Palantir CEO Alex Karp

https://www.cnbc.com/2020/08/25/palantir-files-s-1-before-going-public.html

After 17 years, Palantir has a whopping.... 125 customers after 17 years, and to make matters worse, separate government departments are considered as unique customers. The average revenue per customers has also only increased 30% over the last decade. Above all, the company's top 20 customers represent 67% of total revenues illustrating the large concentration risk found within the company's business model.

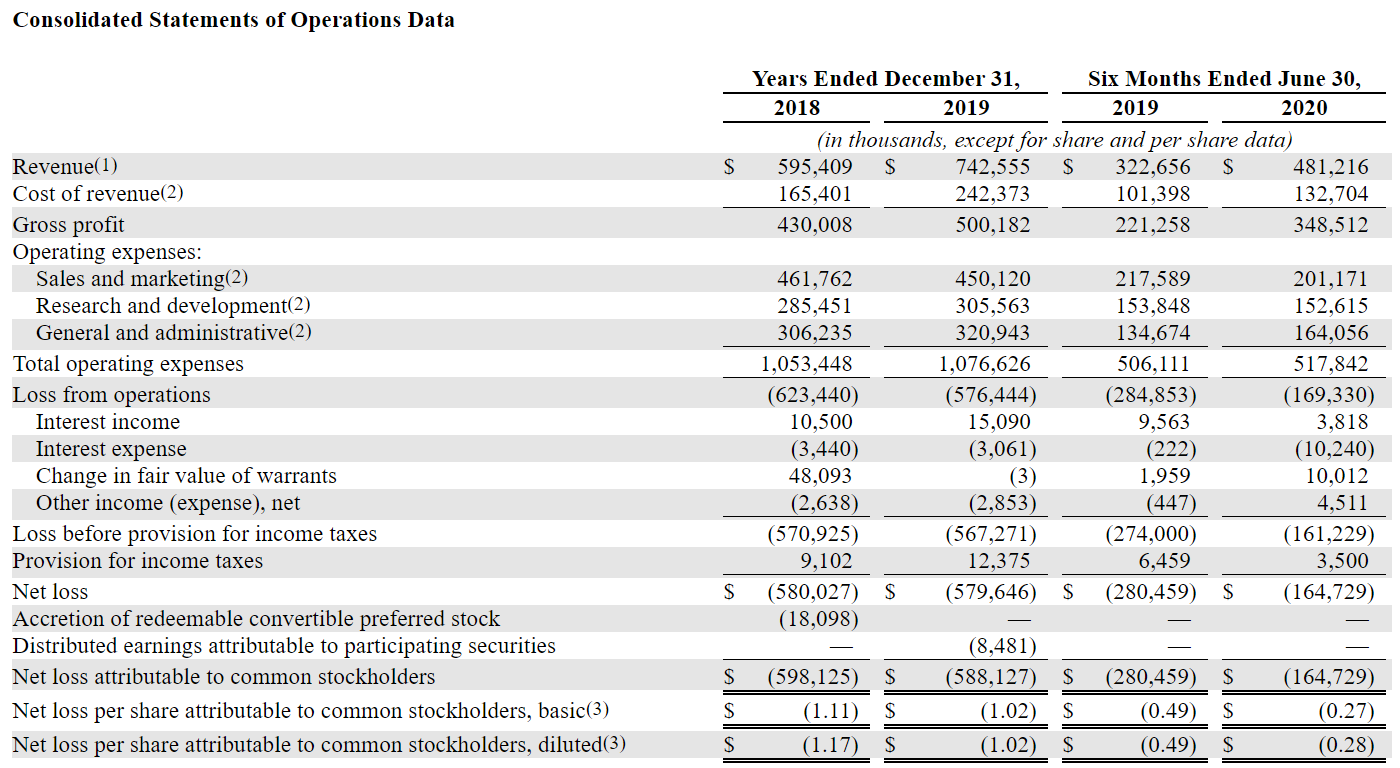

Maybe this would be OK if the company wasn't losing nearly $600 million in both 2018 and 2019 along with continued expectation for similar losses in 2020.

Yet Palantir continues to see improving growth opportunities going forward. The company argues that its total addressable market is $119 billion and that its customer list is made up of the who's who in terms of the institutions with the largest budgets to spend.

From a niche perspective, the company is also able to provide stability in its lack of ambiguity over moral issues. The company is wholly dedicated to serving the US Government and should largely be viewed as an extension of government services in that regard akin to a defense company.

More importantly, most of its expenses to date have actually come in the form of marketing & research & development expenses. The company argues that these expenses should begin to flatten out now that its latest platform, Apollo, has been developed.

Investors should also bear in mind that the company should continue to increase revenue without significant expense growth going forward. Additionally, we should note that gross profit continues to come in around a high 80% level.

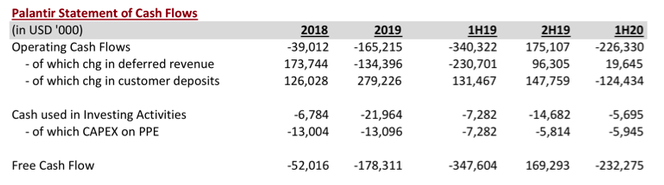

It's also ideal to consider that the company's free cash flow is likely to improve in the coming years.

Offhand, it remains far too early to determine whether Palantir is overvalued at present considering its recent top-line growth. The company's past performance remains ugly without a doubt, but going forward the opportunity remains to be seen where this company is heading. I would not be a seller of the company at the current levels under $10/sh.

Posted Using LeoFinance Beta