https://thenewswheel.com/top-5-worst-car-salesmen-from-movies/

What is Securitization?

Securitization is when an investment bank buys debt from a commercial bank and creates a tradable financial instrument (security) from that debt (like 1000 home mortgages with similar terms) and sells this security to investors. Sort of like how NFT’s work in the crypto space, but in this case, these securities are fungible.

Buying debt makes debt more affordable.

In the US, buying debt, securitizing it and selling the securitized assets to investors has been used for decades to make large purchases more affordable, like a house, car or education.

Starting in the 1970s, the United States government authorized the two largest government sponsored enterprises, Fannie Mae and Freddie Mac, to buy home loans from banks.

Since 30-year home loans (mortgages) were not sustainably profitable for banks, this authorization encouraged banks to make more 30 year mortgages (rather than 10 to 25 year mortgages), because the two GSE’s bought the loan from the bank, removing that risk of non payment.

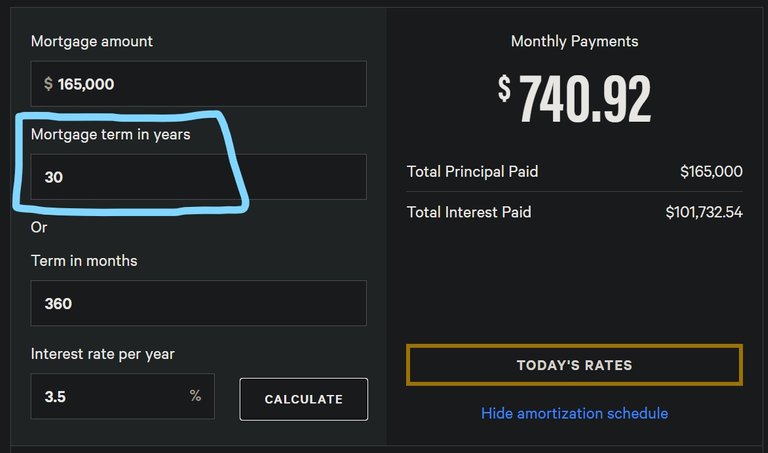

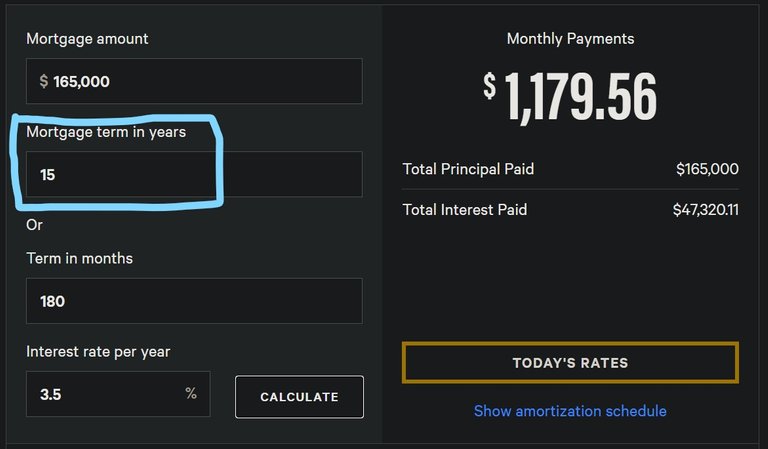

This made homes more affordable for people because spreading a loan over 30 years (Figure 1) rather than 15 years (Figure 2) makes the monthly payments lower.

Figure 1

https://www.bankrate.com/calculators/mortgages/amortization-calculator.aspx

Figure 2

https://www.bankrate.com/calculators/mortgages/amortization-calculator.aspx

Securitization for Profits.

In the 1980s, banking institutions began consolidating, and growing larger, enabling them to compete with GSE’s in the debt buying market. To further offset risk, these GSE’s and banks, started securitizing these loans and selling the securities to investors making this process profitable.

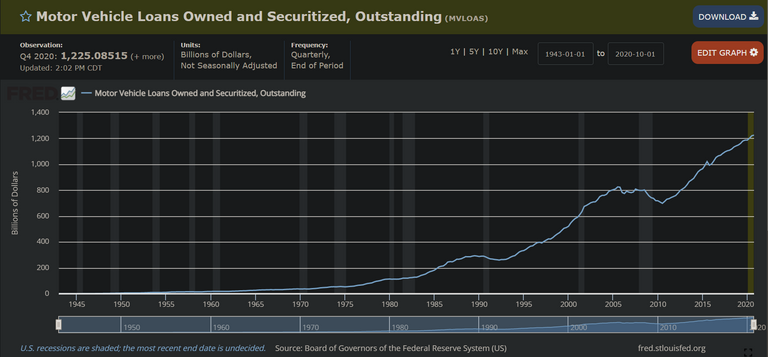

Not only were home mortgages securitized, but auto loans as well. And since more people buy cars than houses, lets talk about auto loan securitization.

The Originator.

No, it's not the name of a new superhero movie, haha. The originator is the lender where the loan originates from, usually a bank.

For example, I walk into a car dealership and take out a loan to buy a car. That loan is issued and underwritten by a constituent bank. That loan now becomes a future income asset for the bank.

The Risk.

From the originator’s perspective, a car loan assumes a certain amount of risk that the borrower (me) will not pay back the loan.

Before the 1970’s, car loan lenders were careful who they issued a loan to because they wanted to make sure the borrower could pay it back. Because if the borrower didn't pay it back, the bank would have to eat the cost of the loan.

So they issued loans to creditworthy people; good income, paid back other past loans, had money in the bank for collateral, no excessive debt, young enough to pay back the loan, etc...

This created a mutually beneficial relationship, the originator (bank) didn't want to lend money to people that couldn't pay it back, and the borrower (me) did not incur an excessive amount of debt that I couldn't pay back.

Transferring Risk.

Fast forward to the 1970’s and beyond. That loan that I just took out to buy my car can now be sold to an investment bank, who then creates a security from my loan and 999 loans just like it and sells that security to investors. Those investors receive a yield (income from the payments I make on the loan) from the security they bought, and everybody's happy.

You know that “risk” that I was talking about where I may not pay back the loan to the bank and the bank would have to eat the cost? Well, with securitization, that doesn't happen anymore, because the bank sold the loan to the investment bank. And the investment bank sold the security to the investor (Figure 3). Now the originator, the bank that lent me the money, is whole again.

Figure 3

https://fred.stlouisfed.org/series/MVLOAS

What they tell me I can afford.

Here's the “Big Show” boys and girls! The originator is financially whole again. And in the future, any money that they lend out, they can just sell to an investment bank, therefore they don't have any risk of losing money if the borrower (me) doesn't pay it back. Now there is not much incentive for the originator of the loans to be conservative when they lend money to borrowers.

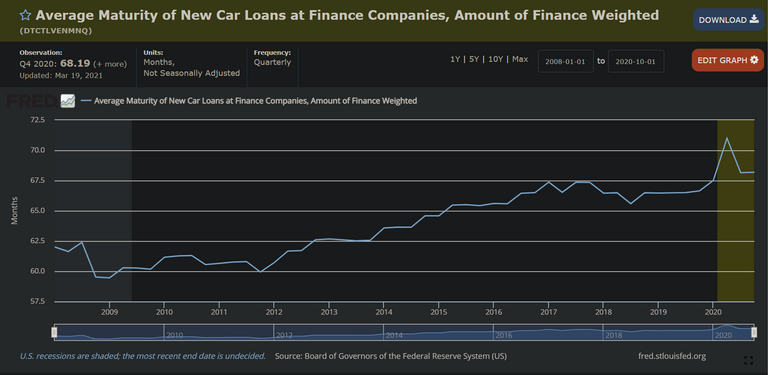

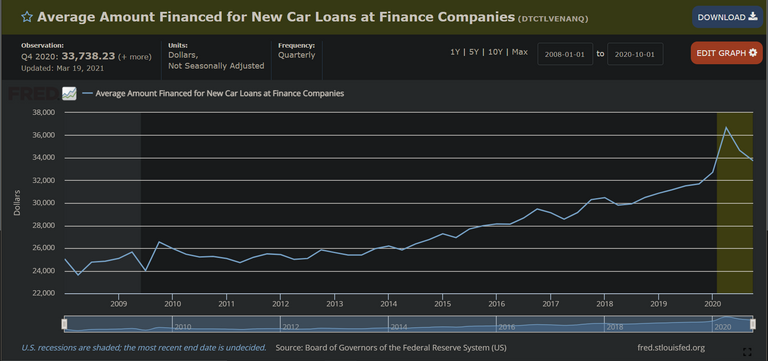

Figure 4

https://fred.stlouisfed.org/series/DTCTLVENMNQ

Figure 5

https://fred.stlouisfed.org/series/DTCTLVENMNQ

Now that $24,000 car loan can become a $34,000 car loan, and the only one that really hurts from that is the borrower (me). Plus, to make it less painful on the monthly payment side, all they have to do is extend the term of the loan (Figure 4), so it's less money per month for the borrower, but more debt overall. The growth of car loans amounts over the past decade has increased at least twice the rate of inflation (Figure 5).

For example, when I walk into the car dealership now, the bank doesn't loan me the money based on whether I can afford it. They loan the money based on how much they can sell to an investment bank and how much that investment bank can sell to an investor.

Because at the very least, if I can't pay the loan, they repossess my car, the car dealership sells the car to somebody else, the bank recoups some of the money from the new car sale (that they already had the money for because they sold my loan originally to the investment bank), and I'm still stuck with some of the debt.

Now I have no car, I still owe money, and the bank gets paid. What a deal!

In Conclusion.

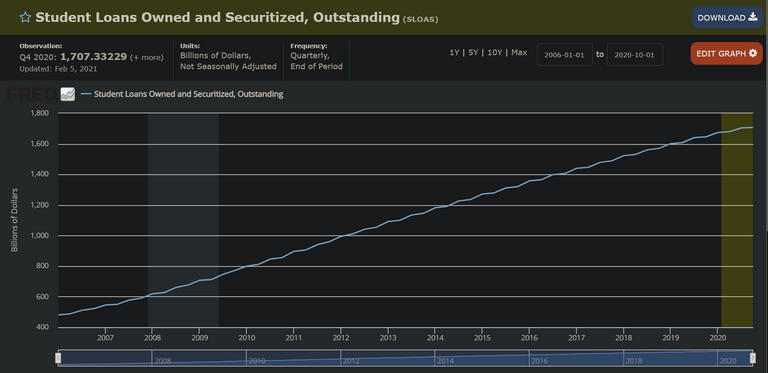

From education loans (Figure 6), home loans, personal loans, home equity lines of credit, revolving debt (credit cards), etc...pretty much all debt in the United States works this way.

Figure 6

https://fred.stlouisfed.org/series/SLOAS

Why does securitization exist? Well, the industry will tell you it makes large purchases more affordable, plus it frees up liquidity. These are a true statements. The crypto markets are based on that concept as well. Crypto's greatest selling point is more frictionless transactions (that is part of liquidity). That is what securitization does. Just like NFT’s.

So rather than these loans sitting on the books for decades doing nothing, they are packaged up in tranches (baskets of similar loans) and sold at the fair market price. Making money for investors, which makes money for the investment banks, which makes money for the originator of the loan, which makes loans more affordable for the borrower.

BORROWER BEWARE!

This also makes bank's more reckless with the amount of money they lend you. Because technically, the more money they lend out, the more money they make from investment banks when they sell the loan, whether you can pay it back or not.

If you are the borrower, securitization is not your friend. Make sure you do the math yourself, and don't let a bank tell you how much money you can afford to borrow, your net worth depends on it.

Sources:

https://www.investopedia.com/terms/s/securitization.asp

https://www.investopedia.com/articles/economics/08/fannie-mae-freddie-mac-credit-crisis.asp

https://www.marketplace.org/2018/10/31/why-do-we-have-30-year-mortgage-anyway/

Stay frosty people.

50% allocated to ph-fund.

None of what is in this article is really the problem. The problem is how these asset classes were rated, especially when they started mixing high risk loans into everything. The ratings were complete B.S. This is what led to the housing crisis a while back. If the likes of Fredddie Mac were doing their due diligence with properly rated securities and not just buying everything and then selling to investors as a supposedly safe investment then it wouldn't be a problem. But with the government stepping in and insuring everything plus bailing them out when even that's not enough...that really screws up the market encouraging people to take out loans they have no business taking out. It just snowballs from there.

I agree with this...too laxed ratings standards and too much government financial backing pre and post crisis encourages moral hazard. The issue lies in making sure the income from what the debt buys offsets the service payments and pays off the principle in a reasonable amount of time….rather than being indebted in perpetuity...or worse, using debt to pay debt.

Encouraging people to do their homework to make sure it’s affordable instead of depending on the "experts" for financial guidance is the message we should send. At the very least, if the government and industry make bad policy, the people can choose not to follow it with their own money.

@tipu curate 4

Upvoted 👌 (Mana: 56/112) Liquid rewards.

Thank you @tipu.

Thank you @emsonic.

لطيف

Thank you @rose7 :)

Congratulations @fijimermaid! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 4750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!