ONELEDGER:

BLOCKCHAIN INTEROPERABILITY AT ITS BEST

Blockchain interoperability has been the subject of discuss in recent time and there isn’t much information available as to how this can be easily achieved owing to the cumbersomeness of different Blockchain.

Interoperability simply means ability for different machine, system or Blockchain to communicate or synergise with others under some underlying protocol. This lack of interoperability in Blockchain has force consumers and enterprises to choose between one Blockchain and the other, thus resulting in high operating cost,maintenace and high energy consumption.

OneLedger stands out among several other interoperability projects out there because of the following features;

1.Business Modularisation

OneLedger forms a realizable and verifiable blockchain network which is modularized from real-world functionality, based on the sharing and immunity mechanisms provided by blockchain techniques.

- Protocol-based Blockchain Communication

All transaction data and real source records are written into distributed nodes by validation mechanism of data sharing through OneLedger protocol. OneLedger protocol enables communication and access across the blockchain, and allows for deployment and extendability across various Blockchain networks.

- High-performance Transactions

High-performance transactions enabled by a uniquely-engineered role and arbitration mechanism allowing for storage of data in a hierarchical structure.

- Multi-chain Runtime Support

Focuses on providing a consistent runtime which is compatible with various blockchain protocols and application development stacks.

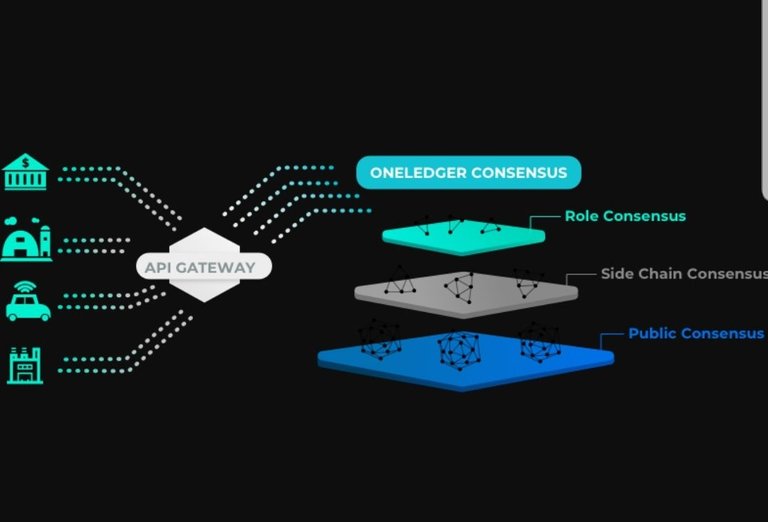

THE ARCHITECTURE OF ONELEDGER.

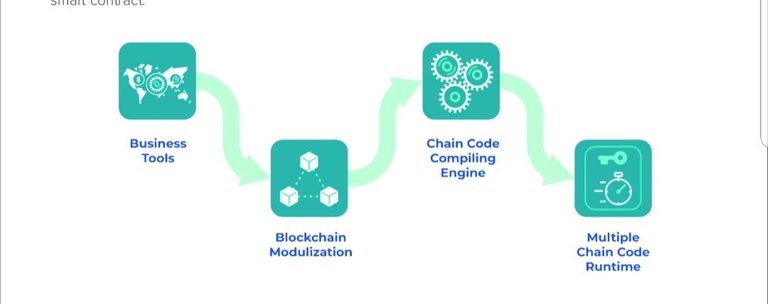

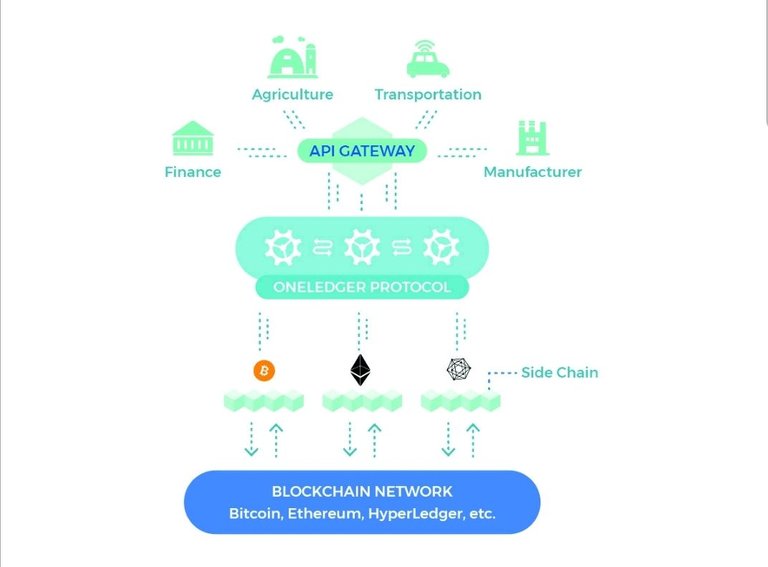

OneLedger enables you to focus building your business application through OneLedger modularization tools, which will communicate with OneLedger protocol using its API gateway. This mechanism will make your business application interact with different public and private blockchains synchronously through corresponding side chains implemented in OneLedger platform.

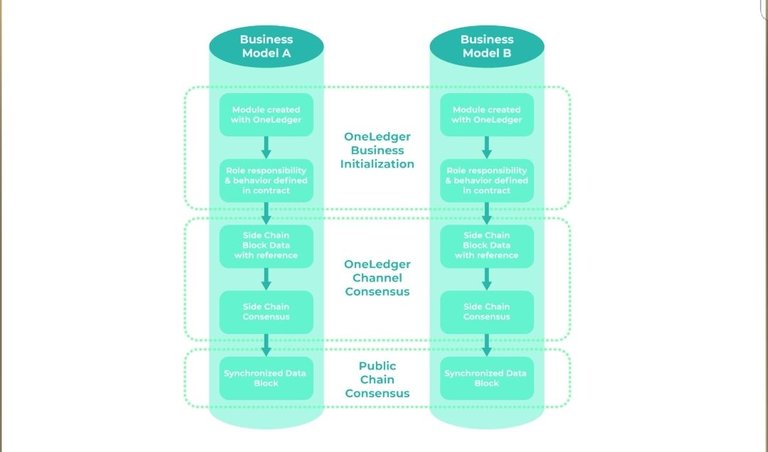

OneLedger architecture relies on two core principles, namely;

Side Chain

Business Modularisation.

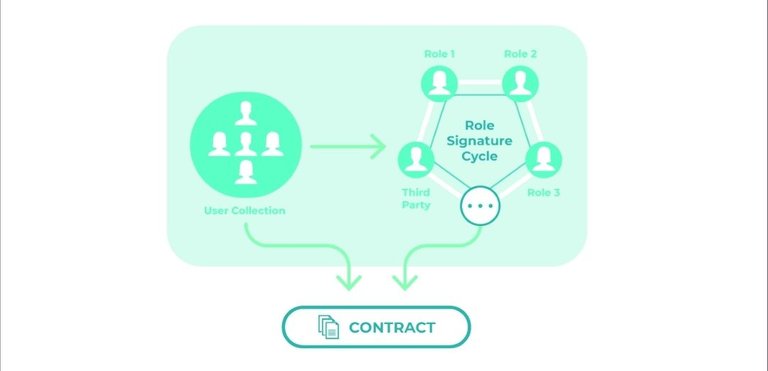

Through a user-friendly API system, businesses and individuals turned businesses, create specific modules for their needs that would easily access the OneLedger consensus protocol allowing their off-chain data to first interact with the OneLedger Blockchain, and second to connect and interact with all other Blockchains available on the platform. In this way, businesses could preserve their internal access controls and specifications without suffering from any separations from their existing technologies.

The OneLedger platform will also act as a bona fide transactional storage platform which through its compiling engine and chaincode run time, will free each blockchain interacting on the platform from the shackles of built-in protocols, often culprits of the scalability and exponential cost issues faced by many blockchains. Businesses would therefore be able to operate and interact with other blockchains without affecting the underlying chains for settlements and other operational functions.

This feature particularly satisfies the requirements of enterprise clients and opens them up to the value of tokens and other technologies while maintaining their privacy.

Finally, OneLedger differs from other interoperability project because it deliver aside the interoperable feature, higher scalability, flexibility and pluggability options.

THE CONCENSUS

OneLedger defines a three-layer consensus protocol to enable more effective integration of different blockchain applications. Business logic can be implemented by the first layer – a configurable role-based consensus protocol leveraging hierarchical grouping similar to the structure of Merkle Tree. The side chain consensus protocol can move consensus traffic from the main chain with public consensus to the side chain with high performance and efficiency. OneLedger block structure enables the synchronization and reference between the three-layer consensus.

USE CASE

1.OneLedger’s protocol and interface enables interaction with an arbitrary number of core infrastructure networks in a highly scalable manner.

OneLedger uses HTCL protocol to facilitate cross chain transactions. HTCL means Hash timelock contract. It is a combination of a hashlock and a timelock. A hashlock is a restriction on a receiving address or account in that the owner must publicly reveal a piece of data on order to lift the restriction. Likewise Timelock on a transaction restrict the time when a transaction can be spent.

Because oneledger is more than just a cross ledger decentralised exchange, with the use of smart contract and oneledger business integration API, on-boarding business processes will be a able to use distributed ledger technology for their particular applications, whether be it supply chain/inventory management, accounting, digitization of assets etc. much easier.

Ability to move business traffic into sidechain with high performance.

Ability to deploy and migrate dApp with ease.

Enablement of cross chain and concensus through oneledger protocol.

Standardized communication between dApps within oneledger protocol .

Assets identification and transparent flow such as assets registrations, donation processes.

Blockchain as a Service, BaaS offering to users create business modules with open source dApp within the business portal i.e supply chain and e-commerce flow (catalog, cart could be build as service and hooked up flexibly).

Help business and individual with AI support and flow optimization.

Transparency and Traceability of process through tagging of business flow.

TOKEN ECONOMICS

1billion OLT token will be premined. Each OLT token will initially be mapped to one corresponding ERC20 token so early adopters of OLT can use them on Etheruem ecosystem as the oneledger ecosystem is being developed.

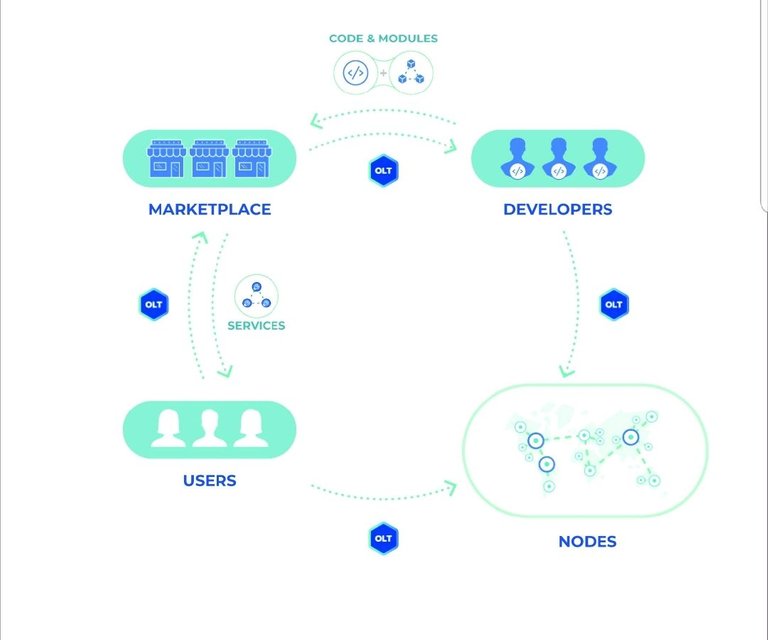

As the oneledger ecosystem continue to mature, there will be three major participants in the oneledger token economics, namely;

1.Users.

Network Supporters (nodes).

Developers .

In addition, OneLedger will also build a decentralised market place, which is a decentralised application on the oneledger platform.

Users : The users of oneledger includes businesses (Both private and Public) and needs to pay network fee to nodes in order to use any service on the OneLedger platform. OLT tokens are paid to access service sold in the market based on the distribution smart contract set by the developers.

Network Supernodes (Nodes) : These are individual who supports and help validate transactions. Network supporters will receive OLT as network fee. In the early phase, OneLedger will allow everyone to run a node. After after a period of time, a staking amount May be established to ensure commitment and quality of the Network.

Developers : Developers in oneledger Tokenomics will range from individual contributors to enterprise teams, to consulting firms. Developers need OLT token to deploy their modules on Oneleger platform. They can submit modules and codes to oneledger marketplace with a smart contract that defines the terms of sale. Additionally, OneLedger will give development grants to the best developers and most qualified project by leveraging 25% of token reserved for the community.

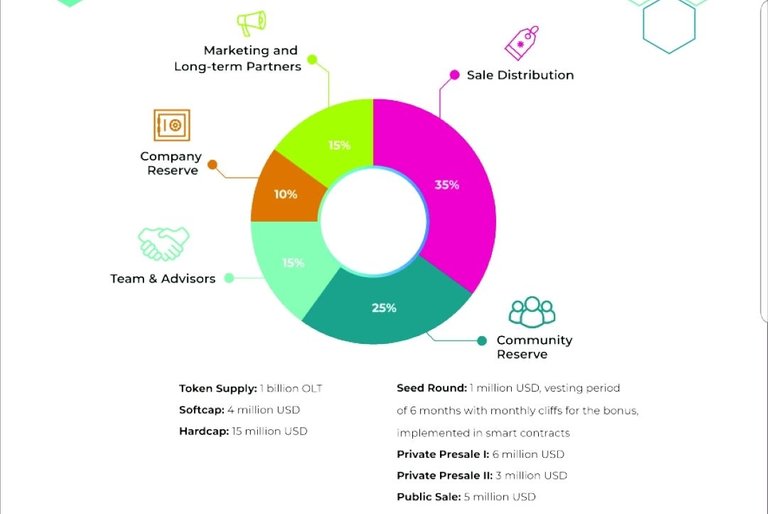

OLT TOKEN DISTRIBUTION

OneLedger token distribution is as fair as possible and it’s represented in the pie-chart below;

Token supply: 1 billion OLT

Softcap: 4 million USD

Hardcap: 15 million USD

Seed round: 1 million USD, vesting period of 6 months with monthly cliffs for the bonus, implemented in smart contracts

Private presale I: 6 million USD

Private presale II: 3 million USD

Public sale: 5 million USD

Community reserve: locked for a minimum of 6 months in smart contracts, and followed by 1 to 2+ years vesting schedule for the long-term benefit of the community.

Team reserve: vesting period of 24 months with quarterly cliffs implemented in smart contracts

Advisors reserve: vesting period of 12 months with monthly cliffs implemented in smart contracts

Company reserve: locked for the first 6 months and followed by a vesting period of 18 months with monthly cliffs implemented in smart contracts.

Marketing and long-term partners: vesting period of 3 to 6 months for marketing reserve. A minimum of 6 months lock-up period followed with a 1 to 2+ years vesting period target for long-term partners. All vesting and lock-up periods implemented in smart contracts.

PARTNERS AND INVESTORS.

ROADMAPS

Q3–Q4 2017

Final whitepaper

Theoretical Proof of Concept

Q1-Q2 2018

Launch Ethereum sidechain testnet

Synchronize Ethereum sidechain with OneLedger protocol engine

Implement and optimize cross-chain consensus

Add more public chain support

Launch MVP with crosschain consensus

Q3-Q4 2018

Enable Bitcoin sidechain to allow for cross-chain support

Complete decentralized cross-chain exchange protocol

Complete implementation of modularization tools and compilers

Implement OneLedger's Identity Management System and Smart Contract Authorization System

Launch API gateway

Launch Alpha version of the OneLedger platform

2019+

Release first version of the OneLedger platform

Integrate with more blockchain protocols

Expand business network.

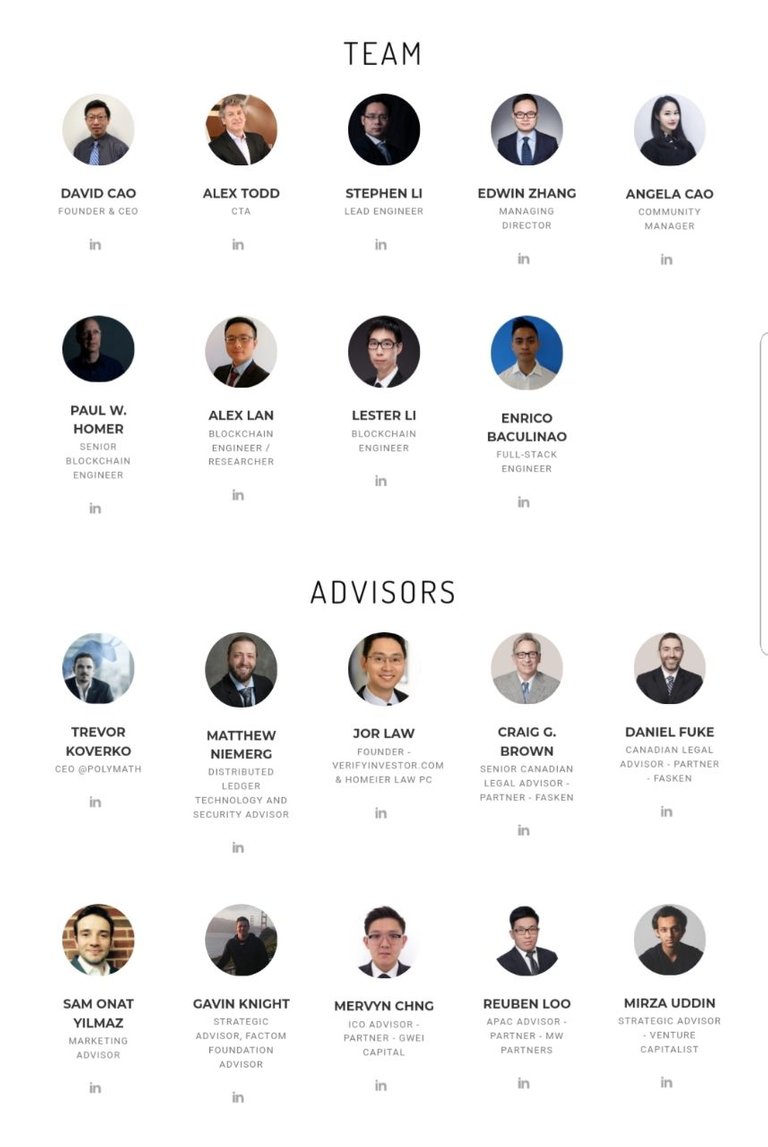

TEAM

Useful links/Resources

Website: https://oneledger.io

GitHub: https://github.com/Oneledger/

Telegram: https://t.me/oneledger

Medium: https://medium.com/@OneLedger

Twitter: https://twitter.com/OneLedgerTech

Reddit: https://www.reddit.com/r/OneLedger

LinkedIn:https://www.linkedin.com/company/27226077/

Mail: [email protected]

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://oneledger.io/

😂

Haha

This opens up a lot of argument