cap of the four largest US banks combined:

JPMorgan - $ 461 billion

Bank of America - $ 334 billion

Wells Fargo - $ 174 billion

Morgan Stanley - $ 151 billion

In the future, when Bitcoin Price Continues to rise, its market capitalization will exceed the total market capitalization of the five largest US banks combined. Obviously, this is only a matter of time.

The digital currency invented by Satoshi Nakamoto (the father of Bitcoin) is also larger than the market capitalization of China's top 5 banks. Bitcoin also surpasses the market cap of the two payment giants Visa ($ 483 billion) and Mastercard ($ 383 billion) combined.

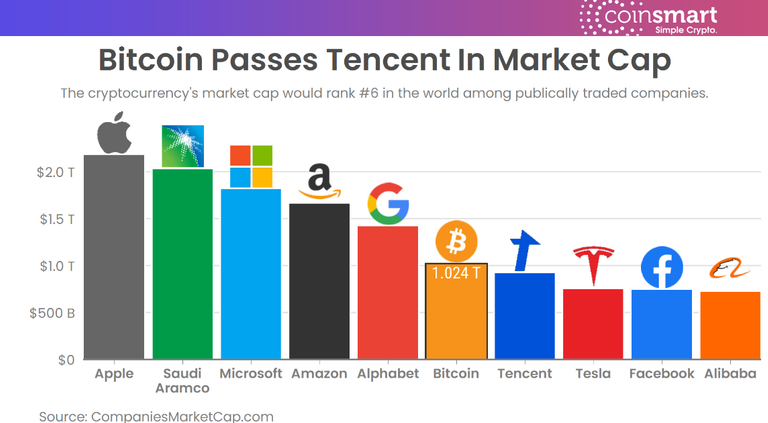

Eventually, Bitcoin surpassed the market capacity of all publicly traded companies except Microsoft, Apple, Google, Amazon, and Saudi Aramco. In short, Bitcoin is the biggest of all.

Now, we come back to the term "too big to fail." This term is often used for the big banks and companies that governments will save because it is recognized that its collapse will cause the global collapse of the economic system.

Strong people will stand out to save these banks or companies at any cost because they have personally invested large sums of money in this business and have too much to lose.

Examples of such rescue packages were seen during the 2008 crisis and the 2020 crisis caused by the COVID-19 pandemic.

However, there is an exception. Lehman Brothers is an example to show the public that those in power in the system are not left alone with the actions of bankers.

Rescue packages are often decided by the central banks of the great economic powers and the politicians who have links with these companies or banks.

Bitcoin does not need governments and central banks to exist

As for Bitcoin, you can imagine that this would not have happened if Bitcoin had collapsed. Politicians, central bank governors, and economists will be happy to say that they have warned people for years about Bitcoin that a dangerous investment will end badly.

However, we can see that more and more institutional investors, large companies, and American banks are starting to invest in Bitcoin.

For now, these investments remain low, but as the capitalization of the Bitcoin market grows and approaches gold, Bitcoin's relationship with the rest of the economic system will become more and more linked.

Strong people, the tycoons of the world, will be forced to consider this because the sharp decline of Bitcoin could have a negative impact on other financial industries.

However, Bitcoin does not need billions of dollars to function like the banks or large companies mentioned above. Bitcoin only needs people's trust to survive and prosper.

Bitcoin is the safest peer-to-peer exchange in the world. Bitcoin is not only supported by the laws of mathematics, but also by its users. These are the supporters of Bitcoin.

As long as everyone trusts Bitcoin, the Bitcoin revolution will flourish. The demand for Bitcoin will continue to grow in the future, as Bitcoin meets the enormous demand of hundreds of millions of people: protecting the fruits of their labor from the ravages of inflation and fighting censorship.

epilogue

In my opinion, as long as Bitcoin continues to maintain the properties it has offered people since its inception, it cannot fail. That is why we must continue to fight for Bitcoin to maintain the monetary attributes that gave it power.

If Bitcoin, for some reason, distorts this original promise, its future will be called into question. But I see no reason for that to happen. Bitcoin will continue to grow block by block. And the problem is not market capitalization, because more and more people believe in the freedoms that BTC offers.

Therefore, the future success of Bitcoin is inevitable. So, you can be sure about the future of Bitcoin if you ever have doubts.

A final note - I trust BTC, I distrust the matrix flies and crows around it. See my previous article about Kraken here: https://leofinance.io/@regenerette/super-krakedjacob-rothschild-loves-the

What do you think?

Thank you for reading,

@regenerette is sending you her appreciation for your time!

Posted Using LeoFinance Beta!

Hey this is your next post and I had a nice read, BTC will not go anywhere, it will be a store of value for many. You told me on twitter to tag me and @tinty.art here.

Thanks for taking the time

!invest_vote

!LUV1

Hey!

Thank you for reading and for your feedback.

I'm sending you a message with the steps on twitter, related to you and her.

Thanks thats so kind!

@solymi denkt du hast ein Vote durch @investinthefutur verdient!

@solymi thinks you have earned a vote of @investinthefutur !

Sorry, you're out of LUV tokens to be sent today. Try tomorrow. (Having at least 5 LUV in your wallet allows you to freely give 3 per day.)

BTC is going after the TAM of money which si well into the hundreds of trillions when you count all the paper money, asset inflation, bonds, credit and derivative markets we have today, This train is only speeding up, so hop on board we going to the moon

Great!

I'll be pumping some more soon.

Thank you for reading.

Must get off Hive the next 3 days and only come in for posting so I get in the city to get some fast BTC from the BTC ATM downtown.

Hugggs!

Oh sweet you have a BTC ATM in your town? Sounds like a trip that could turn into a cool post

!LUV

Here it is. I was just coming back from my head RMN there and I was so dizzy...lol...from one machine to another.

Ty for the love.

Let me try to use it now also, for the first time.

!LUV

Hi @chekohler, you were just shared some LUV thanks to @regenerette. Having at least 5 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV tokens in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares https://ipfs.io/ipfs/QmUptF5k64xBvsQ9B6MjZo1dc2JwvXTWjWJAnyMCtWZxqM

Hi @regenerette, you were just shared some LUV thanks to @chekohler. Having at least 5 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV tokens in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares https://ipfs.io/ipfs/QmUptF5k64xBvsQ9B6MjZo1dc2JwvXTWjWJAnyMCtWZxqM