source

"Crypto Loans" is a service that KuCoin provides in addition to margin trading and is a type of cryptocurrency loan. And these are reasons why you should know about this service:

- Because it represents an evolution, or at least a fundamental change, in the operation of the money loan (and in terms of its availability)

- Because it offers loans in multiple currencies, unlike a bank whose lending options are limited to the local currency

- Because traditional banks are a bit outdated. In this context, exchanges like KuCoin have become a kind of international digital bank.

The first thing is to create an account

Access the official KuCoin website through official channels or channels (beware of phishing). Click on the globe in the upper right corner and select Spanish. Next, also in the same corner, click "Register".

Enter your details, read and accept the terms of the user agreement (unfortunately not available in Spanish), enter the reference code if you wish and click the green "Login" button. Finally, enter the verification code and confirm. You are officially a KuCoin user. Performing KuCoin Identity Verification (KYC) is not a required step. It is up to you how comfortable you are with providing your personal details or what restrictions you want to place on trading and withdrawals.

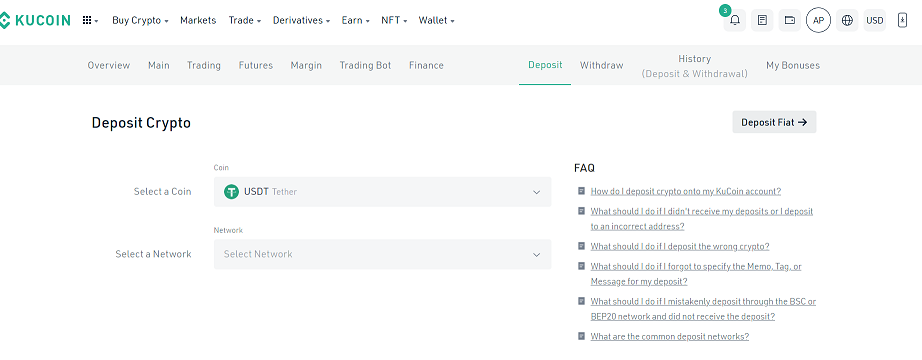

Now it's time to deposit

You can imagine that the next step is to deposit money into KuCoin to fund your account on the exchange. After registration, the main menu opens. In the upper right corner, open the list of features and click on the wallet icon.

Now you will be in another window. For now, focus on the gray rows where the various subgroups and features of your wallet appear. Click on "Deposit". When you tap on it, you will see options to deposit your national currency (fiat currency) or cryptocurrency. Open your wallet or other cryptocurrency exchange and get ready to send, as the relevant data will appear below to complete the trade. Choose to deposit cryptocurrency.

After selecting the currency and network, a deposit address will be automatically generated in your main account. This is the address to which you will send crypto from your wallet.

WARNING: Cryptocurrency MUST only be sent to this address or you may lose your money. If you would like to use a different deposit method or would like a more detailed explanation of the process, please refer to the KuCoin cryptocurrency deposit guide. In any case, please confirm that you have received the payment.

It is time to use the Lending service.

Hover over the "Earn" option in the top menu and click "Cryptocurrency Loans". There will be a window to allow margin trading, as loans are often used only for margin trading, i.e. trading with borrowed funds. After enabling margin trading, you will see a text with "Margin Trading Agreement" before proceeding, unfortunately this text is only available in English. Before proceeding, fully understand the implications and risks of margin trading. Read the contract, translate it and accept it if necessary.

Eventually you will be taken to the main loan or loan screen. What you do depends on whether you want to be a lender or a borrower. If it's the latter, select Loan from the menu at the top of the screen. On the other hand, if you want to offer a loan with interest, you must click on "Loan".

Click "Loan" even if you don't want to, because there is a link in this section that will allow you to deposit directly into your margin trading account without the risk of messing up your wallet options.

Click "Transfer" and in the new window you will be able to transfer money from your Instant account to your Isolated Margin or Cross Margin account. This account allows you to borrow or lend. Send funds to a segregated reserve if you want to allocate funds to a specific currency pair without affecting other potential segregated or cross positions. Use Cross Margin if you want all currency pairs to share your capital commitment.

Once this is done, you will have funds in one of your margin accounts and you can borrow and lend money to earn interest. Now learn how to set up loan adjustments based on any of the options.

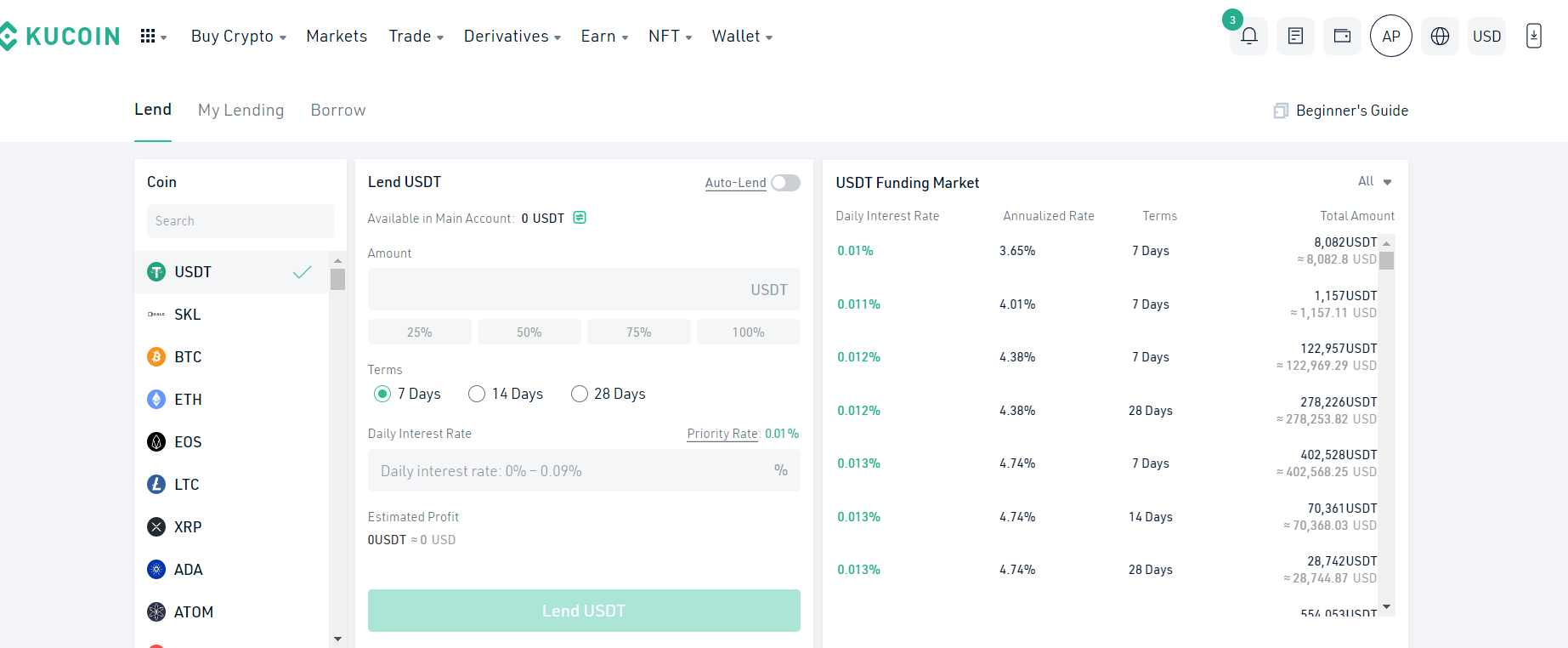

give out loans

Return to the "Loans" screen. As you can see, the loan screen is divided into two parts: on the left is the place where you have to set when you borrow, and on the right is where the orders and interest for the day, week, fortnightly and the month. Thus, when taking out a loan, the section on the right serves as a reference to the one on the left, offering competitive but advantageous rates.

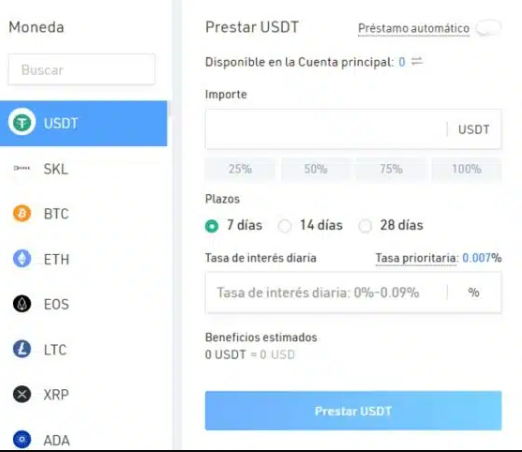

The purpose of daily interest cryptocurrency loans is, of course, to get the highest percentage possible. But if it's too high, you won't be competitive and borrowers will ask someone other than you for money. So you need to check the order book on the right hand side and always assess what the competitive rate is at that time in the market. To lend, select the currency you wish to lend in the left column, which you should send to your margin trading wallet. Remember that USDT stablecoin is usually the best indicator of KuCoin borrowing. Then enter the amount or amount you want to use for the loan and the period in which the borrower has to repay the loan.

The daily rate must also be entered manually. Remember, this is where it gets competitive in terms of loans. Either way, you have a valuable metric at your disposal: APR, which is great for auto loans or auto loan features. This function automatically re-lends the money returned by the borrower. It's that easy.

Once you have entered your data, you will be able to see your estimated earnings based on the maximum payment term of the chosen loan. If you agree with this estimate, finally click on "Borrow USDT" or the currency of your choice. And that's it: your order is automatically submitted and compared with the borrower's order. In the "My Loans" section at the top center of the screen, you can monitor the amount of funds borrowed, accrued interest, realized earnings, etc.

Remember that KuCoin is a fund to pay off the borrower's debts if the borrower defaults. This means that the repayment of your loan and the corresponding interest rate are guaranteed.

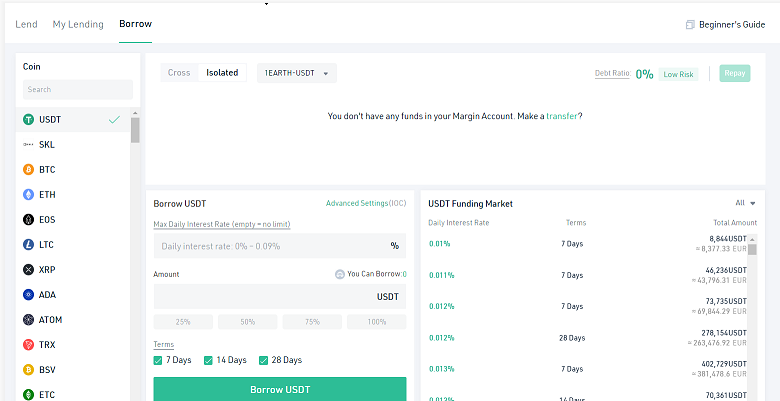

To borrow

If you want to get a loan instead, you need to follow the steps below. Click Borrow at the top center of the screen. In the upper left hand corner, you must choose whether you want the loan to go to your split or cross-margin account. Then select the USDT pair or other currency you wish to select from the dropdown list on the right.

Enter the daily interest you want to pay, which is up to you, as well as the total amount you want to borrow and the maximum repayment term. This is the maximum term because you can also prepay, saving several days in daily interest payments. An interesting measure to consider is in the upper right hand corner and it has to do with the interest risk of your debt. Of course, choose an interest payment method that does not put your finances at risk. When you are sure of the data you have entered, click the "Borrow" button in the bottom left column in USDT or your chosen currency.

As with the "Loan" feature, your order will be matched with a matching offer in the order book and voila, you'll have access to a loan. As a borrower, the loan must be repaid within the agreed term. The green "Back" button is used for these purposes in the upper right corner. That is all. Whether it is a loan, it is a simple service, and yes, the borrower will have more risk than the borrower. While the latter has a full payment guarantee, if the former does not, part of your funds may be liquidated by the exchange as compensation for losses.

Posted Using LeoFinance Beta