I'm going to have to pay quite a chunk of tax next January, just over £10K I estimate, and since it's money that's already owed based on past earnings (near enough, there's only one month of this current tax year left to run) I figure keeping this amount in as high an interest account as possible is the best bet - inflation won't affect it, in effect.

I set up a 3% ISA account with Virgin last month, that was the best rate I could get on £10K (in fact you can put in £20K), but I also already had another savings account offering 2%.

Now obviously I decided to fill the 3% account first, but I realised a couple of days ago that the 3% interest isn't paid until December 2023, just before I have to pay my tax bill, so there's no compounding effect.

Wheares with the 2% interest account the interest is paid monthly, so it compounds. Although the 2% rate is only up to £10K the it plummets, so you'd only want £9.8K or thereabouts in there.

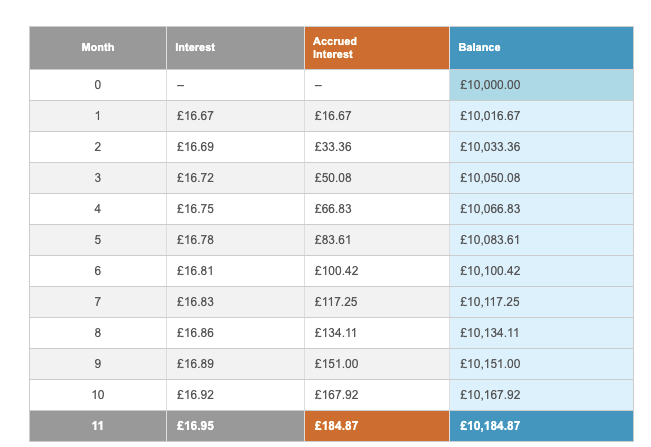

I go to wonder how the two compared and the results are as below, for £10K invested for 11 months with no further inputs...

- 2% interest compounded monthly after 11 months = £10184

- 3% interest compounded yearly after 11 months = £10274

- Difference = £90 in favour of the 3%

The interest on the 2% compounds as below....

So the compounding over 11 months only gives me around an extra £10-15 compared to if the 2% was also compounded yearly.

So for me personally it makes sense to keep the money in the Virgin account, it yields better despite the annual only compounding.

A couple of thoughts

It's the short time scale that makes the lack of monthly compounding on the 3% account not an issue. If I was saving for several years, probably only a few then the monthly compounding would start to be better.

I'm now imagining just how much money Virgin is going to save itself from only annual compounding, I mean on one account it's nothing, but on thousands and thousands, we are talking considerable sums!

I can see more savings accounts switching to yearly compounding, it doesn't detract from the heading savings rate after all!

You didn't think about whacking the lot in HBD savings (l can see you already have a fair whack in there) ?

Or is it literary too much of a tax nightmare trying to get an accountant to figure what's owed on a 20% compounding interest crypto annual apr into a complex tax return 😂

Could also be an FX concern given that he wants to use that money to pay taxes?

God.... FTX. I'm glad i never used that shitshow of an exchange!

Yeah it's not worth the hassle for the short time period!

Hmmm....just curious, is your 3% ISA account similar to a fixed deposit account then whereby you are unable to withdraw your funds till the time they pay up your interest.

First time I heard of a savings account that doesn't at least pay out monthly....

I can withdraw anytime without penalty, I think it's not that uncommon these days, saves them a bit of money after all!

hmmm....so you can withdraw anytime and they will pay you the interest? Does that mean you can manually compound it if you want. i.e. Withdraw at EOM and deposit again?

The interest is calculated daily.

this very low amount, in India we did get the yearly interest of 3.5 % in savings, 6.9 % in recurring amount, and 7.1 % in fixed deposits but I do prefer HBD saving more than others. 20 % is really a good deal for sure.

Those are good fiat rates, but yeah nothing beats HBD!

indeed, and some do give even more 😃, but HBD is unbeatable. 💰

Bank interest rates are pretty crap, even on an ISA, and your money still loses value due to inflation. I may invest more in crypto where I can get 20% or better with not too much risk.

I do have some in ISAs though. Need to spread it around for security.

Oh yes spread the risk, I am a big fan of that! My premium bonds came up AGAIN this month, two in a row. I have this theory that people are selling them because times are tough!

Now we have more Premium Bonds I would hope for a few wins. Had one this month. Mind you, we also had a bit of a tax bill to pay.