Opinions Abound

Opinions Abound

People will always be quick to offer their opinion in regards to a particular matter that affects them. Obviously, there were numerous suggestions offered by the Publish0x community when ETH gas fees initially began to surge and consequently began affecting payments. My own personal opinion is that the platform should have never removed ETH. Cross-chain activity is everywhere and the platform could have maintained its “0x” branding and simply processed payments on a number of viable alternatives. “Earning ETH” is a tremendously powerful drawcard and conveys a very strong message. I personally believe that Crypto participants really need to stop thinking in terms of the base layer. This is 2022 and there are a lot of solutions to various problems such as scaling and fees to mention a few. However, the decision was made and users have seen various tokens come and go.

Statera Is Incorporated

Earlier this year Publish0x chose to add Statera as a rewards token alongside AMPL, which for the first time I haven’t minded earning. AMPL has remained relatively stable during the recent carnage, so it has offered some value. Credit where credit is due and all that good stuff! Statera, on the other hand, has not been performing too well and I will get into a few reasons and observations shortly. Before I do go there, it is important to note the general performance of Statera and not only during its time as an earning token on Publish0x.

Let’s Rewind

In February this year I posted the article, “Is It Time To Begin Thinking About Altcoins?”. What we then saw a few days later was the local bottom for altcoins. Major altcoins went up as much as 75% from this point and then topped out before heading back down. The LUNA fiasco went on to extend that downside to some pretty crazy lows. What I want to address is the performance of STA during this mini altcoin run. Statera delivered approximately 600% to traders who bought the bottom in February. This also happened to coincide with Statera making a shift to cross-chain activities and being available on the Fantom network. when you look at the price history of Statera you will also note that it is performing as an oscillator, which is generally great for and attracts traders.

A Closer Look

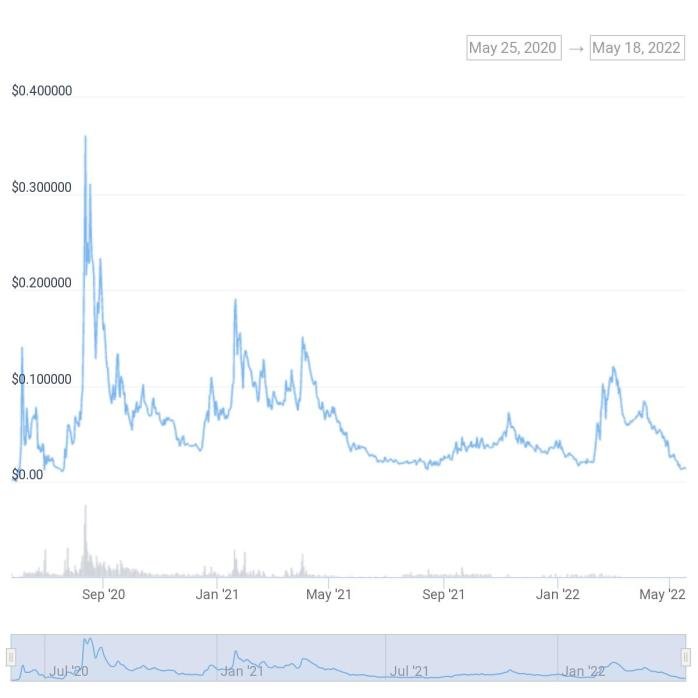

When a project fails or is dying you will see a graph that spikes initially and then proceeds to just continuously hit lower levels. Usually, the lower levels are so low that the graph just begins to flatline. Looking at Statera is rather interesting. Below is the complete performance of Statera, as recorded by CoinGecko. Please note that any performance prior to being added on CoinGecko will not be displayed by CoinGecko. In other words, data that is displayed on CoinGecko is from the time of any particular listing on CoinGecko. All prior activity is excluded.

Image Source – Coingecko.com

You will note that after an initial surge, which is quite normal, the price action becomes subdued. What is also evident though is that STA has consistently risen to significant previous levels. This is a typical oscillator and is generally a very good sign when assessing altcoins. If you view the price action of STA in the Logarithmic chart it becomes a bit more impressive.

Image Source – Coingecko.com

The initial surge is now very clearly visible and shows STA trading in a relatively modest range when compared to the all-time low. At the time of writing STA is up 925420% from its recorded low.

Why Is It Performing Badly?

Quite simply, all alts are performing badly. What also needs to be factored in here is the fact that Statera is a micro-cap. These things get pummeled in downturns. You are looking at a project with a market cap of $1 million dollars! This is tiny and when you actually zoom out the performance is relatively good. Traditionally, blue chip projects perform the best in bear markets. Looking back over the past year reveals that Cardano is down 72%, while Statera is only down 69%! That’s fairly impressive by any standards. One needs to look at something from as many angles as possible.

Final Thoughts

This is by no means a guarantee that STA will pump again but there are some fairly good signs. What you need to understand is that if this market goes lower these smaller projects will suffer. Depending on your investment horizon, this may or may not be a good idea to hold. Personally, I consider the risk/reward ratio very good, so I am prepared to hang on to my STA. This article aims to give you a bit of an overview and nothing more. Please do your own research in relation to your own investment decisions.

Disclaimer

First of all, I am not a financial advisor. All information provided on this website is strictly my own opinion and not financial advice. I do make use of affiliate links. Purchasing or interacting with any third-party company could result in me receiving a commission. In some instances, utilizing an affiliate link can also result in a bonus or discount.

This article was first published on Sapphire Crypto.

Comprehensive list of referral links for platforms & opportunities I utilize to generate daily Crypto income.

Posted Using LeoFinance Beta

Congratulations @sapphirecrypto! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 700 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!