As per steem protocol - the market cap of SBD at any point can be 10% or less than total market cap of Steems. That means if Steem price drops then SBDs have to be burned, meaning more steem should be issued, to maintain the above 10% cap.

So effectively - if steem price drops then steem supply hidden in SBDs increases.

Currently apprx 7.5mn SBDs are issued. And current price for steem is 0.13usd. And steem market cap is apprx 47mn.

So this steem market cap can support 4.7mn SBD. That mean 2.8mn SBDs are in excess and should have been converted to steem which are not converted due to artificially maintaining the blockchain level steem price higher than the market steem price.

If artificially not maintained then these 2.8mn excess SBDs should generate apprx 21mn more steem at current prices.

Therefore, 21mn steem are hidden in excess SBD supply that are not supported by blockchain protocol.

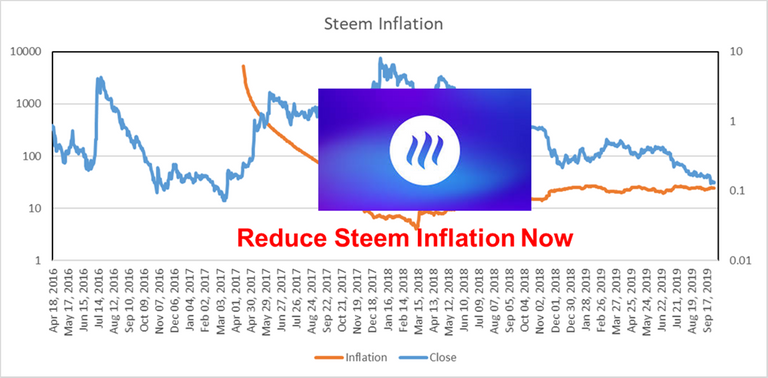

It is not good for the investors - and to correct it blockchain inflation has to be reduced immediately. There are already many suggestions about how to reduce and what activities to support from the inflation pool.