I've been trying to figure out how much of my stake to put into the WLEO 2.0 Pool.

Details of the pool are in this post here.

I calculated a couple of weeks back that my curation return was around 26%, and I imagine this will stay pretty much the same going forwards.

However, having played around with the the WLEO liquidity pool returns simulator (which is a real thing btw, despite sounding like something out Hitch Hiker's Guide to the Galaxy), the returns seem a bit better.

The simulator provides different returns based on some randomly generated 'other pool providers'.

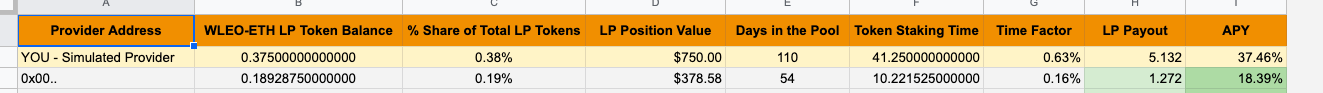

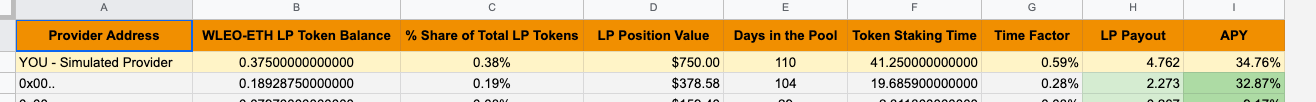

Below are my returns for a simulated 5K LEO staked in the pool for 110 and 120 days respectively - the return averages out at around 36% which is in technical investment terms is proper tasty.

.

.

Don't forget you have to minus the ETH fees for moving and staking your tokens, so minus a few dollars for that and we've still got a WLEO return comfortably in the 30% region.

>26% return with curation for larger stakes?

Now that 26% return curating other people is probably going to remain the same no matter what you stake, HOWEVER, if you're also an author on LEO and you throw in one self-vote a day that gives you a percentage boost.

Also, if you leave a largish stake powered up, say >20k (the more the better) you attract more votes just because you've got a large stake which is visible - come on, you all know the way it REALLY works around here.

The last two factors combined, for me, means it's probably worth leaving most of my LEO powered up, and putting a smaller percentage in the WLEO liquidity pool.

Also, I'm more of a writer rather than an investor, I like blogging, I like to have an active stake, so I'll probably leave most of mine active so I can use it, and put 25% in the pool.

Posted Using LeoFinance Beta

Things are much more complex as it may look at the first.

So what will change after NOV-10 ?

5 How fast the ETH will go UP? Faster then LEO? Or much slower? We can only keep guessing.

And few more factors, smaller, so I don't take time to describe. Plus, I'm not so sure I understand all of them correct.

Posted Using LeoFinance Beta

Thanks for the clarification.

I was wondering about how my curation returns would be affected by the size of other people's stakes - I think the balance situation is reasonable!

According the simulator it makes no difference to my APR whether I go in on day 1 or day 10, although my understanding is as yours, it's better to go in hard on day 1.

It's kind of moot for me anyway as I can't powerdown fast enough to get >5K into the pool from day 1! Not with having to undelegate half of my stake first!

I hadn't considered the price of ETH, that is a factor for sure.

At the end of the day I think some kind of split works well for me, and also just qualitatively I prefer to be active curating!

Posted Using LeoFinance Beta

Interesting thoughts. I was planning 2/3s in the pool and keeping only 1/3, but I am not that often posting financial themes than you.

I think if you post less often, it's probably worth putting more in the pool, so good move I think!

Posted Using LeoFinance Beta

So true, just wondering should I now openly declare whose "alt" account is this account is.

Same here, I like to read and write.

Posted Using LeoFinance Beta

Whose alt account? No idea, I hadn't even noticed you had 100K stake until now TBH.

There aren't too many options as there aren't that many people besides TM and Trumpman who i think just delegate to themselves) who have enough LEO delegated out to make up 100K!

It's funny - I like writing about investing more than investing, I like writing about Splinterlands more than playing the game!

Posted Using LeoFinance Beta

Mine Revise, but it contains delegated LP of others too.

I am avid player of SL though I stopped upgrading my account because it look like SL put so many "upgrades/cards" for players that they can keep investing in SL and still feel should they put further more.

I never would have guessed!

I know what you mean about Splinterlands, I think LAND is exactly the same, just to a factor of 10!

Posted Using LeoFinance Beta

Another variable may be the fees you get as an LP provider for every trade. If there is high activity in the wLeo/ETH pair, this may add up. For a lot of pools in Uniswap this is the only source of income for LPs.

Yes true, generally best to keep those trades >$100, ideally more, otherwise the fees are silly!

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

Congratulations @revise.leo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

So your towel will be in the simulator?

Posted Using LeoFinance Beta

Eh?

You lost me there!

Posted Using LeoFinance Beta

LOL, I guess I went too nerdy there. Always gotta know where your towel is, right?

Posted Using LeoFinance Beta

Ah NOW I get you!

And salted peanuts too.

Posted Using LeoFinance Beta

Another thing you need to consider before you become a LP is that if there is great demand for Wleo and this time not only from Hivers but also from people outside the Hive ecosystem you'll probably end up with way less LEO tokens than the ones you provided...plus there will probably be many arbitrage opportunities as this time, LEO won't be a pair with Hive but Eth...

Yes fair point - I think it will have to be something that's actively managed - I don't think a 5K in will see me losing that many tokens though!

That'll probably be quite a small stake in the grand scheme of things.

I'll probably wrap a few and wait for a decent swap opportunity too!

Posted Using LeoFinance Beta

Everyone going hard with WLeo - good luck guys, you are the example that there's trust here!

Posted Using LeoFinance Beta

I think that your analysis makes sense to a lot of us.

Posted Using LeoFinance Beta