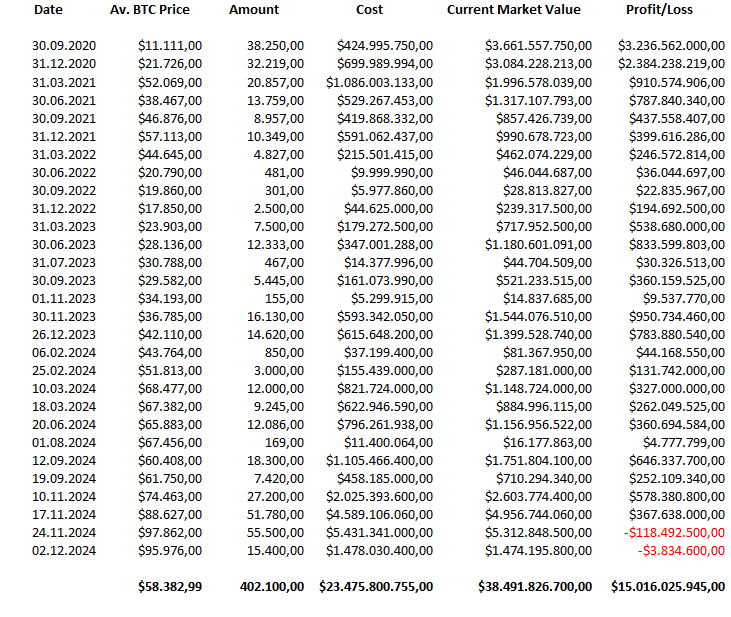

Since August 2020, MicroStrategy has accumulated a staggering 402'100 BTC, spending approximately $23 billion at an average price of $58k per Bitcoin.

As of today, with BTC valued at $95'727, the market value of MicroStrategy’s holdings has surged to $38 billion, reflecting an unrealized gain of $15 billion. This translates to the company’s total Bitcoin position being 64% in profit.

Acquisition Breakdown

MicroStrategy’s CEO, Michael Saylor, has been highly active in acquiring Bitcoin, with the majority of purchases happening in 2024:

| Year | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Funds Deployed (%) | 11.2 | 1.2 | 8.2 | 74.7 |

| BTC Acquired (%) | 13.4 | 2.0 | 14.1 | 53.0 |

In 2024 alone, Saylor deployed $17.5 billion on Bitcoin – a staggering amount enabled by the premium at which MSTR shares trade above the market value of BTC owned.

Financing the Bitcoin Bet

Saylor has financed these acquisitions by selling Convertible Senior Notes. Early on, these notes had an interest rate of 2.25%, but he has since managed to secure 0% interest for a 55% conversion premium.

A Dominant Stake

MicroStrategy now controls approximately 1.9% of Bitcoin’s maximum supply of 21 million, solidifying its position as a key player in the cryptocurrency market.

Sources:

Source Microstrategy financials: Microstrategy investor relations page for 8-K, 10-K and 10-Q reports.

Source Microstrategy stock market data: finance.yahoo.com

Source BTC price: coingecko.com

Notes:

- Funds deployed: funds allocated during a certain period in comparison with overall investments in a particular asset

- Nr. BTC acquired: amount Bitcoin acquired during a certain period in comparison with the total amount on the books

Vote for my witness: @blue-witness

Posted Using InLeo Alpha