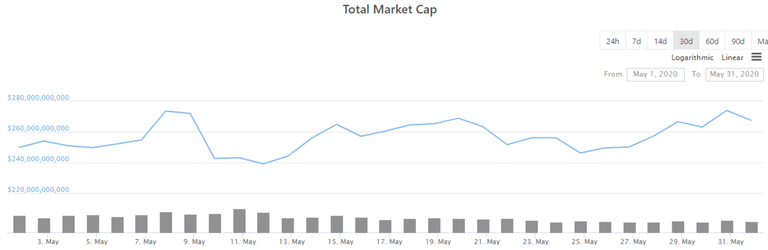

Overall, the market capitalization of the crypt asset class was up in correlation with most risky assets in the month of May. It was interesting to see how equities outperformed cryptocurrencies but it is more a factor of adoption and ease that is still prevalent in addition to the liquidity available was more likely to find its way into traditional markets. In fact, we saw how the Federal Reserve injected millions of dollars into the equity markets via investments in Corporate Debt ETFs. While not a direct flow into equities, it has made equities be in more demand with the available liquidity.

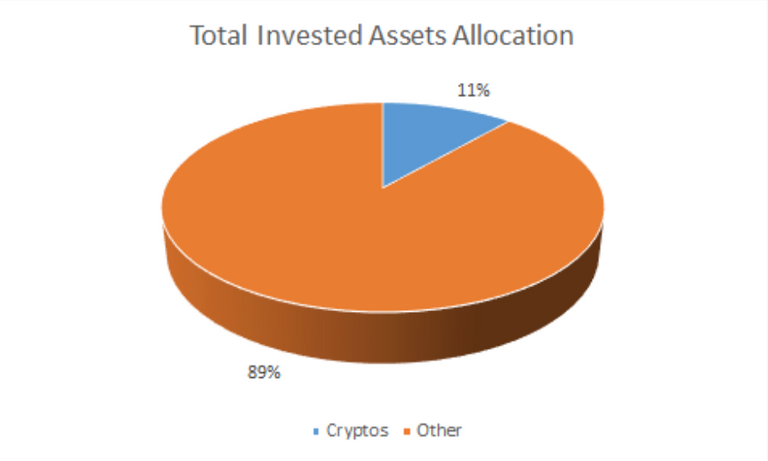

These moves in the traditional markets and it's impact to the financial system have continually made me think of how it will all be paid. I have grown more disappointed in investment opportunities in the traditional markets as yields have been substantially reduced to levels were risks are no longer being rewarded. Therefore, the thought for me personally has been to focus on storing capital and its value. This has brought me back to precious metals and of course, cryptocurrencies.

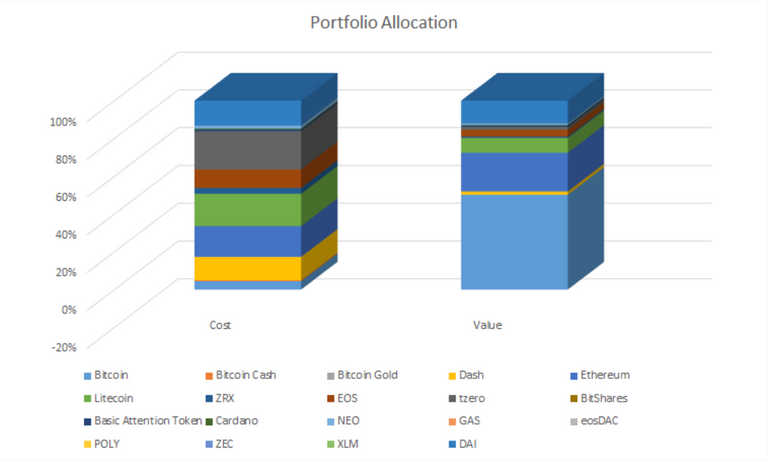

Unfortunately, with the amount of assets to choose from in the crypto market, it becomes more difficult to select the best places to store capital. I have continued to allocate most of my new money into the DAI stablecoin as I look for more research to diversify my portfolio. The first view is that I will start distributing some funds into holdings I already have like Ether, Dash, EOS and others that seem attractive still. I also believe that a number of ERC-20 tokens have come back into the spotlight which could lead to some interest from investors.

This had made my portfolio to continue to be somewhat boring although it continues to grow in value as I add to it through my monthly transfers in addition to positive performance. While the asset class is still immature, it seems that it is in a great spot to attract more investors as technology continues to lead the economy out of its crisis. I continue to find myself making traditional transactions while thinking how much easier they could be with Blockchain and Cryptocurrencies. Some same that Bitcoin was born from the last crisis so it will be interesting to see if adoption comes from this one!

Discord: @newageinv#3174

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

The best new browser to protect your privacy while still being faster and safer. Try the Brave Browser today with my affiliate link here: https://brave.com/wdi876

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.

Which of the ERC-20 are you tracking at the moment? I wonder if the interest is genuine.

I really like BAT and ZRX at the moment but have also started to look at some that I do not have a position in yet like Loopring and Holo.