First, I don’t want to be overly pessimistic. Bitcoin has become one of the greatest investment assets in the world, but whenever bitcoin prices approach historical highs, every investor should consider the currency closely. Consider the end of 2016, when bitcoin approached $1,000 dollars. The first time bitcoin had broken the $1,000 dollar mark was back in late 2013, and as many experienced bitcoin traders will remember, prices suffered a dramatic collapse after peaking, then rebounded, then suffered a long-term collapse shortly after.

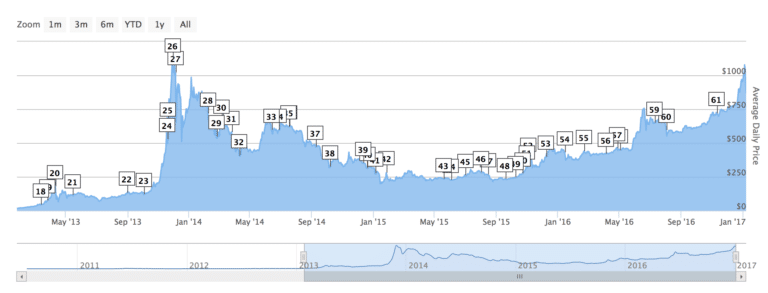

Many bitcoin investors lost a lot of money in that collapse. Some lost fortunes. So are bitcoin prices destined for a collapse every time they approach historical highs, or was 2013 a one time occurrence? First, let’s look atBitcoin historical price chart

Now, before we go any further, it’s important to note a key difference between the first $1,000 dollar boom, and the second surge in 2016. Look at the chart above, notice how the first time bitcoin skyrocketed from less than $250 to $1,000 over a matter of just weeks? Now look at the second half of the chart, the build up was much slower, and more steady.

In hindsight, the first $1,000 dollar peak was a case of obvious over exuberance. Bitcoin was new, it was hot, money was pouring into it. Bitcoin investors got excited. Too excited. This caused a price surge. As prices started to surge, a lot of people jumped on the bandwagon, hoping to tap into rising prices.

Then, savvy and cautious investors started to realize that the price surge wasn’t due to the fundamental value of bitcoin (at the time), but instead over exuberance. They started selling. As more people started selling, prices began to drop, then more people began to panic, creating a stampede that led to prices eventually collapsing. Those who didn’t get out early enough lost a lot of money.

If prices are surging at unnatural rates, as an investor you need to keep a close watch on markets.

As a “Safe Asset” Bitcoin Can Suffer from Fleeing Investors

Exuberance driven surges aren’t the only reason prices can rise unnaturally. One of the most appealing aspects of bitcoin as an investment currency is its emergence as a “safe haven” asset. When stock markets and other more traditional financial markets are rambled, people have a tendency to pour their wealth into safe haven investments, such as gold, and now bitcoin.

In late 2016 a lot of people began to pour money into bitcoin because they were worried that stock markets and other assets were due for a drop. For investors, it’s essential to figure out whether or not these fears are actually founded. Safe haven assets are great investments, but they are prone to suffering from “bubbles.” People get scared, pour their money into gold, or bitcoin, then realize that their fears were unfounded. Then, bitcoin prices could plummet.

The most important lesson here is to pay attention to why prices are rising. At the end of 2016, bitcoin prices rose largely because of the election of Donald Trump and also fears over the global economy (e.g. India banning its largest banknotes, Venezuelan inflation, etc.). As a safe haven asset, many investors felt their wealth would be safer in bitcoin.

Was this price surge justified? Perhaps, but a lot of economic indicators at the end of 2016 were also pointing to economic growth and positive developments. Thus, people looking into investing in bitcoin had to not only look at bitcoin itself, but also state of the global economy. This makes investing more difficult, but if you do your homework, it will also make investing far safer.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://99bitcoins.com/why-is-bitcoin-going-down/