I see a lot of people complaining about the price of Hive. What they don't realize is that we are doing A LOT better compared to the last cycle.

It is easy to see all the coins go up in value and feel left out, but as I said, we are doing way better relative to other cryptos this cycle compared to the last one.

Let me explain.

Crypto cycles

In this post, I assume that crypto prices move in 4 year cycles, and are mainly influenced by the Bitcoin halving. The previous cycle was from 2013 to 2017 and the current one is from 2017 to 2021.

The best predictor of future trends is past data. Nothing is 100% correct, but it should be good enough. Comparing cycles, we can assume that 2020 should be similar to 2016 and that 2021 should be similar to 2017.

Now the good news is, 2020 is almost over and it was extremely similar to 2016. So as of today, the 4 year cycle theory seems to be working.

Steem/Hive within the cycle

Hive hardforked from Steem. So the Steem price history is technically also Hive's price history. Therefore I will need to work with both charts and will compare them to Bitcoin in both the previous and the current cycle.

Now funnily enough, Steem launched in April 2016, while Hive launched in March 2020. This is exactly 4 years later, making the cycle analysis super easy.

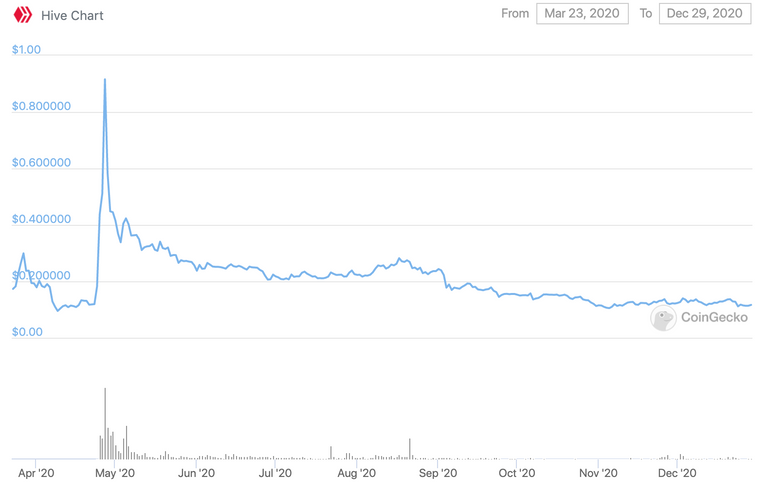

Now let's compare Steem's 2016 to Hive's 2020.

It's exactly the same chart. I can't stress this enough. Yes Steem's price looks higher, but the Supply was also way lower. If we look at the market cap, which is more accurate:

- December 2016 Steem = $31 million

- December 2020 Hive = $43 million

Both spikes in price (around may or june depending on the cycle) took us to a market cap of approximately $350 million. This repetition in price action is astounding.

Meanwhile, in both cycles, Bitcoin tripled in value while Steem/Hive stayed flat.

| Date | May 1st | December 29th |

|---|---|---|

| Bitcoin(previous cycle) | $452 | $1,000 |

| Bitcoin(current cycle) | $8,600 | $27,100 |

Clearly, Hive/Steem has a tendency to lag Bitcoin and remain flat well into the bull market. It does nothing for the first year of the bull market (2016 or 2020).

2020 is a repeat of 2016, almost like clockwork. Hive is even doing slightly better in marketcap terms (and much better if you include all the value that is held in Splinterlands, Leo, dCity, etc...).

But....

Now to the interesting part.

The question is, assuming that 2021 will also be a repeat of 2017, what's going to happen to the price of Hive?

Let's take a look at the Steem price in the last cycle.

The red arrow indicates where we currently are in the cycle.

Takeaways:

- Hive's price will probably remain flat for 2 or 3 more months.

- Expect a 100% move up in Hive's price in March.

- Expect craziness to start around June, 10X or more in price.

- Even more craziness at the end of 2021, 100X from current price.

What am I doing now?

Knowing all of that, I can't see any reason not to accumulate hive right now. I always like to be 2 steps ahead, and not chase the market. I will regularly increase my hive holdings in the next 2 to 3 months as the rest of the crypto market keeps rising (hopefully). Even if hive remains flat, as it is supposed to.

In fact, I have already started accumulating, and increased my HP by 12% yesterday. I also hold more Hive on exchanges, almost as much as I powered up.

It all boils down to investor awareness that Hive token is a good buy when their hedge on bitcoin wane.

Also i didn’t realize we forked after exactly one cycle. How cool!

I hope you are right and I know you put a lot of work into the Analysis. Let me play devil's advocate for a second. I have been in crypto since 2013 and have had my teeth kicked in enough to be cautious in certain situations.

The concept behind Steem / Hive is a great use case for crypto and freedom of speech so I want to see them succeed.

That being said there are a lot of differences now from previous cycles.

For starters copies of coins almost always do worse than the original price wise. HIVE is viewed as the copy.

Secondly in the last cycle the concept was new but most people in the crypto space tried it out and most determined it was an unfair system.

Essentially on a content creation platform with that high of a market cap and not one content creator can make a fulltime income. Not even 1. That's an issue.

Now both STEEM and HIVE are no longer on the first page of Coinmarketcap.com. in the last cycle STEEM was high on the first page. Out of sight out of mind.

Last cycle we had Jerry Banfield marketing hard on YouTube and Facebook. He was effective

Now no one is going to do that and the worker proposal system is mainly just to feed a small circle of friends.

Typically during bull Markets people will look for the goose that lays the golden egg. The STEEM backed dollar pumped hard last time amplifying earnings.

Again it isn't to be negative but I have to caution you. Good luck!

You made good points, but things have changed positively as well. Immutable communities, second layer apps taking advantage of custom_jsons, being truly decentralized without a premine stake...

Imagine the hype splinterlands can generate on its own, that will feedback into hive at some point. Same can be said of communities like Leofinance or even another one by then.

and 3speak will probably do their thing by then.

Wow, I have given up hope on Hive rising again, but I pray that you are correct and we can see some gains in 2021/2.

Posted Using LeoFinance Beta

You got my upvote for the paint skills :D

More seriously that's a very interesting analysis and I like it even more as it's based on cycles.

In my opinion cycles are THE indicator that makes sense in any market.

Posted Using LeoFinance Beta

Interesting, let’s see what the next few months brings us! I think the cycles for bitcoin usually go that when the bitcoin price peaks, people start to sell like mad then buy alt coins with the earnings. Hopefully we can be there with hive to soak up some of that alt coin attention!

I love that you brought this up.

There are way more hive out there and a lot of our community is balancing their wealth in different tokens now, Leo,dcity, dark energy crystals etc.

Still, I don’t think we can get past $1 without a user base as large as steem was at its peak, but perhaps the momentum from a March rally (which could be possible because many of us put our btc earnings into Hive) might help !

Yet in 2016 it was a top 10 coin, environment was different, back then it was easy to spot OKish projects, unlike now.

Agree with the ranking statement, however it's important to look at the coins making up the rankings. There are at least 10 stable coins which should be removed as their price can't go up.

There are also tons of wrapped coins in the top 100. Bitcoin alone has 3 spots in the top 100 with Wrapped Bitcoin and Ren Bitcoin. In reality it's just one marketcap divided under different forms.

Compound and Aave also have coins making up the top 100 such as cUSDC or cETH, which also unfairly take extra spots as their market cap should be combined with USDC and ETH respectively.

Finally, exchange coins that have no use other than being a buyback token for exchanges or a way to get a discount on fees are a different beast. They are not technology projects just a way to capture a community for exchanges.

If we take all that into account, Hive is probably still in the top 100, which is impressive given all the new DeFi coins that did not exist back in 2016.

We have to expect a lower ranking with time as huge projects like Polkadot and Filecoin will always be above Hive, especially at lauch. They did not exist then.

Also, Steem was only top 10 (even top 3 at one point) during the pump, it gradually slumped down after that. Hive in comparison, reached top 30 when it pumped to $1, then went back down. Given all the new projects, I think this is fair.

I hope so too, I still have quite some Hive I havent sold yet. imho it's also easy to analyse when the possible pump will start, when the airdropped hive to those exchanges finish their dumping. Maybe another 3-6 months. Before that I doubt any big investors, both old or new one, will start buying in.

You might be right. And 3-6 months fits perfectly with the cycle timing I showed in the post...

I hope you are right! Your cyclical analysis certainly makes some sense. I kept on actively blogging all the way through 7c Steem during the last cycle... and it would sure be nice if it happened again.

I just have to wonder IF Hive climbs up to about $8-10 per token, how much of it will it give back, during the next down part of the cycle...

great analysis! I also use cycles for my TA. In my opinion there will be a high in Feb/March for bitcoin before correcting to about 25k in the summer. However, this doesn't have to be contrary to your outlook as Hive has often shown to trade in counter cycles to bitcoin.

https://peakd.com/hive-167922/@tobetada/crypto-analysis-or-btc-35-40k

Great post! I was actually thinking bitcoin would behave in a similar way but seeing it charted as part of a fractal is very helpful.

Thank you for these charts ... time to do a bit of New Year's planning!

Why you block @firep0wer7777 and me @stardivine on telegram?

Great analysis here and certainly helps provide a different perspective of what's going on. The charts are strikingly similar in terms of timing and shape! I think we're in for a wild ride in 2021 and seeing as Hive is only 8.5p at the moment, I might as well get some in time for PUD, lease it out to get some liquid for when the time comes 😁

Posted Using LeoFinance Beta

I have been thinking that we were at the end of 2017, not 16 - Does that mean the HIVE ATH will be March 10th (my birthday) 2021 like the Steem one in 2017? :D

I have some sitting there too, but wonder if it is better to power it up and take the curation advantage, since I am unlikely to sell at these prices anyway.

About powering up, be careful because the pumps with hive are extremely aggressive and seem not to last unfortunately. So if we go back to $1 in a few days instead of having a steady uptrend selling becomes a must.

The all time high for steem was in january 2018. That means that the all time high for Hive should be in January 2022, 1 year + a few days.

March 2021 would be the start of the bull run for hive, if it follows past cycles.

I don't it works that way with the circles and stuff but i agree with the comparison of steem's/Hive price in which steem is a little bit higher!

Posted Using LeoFinance Beta

Hive marketcap is higher though. There was only 150 million Steem at that time. There is now 450 million hive

Congratulations @marki99! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Your post has been voted as a part of Encouragement program. Keep up the good work!

Try https://ecency.com and Earn Points in every action (being online, posting, commenting, reblog, vote and more).

Boost your earnings, double reward, double fun! 😉

Support Ecency, in our mission:

Ecency: https://ecency.com/proposals/141

Hivesigner: Vote for Proposal

I hope you are right, though things are very very different this time around. I won't go into all the specifics as to why exactly they are different and instead just conclude with, I hope you are right and history repeats one more time! :)

I agree things are different. I still can't believe how similar the price action was between 2016 and 2020 even though things were also very different. Maybe it's just all Bitshares whales having fun pumping and dumping. Let's see what will happen.

Yea it's a lot harder to manipulate coins these days than it was back then. Plus there weren't nearly as many stable coin options as well as fiat on/off ramps. The majority of the pump had to do with bitcoin profits rolling over into altcoins since there weren't many other places to go. I am not sure it will play out like that again this time... especially since altcoins haven't really been able to do much innovating in the last 4 years, at least not compared with expectation.

Congratulations @marki99! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Do not miss the last post from @hivebuzz:

Congratulations @marki99! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Do not miss the last post from @hivebuzz:

I did a similar analysis but im not confident in TA in low volume financial products like steem/hive. Why im a big bull is this part of your article.

''Hive is even doing slightly better in marketcap terms (and much better if you include all the value that is held in Splinterlands, Leo, dCity, etc...).''

soon or later this should affect the price.

Agree with you on that. I also don't fully believe in TA, but sometimes it's helpful to put things in context, especially when price is not moving.