On days like today when Bitcoin is in free fall and it seems like the entire crypto market is on the brink of annihilation, it's always important to take a step back and remind ourselves why we're invested in this particular asset class.

Like everyone else I'm in partially for the gains. Money is one of the most determinant aspects of life as it grants people access to comforts like food, shelter and recreation.

But at the same time, I wouldn't invest in something I don't believe. It's just not in my personality to speculate in something just for the sake of financial reward. That's why I don't invest in the stock market, despite the massive bull-run we've experienced over the past couple of years.

I invest in crypto because of the LIbertarian philosophy behind its creation, and the freedoms it allows those holding it.

We've been in this situation before. The market is going down ostensibly on rumors of stricter regulatory oversight in South Korea, and a potential ban by the Chinese government of domestic OTC exchanges, as well as overseas platforms offering crypto-to-crypto currency pairs, like Bittrex.

Sure, a market correction of this magnitude clearly influences investors' moods. At least I know it has somewhat negatively impacted my emotional well-being over the past 48 hours or so.

It's only human to question the investment thesis that prompted us to take a leap of faith, and acquire a position in any given asset class.

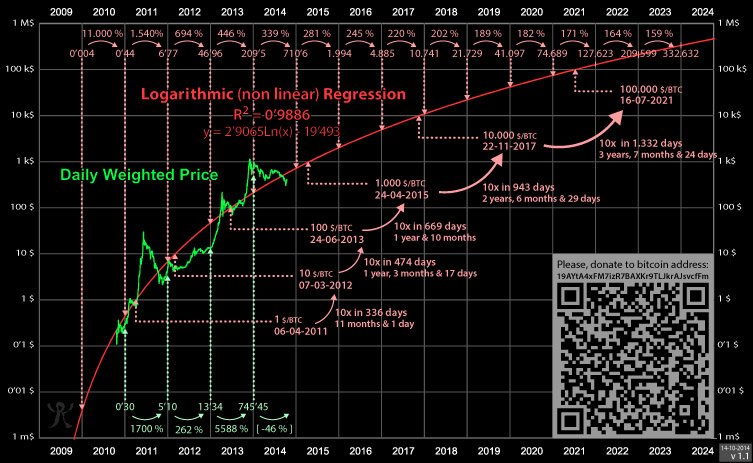

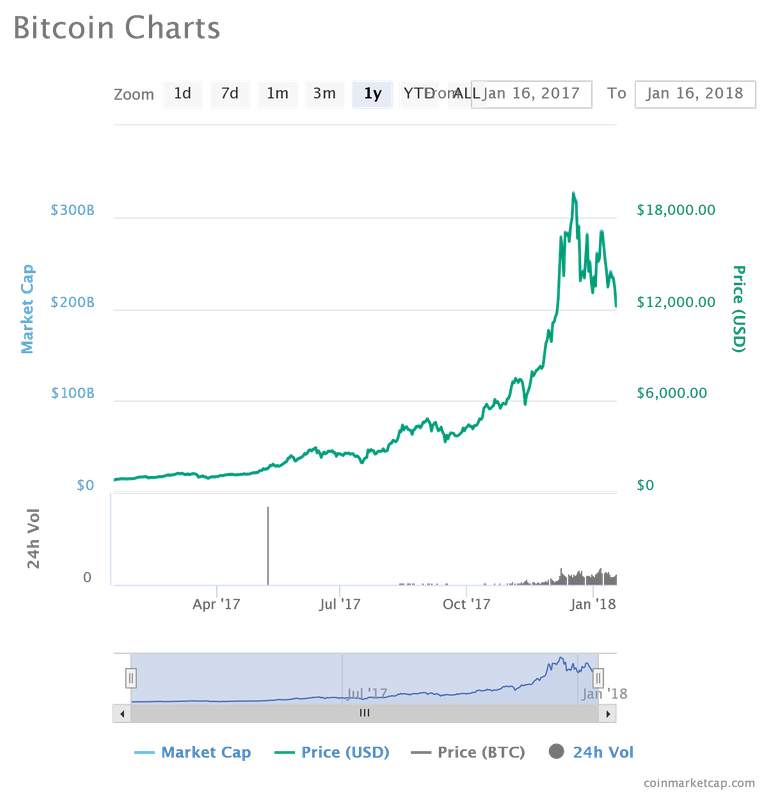

Maybe Bitcoin is just a fad or in a speculative bubble. A logarithmic-regression analysis circulated back in 2015 predicted (with stunning accuracy), that Bitcoin would reach a valuation of $10,000 per coin in November, 2017. That same chart predicts a price of over $300,000 per coin by Summer of 2021.

Still, maybe this is simply a freak statistical coincidence, and the chart holds no predictive power in forecasting future trends.

Sure the value of the network has grown in accordance with Metcalfe's Law, increasing in proportion to the square of the number of users, but what guarantee do we have that more and more people will continue to want to trade or spend Bitcoin in the future? The answer is none. Only ponzi schemes offer the promise of a risk-free, guaranteed return on investment.

If enough countries ban Bitcoin, then maybe the current fad will die off, at which point Metcalfe's Law becomes irrelevant, due to an artificial constriction of the supply not followed by an equal and opposite spike in the demand/price.

If it becomes too dangerous or cumbersome to buy Bitcoin, I'm sure a lot of people will lose interest, and move on to the next speculative mania.

These are some of the internal monologues that have been taking place inside my brain over the past couple of days.

I've entertained similar scenarios in the past: back when it crashed in January of last year on rumors that China would be banning cryptocurrencies.

Back in the days leading to the August hard-fork.

During the September crash, when the Chinese government did indeed close all domestic exchanges offering Yuan deposits and withdrawals, and then again in November, when Bitcoin Cash seemed on the brink of dethroning Bitcoin.

These types of thoughts always manage to creep back in to my mind when the market is in free fall, but I also manage to mute them just as quickly.

When everything is in the red, and all hope seems lost, I find great comfort in reading books and old articles about the Silk Road and its founder, the Dread Pirate Robers, a.k.a., Ross William Ulbricht.

Mr. Ulbricht was a pioneer, in that he built the world's first online marketplace where people from all over the world could trade freely with one another.

More often than not, the types of listings found on the website belonged to the category of controlled substances like cannabis, cocaine, heroin and methamphetamine, but like Mr. Ulbricht and other Libertarian-minded early adopters such as Roger Ver (who despite never having taking drugs in his life decided to get into Bitcoin after hearing about the Silk Road), I believe recreational drug use ultimately comes down to personal choice.

Saying the State has a moral duty to 'protect' its citizens by hunting down and imprisoning people engaging in what amounts to a victimless crime, is like saying the South Korean government is justified in saying it is considering shutting down, or heavily regulating exchanges in order to 'protect' its citizens.

Ross Ulbricht was a true idealist who believed in the cause he espoused. By the time he was arrested in October of 2013, he had amassed a fortune of over 144,000 Bitcoin. Yet he led a very frugal life, living with roommates and buying used furniture in yard sales.

He could have pulled an exit scam and lived very comfortably with the proceeded from his activities, yet he elected not to do so, because he believed in the ideals of freedom and self-determination.

We owe Mr. Ulbricht a great deal of gratitude for catapulting Bitcoin into the public imagination. Had it not been for the Silk Road, I don't think we'd have such such a tremendous appreciation in the price of Bitcoin.

Like Ross Ulbricht, we're all putting our money where mouth is by buying and holding Bitcoin. It's always been a binary bet from the start: worldwide adoption and recognition, or doom. No one can tell you which one it's going to be, but to quote a line from the classic video game, Metal Gear Solid 2: Sons of Liberty: "It's not about whether you were right or wrong, but how much faith you were willing to have. That decides the future."

Good analysis

Thanks for reading!