Liquidity is the lifeblood of an effective currency. New tokens uniformly suffer from a barrier to liquidity, leaving holders stuck and discouraging adoption. Today, tokens must battle to be listed in exchanges and achieve relevant trade volumes to match buyers and sellers through a classic bid/ask order book. These exchanges are distributed throughout the world with various market depths and restrictions, are vulnerable to security and regulatory risks and charge increasingly higher listing fees, if they agree to list a new token at all. Liquidity is the number one challenge for a newly issued token and must be planned for in advance.

The Bancor Protocol enables continuous liquidity for tokens on smart contract blockchains such as Ethereum. These Smart Tokens are convertible for any token in the network, at a predictably calculated rate, directly on-chain. Users can always buy and sell any token in the Bancor Network with no dependency on exchanges, market makers or trade volume. Conversions do not require matching two parties to exchange or depositing tokens with another party. This allows even lightly traded tokens to be easily convertible, so token creators can focus on their product.

Twenty-eight tokens are already convertible on the Bancor Web App, and counting. Aigang is one of the newest projects to join the network. They ran a successful Token Sale last December, attracting $9 million from contributors to build a decentralized insurance blockchain protocol for IoT devices. They recently launched a proof-of-concept on the Ethereum blockchain that can detect faults or failure dates in mobile phones and pay out insurance claims to users without requiring human oversight.

Here is what Augustas Štaras, CEO of Aigang, had to say about integrating the Bancor Protocol:

Why did you decide to join the Bancor Network?

“We have identified the Bancor Network token liquidity solution as a way to help us engage with our community, especially right after our Token Sale has ended. And it has proven to be exactly what our community has been demanding - instant liquidity for our new token. On top of that, Bancor has such an easy user experience, which allowed Aigang to increase our reach and add more token holders to our community.”What do you think about the token conversion experience on the Bancor web app?

“It has been a very smooth experience for Aigang to start working with Bancor and launch our AIXBNT Relay Token. Kudos to the Bancor team, which made the process really easy.”What kind of feedback did you receive from your community regarding the Bancor Web App?

“We have received mostly positive feedback from our community - especially from people who have visited our website and purchased our token instantly from there via the portable Bancor Widget. They liked the overall UX and the simplicity of buying tokens directly from their wallet on our site.”How did this partnership influence you/your token/the project?

“The only drawback so far has been the Ethereum network fees and gas prices for the transaction. So hopefully Ethereum will scale its network sooner and more people will be joining to use the Bancor Web App.”

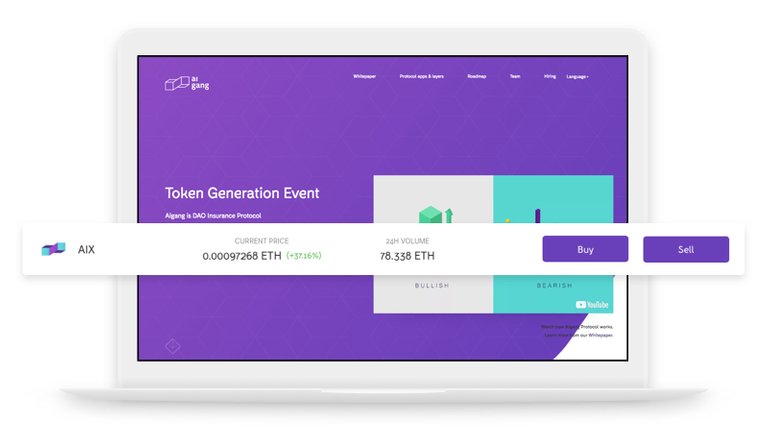

Aigang recently implemented the Bancor Widget on their website, allowing their users to convert the AIX token, along with any other token in the Bancor Network, directly from their website.

Planning to launch a token? Have an existing token? Please reach out to learn more about how Bancor Protocol solves the liquidity challenge for all. [email protected]

Both, Aigang and Bancor are great projects! We just need more tokens using Bancor :D

Working on it! Stay tuned!