Pngme is creating an alternative lending platform that increase the financial institutions , MSMEs and families access to capital by giving them a credit score which can be used in receiving finance.

Introduction

Very similar to the marketplace lending in operation but chose a different building block. It works on the decentralised system.

Pngme creates an open and transparent lending system where borrower's can obtain low cost capital and investors can obtain the alpha. It works through a decentralized rate setting algorithms and a digital scoring scheme. Pngme provides the right tools to credit score the borrower's which serve as their reputation for obtaining loans and the capital,which would be available to financial institutions, MSMEs and businesses, are raised through the issuing of digital bonds on the marketplace lending to investors. This system is yet to prove to be very effective but when properly and globally accepted it can change the fortunes of a nation.

How will pngme change the global economy through innovative financial inclusion?

There is a seamless integration of the credit scoring API and MSMEs banking app also with the borrower's mobile payment

application, significantly it prevents unnecessary parade of financial institutions door for a loan as from anywhere as long there's a mobile device in which you are registered with, getting capital has been made easy. Also the investors digital bonds are gotten from the liquid digital assets and non-replaceable digital assets used to fund and collaterize loan. On account one the ways the economy is boomed is through taxes from companies and businesses and it is worthy of note that MSMEs continually dominate on numbers but sadly they run down too soon or remain insignificant due to the lack of capital. With Pngme serving as the end to connect businesses to capital and integrating it into mobile payment apps there is a way of growth for MSMEs, individuals and financial institutions which will result in the increase of the global economy it is definitely a win-win situation.

which cryptocurrency wallet features are you looking for the png Mobile App?

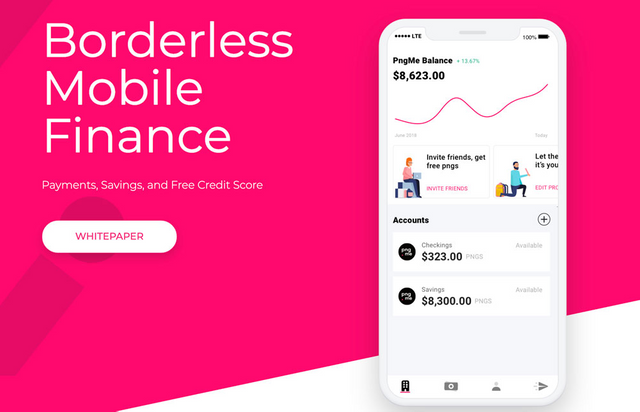

The Mobile App is for borrower's who need to create a credit score for access to capital and who need non-custodial mobile banking experience. It has user management, analytics and portfolio tracking features. Our mobile wallet uses a custom React Native implementation of the BREAD wallet for security and performance.

Conclusion

In the emerging market, the MSMEs has proven they can be the future of the nations wealth and png has risen to solve the problem of capital which would facilitate growth for the companies and it comes easy too with a mobile finance platform which signifies anywhere you can receive a loan and be connected to a lender through your credit score. The MSME banking usually is a common process but under png it has been revitalized to bring in an efficient, sustainable, secure and fast way of transaction, getting loans and mobile-to-mobile payments which indicates png is not just about loans it is about safe and secure banking too.

USEFUL LINKS

🌐 Website — https://www.pngme.com/

📑 Whitepaper — https://docsend.com/view/m8fighb

📑 Token Economics — https://docsend.com/view/929pjg2

📧 Telegram — https://t.me/pngmecommunity

📝 Bitcointalk ANN — https://bitcointalk.org/index.php?topic=5140127

🕊 Twitter — https://twitter.com/pngmemobile

📘 Facebook — https://www.facebook.com/pngme/

📝 Medium — https://medium.com/pngme

🔗 LinkedIn — https://www.linkedin.com/company/pngme/

📱 Android App Early Access — https://early.pngme.com/early-access-beta/

Author's Bitcointalk profile : https://bitcointalk.org/index.php?action=profile;u=1900615