This article investigates the inconspicuous contrasts between digital currency coins and tokens, and why the expression "cryptographic money" is a misnomer.

Digital forms of money can be to a great degree difficult to wrap our heads around, particularly since their fundamental innovation – the Blockchain – is covered in figuring dialect and wording that is specialized in nature. This is a gigantic obstruction to numerous who are keen on the crypto space. In any case, don't stress! We'll direct you in understanding key cryptographic money ideas that is extraordinary for you to know. (See more: Manual for Normal Crypto Terms)

What are Digital forms of money?

We should begin with understanding the meaning of cryptographic forms of money. Digital forms of money are advanced or virtual monetary forms that are encoded (secured) utilizing cryptography. Cryptography alludes to the utilization of encryption procedures to secure and check the exchange of exchanges. Bitcoin speaks to the principal decentralized cryptographic money, which is fueled by an open record that records and approves all exchanges sequentially, called the Blockchain. (Read likewise: Up and coming Bitcoin Hardforks You Should Know: Bitcoin Gold and Segwit2X)

Albeit numerous cryptographic forms of money have existed preceding Bitcoin, it's creation denotes an essential turning point in the domain of advanced monetary standards, because of its dispersed and decentralized nature. The formation of Bitcoin hastened the extension of a lavish and more different biological system of different coins and tokens, that are frequently viewed as digital forms of money by and large, notwithstanding when the vast majority of them don't fall under the meaning of a "cash". (See more: Development of Cryptographic money: The Issue With Cash Today)

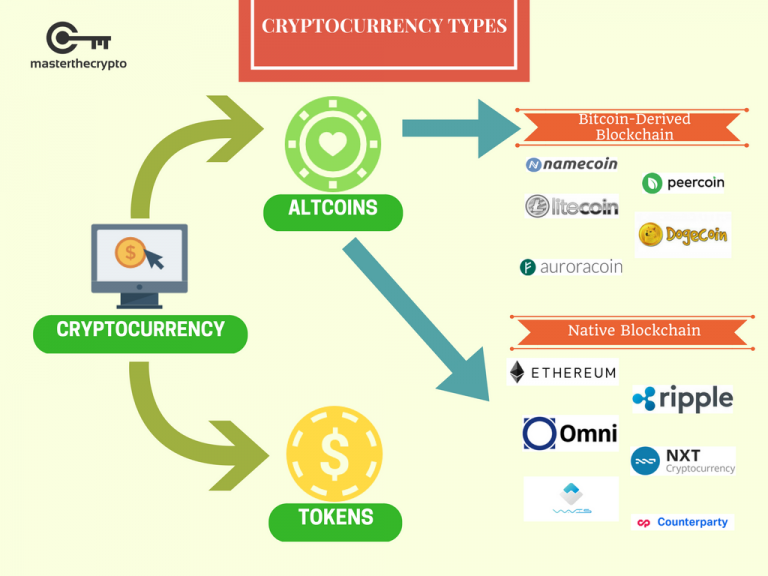

Coins versus Tokens: Classification of Digital forms of money

Note that all coins or tokens are viewed as digital forms of money, regardless of whether a large portion of the coins don't work as a cash or medium of trade. The term digital money is a misnomer since a cash in fact speaks to a unit of record, a store of significant worth and a medium of trade. Every one of these attributes are inalienable inside Bitcoin, and since the cryptographic money space was kickstarted by Bitcoin's creation, some other coins imagined after Bitcoin is by and large considered as a digital currency, however most don't satisfy the previously mentioned qualities of a genuine cash.

The most widely recognized classification of digital currencies are:

Elective Digital currency Coins (Altcoins)

Tokens

Altcoins

Elective digital currency coins are likewise called altcoins or essentially "coins". They're regularly utilized conversely. Altcoins essentially alludes to coins that are an other option to Bitcoin. The lion's share of altcoins are a variation (fork) of Bitcoin, fabricated utilizing Bitcoin's publicly released, unique convention with changes to its fundamental codes, in this manner considering a completely new coin with an alternate arrangement of highlights. Here's an article that improves the idea of forks, hard forks and delicate forks: Manual for Forks: All that You Have to Think About Forks, Hard Fork and Delicate Fork. Cases of altcoins that are variations of Bitcoins codes are Namecoin, Peercoin, Litecoin, Dogecoin and Auroracoin. (Read additionally: Bitcoin's Affable War: How and Why?)

Fun certainty: A product fork happens when there is an adjustment in the hidden programming convention, bringing about the "forking" or split of the first blockchain. This normally brings about the production of another coin. There are distinctive sorts of forks, for example, hard fork, delicate fork or unintentional fork.

There are different altcoins that aren't gotten from Bitcoin's open-source convention. Or maybe, they have made their own Blockchain and convention that backings their local money. Cases of these coins incorporate Ethereum, Swell, Omni, Nxt, Waves and Counterparty.

A shared trait of all altcoins is that they each have their own free blockchain, where exchanges identifying with their local coins happen in.

Fun truth: The main Altcoin was Namecoin, which was made in April 2011. It is a decentralized open source data enlistment and exchange framework

(Read additionally: Guide on Recognizing Trick Coins)

Tokens

Tokens are a portrayal of a specific resource or utility, that more often than not lives over another blockchain. Tokens can speak to essentially any benefits that are fungible and tradeable, from products to dedication focuses to even different cryptographic forms of money!

Making tokens is a considerably less demanding procedure as you don't need to change the codes from a specific convention or make a blockchain starting with no outside help. You should simply take after a standard layout on the blockchain –, for example, on the Ethereum or Waves stage – that enables you to make your own particular tokens. This usefulness of making your own tokens is made conceivable using brilliant contracts; programmable PC codes that are self-executing and needn't bother with any outsiders to work. It truly is super cool! (See likewise: Manual for Digital money Wallets: For what reason Do You Need Wallets?)

Tokens are made and circulated to people in general through an Underlying Coin Offering (ICO), which is a methods for crowdfunding, through the arrival of another digital currency or token to finance extend advancement. It is like a First sale of stock (Initial public offering) for stocks, with basic qualifications which are clarified in the article Crypto ICO versus Stock Initial public offering: What's the Distinction? Numerous are insane over ICOs as they speak to an awesome method for distinguishing fascinating ventures. (Read more: Fledgling's Manual for ICO Contributing: How to Take part in ICOs)

Fun Actuality: A format for token creation is brilliant since it gives a standard interface to interoperability between tokens. This make it such a great amount of less demanding for you to store diverse sort of coins inside a solitary wallet. A case is the ERC-20 standard on the Ethereum blockchain, which has is utilized by more than 40 tokens

Outline

The primary contrast amongst altcoins and tokens is in their structure; altcoins are separate monetary standards with their own different blockchain while tokens work over a blockchain that encourages the formation of decentralized applications.