There is a lot of analysis at the moment about the potential Bitcoin spiral of death:

- Chain Death Spiral - A Fatal Bitcoin Vulnerability

- A tale of Two Coins

- Other articles by the same author.

- Analysis and breakdown by Crypt0: "MUST WATCH VIDEO: How Segwit Could Disrupt Bitcoin / Bitcoin Cash Causing Black Swan Event?"

- Boxmining explanation

- Many other accounts of Bitcoin Segwit proponents propaganda, and vicious attacks (like bans on Reddit) on people highlighting that risk (see /r/bitcoin vs. r/btc, for example).

- Coinbase went offline!

- Bitcoin Cash now more profitable to mine than Bitcoin?

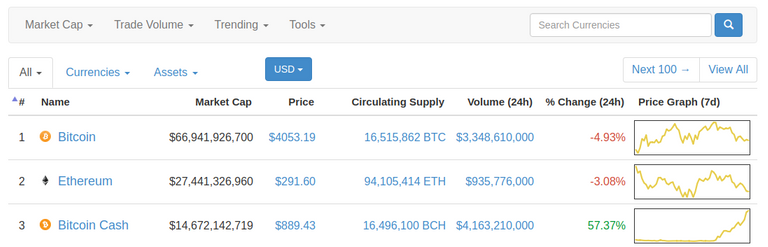

The current rise of Bitcoin Cash and its 24h trading volume surpasses Bitcoin:

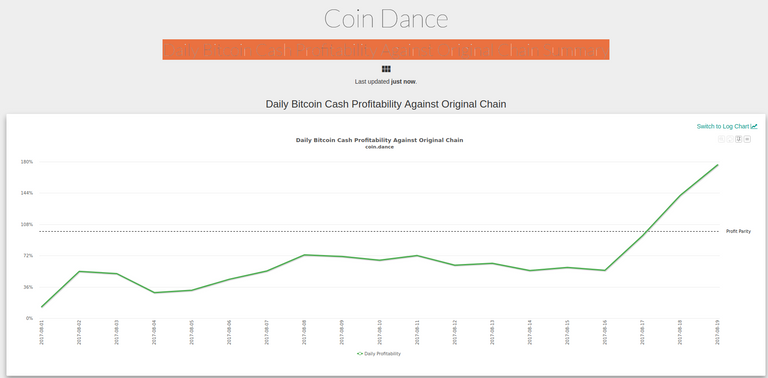

Also, it is currently 76% more profitable to mine bitcoin cash vs. bitcoin segwit:

Source: Daily Bitcoin Cash Profitability Against Original Chain Summary

So, the question is:

What to do and where to find safety in these uncertain times?

#1: Move out of Bitcoin as soon as possible!

Bitcoin has the highest fees, the slowest transactions, and rapidly growing pool of unprocessed transactions (mempool). It looks like miners are slowly moving to Bitcoin Cash and Bitcoin Segwit is loosing hash power. There's no doubt in my mind that the collapse of Bitcoin Segwit is imminent. Get out while transactions still are going through.

As of today (Aug 19, 2017), the fees are as follows (in USD):

- Bitcoin (BTC): $4.177

- Ethereum (ETH): $0.446

- Bitcoin Cash (BCH): $0.177

- Litecoin (LTC): $0.167

- Dash (DASH): $0.138

Source: Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dash, Monero Avg. Transaction Fee historical chart

#2: If you value stability and predictability, choose Litecoin.

It has all advantages of Bitcoin and Bitcoin Cash combined, very stable price, very low transaction fees. It's widely accepted on worldwide exchanges.

#3: If you want to make money and accept high risk, choose Bitcoin Cash.

It has proven that increasing the block size to 8Mb was the right decision, the network has survived and has the potential to thrive and overtake Bitcoin Segwit. Fast and cheap transactions, higher mining profitability than Bitcoin.

The disadvantage is liquidity: not many exchanges and wallets support BCH yet but the situation is rapidly improving.

#4: If you want speed and the lowest fees, choose Dash.

Dash is gaining respect with its over 40% rise today, as the money is moving out of Bitcoin:

5. Dash Dash $2,472,877,290 $329.65 7,501,433 DASH $154,051,000 41.68%

#5: If you want to take advantage of the upcoming Metropolis fork and the expected price rise, choose Ethereum.

Ethereum is well respected and adopted by countless startups (ICOs), banks, technology companies, it is here to stay and definitely will rise in price as the expected technical improvements land. The disadvantage is higher transaction fees and slow transactions.

So, there you go! My analysis of the post-Bitcoin dominance world! Hope you enjoyed, please resteem and post comments.

EDIT (Aug 20, 2017): "It is currently 128.5% more profitable to mine on the Bitcoin Cash blockchain." (https://cash.coin.dance/blocks)

EDIT (Aug 23, 2017) "It is currently 127.2% more profitable to mine on the original chain."

So it looks like indeed the mining difficulty corrections kicked in on both sides. Apparently as much as 30% of mining power of Bitcoin Segwit switched to Bitcoin Cash at some point.

Conclusion: It seems now unlikely that the "chain death spiral" will occur.

i guess you'll get rich somewhere other than BTC. good luck. i doubt the price moves when you leave

I'm way to late to get super rich now :-(

I should have bough all the stuff in January. But well, it's an interesting field with great potential going forward.

I would suggest IOTA because it is new tech and has no fees, maybe it can help you.

I really think it's gonna be litecoin

I only use technical analysis, but I have been calling for a serious drop in price of BTC for a while now ;)

Good article, keep it up

Unfortunately, most market moves actually have a reason and knowing that reason is more important than technical analysis. Especially in crypto, which imo defies reason many times and is unpredictable. For example, when groups are "pumping" smaller coins, or there are deep technical reasons which only few are aware of. It's like with Tesla, which is completely overpriced but just keeps going due to positive perceptions which are not justified by the fundamentals. So, perhaps rely on tech analysis day to day but knowing the deep facts is key, for sure.

Lol, just FUD.

Lie.

http://fork.lol/pow/hashrate

Also no one is using Bcash, mempoool is almost empty - blocks around 100 kb

http://fork.lol/blocks/size

91% of all blocks mined by one miner:

https://cash.coin.dance/blocks/thisweek

Enjoy your centralized china coin. Hope that the miner won't decide to take your coins ;)

Go back to r/btc

Thanks for the links.

Could you please clarify how to interpret the graph on https://cash.coin.dance/blocks/thisweek, which shows 90% mined by Other. I don't think it actually is a single miner, just a category grouping all other miners.

Actually, I don't own any BTC nor BCH. Moved my BCH to litecoin.

Every mine puts a stamp on the mined block so we can tell which one mined it. There were tweets before about some mysterious Hong Kong miner that put a lot of hashpower into BCH. Of course it's possible that it's more than one but I don't think so :)

Excellent post. From some of the posts here and on @kingscrowns latest post it is clear that people get emotional about their choices and are prepared to defend them blindly. I neither agree or disagree with you but wilnuse some of the excellent resources you have identified here to make up my own mind. Thank you, 100% upvote

Thanks! I am actually quite new to crypto and not invested at all into either of the Bitcoins. Ever since I got interested into crypto I was trying to avoid Bitcoin like fire because of its problems and all uncertainty around it.

What bothers me a lot is this whole Bitcoin dominance where in many places you have to buy Bitcoin first before you get to any other currency. It's absolutely terrible because of the fee inflation. It has to end.

I'll post more about the possibilities of avoiding Bitcoin and high fees.

I will follow you and see how it goes. I kept my btc cash as I saw it as a no lose investment. I am glad I did

Bitcoin, is pose to go lower, has not flip yet going back and resuming the uptrend, now is consolidating, to resume, needs to break the recent lows that she did, you can see easily on weekly chart and daily.

You ask why taking the lows, Bitcoin like the other majors Crypto, is manipulated by the banks, and they use the same model, before resuming, they have to take out the the other participants, that follow classic TA.

So who is trying to buy now, put stop loss below previous low, and in most charts there is also a double bottom, two same price lows, another as for TA, where stop loss is a secure place to be.

Now a part this, I think really that 8k is a price where will be lots of interest from the banks, and they will buy, all the people that will pull the plug, from about 12k until 8k, they will buy all from the sellers.

Slaughtering, them, then the price can resume, too many normal people making money is not the Bank model, they will not allow it.

Now Bitcoin seems to dictate the trend also of many other coins....so the market as paused in most coins, or retracing too.....together with Bitcoin.

Notice how ETH instead has a good tone...or BNB for Binance, example, people tend to move to crypto, that are felt more secure....