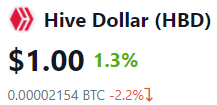

Since the last hard fork, it is worth watching how the Hive Backed Dollar (HBD) performs. The base layer stablecoin is going to be a vital part of the ecosystem going forward. For that reason, it is important that we be aware of how it is operating.

While the peg was lost for a few weeks, it appears to be back in order now. This is going to happen since the market is non-liquid at the moment. With only around 5 million out there before the latest move up, we can see how easy it is for pricing to go awry. With more liquidity comes less volatility.

The fact that there was something like 20 million HBD produced over the last few weeks means there is potentially more stability in the pricing. We will have to see what the exact amount is to keep near the peg. It is possible more HBD is required before we get there.

Conversion Mechanisms

HBD is truly a community driven coin. The production is decided by those who are involved with Hive. There is no algorithm to determine the rate at which they will be produced.

The conversion mechanisms that are in place enable anyone to convert Hive-to-HBD or vice versa. This is a powerful weapon in keeping the peg in place. It enables the community to arbitrage the situation for profit, something that will put pressure on the price.

For example, the reason why we saw a great deal of HBD created recently is the price jumped to $1.20 for a couple weeks. This led many people to convert Hive to HBD and then sell it on the open market for a gain.

It does not take a degree in high finance to see how this will add more sell pressure on the open market. This is the desired outcome. When the price is too high, market forces are needed to push it back towards the peg.

Of course, the intent is to have the same thing if the price drop below the peg. HBD priced at 90 cents is no better than it at $1.10. Thus, the intention is that when the price reaches a certain point, conversion of HBD will take place, reducing the supply. This is the same effect as "buying HBD" providing the individuals with a profit in the other direction.

Let us say the price of HBD drops to 80 cents. Since we know the peg is $1.00, it is safe to presume it will eventually get back to that point. Hence, a trader could see a 25% profit by amassing HBD at this below peg pricing.

Ultimately, having a pegged HBD is vital to the commercial success of Hive. With so much attention being given to stablecoins, having something that is truly decentralized could be a major benefit.

Elasticity And The Hard Cap

For those who are not aware, there is a hard cap on HBD. Since it is a debt instrument, the initial intention is to ensure that the ratio of debt-to-equity did not get too high. Nevertheless, there does need to be some elasticity so that the market can expand or contract the amount of HBD.

At present, this ratio sits at 10%. That means that if the market cap of HBD reaches 10% of the total market cap of Hive, the production of HBD shuts down. All payouts automatically convert to Hive Power and liquid $Hive (on the 50/50 reward option). This continues until the ratio is restored.

As we recently saw, the easiest way to re-align this is for the price of Hive to escalate. Once that happens, the level at which the 10% limit is increased. Thus, even though more HBD was recently created, there is a larger buffer since the price of Hive jump 50%.

This is a mechanism that is hard coded into the chain. Therefore, the only way to change it is with a hard fork. This is out of the hands of the witnesses. We are approaching a time when a discussion of increasing the cap is needed.

To be honest, the 10% looks like an arbitrary number that was assigned years ago. Perhaps in the early stages, this made sense. However, we are at the point now where Hive is a lot more robust than it was when things were originally coded.

HBD for Commercial Purposes

The goal is for HBD to be used for commercial purposes. A stablecoin ultimately used for transactions. The idea is for people to pay for goods and services using HBD. Obviously, having a consistent peg is vital for this end. It is also evident that we are going to require a great deal more HBD.

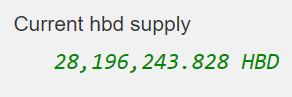

Here is the latest HBD count according to HiveBlocks:

For commercial activities, it is evident that having 28 million HBD is not going to be enough to operate. Of course, this also includes the amount that is locked up in the Decentralized Hive Fund (DHF) which is, for the most part, not liquid.

In short, we need a lot more HBD if commercial activity on a large scale is to occur.

Here is where we see the idea of lifting the HBD debt-to-ratio ceiling. It is starting to see some discussion and worthy to express our ideas on it.

To start, this is something that should remain hard coded into the blockchain, at least for now. We do not know all the attack vectors that are created so it is best to proceed with some caution. Nonetheless, we are tasked with expanding HBD while also protecting the tokenomics of the chain. Security is obviously included in this.

Here we can see how raising the limit to 15% or 20% in the next hard fork is a good starting point. It is something that can be looked at as each new one approaches. If overall network stability is still maintained, the cap can keep being moved up.

In Hive dominance HBD buffer, @edicted formulated some reasoning as to why we need to remove the "training wheels". While removal might be too aggressive at this point, moving it higher with each hard fork could be a viable path.

This will ensure the ability to keep expanding the HBD supply for commercial purposes is there.

HBD Savings Account

During the last hard fork, we also saw a new feature implemented where HBD that is moved to savings is paid interest. This is a rate determined by the witnesses, presently at 10% (do not confuse this 10% with the HBD ceiling which carries the same rate). Therefore, this can be adjusted at any time by them.

It also serves to help expand the supply of HBD. Each month, those who stake HBD receive a payout. This puts more HBD on the market, further assisting in what was described about.

Here a different discussion needs to take place.

With the saving program, a balance between liquidity and attractiveness has to be maintained. The point this occurs requires some experimentation.

We want people to be enticed by the return yet do not want it to be so great that every HBD on the market is shoveled into savings. This would eventually cause a liquidity crisis, negating the utility of a stablecoin.

It is an aspect of the ecosystem needs to provide some stability. All interest earned is paid into savings, requiring one to go through the withdrawal window to get it liquid.

We should keep in mind, this is base layer operation not necessarily focusing upon providing maximum return. There are a variety of benefits this brings to Hive, all of which need to be balanced. If hunt for return is the only consideration, there is nothing preventing HBD from being incorporated into a second layer DeFi application.

Is the 10% paid out in savings enough to pull more HBD off market and get it into savings? At this point, is it even necessary? The utility of HBD in terms of commercial purposes is not present at the moment. However, locking away a fair amount of HBD does provide more stability to the network.

This is something that the witnesses can play with. The medium among the consensus is 10%. If some feel that we need to go higher, they can increase their choice to 12% or even 15%. Certainly a case could be made for experimenting with it.

What are your thoughts on this? Do you think that lifting the hard cap ratio in the next hard fork is a good idea? If so, what should it be?

Also, what is your thinking on the interest paid? What is the fine line because return and still maintaining the utility of the token? Is it 15%? 20%? 12%?

Personally, it looks like we should phase both these up. Take the ratio in, perhaps, 10% chunks. With each hard fork, approximately every 6 months, look at how things are doing and, if the system looks stable, increase it another 10%.

As for the interest paid, a couple percent every quarter or so might make sense. The advantage here is the situation can be quickly reversed if problems arise since it is all in the hands of the witnesses.

Let us know what your thoughts are in the comment section.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Well I can add this to the discussion, ever since the change occurred and HDB starting earning 10% interest in savings, I stopped cashing out my HBD into other interest bearing coins like XTZ, or Algo, or ETH 2.0. For years I had taken half my earnings in HBD and immediately sold it for one of the above coins which I HODL to earn interest. However at 10% interest I plan to keep some $ on Hive in my savings account to earn 10% on my holdings, so for the past month or so I have just been storing any HBD I earn into savings until I reach a certain amount that I feel comfortable with as another rainy day fund sitting there earning interest. The pegged to $1 USD thing makes me feel as though HBD is one safe asset that I can stash, earn interest on and still be ahead of inflation which is about 8% right now or higher thanks to Biden and more realistically the Banksters at the Fed.

Keeping more on chains certainly helps in this endeavor.

It is good that the sell pressure was removed by adding the interest component to HBD.

Posted Using LeoFinance Beta

To me the 10% of Hive market cap limit is indeed arbitrary and bad. No token or DeFi protocol on Ethereum, or any other DeFi blockchain, has such a cap.

If we removed that cap it would unlock the DeFi potential for Hive. DeFi and smart contracts are what we need to ensure we build a platform and not just an app (because Hive to me right now feels more like just a single purpose app)

No other blockchain has a debt instrument (except for Steem) like Hive does. That is the difference.

HBD could be a point of vulnerability in that it could allow someone to stack up on that token and then convert it during a down time in the price of Hive. If the price dropped to 1 cent, as an absurd example, then someone could convert their HBD into a crazy amount of Hive. Thus a few million HBD would open up the possibility to take over the chain.

The question is how unrealistic is that, especially if the activity keeps increasing substantially on Hive.

Posted Using LeoFinance Beta

Although the 10% cap limit is pretty conservative and was arbitrarily selected in the past, removing it can end up very, very bad for Hive during the bear market (printing a massive amount of Hive because of HBD conversions). I believe there is a common agreement among witnesses to increase it during the next hardfork.

There is no point to compare HBD to any other DeFi coin as none of them are debt based (AFAIK).

I concur. I say leave the cap for now.

As it was arbitrary it would be interesting to change it and see what happens over a few ups and downs of the market. Everything is very new, so experimenting without fully compromising would be a way to test how things go over a long period of time.

It all comes down to volatility of Hive price. Potential top of $2 HIVE price gives us around 70mln HBD possible in existence (with 10% haircut applied). Even half of these coins, aftet conversion during bear market while Hive is absolute low gives around 350mln of HIVE to one entity (exchange or potential bad actor willing to harm).

Even paying 20% surplus for these massive ammounts of HBD gives realtively cheap (less than $50mln) opportunity to compromise our security for potent player willing to destroy Hive. And this will happen without massive pump of $HIVE price, which would occur while buying assets on the free market.

That is certainly possible. However does that happen in reality with different market dynamics in place.

There are a few assumptions like the idea that the market low will be the same in the future. It might but then it might not. Also, there is the idea that one person will be able to get a hold of a massive amount of HBD. Right now, without many use cases, that makes sense. However, if there is hundreds of millions of dollars in commerce taking place along with layer 2 options that use HBD for DeFi or whatever, is that still viable?

Also how does the need for Resource Credits, as the chain gets more active, affect the ability to convert Hive? Could this minimize the amount of HBD that is created, negating some of this discussion anyway? At the same time, does that put in a "floor" on the price of Hive dropping?

All things to consider when looking at this equation. Hard to tell where the vulnerabilities could crop up along with where they will.

Posted Using LeoFinance Beta

Yeah, there is a lot of IFs on the both sides of equation. I think it's important to avoid both extremes, hope for the best, prepare for the worst as they say.

It's easy to fall for instant gratification, we all are hungry for gains seen in the rest of the crypto world, this emotional factor also shouldn't be neglected. Working haircut gradually up, together with all metrics growing or even creating some sort of safety system which would consider many factors could do IMO.

Agreed. We fall into the trap of wanting things now without looking at the long term outlook.

We cant see how things will unfold (law of unintended consequences). I do concur that at the end of the day, it is vital to protect the chain from vulnerabilities.

Growth is vital and expansion needed. However, that must be tempered with an eye on security.

Posted Using LeoFinance Beta

Only on paper did 10% make sense.

The theory did not match reality.

Steem ironically death-spiraled even harder because of this limitation.

Funny how I have to beat a dead horse even after you linked my own post on the subject. HBD is pretty important though. I think we are headed in the right direction. I'm very glad no one at the top is entertaining trying to scrap it and remove it from the ecosystem.

Posted Using LeoFinance Beta

Its not a dead horse, its a Pinata.

Posted Using LeoFinance Beta

nice

Yeah I think the idea of scraping it is a bad one.

HBD is going to be an asset to the entire ecosystem. Does it need more tinkering? Most likely, yes. What are the exact numbers? I do not know.

However, I think there is the opportunity to expand both the value of Hive along with the number of HBD that can be utilized.

Posted Using LeoFinance Beta

I think we should be able to claim the interest rewards on HBD like you claim other rewards but limited to once a day or something. The current system not very engaging

So the witnesses pretty much decide the interest rates and I think the hardforks will decide the required marketcap limit. I think the 10% is just so the entire supply doesn't get kick off. It makes people want to hold on to it.

Posted Using LeoFinance Beta

Correct. The interest rate is directly in the hands of the witnesses. That can be moved up or down at any time based upon the medium consensus.

We will see what happens in the discussion about the cap. Will it be increased or not? Worthy of a discussion.

Posted Using LeoFinance Beta

What would be really interesting to me about the whole HBD thing is the idea that IF it truly can be held as a stablecoin, what would happen if an actual use case emerged in which it became the de-facto currency base for commerce within the Hive ecosystem. Consider a peer-to-peer marketplace in which the accepted currency is HBD, and good and services are priced in HBD. Would the draw of being able to "go shopping without the fiat, and without leaving the ecosystem" somewhat limit the amount of HBD being plowed into savings? Would people start "saving up" so they could buy that PS-5 from a Hive-based seller?

There is something very attractive about that, because even though you can use a crypto-based debit card to buy (for example a PS-5) it ultimately requires shuffling through currencies and getting to fiat... which might include transaction/exchange/gas fees.

=^..^=

No doubt what you describe is the appeal to HBD. The ultimate use case is, well, use. That is the problem with cryptocurrency, people treat it like stock to speculate as opposed to utilizing it. Stablecoins are the exact opposite.

I love what you detail. A peer-to-peer marketplace built on Hive using HBD as the token is a huge step forward. It would certainly advance all aspect of the decentralized world.

Yes I think it would hinder the amount that goes into savings yet would increase the amount held liquid for the purposes you set forth.

The key, as always, is distribution.

Posted Using LeoFinance Beta

A blockchain version of Etsy is what I'm waiting for.

Posted Using LeoFinance Beta

Well this can be tricky, however, since 10% is quite a decent interest rate I believe some people would be interested and others generally wouldn't. Nevertheless if it'll be too much, 5% wouldn't be bad. Since having too much of HBD saved for the profit can't be so good. All in all I hope we will maintain the stability of HBD for a really long time.

Posted Using LeoFinance Beta

At this point there is little use case for HBD so it is really not totally relevant. I think the 10% makes a lot of sense and, if the Witnesses wanted to, they could increase it a bit more to see how things go.

Posted Using LeoFinance Beta

Well seems the increase or decrease could be done at least for experimental purposes to see what eventually works.

Posted Using LeoFinance Beta

I wouldn't like 5%...

It would change my investment strategy.

Posted Using LeoFinance Beta

Very good article, I like to read them to learn more about the HIVE ecosystem, you have my vote.

I have another opinion

For me the maximum 10% emission of HBD is fine, since that emission is expansion of money based on the total Hive.

This is fine when the currency is on the rise, but in times of correction if the issue is not corrected it would generate inflation.

And in corrective cycles it can enhance the falls.

Thanks

Posted Using LeoFinance Beta

When the correction hits HBD stops getting printed. Its sad and we don't like it but it fixes the problem.

Posted Using LeoFinance Beta

stable coin needs to be on demand but the mechanic that's connected with the inflation makes it not possible.

Generate HBD with an Asset behind makes more sense to expand. Or a pool mechanic with fee+ burn (including the 10% APR).

So 2 pools can work to stabilize.

I think we will see a way lower than 1$ HBD sooner or later. Special if the number becomes too high and the haircut comes into place.

I would remove the 10% cap that will certainly allow for more flexibility. As for the interest for me it is fine although I think that in other markets 10% is not so much, but as I have said it is easy to change. It is a matter of testing and adapting.

Quite honestly, I would think the ideal rate is somewhere below 10%. Not that I want to see it decrease. When you think about it though even 5% is more than you would get at a traditional bank so by many respects it is attractive. It is also low enough that it shouldn't bug you too much to keep some HBD liquid. I think anything over 15 to 20 percent and you are going to start seeing too much HBD locked up like you are concerned about.

Posted Using LeoFinance Beta

That is true compared to traditional yields. However, we know that compared to what is taking place in cryptocurrency, the 10% on HBD is low. Thus, will people flock to 10% or even 15%? Hard to tell.

So far, it does not appear that a lot of people rushed out to by HBD to stick into savings. I havent seen any posts but I wonder how much of that 28 million excluding the DAO is really in savings.

Maybe @dalz will give us an update.

Posted Using LeoFinance Beta

Does this graph answer your question?

True, but a lot of those high percentages are in DeFi and I think we all know that DeFi (at least right now) has its own set of risks. If people are looking for something relatively stable, that 10% isn't so bad. Heck, my long term traditional investments don't always make that annually. Maybe we need to use the CUB kingdoms as a measure since. So somewhere between 10% and 80%? :)

Posted Using LeoFinance Beta

Certainly there are risk associated with DeFi. The key to return is growth. We see little growth in the traditional economy which makes the investment centers very low.

With DeFi, moving passed the insane stuff, we see growth rates that can sustain those returns for the foreseeable future. Hence, 10% is a very low number in my opinion, especially on Hive.

I foresee more than 10% growth annually using a number of different metrics.

Posted Using LeoFinance Beta

HBD had recently been the best savings option for many Nigerians on the platform.

However, I don't understand how there's the 10% APR yet every month I claim a little profit. Is the profit different from the APR? I don't understand.

Posted Using LeoFinance Beta

As far as I understand, the HBD has to stay in your savings account. The interest is based on how much HBD you have in savings and how many seconds it has stayed there since the last savings transaction (whatever the transaction was).

Also, APR means yearly. So if you put 100 HBD in savings, then over one year you will get 10 HBD interest.

I am not sure what you are referring to. Each month, your HBD in savings earns based upon the 10% APR. So if you have 120 earn 1 HBD for the month.

Posted Using LeoFinance Beta

Perhaps there is more than one retailer you can mention here accepting Hive Dollars? You can make donations in Hive dollars certainly. Unless you're running a pretty demanding internet application server through Privex, there really is no reason for someone to be spending hundreds of Hive dollars a month.

I am of the opinion that 28 million is the amount of dollars we need or an upper bound because if we needed more dollars, the value of the dollar would go up slightly and the mechanism would compensate to create more dollars.

Should witnesses take away interest payments, the number of dollars will go down in a similar way.

Long before the Hive fork, I had something that accepted Steem Dollars and people mostly tried to sell jpegs. I guess it was too early. Yet @privex has a payment system that takes multiple currencies including HBD and even integrates Hive Keychain so the user doesn't have to fuss with memos. If someone wants to accept Hive dollars, they could contact me, or better yet contact him. The system I had set up was quite primitive.

I agree with the 10% increase steps you suggested. I think lifting the hard cap ceiling is absolutely necessary. HBD is a stablecoin so there needs to be enough liquid for people to use. With more users coming to Hive, the demand for HBD is higher. As far as the savings account, maybe increase to 15% to entice more people to keep HBD on chain and ease sell pressure. Both of these would help HBD become more stable in my opinion.

That is if an easing of sell pressure is needed. Keep in mind, when it was trading at 1.2, sell pressure was required. I look at the interest paid as a mechanism to lock more HBD up since it likely will not flow to much. This could add some stability to the equation. Maybe I am looking at it wrong but I use the savings, not to trade, but to just stash and forget about.

This is true if we get use cases for it. Presently, there are few commercial options for HBD. If we start to see people using it as a stablecoin (if the peg holds), then we will require the liquidity.

I think the first line is that more Hive is required since people are going to need the Resource Credits. Yes, I do no agree that the number mandate that HBD will also be desired especially as commerce evolves. So it is really which one gets created and converted.

Posted Using LeoFinance Beta

Great points. I think too many people are speculating on HBD price as well instead of using it as a stable coin.

Hi, interesting point of view and analisys to read.

As all crypto coins also Hive has up and down, maybe not so much connected to Bitcoin market like others crypto.

But I will hold them for long , as you can do many things with Hive, beside fiat conversion. You can use hive for many purposes. Let the Hive platform grow more then ever ^^

Read how this all have started with Toruk

Posted Using LeoFinance Beta

what I have noticed with people investing in crypto buying coins is: they are looking for a short term return and not something very stable like HBD.

one of my doubts regarding the HBD is: why can't it go above 1.50? I remember that one time I broke the 2 dollars.

HBD Stablizer is using a tremendous amount of HBD to ensure that does not happen. Also, with the different conversion mechanisms in place, market arbitrage will keep that from happening. As more people convert Hive to HBD if the price was up to 1.50, that would flood the market with HBD being sold.

That will push prices down.

Having a stablecoin that is not very stable defeats the purpose. The eventual goal, in my mind, is to get the token used for commerce. For this to happen, merchants need stability.

Posted Using LeoFinance Beta

I know I barely have months in this social network, however from the moment I started my way in Hive I was wondering why our crypto is not usable for commercial transactions of goods and services? In particular, I dream of the possibility of generating purchases and sales of paid items in HBD or Hive, although I do not know if the developers as the community that makes life here are aware of what a step like this would generate in our environment.

I think you opened an important topic of discussion to put in the balance if we really want to stay stabilized in an order that seems that we already overcome or better take the opportunity to experiment towards a more successful percentage that allows to consolidate both Hive and HBD.

Posted Using LeoFinance Beta

I think part of the issue is that the network incentivizes holding Hive. Therefore, people used to convert their HBD into Hive in order to facilitate earning more Hive. But, now that holding HBD is incentivized with earned interest, we are starting to see a shift. I think we are still early. Not enough HBD has accumulated for us to consider it for commerce.

For example, I have only managed to accumulate almost $25 since the hard fork. This is not very much. It's still a curiosity rather than real money. But, once users have savings in the thousands of HBD, we may very well see commercial use.

Posted Using LeoFinance Beta

Well, it's safety first for me. While I agree the cap needs to be raised at some point, I think we need to consider what the overall needs of the chain are at present and where we see them heading.

With HIVE still trading under $1, it seems it could still be vulnerable to the bad actors you're talking about. If and when a couple more of these projects come out and HIVE starts garnering some mainstream attention (outside of Splinterlands), then it would seem raising it may be advantageous and worth the risk.

I'm certainly no expert on how this all works so this is just my opinion based on reading the opinions of others.

As far as hard forks go....is there one per year? Are they arbitrarily decided upon when something major is developed? How do those come about?

The reason I ask is because if they happen fairly regularly, then there could be some experimentation with moving it. If they don't, then it would seem like it might be better to wait for the need before raising the cap.

But, like I said, I don't completely understand the dynamics at play so...take my opinion for what it's worth.

Posted Using LeoFinance Beta

It's baffling how hard it can get to maintain a peg in a decentralized environment. DeFi is trying to solve this with rebasing tokens and Badger DAO probably had the most ambitious idea. They crated Digg and want it to be pegged to BTC rather than to the USD. They were also counting on arbitragers to take care of the peg but it turned out to be a lot harder than that...

Everyone needs to know why a certain token is pegged to something and the mechanisms behind it. Your post actually gave me a much deeper understanding of HBD but it also made me wonder why there isn't any Wiki page for new users to browse through? It could be like the sidebar on Reddit and every community can express their goals and guidelines. I know this is a Leo front-end thing but just curious if an idea like that was discussed in the past.

Posted Using LeoFinance Beta

@taskmaster4450! I sent you a slice of $PIZZA on behalf of @pixresteemer.

Did you know you can earn $PIZZA daily by delegating HivePower to Hive.Pizza? (5/10)

Thank you for your encouragement.

Explaining young hivers what a savings account is and interest. Hope they get it. ;)

.

now I go to ecency and translate this post because I can't wait to read it !PIZZA !LUV !BBH !ALIVE

@taskmaster4450! I sent you a slice of $PIZZA on behalf of @zottone444.

Did you know you can spend $PIZZA on games in the $Pizza Store? (7/10)

<><

@taskmaster4450, you've been given LUV from @zottone444.

Check the LUV in your H-E wallet. (3/3)

Sorry, you need more staked ALIVE tokens in order to use this service, the minimum is 1000 ALIVE Power.

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Personally I feel the 10% interest yearly is too small, I have to wait for a full year to get 10%. I rather risk buying hive and powering up, I love the chances of seeing hive’s price grow

i wanna see 15 why not

good point if you decide to invest your profits that way, for me I think it has remained quite stable in recent weeks

HBD price is much stable now than before I hope it stays that way but I know it to a lot of work to keep it stable I'm sending all my hbd to savings for now

Every time you type, I learn. Thanks!

Posted Using LeoFinance Beta

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

I'm for this option, of gradual increasing the debt limit percent. I'd double it from 10% to 20% in the next hard fork, and we'll see how quickly it needs to be adjusted from there onwards.

Posted Using LeoFinance Beta

Even before the HF, the HBD was already proving to be very reliable and stable.

Today it's the main currency/token of the entire hive that I haven't suffered losses in the last 6 months!

Thank you for this explanation as it answers many questions I have been thinking about.

Posted Using LeoFinance Beta

I think that we have many Hivers who depend on rewards for income, which has had a downward pressure on the price as they have to sell to pay for living expenses. By having a stablecoin and paying interest, we might be able to shift some of that sell pressure into converting to HBD, which itself pays interest. This income, compared to Hive rewards, is more stable. 10% interest is decent by most financial standards. Getting closer to 20% interest on HBD, I think, gets close to killing the goose that lays the golden eggs.

As far as the debt cap, it could be a non-issue if we raise the overall value of the Hive network. If Hive were to hit $1 Billion in market cap, we are looking at $100 Million in HBD. That's still not a lot for commerce.

Tether is $69 Billion

USDC is $29 Billion

BUSD is $12 Billion

DAI is $6 Billion

TUSD is $1.4 Billion

Hive is sitting at around $265 Million. Even if we raise the debt limit to 100%, we're not talking a lot of money for commercial purposes.

We should focus on increasing the value of Hive. I could see maybe setting the debt limit to 20%. If we go too high, we risk the security of the network. We should not lose sight that what gives HBD value is the underlying Hive. So, we need to focus on maintaining that value. We should proceed in 2% increments as there are likely unexpected consequences in maintaining the peg at higher levels of debt. I get the sense that upswings in HBD price at higher debt levels could prove highly deflationary for Hive as we recently saw.

Posted Using LeoFinance Beta