Silver Price Analysis

The silver market is way undersupplied. There are many reasons, but one of the largest is is because the world's demand for silver is increasing. According to the Silver Institute, demand will increase by 16% in 2022, totaling 1.21 bn ounces, creating the biggest deficit in decades! The total deficit will be 194 mln ounces this year, a big jump from 48 mln ounces in 2021. Demand in India rose almost twofold in 2022 so long term I think prices will reflect these fundamentals. Right now, silver continues to consolidate after the big move that we have had over the last couple of weeks. We are still above the 200-Day EMA, so it suggests that we are going to continue to see a bit of a fight here. I'm about even on my investment but would not be surprised to see a dip.

Silver Chart

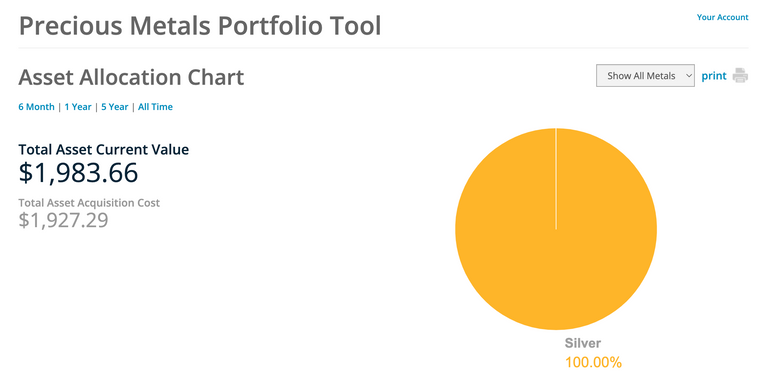

Portfolio Update

My current assets are valued at $1983.66 with a total acquisition cost of $1927.29. Silver was up 2.36% thus week and is keeping me in the black.

Asset Allocation Chart

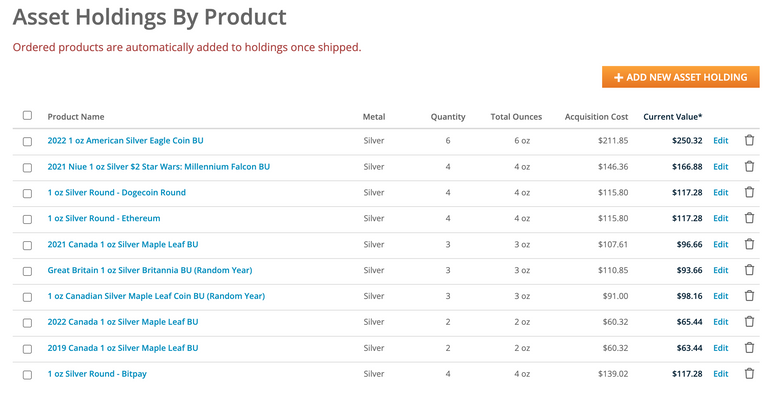

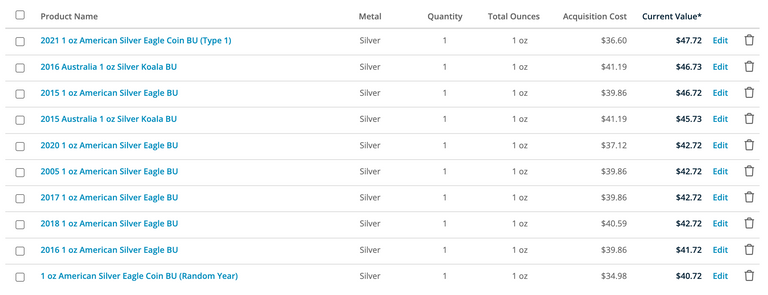

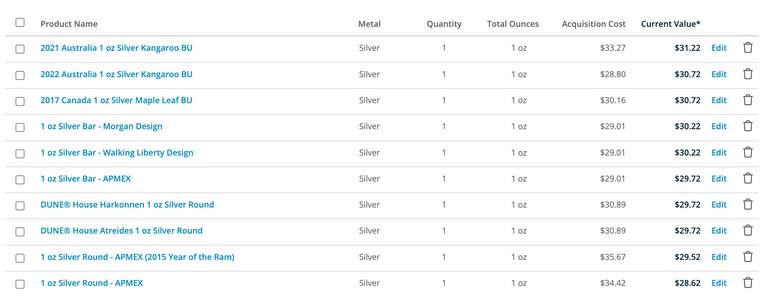

Asset Holding by Product

We will definitely see a dip. Anything under $20, I’ll probably buy some.

I agree I was looking at black friday deals and they were not any better than sub 20 prices.

You received an upvote of 11% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

I think Silver is in demand more than Gold now. And the price is starting to become more attractive. For a lesser amount of money, one can easily own a few ounces of Silver before it gets too expensive !

I do think will will need more for green energy projects. I think industrial silver will be high demand.

Thanks again for keeping us updated, @cryptictruth. The Local Coin Shop Dealers, in my neighborhood, are really worried about a shortage of US 90% Silver Coins. At LCS price, of $12.50 (USD) each, per Silver US Half-Dollar Coin, premium is about, 63% or $34+ per oz. And they don't have many. Nor Quarters & Dimes.

It will start at the LCS then laker silver will have a short squeeze when people start wanting to collect on that paper.

If the demand of silver increases then the investors will get a lot of profit and for this if the investment increases then the silver will be pumped to the sky. good news

Yes that's supply and demand.

Silver is not doing really bad in the market