Week ago Jamie Dimon made headlines by proclaiming on Bitcoin address:

- “The currency isn’t going to work. You can’t have a business where people can invent a currency out of thin air and think that people who are buying it are really smart.”

- “I would fire them in a second, for two reasons: It is against our rules and they are stupid, and both are dangerous.”

- “It is worse than tulips bulbs,” Dimon said, referring to a famous market bubble from the 1600s.

- “It could be at $20,000 before this happens, but it will eventually blow up. I am just shocked that anyone can’t see it for what it is.”

Market reaction sent Bitcoin from 3800 $ to 3000$ (2917$ lowest low) which is about -21%.

Now guys from Blockswater, an algorithmic liquidity provider, has filed a market abuse report against Jamie Dimon for "spreading false and misleading information".

"Jamie Dimon's public assertions did not only affect the reputation of bitcoin, they harmed the interests of some of his own clients and many young businesses that are working hard to create a better financial system,” said Florian Schweitzer, managing partner at Blockswater. https://btov.vc/people/florian-schweitzer/

Blockswater said Dimon violated Article 12 of the European Union's Market Abuse Regulation (MAR) by declaring that cryptocurrency bitcoin was "a fraud".

You can find full text of Article 12 here http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32014R0596

I have pinpointed two parts of Article 12, 1c and 2d, which might be most applicable for the case.

Market manipulation

For the purposes of this Regulation, market manipulation shall comprise the following activities:

(c) disseminating information through the media, including the internet, or by any other means, which gives, or is likely to give, false or misleading signals as to the supply of, demand for, or price of, a financial instrument, a related spot commodity contract or an auctioned product based on emission allowances or secures, or is likely to secure, the price of one or several financial instruments, a related spot commodity contract or an auctioned product based on emission allowances at an abnormal or artificial level, including the dissemination of rumours, where the person who made the dissemination knew, or ought to have known, that the information was false or misleading;The following behaviour shall, inter alia, be considered as market manipulation:

(d) the taking advantage of occasional or regular access to the traditional or electronic media by voicing an opinion about a financial instrument, related spot commodity contract or an auctioned product based on emission allowances (or indirectly about its issuer) while having previously taken positions on that financial instrument, a related spot commodity contract or an auctioned product based on emission allowances and profiting subsequently from the impact of the opinions voiced on the price of that instrument, related spot commodity contract or an auctioned product based on emission allowances, without having simultaneously disclosed that conflict of interest to the public in a proper and effective way;

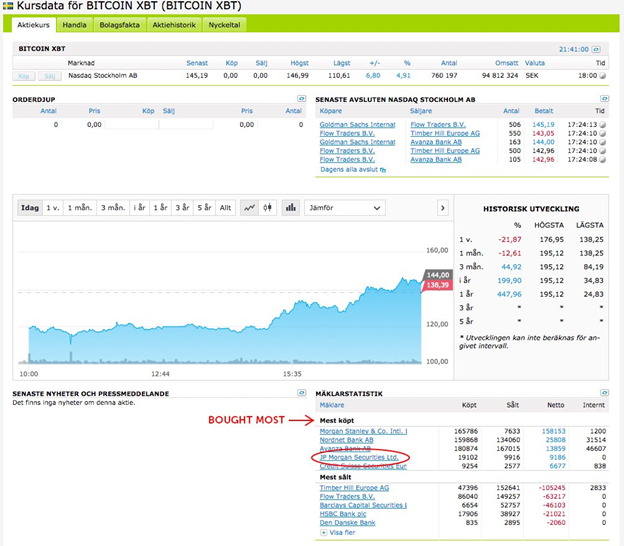

Twitter user “I am Nomad” shared evidence of J.P. Morgan Securities Ltd. Bought lots of bitcoins after the “fraud talk”.

What do you think? Did Jamie and big bankers from J. P. abused markets for their own entry positions at better price?

Sources:

http://www.cityam.com/272451/jamie-dimon-faces-market-abuse-report-after-his-comments/amp

http://www.businessinsider.com/bitcoin-price-jpmorgan-looked-like-it-was-buying-after-dimon-called-fraud-2017-9

Image is taken from The Guardian:

https://www.theguardian.com/business/2017/sep/17/jamie-dimon-bitcoin-bubble-he-would-know-banking#img-1

Disclaimer: I am just a bot trying to be helpful.