Anyone who is in crypto world more than month and share his/her passion with friends, co-workers or SO must heard something like „but what is the real value?“, „isn't it like printing money from thin air?“ or „it is just fraud, it has no value“.

These remarks leads me to wrote this article on exactly that fundamental question „What is fundamental value of Bitcoin“, and between lines all crypto currencies nowadays. I will try to explore and give you examples of real life usage of Bitcoin and thus shows its intrinsic, fundamental value. It is also my first big article here on SteemIt, so I want to introduce myself a bit to the community here :)

Main currency for trading other currencies

If you are trader you know that Bitcoin (BTC) is used for trading a lot. There are exchanges you cannot load fiat money, you need to use some crypto currency, and BTC is the most widespread and most used.

King of volume

When I’m writing this Bitcoin has daily volume of $1,060,500,000 and market cap of $71,173,097,441 (https://coinmarketcap.com/currencies/bitcoin/). Means that every day ~ 1.5% of Bitcoin are traded to/from various other cryptos and fiat. Compared to send placed Ethereum with “only” $322,774,000 (~ one third of BTC volume) daily volume or third placed Ripple with $41,277,100 (~4% of BTC volume).

When Bitcoin Sneezes, Altcoins Catches a Cold

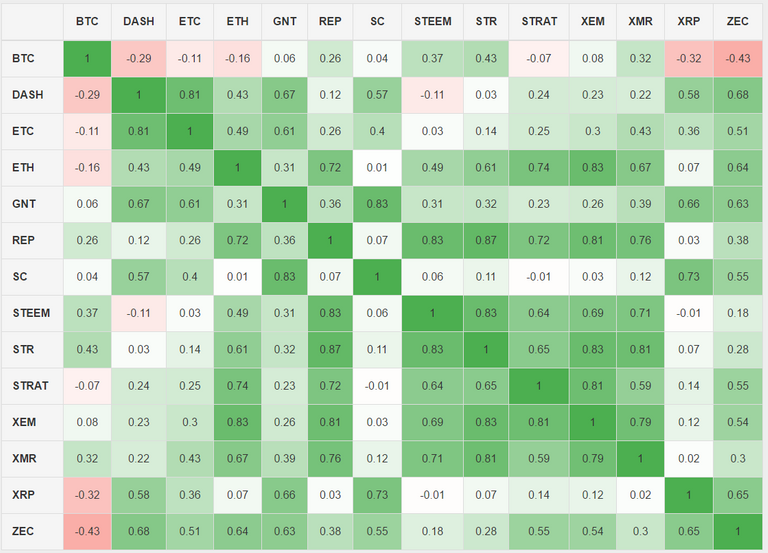

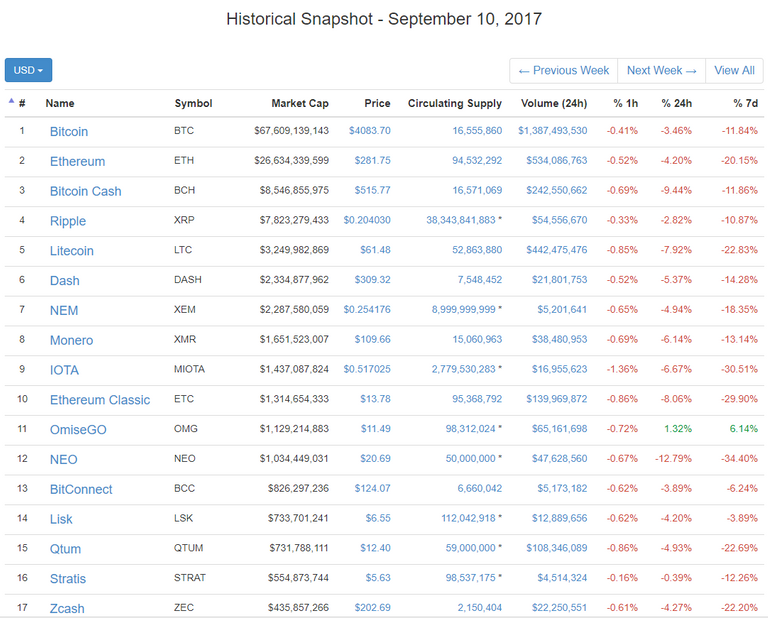

In other words, when BTC is losing its USD (replace your favorite fiat) value, many other crypto currencies (also called alts or alt coins) are losing it faster. You can see on table below, that many alts are positively correlated to price of BTC. [1]

What it means in practice?

See example from September 10, 2017 when BTC goes in last 24h -3.46%. Majority of alts are going more down than -4% (some are even -6% or less).

Hedge against fiat currencies and fiat services

Remittance - How to send money home

Bitcoin is used as remittance [2] by migrants from less developed states. Basically they are sending some Bitcoin back home so their parents and relatives can live better live. At some of these states, banks wants huge fees for transfers or it is not transferable at all (so Bitcoin is cheaper and more viable solution), Bitcoin is also much faster transfer than cross-borders transfers between banks.

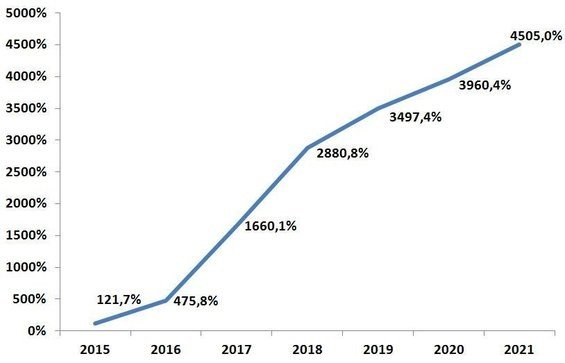

Hedging against hyper inflation

Bitcoin is better at maintaining value than currencies of some of these countries (especially those with hyperinflation). E.g. Venezuela got into hyperinflation and here are its figures with forecast, for more info see report from International Monetary Fund [3].

As Venezuela got cheap electricity, some of their people starts to earn money by mining.[4]

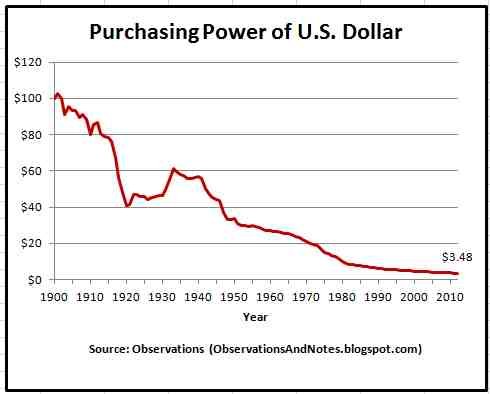

Hedging against „slow inflation“ of fiat

Mighty Dollar (and also other less mighty fiat currencies) is decreasing its purchasing power over years by inflation. The graph shows that if a shopper were magically transported from the year 1900 to 2012, the 100$ bill that he had in his wallet in 1900 would now be worth only 3.48$! That's a 96.4% decrease in buying power. Our shopper would consider current dollars virtually worthless. [5]

Bitcoin in other hand is gaining strength since its eve in 2009 (but it is still young) but some believe it will continue to maintain its value more than traditional fiat money. Partly because of its anti-inflation (See Speculative material part).

Cost of mining and mining equipment

Bitcoin has its value partly also because people are willing to spent fiat money for buying things witch are for nothing less than supporting Bitcoin network. Most considerably miners needs to sink some fiat costs into mining equipment and electricity for mining. If it won’t be profitable, they would not do that right?

You can buy mining rig for ~2000$ and start mining with power consumption of ~1400W (AntMiner S9). It is not easy to calculate ROI of mining as HW is getting better year-to-year and difficulty and pool fees are getting higher over time. But if you want to have rough idea, you can get about 10-15% ROI by doing so.[6] On the other hand, if Bitcoin USD price will go up (speculation alert!) or mine pools in China mysteriously evaporate (low probability alert!), you can get much better ROI.

We can roughly calculate how much money are sunk in Bitcoin mining looking at 51% attack on Bitcoin network (how much money it would cost to attack the network). Actual number I see is 2,933,592,630$ hardware only cost which is 51% addition to existing Bitcoin network. Meaning that cost of HW for mining Bitcoin right now is at least 4 billion dollars (3,911,456,840$ is 51% attack cost /(3+1.5)*6). Also cost of power consumption for mining whole network is 7 million a day (just pennies, doesn't matter if you have 4 B$ to HW right). [7]

Cost of ATMs

You can buy ATM and provide it as service to people to put into or withdraw money. Cost of that is 3000-8000 $ [8] and there are more than 1600 of them in the world. https://coinatmradar.com/

There are also additional costs like legal and other costs of running them.[9]

Possibility to pay for goods and services

Mainstream usage of Bitcoin starts when big companies will accept it. More people will be willing to buy BTC and hold it so they can spend it on things they like (more they will hold, less will circulate and price will go up, this is also why so many people are looking forward to debit/credit cards backed by cryptos like TenX or Monaco). If you are having small business you can get some inspiration on how to pay via Bitcoin on https://en.bitcoin.it/wiki/How_to_accept_Bitcoin,_for_small_businesses . It is not costly, just needs your time and you need to figure out taxation. Here you can see bigger companies which are accepting Bitcoin already https://99bitcoins.com/who-accepts-bitcoins-payment-companies-stores-take-bitcoins/ .

There is one nice post around value of Bitcoin which is looking on value just being used for purchasing illegal goods, specifically drugs. I hope you like my article a bit better, as it is more complex, but look at this one also https://steemit.com/bitcoin/@jrcornel/is-it-possible-to-find-bitcoin-s-intrinsic-value .

Speculative material

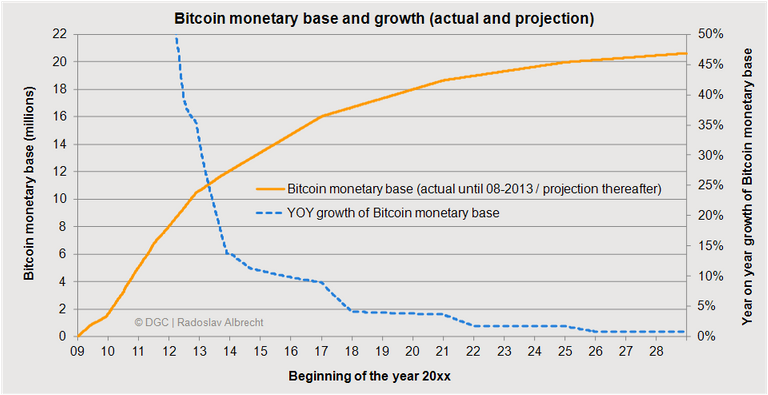

Price (or monetary value) or anything is on open market driven by supply and demand. Investors with technical background knows that Bitcoin is anti-inflationary by its protocol. It will issue less and less Bitcoin over years and 99% of Bitcoins will be in circulation around year 2036. You can see on illustration that number of Bitcoins issues every year is decreasing [10].

There are also many Bitcoins which were lost (corrupted HDD, lost private keys, burned)... so in fact Bitcoin is more scarce than market cap shows.

This fact and also graph showing price spiking over long term up, luring lots of speculators to own Bitcoin and other crypro currencies. Here you can see logaritmic price of Bitcoin over years. Still going to all time highes... https://99bitcoins.com/price-chart-history/

Internet of Value – Money 3.0

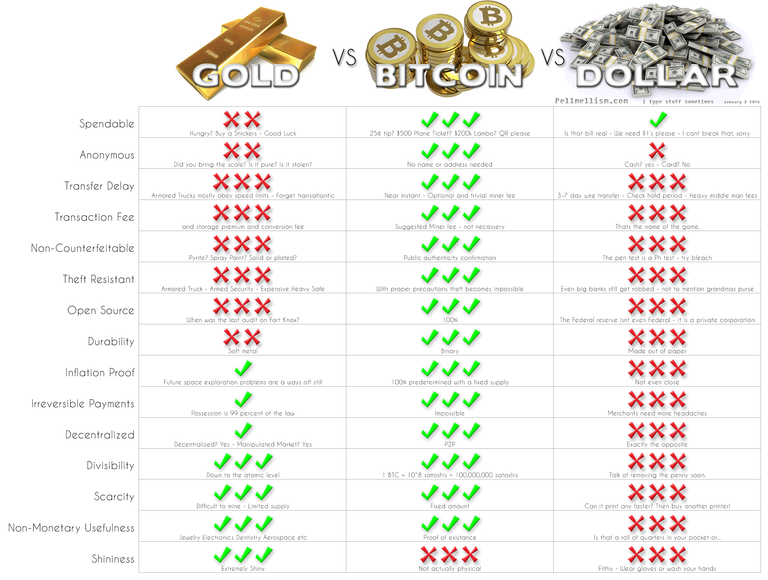

Bitcoin is also investment to technical novelty and usage of electronic money, decentralized, pseudo-anonymous which cannot be counterfeited (unless breakthrough technological advancements will appear, which will devalidate cryptography as we know it now). There is nice picture here comparing main traits of Gold, Bitcoin and Dollar. https://www.investitin.com/buy-gold-using-bitcoin/

Conclusion

It is hard to conclude what is fundamental dollar price of Bitcoin but I hope you agree with me, it is not thin air, zero value bubble now. Many people across the world invested billions of dollars of sink costs because they believe it is good investment, and will get their ROI back. I would say that so far, they were right :)

List of sources:

[1] Source of this table is: https://steemit.com/cryptocurrency/@jverhoelen/correlation-between-bitcoin-and-altcoins but you can create your own by using Pearson correlation when having data of coins.

[2] https://en.wikipedia.org/wiki/Remittance

[3] http://www.imf.org/external/pubs/ft/weo/2016/02/weodata/weorept.aspx?pr.x=45&pr.y=15&sy=2008&ey=2021&scsm=1&ssd=1&sort=country&ds=.&br=1&c=299&s=PCPIPCH&grp=0&a

[4] https://cointelegraph.com/news/bitcoin-mining-thrives-in-venezuela-thanks-to-hyperinflation-and-free-electricity

[5] http://observationsandnotes.blogspot.cz/2011/04/100-year-declining-value-of-us-dollar.html

[6] https://99bitcoins.com/bitcoin-mining-profitable-beginners-explanation/

[7] https://gobitcoin.io/tools/cost-51-attack/

[8] https://coinatmradar.com/shop/buy-bitcoin-atm/

[9] https://coinatmradar.com/blog/revenue-and-costs-of-running-a-bitcoin-atm/

[10] http://dgcmagazine.com/bitcoin-money-supply-and-money-creation/

Headline picture is from: https://news.bitcoin.com/peter-schiff-bitcoin-digital-fools-gold/

Welcome to family :)

I have missed ICOs in that article. I will add that later.

Welcome to steem