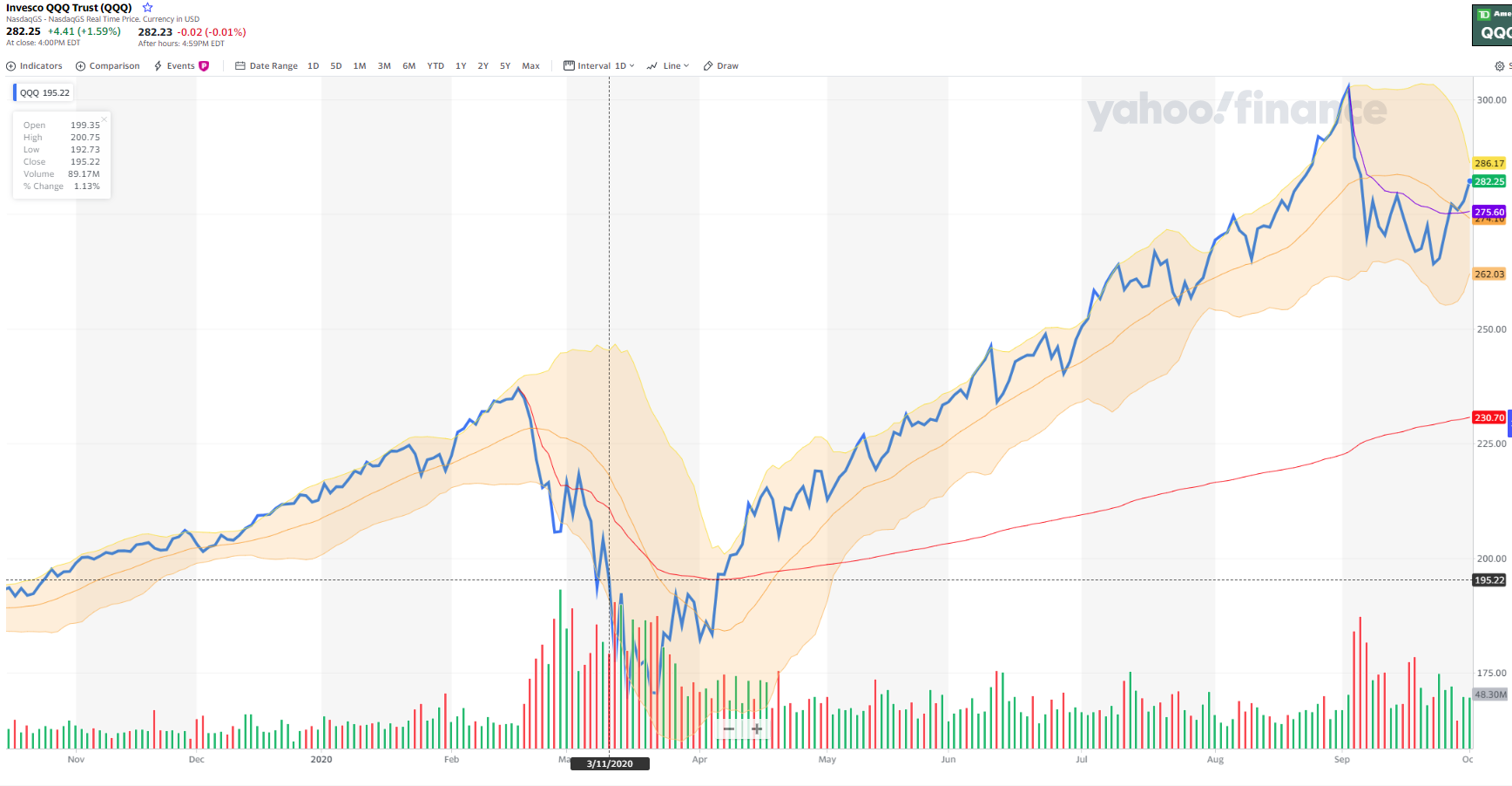

The tech rally has been strong. No doubt about it. The chart below is a look at the QQQ which tracks the Nasdaq 100.

Taking a quick look at two anchored VWAPs at the market highs, the one thing that is clear is that momentum is still favorably in the hands of the bulls as noted by the price action trading above the red and purple lines respectively. More people are in the money rather than out of it relative to those two points in time. Also interesting to note is how we broke through that top purple line suggesting it has become the new support line rather than base line.

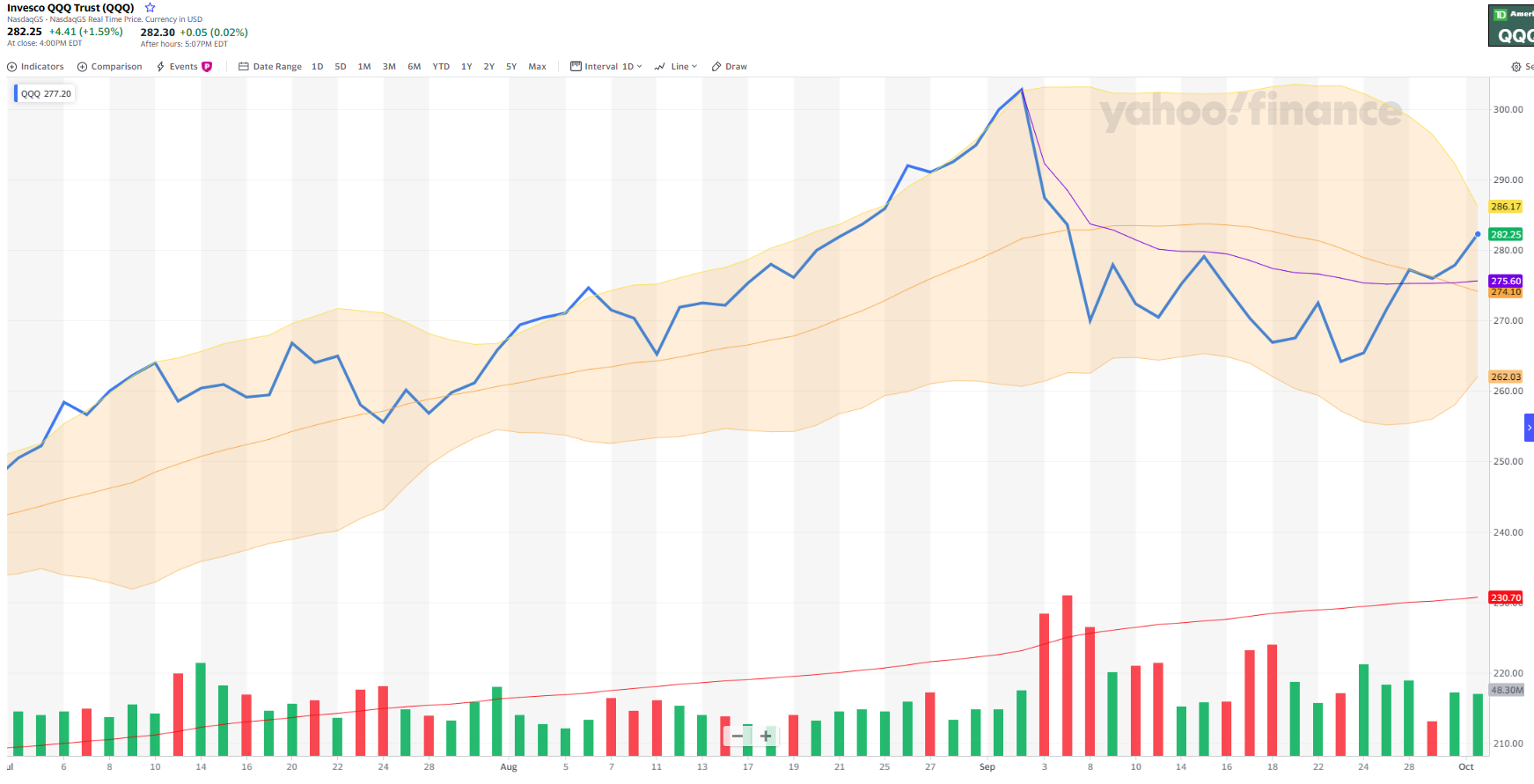

However, the one thing that does concern me a bit is how the top of the bollinger bands is coming into view very quickly as we trend higher. With the constraint of moving averages, we might soon be testing a near-term ceiling. It remains unlikely that we test new market highs anytime soon barring a meaningful catalyst so investors beware that we might be up for some sideways action coming up. The chart is blown up below with a shorter timeframe for a better view.

Posted Using LeoFinance Beta

Do you see the biggest risk to the tech bubble being Biden winning the election?

Posted Using LeoFinance Beta

Offhand, I think the biggest risk is probably going to be if the Federal Reserve gets uneasy with its low-interest rate policy or if valuations run so high they scare away momentum investors. The election, while volatile, probably won't mean much market-wise.

Posted Using LeoFinance Beta